Another Gold Record with Comex Gold up over 1.5% today

It is still astonishing to me that very few North American investors have caught on to this gold bull market yet. However, I am not surprised because it is well known that the majority of investors chase the last hot thing and buy around the top. Most investors will jump into gold at much higher prices. We need them later on to drive the bull market higher. I expect this could start to happen when returns from Crypto and high flying tech stocks falter. Recently they appear in topping patterns.

I expect this too is a reason that my substack has low interest, not many in the gold market yet. Please share, months later I don’t want to say ‘told you so’.

Gold continues to ramp higher to my $3,000 magnet on Central Bank buying and some uncertainty on tariffs as Trump announced 25% tariffs on all steel and aluminum imports into the U.S.

Steel will be a larger factor for Canada than Aluminum. Today, every remaining steel mill in the country is owned by foreign investors and Canada is a net importer of the manufactured product.

Two of the large mills - steelmaker Stelco Holdings Inc. was acquired by U.S.-based Cleveland-Cliffs Inc. and Algoma Steel, the century-old Canadian steelmaker has been taken over by New York-based acquisition firm Legato Merger Corp.

So steel tariffs on Canadian imports will just shoot U.S. companies in the foot. However, if there is an industry slow down, these U.S. companies would probably shutter the Canadian operations first because of their higher costs with tariffs.

Canada is the world’s fourth-largest aluminum producer and top aluminum exporter. Aluminum mining supports 9,500 direct jobs in Canada, with 7,600 of those jobs located in Quebec.

Canada is home to three aluminum producers that operate nine smelters mostly operated by Rio Tinto that is a British-Australian multinational. Rio Tinto does not have much operation in the U.S. so basically all their aluminum around the world would be affected by tariffs if imported to U.S.

North American Investors still Selling

In today's world, the best hedge and the best investment by far in the past year is gold. Asia has figured that out and according to ETF flows we can see that Europe has figured it out too, but most North American investors are story eyed by tech stocks and Crypto.

According to World Gold Council. Global gold ETFs kicked off 2025 with positive flows, led by Europe, while North America saw outflows. Following the second consecutive monthly inflow and supported by a higher gold price, global gold ETFs’ total AUM rose to US$249bn and holdings bounced to 3,523 tonnes.

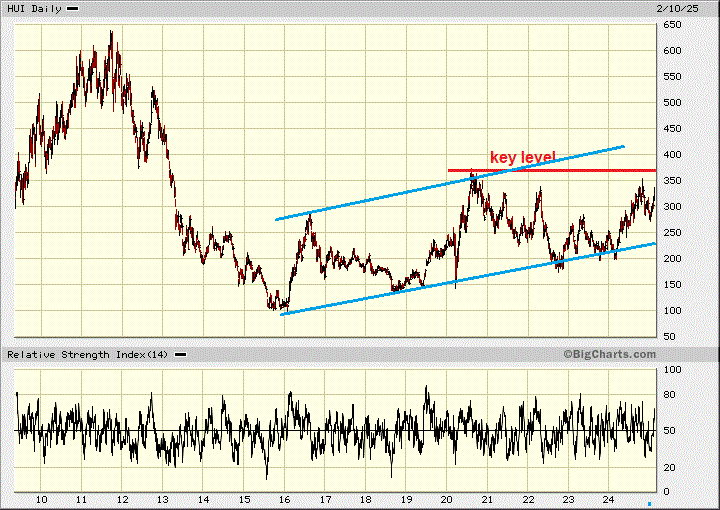

It is amazing how far behind and cheap the gold producers still are. I have a couple longer term charts here. The first is the HUI Gold Bugs Index.

The index is way below it's 2011 high when gold got close to $2,000 and still below the 2020 high when gold hit $2,000 again. The key area to watch is around 360 where the index peaked in 2020. Once it bounces above that, the next 100 points and more will come quickly. Perhaps then more North American investors jump in?

Despite low participation this market has been strong, since the February low in 2024 around 200, the index is up +67% and are gold picks are up over 90% since are purchases in 2023 and 2024. The other good news is the gold stocks up about 60% on this chart to gold about 42%, the stocks have started to outperform gold.

Goliath Gold - - TSX-V: GOT, OTCQB: GOTRF - - Recent Price - $2.35

Entry Price $1.22 - - - - - - - - Opinion - hold

Today Goliath reported exceptional gold intercepts in hole GD-58 intercepted two separate intervals with exceptional gold grades over substantial widths within a reduced intrusion related porphyritic intermediate feeder dyke that remains open containing visible gold, bismuth and molybdenum mineralization reminiscent of a RIRG system at depth:

12.03 g/t AuEq (11.84 g/t Au and 15.61 g/t Ag) over 10.00 meters, including 19.91 g/t AuEq (19.62 g/t Au and 25.61 g/t Ag) over 6.00 meters, including 23.82 g/t AuEq (23.47 g/t Au and 30.54 g/t Ag) over 5.00 meters.

8.59 g/t AuEq (8.35 g/t Au and 20.74 g/t Ag) over 5.00 meters, including 14.26 g/t AuEq (13.87 g/t Au and 34.10 g/t Ag) over 3.00 meters.

Goliath believes this excellent interval clearly indicates close proximity to a large feeder source at depth believed to be a Reduced Intrusion Related Gold system (RIRG). In addition, initial assays compiled/modelled for 5 additional drill holes from the successful 2024 drill program intersected excellent gold grades up to 11.66 g/t AuEq (11.13 g/t Au and 17.82 g/t Ag) over 5.97 meter in the shear hosted veins at Surebet, clearly demonstrating minable widths and grades and exceptional continuity and predictability of this large expanding world-class gold discovery that remains wide open both laterally and to depth with tremendous untapped discovery potential remaining.

Assays compilation, interpretation and modelling are currently underway for an additional 83 holes and will be announced shortly. The majority of these showed visible gold. The stock has been on quite a run and we are sitting on over 90% gains, but I expect it can go much higher and will be bought out at higher prices.

FITZROY MINERALS - - TSXV: FTZ, OTCQB: FTZFF - - Recent Price - $0.16

Entry Price - $0.15 - - - - - - - Opinion - buy

Fitzroy announced today that a drill hole completed to a downhole depth of 350 m at the Caballos Copper Project, Chile has intersected wide intervals of sulphide mineralization. The drill hole crossed the Pocuro Fault Zone (“ PFZ ”), targeting the down-dip continuation of a copper-molybdenum anomaly mapped at surface. Disseminated sulphides (chalcopyrite, molybdenite, and pyrite) are present over an interval of 185.7 m (from 62.5 m). The core is currently being logged in detail and prepared for assay, with results expected in March 2025.

The drill rig has moved to the Polimet Gold- Copper-Silver Project, Chile (“ Polimet ”) . As previously announced on January 27, 2025, the Polimet Phase 1 drilling program is designed to test a series of targets based on a combination of structural setting, gold and copper assay results, hydrothermal alteration, and IP geophysical conductors. The first of a seven-hole, 2,500 metre, diamond drilling program has begun.

As you can see above with Goliath, the time to buy these junior explorers is before drill results and they run higher. There is no guarantee that drilling will hit and the stock pop higher but before drill news is when I believe you have the best risk/reward odds.

The stock is probably also held down by the $0.15 per unit financing that was announced. Once this closes, the stock could easily move back above $0.20.

Paid Advertisers at playstocks

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.