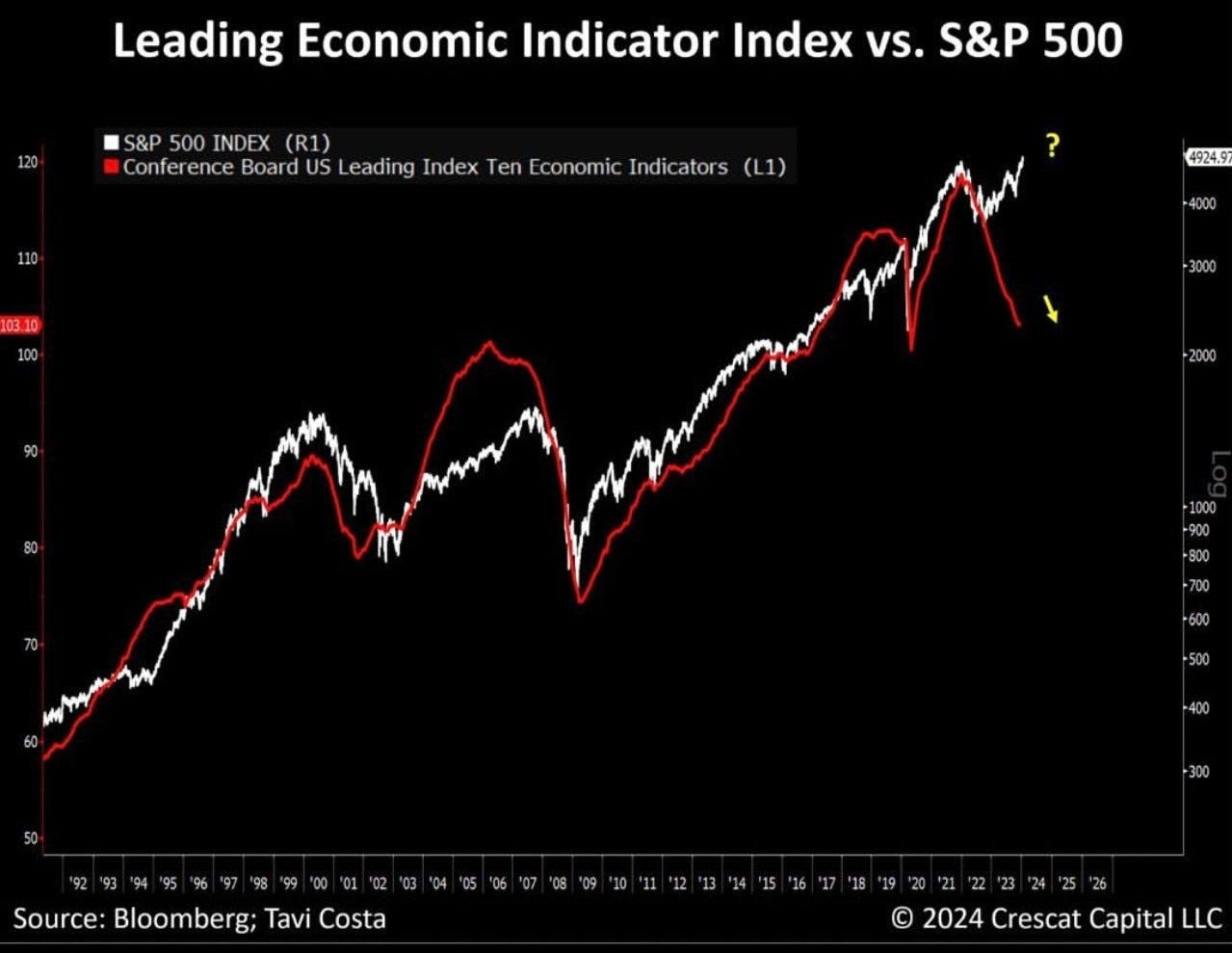

I have talked about the Leading Economic Indicator and it has been declining for about 2 years. Not a good sign and I came across this Bloomberg chart at Crestcat Capital that compares the LEI to the S&P 500.

Note that in the past 30 years that the S&P 500 has moved up and down with the LEI except for about the last 1 1/2 years. The gap is unprecedented. These are strange times and markets. And as I have been commenting, a lot of risks and uncertainties for 2024.

