Atlas Salt, SALT, RAMP, AZT and Gold with War

Many of you know Atlas Salt as we did very well with the stock, buying around $0.80 in 2021, taking part profits in 2022 at $3.10 and getting stopped out at $1.20 in 2023. I also suggested it was OK to hold some of your position long term because it will eventually get bought out at higher prices.

Salt Industry

Salt is produced by the following three primary production methods: seawater solar evaporation or inland brines, brine extracted through solution mining, and mined rock salt as with Atlas.

However, when it comes to Atlas Salt, the highway deicing market is key and consistent. Demand is mostly affected by weather and with climate change we can expect wild swings in winter weather. Remember the snow storms in Texas in 2020. De-icing salt is a very specific salt that requires a minimum 95% grade.

What is more important is over sea supply is far more expensive to ship compared to what Atlas could do. Millions of tonnes per year are shipped from three distant sources into the Eastern US and Canada. There has been no new mines in North America in the last 20 years.

Atlas Salt - - - TSXV:SALT, OTC:REMRF - - - - - Recent Price - $0.59

Shares Outstanding 94.8 million - - - - - Cash on hand $12 million

A salt mine is very basic and can be very lucrative, especially the Great Atlantic Salt deposit that Atlas Salt has. It is strategically located on NFLD's west coast just 2 kms from the Turf Point sea port. This gives access to eastern North American markets and can better compete with low transportation costs compared to the over sea imports serving this market. It is next to the Trans Canada highway and 1.4 km from electrical power. It really is location, location, location.

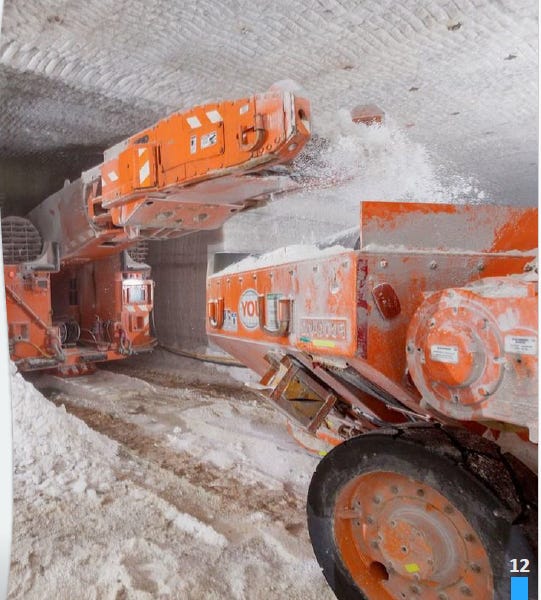

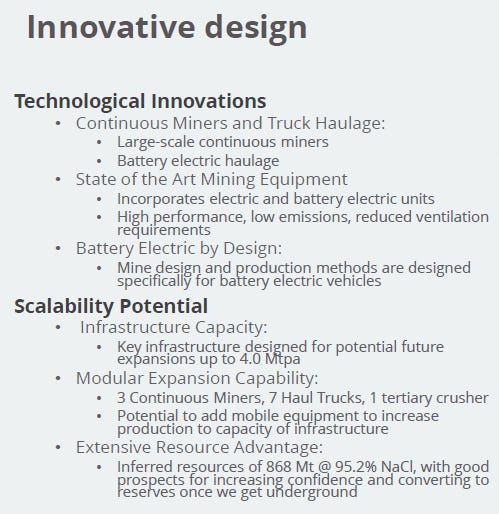

What is more, it is a world class salt deposit with grades of +98% NaCI. Probable reserves are 88.1 tonnes at a 96% NaCI cutoff with 383 tonnes of Indicated Resources at 96% cutoff. It is very pure high grade and near surface deposit that ca be accessed by a ramp. The Capex to build the mine is very reasonable, estimated at $480 million in a Q3 2023 feasibility study by SLR Consulting:

Base case of 2.5 Mtpa over 34 year mine life;

4.8 year after tax payback;

$23/tonne cost of production with est. $72/tonne selling price;

Infrastructure support for future expansion to 4.0 Mtpa.

The total resources is massive that varies in thickness between 200 and 250 meters. It could have a mine life of over 100 years. What is most important to understand is there is no risk with grade, metallurgy, strip ratios, processing and mining methods like mining other metals or materials. A processing plant is not required, you simply scoop material out of the deposit with a salt processor and ship to port. It is more like a salt factory than a mine.

Conclusion

Atlas Salt is a prime take over target for Compass Minerals or Stone Canyon.

In April 2021, when Stone Canyon Industries Holdings purchased K+S America's Salt division it took control of significant rock salt deposits, mines and facilities in South America and Caribbean in addition to those in the U.S. and Canada. Its acquisition included operations in Chile, Peru and the Bahamas. In June 2023, it added another one in Brazil. Compass is contemplating expansion with a new mine in Chile, it might be an easier and better option of they buy Atlas Salt.

