Time to Sell Crypto

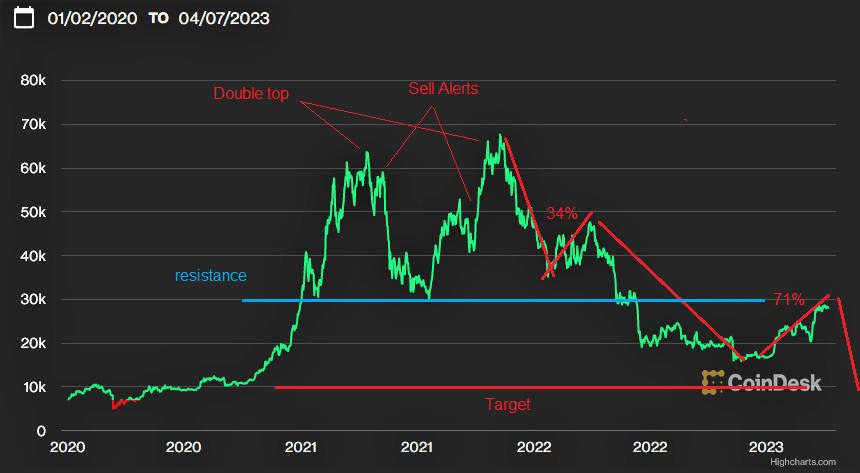

I was within a few weeks in picking the bubble tops in bitcoin and crypto in early May 2021 and late September 2021. I expected April 2021 was the blow off speculative top and I did not expect the retest of this high with bitcoin in October. Never the less, if you sold out bitcoin on my warnings between 55,000 and 60,000 one did very well. Basically my thesis is that crypto was all part of a huge speculative bubble that included stocks and bonds and hence it crashed along with the unwinding of these bubbles.

I said May 11, 2021 “ I believe crypto currencies are in a bubble. They are actually part of a huge bubble that encompasses stocks, bonds, real estate and other financial assets.”

September 24 2021 “I warned about the bubble tops in lumber and crypto currencies in May. Nobody listens because they are consumed in all the hype at the top.................... Cryptos are going lower, the most likely negative catalysts in the near term is regulation. It is not a question if crypto markets will face regulation, but when”. Today, regulation and the lack there of will still be a big negative factor.

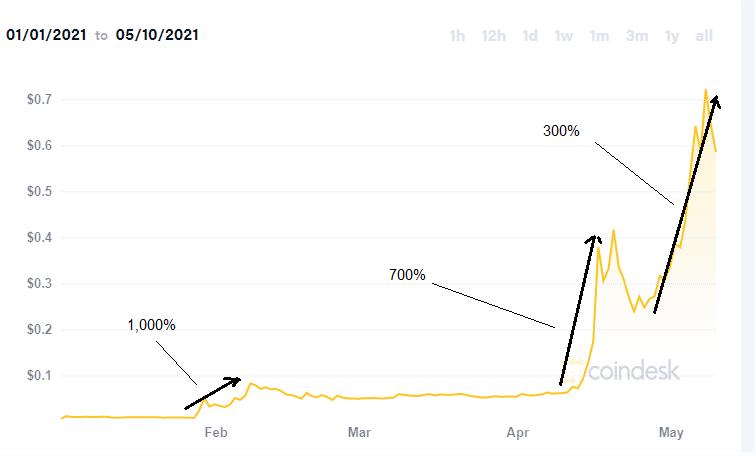

Markets never go straight up and down, but usually in waves. Bear markets often see their first biggest decline after the 3rd up wave in a bull market . I highlighted this with Dogecoin in May 2021 that ended up picking that top very precisely and of course after that Dogecoin collapsed.

I did another update on Dodgecoin in June 2021 and with a target price of around 5 cents. It did decline to under 6 cents so my target has been met. My target on Bitcoin is US$10,000 so I expect further declines.

I did buy some Dogecoin when prices bottomed but not what most would expect.

Net purchases of stocks by retail investors decelerated sharply in recent weeks, with individuals buying ~$8.9 billion in equities over the 10 days ending last Thursday, down from $17 billion in the comparable period a month earlier. The rally in US equities to start the year has been driven largely by the S&P 500’s top 20 stocks which have accounted for nearly all of the index’s gains in 2023. According to Apollo’s Torsten Sløk, this suggests a market driven by rates rather than broad-based growth expectations.

As of February 2023, the monthly bankruptcy filings exceeded 31,000, an 18 percent rise from the 25,564 bankruptcy filings reported in February 2022, according to data provided by the American Bankruptcy Institute. The increase in Chapter 11 bankruptcies—typically used by larger businesses—rose by 83 percent over the same period, with 373 total filings in February of this year.

I mention this because crypto has moved up and down with the stock and bond markets. I am expecting a significant recession that will remove more speculative money out of markets and drive another leg down in stocks and crypto. There was over 7,000 crypto currencies and most of these will go to zero and disappear. I do expect bitcoin and some others to survive longer term, but they have not hit their bottoms yet.

As I mentioned above, more unfavourable regulation is coming for the crypto market or more bad surprises because of the lack of regulation. More scams will come to light.