Bold Predictions for 2024

I am sticking my neck out here and lets see how many I get right:

US goes to war against Iran;

Oil tops $95;

Gold tops $2200;

The S&P 500 drops over -21% from top to trough;

The highs for the S&P500 will be in Q1 2024;

Trump wins the 2024 election or is assassinated;

RF Kennedy Junior takes over 19% of the vote as an independent;

Inflation starts to rise again;

Bitcoin drops below $30,000;

So far the new bullish move in the gold market remains intact. However the gold market remains in limbo and undecided. Wednesday gold was up anticipating Fed news on interest rates but came back down when the Fed appeared more hawkish. Gold dropped further today on strong job numbers hence no rate cuts on the horizon.

Open interest has declined to under 5,000 future contracts reflecting low levels of interest in gold. I believe gold has the best chance to move later in the year. We need to see a higher close at $2120 or better and ultimately as I have been commenting that it will take a close above $2150 to get positive attention in the gold market.

I remain bullish and believe gold will break out this year. Mean while an update on a few of our picks.

Aztec Minerals - - - - TSXV:AZT - - - - - Recent Price - $0.165

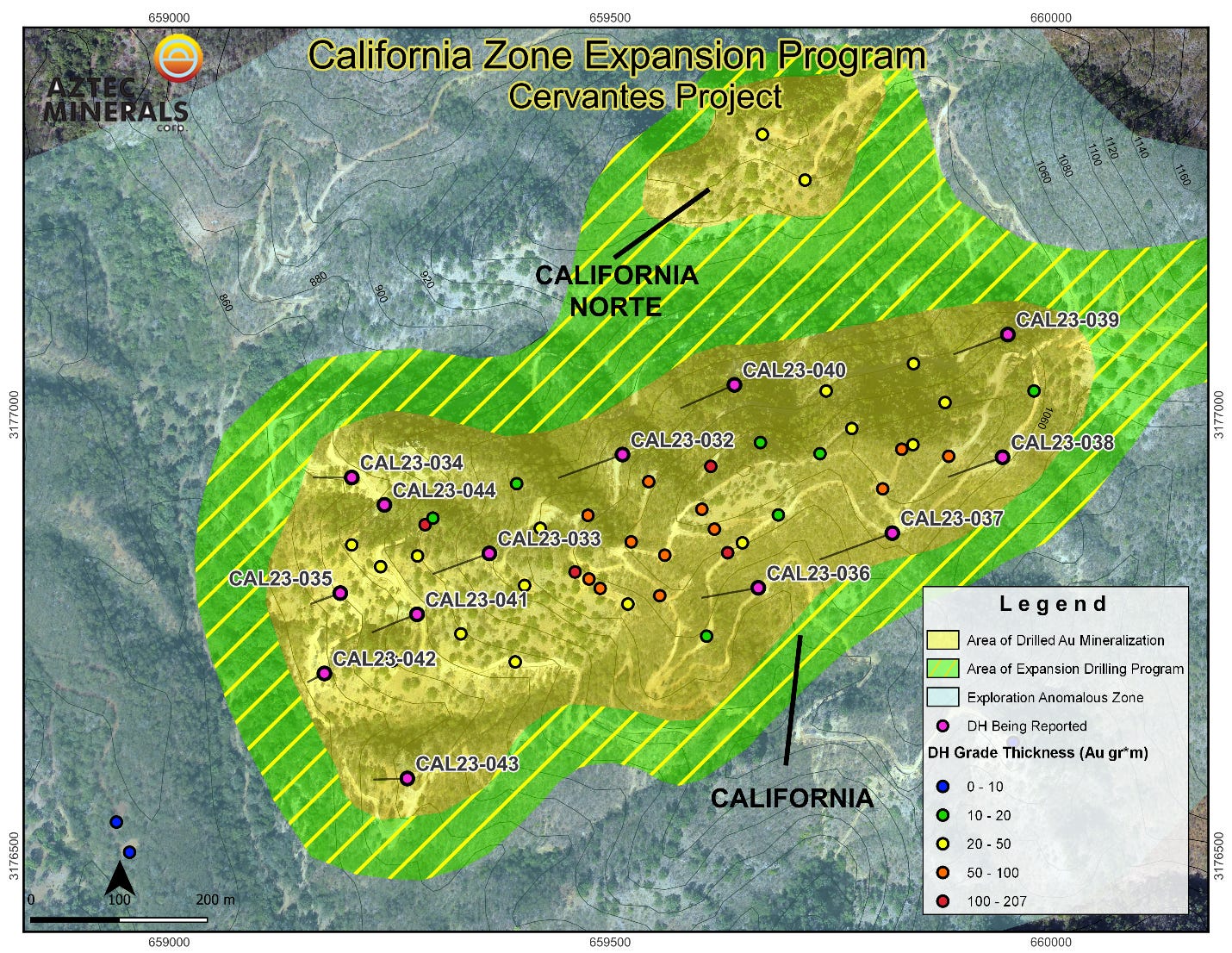

Aztec released additional gold results from their California gold zone of the Cervantes project in Sonora, Mexico. The results of the final 10 of the total 13 RC drill holes, CAL23-035 to CAL23-044, continued to show intersections of gold mineralization in the altered California intrusive porphyry complex, extending the California gold zone to the west, north, south and east, as well as to depth.