Atlas Salt ran to over $4.00 on the exciting discovery phase and mining stocks typically languish as they go through the long and boring permitting and mine development phase. I believe that as why the stock has drifted down. Speculative investors bail out and a different type of investor buys in expecting the future cash flows from mining. There is still speculation of a buy out, but at these stock prices, the market is not expecting so at this time.

SALT is advancing through the permitting phase, as mid April Newfoundland released Atlas Salt Inc.'s proposed Great Atlantic salt project from the provincial environmental assessment (EA) process. The Minister's decision follows regulatory and public review of the project's environmental registration document, which was submitted to the Newfoundland and Labrador Department of Environment and Climate Change on Feb. 29, 2024. This means that further provincial permitting can now proceed, which will position the project for development and eventual production.

My main reason for pickling SALT at this time is the stock price and chart. The stock is down to it's bottom and at strong support. At $0.60 it is even cheaper than the $0.80 price we bought at in 2021. There is also a wedge pattern that we should see a break out from and I expect that will be to the upside. A break above $1.00, a higher high will be key. For now. I see no reason to chase the stock, but try bids. I see it as a strong but at $0.60 and high $0.50s.

***************************** Updates ****************************

Ramp Metals - - - - TSXV:RAMP - - - - - Recent Price - $0.84

Entry Price $0.47 - - - - - - Opinion – hold

Our latest pick has done really well and we got lucky with the timing. The day I put my report out, the stock traded all morning at $0.47 and lower, dipping down as far as $0.385. Around Noon it started moving above $0.47 and in about half an hour it was at $0.59 where it ended the day on volume of 1.4 million. I hope you bought into the dip but will use $0.47 as the entry price.

I am waiting for the rest of the drill results on hole 1 and if we get another pop higher, will likely suggest selling or taking profits. A stock cannot go straight up forever, lets see if we can pick a top

Aztec Minerals - — - TSXV:AZT, OTC:AZZTF - - - — - Recent Price - $0.18

Entry Price - $0.40 - - - - - - Opinion – buy, average down to $0.25

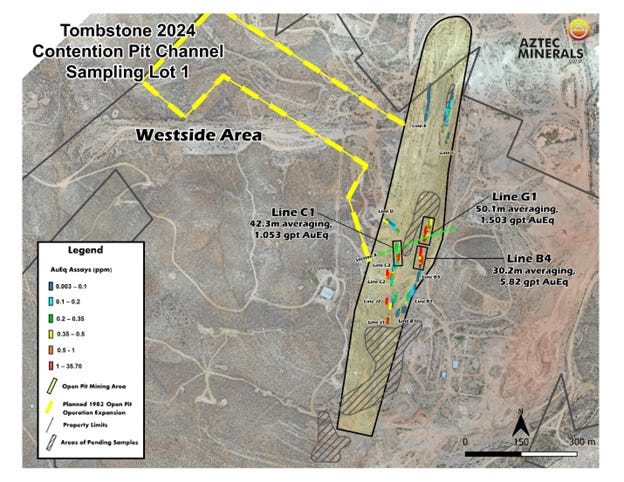

On Monday, AZT released initial results from its 2024 surface exploration program in and around the Contention pit at the Tombstone project. AZT reported a number of very strong channel samples right at surface, with the best at 30.2 metres averaging 3.72 gpt Au (gold) and 167.93 gpt Ag (silver) (5.82 gpt AuEq using an 80:1 silver-gold ratio). These are very strong numbers at surface and this stock is way too cheap for the discovery they have, so I am averaging down to $0.25.

Highlights:

Initial Contention zone channel sampling results further demonstrate the presence of near-surface, broad, high-grade gold and silver mineralization confirming Aztec's drilling from 2020 to 2023. Select channel line interval highlights include:

Line B4: 30.2 metres averaging 3.72 grams per tonne Au (gold) and 167.93 gpt Ag (silver) (5.82 gpt AuEq using an 80:1 silver-gold ratio) including six metres of 13.15 gpt Au and 602.67 gpt Ag (20.68 gpt AuEq);

Line G1: 50.0 metres at 0.827 gpt Au and 54.08 gpt Ag (1.50 gpt AuEq);

Line C1: 42.3 metres at 0.46 gpt Au and 47.27 gpt Ag (1.05 gpt AuEq).

Preliminary results provide a roadmap for additional potential mineralization footprint expansion drilling on the western portion of the Contention Pit, aiming to discover new mineralized gold and silver zones.

Additional continuous chip channel and reconnaissance sample assay results are pending.

This high-priority target area was historically reported as a target for open pit mining expansion by previous operators.

The mesothermal mineralization geological setting indicates a high potential for further discovery of wide oxide gold and silver along strike and down dip of prospective hosting rocks outcropping in the Contention pit areas.

Attractive, wide, gold and silver oxidized mineralization supports ongoing geological modelling targeting a potential bulk style of mineralization at the Contention pit area in the Tombstone project.

This graphic nicely shows the location of the 3 channel samples. Channel samples are like a drill hole on surface, so are very indicative results.

The stock is down near support and a very good buy level to average down before the next drill program. The down trend of 2023 was broken and two higher highs. The stock took a strange dip on the 21st and looks like some kind of paper shuffle with Anonymous trading. There were a few trades at $0.11 and just two trades at $0.95 and the next trade it popped right back to $0.175.