I have commented plenty on the collapse of FTX and this was also an embarrassment for the Commodity Futures Trading Commission (CFTC) that held many meetings with Sam Bankman-fried of FTX in it's hay day. The main beneficiary of the FTX collapse is offshore crypto exchange Binance led by founder, Changpeng Zhao. It is the largest crypto exchange still in operation, Binance accounts for 92% of global Bitcoin trading volume at the end of 2022, according to a Coindesk report.

The report says, the exchange’s market share was just 45% at the start of last year, but the elimination of trading fees in June, not to mention the collapse of rival FTX in November, served to push users to Binance. which is the world's largest crypto exchange by trading volume.

“No matter how you look at it in terms of trading activity, Binance is the crypto market,” Arcane wrote. “After lifting trading fees for its BTC spot pairs this summer, Binance completely overtook all market share in the spot market.”

It is not very healthy to have so much trading volume in one place, especially now that Binance is in the gun sights of the regulators. If regulators shut this down and/or prove corruption, it would be disastrous for the crypto market. Is this a risk you should just wait out?

It is sort of an oxymoron, but I believe the recent banking crisis has renewed the crypto bulls enthusiasm that crypto is safer or better than banks while nothing could be further from the truth. In fact this banking crisis highlights very clearly that the Fed/treasury is set against crypto.

Silvergate and Signature Banks failed and those two banks aggressively facilitated payments into and out of the crypto universe. Silicon Valley Bank, which was heavily into venture capital firms had all their depositors made whole, well above the $250,000 insured levels. In the case of Signature, deposits were guaranteed but any crypto assets or accounts were wiped out and the management of the bank removed.

Signature board member and former US Congressman Barney Frank was shocked by the so called rescue. He was interviewed by CNBC ‘” think part of what happened was that regulators wanted to send a very strong anti-crypto message,” Frank said. “We became the poster boy because there was no insolvency based on the fundamentals.’”

Yes sir, the writing is on the wall.

Now back to regulators and Binance. Last week, the CFTC dropped a 74-page assassination report on Changpeng Zhao and Binance, There is no doubt, Federal agencies are cracking down on the sector.

Part of the claims is Binance allegedly hid extensive links to China which contradict previous claims by executives that it had left the country after Beijing’s 2017 industry crackdown.

“The Commodity Futures Trading Commission today announced it has filed a civil enforcement action in the U.S. District Court for the Northern District of Illinois charging Changpeng Zhao and three entities that operate the Binance platform with numerous violations of the Commodity Exchange Act (CEA) and CFTC regulations. The complaint also charges Samuel Lim, Binance’s former chief compliance officer, with aiding and abetting Binance’s violations.

I have read numerous reports comparing Bitcoin to Gold. I don't believe there is any comparison at all other than they are both medians of exchange or trade. I think it is just nonsense, because they are so different they cannot be compared, it is like comparing apples to hammers.

Gold is real, you can see it, feel it and it has weight and dimensions whether a bar or coin. Crypto is digital, it only exists in cyber space, the internet or a digital wallet on your phone or computer;

Gold has been used as money for centuries, crypto currencies have been around about one decade;

You have control of your gold, where you keep it and what you do with it. You have little choice with crypto, it is in cyber space controlled by the Blockchain;

Both have value as measured in dollars, but these values are different and move up and down independently. The gold price has nothing to do with Bitcoin or other crypto currency prices;

Gold can make personal transactions directly. You can sell your gold coin directly to a friend, merchant or bank. With crypto currencies you must use an intermediate like a coin exchange. You can trade or sell your crypto through the exchange and they take a tiny cut, percentage of the trade;

Central Banks around the world hold gold as a reserve currency, they do not hold crypto currency;

This latest Report: While the number of crypto attacks increased during Q1, total losses fell from a year earlier ($317 million vs. $477 million). Pretty hard to hack into ones gold in a safe, safety deposit box or buried in the ground.

Central Banks have been buying gold in record amounts, it is obvious where they see the future going. There is also some forms of digital gold, like Pax Gold, but it is only a tiny amount of the gold market. The latest figure from the World Gold Council says there are 208,874 tonnes of gold and at $2,000 per ounce gives a value of about $14.7 trillion.

There is a possibility that gold will be used to back a future US digital currency, there is certainly no chance of crypto that we have today doing that. Just this week, lawmakers in the U.S. introduce bills pushing back against the creation of a U.S.-dollar-based central bank digital currency, Texas is opting to go a different route with the creation of a state-issued, gold-backed digital currency.

In the Bitcoin chart above, the two tops are close enough to call a double top. Since then, Bitcoin has had two good bear market rallies of 34% and the recent one around 71%. The blue line is resistance that acted as support on three previous occasions so I don't see much chance of Bitcoin going above 30,000. Bitcoin is currently about $28,026 and I don't think it is worth the risk to try and eek out another $1,000 or $2,000 to the upside. This is a good opportunity to sell before what I expect will be the 3rd leg down in this bear market and test $10,000. The timing is uncertain but I believe will be this year sometime.

I also want to wish everyone a happy Easter weekend. The one thing about crypto, it trades 24/7 so you can sell this holiday weekend.