Results for hole CAL23-041, a stepout extending the California zone to the west, returned 57.76 metres grading 0.42 gram per tonne gold. The results from all final 10 RC drill holes encountered the gold-mineralized and altered California intrusive complex. Drill Highlights:

CAL23-035 -- 47.12 m at 0.51 g/t Au;

CAL23-041 -- 57.76 m at 0.42 g/t Au;

CAL23-044 -- 59.44 m at 0.28 g/t Au.

Project Highlights

All 13 step out drill holes of the recently completed program expanded the California zone gold mineralization in multiple directions.

Step out drilling has grown the area of demonstrated Au mineralization of the California zone to 1,000m East-West.

The 2023 exploration program was successful in discovering extensions, particularly to the West and Northwest, and confirms the broad style of the gold mineralized zone.

Surface reconnaissance confirmed that the mineralized and altered quartz feldspar porphyry and hydrothermal breccias continue to the east for at least another 400 meters.

Results were inline with expected grades but was not enough to get the stock excited.

Adicet Bio - - - - Nasdaq: ACET - - - - Recent Price - $2.99

Entry Price - $1.80 - - - - - - - Opinion - hold

ACET closed an underwritten public offering of 32,379,667 shares of its common stock at a public offering price of $2.40 per share. This gives ACET another approx. US$98 million. I expect this has positioned some good shareholders and funds that could move the stock higher. I am still expecting the stock to fill the gap and hit my $4.50 target.

Drone Delivery - - - - TSXV:FLT - - - - - - Recent Price - $0.32

Opinion – sell

The stock took a good run up in January on news, but failed to break upper resistance on the chart.

On Jan. 9, Drone Delivery announced their DroneCare project with Halton Healthcare Services Corp. is commercially operational effective Jan. 9, 2024.

The DroneCare project will deploy DDC's patented drone delivery solution to establish a new two-way transportation link between two of Halton Healthcare's hospitals, Milton District Hospital and Oakville Trafalgar Memorial Hospital. This bidirectional route will facilitate the exchange of a variety of critical medical supplies between the two hospitals including but not limited to laboratory blood, urine and tissue specimens requiring testing. Additionally, the Canary remotely piloted aircraft (RPA) will be used for this project making it the first commercial route for the Canary RPA.

On Jan 18th, Drone Delivery announced that with the assistance of its sales agent, Air Canada, has entered into multiple commercial agreements executed by the company on Jan. 9, 2024, with each of Edmonton International Airport (YEG), Apple Express Courier Ltd., BBE Expediting Ltd. and MFN Management Inc. (a wholly owned corporation of Montana First Nation) to deploy Drone's award-winning and patented drone delivery solution at Edmonton International Airport.

The agreements, with an aggregate value of $417,000, will run for a 12-month duration. Pursuant to the terms of the agreements, Drone Delivery will expand the defined route delivery from YEG with an additional DroneSpot at a medical clinic located in the city of Leduc, Alta. Cargo delivery will take place from YEG to the medical clinic while also maintaining the current delivery route from YEG to the off-airport DroneSpot in Leduc county, which formed the delivery route for the first phase of the project. The medical clinic is wholly owned by Montana First Nation and provides health care services to indigenous and non-indigenous Canadians.

These are great news items, but the revenues are still small and a lot more growth is required. My concern is there is not going to be enough meat this year to get the stock through a considerable resistance area between $0.40 and $0.50. We can always buy the stock back if circumstances change

I am also looking to sell Aires, Gatekeeper, Air Test and Gilat on up moves in the stocks. I think it is a good idea to be more diligent taking profits and have less exposure to the TSX Venture stocks until this market gets back on it's feet. We have had a bit of a rally, about 10% on the Venture index and we now need to see a higher high, a close at 600 or better. Around 615 would signal a new bull market.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.

Thanks for the comments Jim, I agree the economy and jobs are not as strong as perceived. I wrote about it in my 2024 Outlook. I call the Fed and government the masters of economic data because they massage and adjust as needed. Never much reality

Per ZH: https://www.zerohedge.com/economics/inside-most-ridiculous-jobs-report-recent-history