Gold – Central Banks New Partner

Most of the market, including most retail investors seem oblivious to gold's strength and why it is rising to record levels. It is really quite simple but too frightening for the main stream to talk about. Simply put, a lot of Central Banks are ditching the US$ and switching to gold. These banks around the world see that the U.S. government has a debt and spending problem and is unwilling to bring in any control. The Biden Administration continued with Covid spending spree and will not stop.

The May deficit pushed the fiscal 2024 budget deficit to $1.2 trillion with four months remaining. And it is not tax cuts because revenues are up. The real problem is on the spending side of the ledger. Government receipts came in at $323.65 billion in May. Year-to-date receipts totalled $3.29 trillion, up 10 percent from the same period in fiscal 2023. The deficit will come in close to $2 trillion this fiscal year, plus they have to re-finance $trillions in debt that rolls over, comes due this year.

If that was not bad enough, the Biden Administration's big blunder to weaponise the dollar in the Ukraine war has created a severe loss of confidence in the dollar. The US seems hell bent and determined to escalate this war which would bring more upward pressure on gold. US supplied missiles were used this past week to strike Crimea and one of them exploded above a public beach causing deaths and injuries. There is talk of US F-16 jets being stationed in Poland because Ukraine has only one suitable airport that Russia has bombed. If they are used from Poland (a NATO country), Russia says they will attack Poland. How many times can you poke a hornet nest?

Now here this, the US government house last week passed the $883.7 billion National Defense Authorization Act. There are some controversial changes in the bill, but one that rose my eyebrows - For Fiscal Year 2025 an amendment to the NDAA which automatically registers all draft-age male U.S. residents with the Selective Service System. If this is a signal of what is to come, WOW!!!

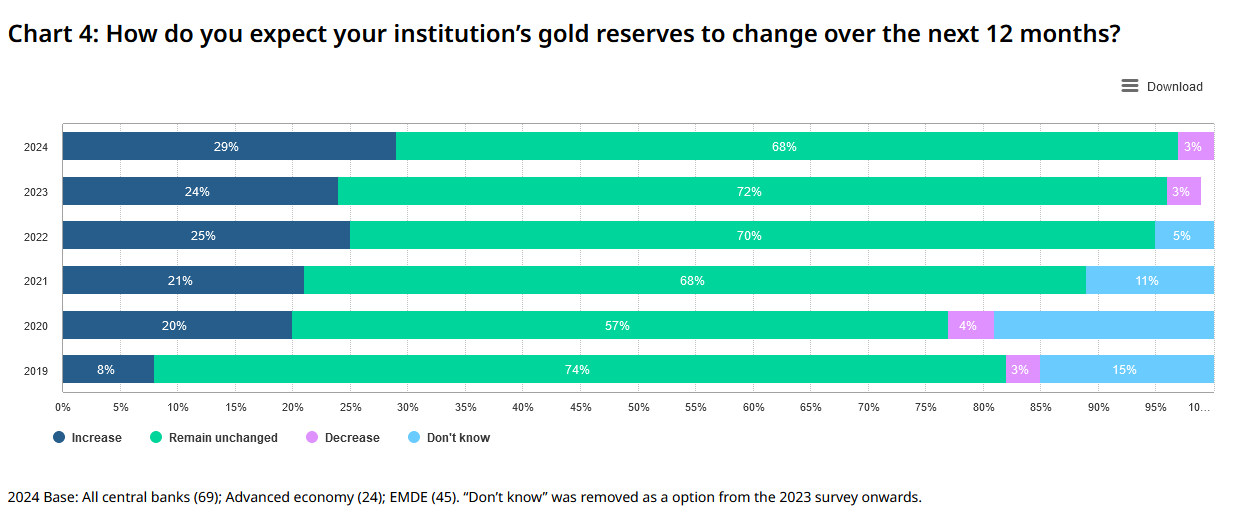

In 2023, central banks added 1,037 tonnes of gold – the second highest annual purchase in history – following a record high of 1,082 tonnes in 2022. It could be another record year in 2024. According to the 2024 Central Bank Gold Reserves (CBGR) survey, which was conducted between 19 February and 30 April 2024 with a total of 70 responses, 29% of central banks respondents intend to increase their gold reserves in the next twelve months, the highest level we have observed since we began this survey in 2018.

Reports say China stopped buying gold, but this is misleading because the reality is they did not report any buying. In the past China has bought a lot of gold that they did not report. I expect gold will stay range bound for a while as Central Banks try and suck as much gold out of the market at these prices. Once that gold is sucked out, the price will go higher again.

Conclusion

I expect gold to be range bound for now as Central Banks accumulate at these higher prices;

The war in Ukraine looks to escalate as Ukraine and US get more desperate;

The war in Israel will probably escalate with Hezbollah in Lebanon;

Most markets are not on a war footing, they seem to be fixed on hope for the best;

US interest rates cannot fall much and will probably increase as the bond market gets squeezed with debt as the Fed loses control;

It is not the price of gold, but do you own enough.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.