B2Gold BTO, Victoria Gold VGXC and Zonte ZON, RAMP, RECO, Gold

Welcome and thank you to all the new, smart, savvy and contrarian investors who have joined my substack. I am still very small here so please share and subscribe while this is free.

A lot of news on one of my favourite juniors, Zonte, and on numerous fronts.

B2Gold releases a pre feasibility on Gramalote, Victoria Gold exploring adjacent to Zonte will probably go under and Zonte started drilling at Cross Hills. Lets start with -

B2Gold - - - - TSX:BTO - - - - - - Recent Price - $3.75

Entry Price - $4.45 - - - - - - - - Opinion - buy

B2Gold has pulled back in the last couple months like most gold stocks. On June 19th they released a very strong pre feasibility report on the Gramalote Project in Colombia. As most readers of this newsletter are aware, Zonte Metals holds disputed claims right over the middle of the Gramalote proposed open pit. This has been stuck in the Colombia courts for many years, First, previous Gramalote partner and operator, Anglo Gold tried to get Zonte's claims dismissed and with no success they recently dealt their 51% interest in Gramalote to B2Gold. This does give B2Gold potentially better economics with 100%.

Anglo Gold promised a full feasibility study and now B2Gold is promising a full feasibility by mid 2025. The problem is a full feasibility cannot be completed if they do not have clear title to all the claims, or perhaps they could put a disclaimer in the report that it relies on a settlement with Zonte.

As a reminder, Zonte’s Legal Counsil is the former minister of mines largely responsible for the current mining code and took mostly Zonte stock for payment.

B2Gold will probably drag this out, but judging by how good this pre feasibility study is, they will want to push this towards production.

Highlights:

Significant gold production profile with low-cost structure and favourable metallurgical characteristics:

Open-pit gold mine with an initial life of mine of 10 years, with mill processing over 12.5 years;

Average grade processed of 1.26 grams per tonne gold over the first five years, benefiting from the processing of the higher-grade core at the Gramalote project; life-of-project average grade processed of 1.00 g/t gold;

Life-of-project gold production of approximately 2.3 million ounces with an average gold recovery of 95.9 per cent from conventional milling, flotation and cyanide leach of the flotation concentrate;

Average annual gold production of approximately 234,000 ounces per year for the first five years of production;

Average annual gold production of approximately 185,000 ounces per year over the life of project;

Projected lowest-quartile all-in sustaining costs of $886 per gold ounce over the life of project;

Annual processing rate of 6.0 million tonnes per year;

Strong project economics:

Life-of-project after-tax free cash flow of $1.38-billion;

Assuming a discount rate of 5.0 per cent, net present value after tax of $778-million, generating an after-tax internal rate of return of 20.6 per cent, with a project payback on preproduction capital of 3.1 years;

Estimated preproduction capital cost of $807-million (includes approximately $93-million for mining equipment and $63-million for contingency);

Gramalote has a long history of studies and technical reports, which supported the existing mining permit that is currently in place. The existing mining permit is currently in place on a larger-scale project so this permit will require modification to reflect the new medium-scale project contemplated in the PEA. B2Gold anticipates the permit modification time frame will be between 12 and 18 months from submission to the permit authorities;

The PEA includes indicated mineral resources of 192.2 million tonnes grading 0.68 gram per tonne gold for a total of 4.21 million ounces of gold and inferred mineral resources of 85.4 million tonnes grading 0.54 g/t gold for a total of 1.48 million ounces of gold. The PEA assumptions include revenues using a gold price of $2,200 per ounce for the first three years of production and $2,000 per ounce over the remaining life of project.

This is a large deposit at nearly 6 million ounces and the limits not reached yet. Rough numbers show Zonte has close to 10% of the claims at Gramalote and 10% of the US$778 million net present value in the report would be US$77.8 million or about C$106 million. That is about 15 times Zonte's current Market cap.

Victoria Gold, TSXV:VGCX - - - - - Recent Price - $0.80

Victoria Gold was once on the Selection List but we were stopped out in 2022 at $13.70. Zonte had great benefit from Victoria Gold because VGCX was exploring right to Zonte's McConnell Jest border in the Yukon with their Raven project. In essence Victoria Gold was increasing the value and potential of Zonte's project without Zonte spending a dime.

Those days are over for the foreseable future as Victoria Gold reported a heap leach pad failure, basically a landside outside containment banks at their Eagle mine. It is located 375 kilometres north of Whitehorse, and 85 kilometres north of the village of Mayo, Yukon. The site employs around 500 people.

Thankfully nobody was hurt, but this is a massive problem and will be costly to remedy. I heard one analyst estimate of $70 million.

The big problem is Victoria is a one mine company and this is their only source of cash flow. They have under $30 million in cash and a lot of debt. About $180 million of debt, plus about $34 million in equipment debt facility with Caterpillar.

There will be massive dilution in the stock at best and most likely the company will go bankrupt and shareholders left with nothing. Perhaps a White Knight arrives and buys the company for the asset but that will depend on repair costs and probably environmental liabilities we don't know of yet.

Here is a picture of the landside in a Yukon news article. You can view more detailed pictures if you view this article, but they were copyright so I did include here.

This has no negative effect on Zonte, only that Victoria Gold will ne longer be exploring Raven next to Zonte's border. Fortunately Victoria Gold already made the discovery there.

Zonte Metals - - - - TSXV:ZON - - - - - Recent Price - $0.08

Entry Price - $0.09 - - - - - - - Opinion – strong buy

Most important, Zonte has started their next phase of drilling at the K6 target on their Cross Hills project in NFLD. The last round of drilling hit some decent copper numbers, but Zonte needs to find longer intercepts, higher grades or both.

In yesterday's news it was highlighted and I believe this is an important point. The Company has conducted additional multi-faceted exploration to aid in better understanding the mineralizing system. The Fall 2023 K6 drilling demonstrated that the integration of the new exploration data with the initial datasets has provided a better understanding of the mineralizing system. All drill holes from the Fall 2023 program intersected copper mineralization with 11.2m averaging 0.42% Cu in the deepest drill hole, suggesting possible increasing grades with depth. The Summer 2024 drilling program aims to test extensions of this mineralization along strike and to depth.

The Cross Hills Copper Project is an IOCG system with 12 identified targets across its 25 km extent, K6 being the smallest. These targets are defined by coincident geological, geophysical, and geochemical data. Depending on the results from the current phase of K6 drilling, further drilling will continue at K6, and additional targets will be prepared for drilling using the same advanced exploration methods that led to the copper discovery at K6.

I have a strong buy on the stock because they started drilling where I expect more success and the stock is cheap and near a bottom. Considering there is strong share holder support from 3 major groups, there was heavy volume when it bottomed last year. The stock has been in a long down trend like most of the junior exploration stocks. We need to see a close at $0.10 or better to break the down trend channel and than a close above $0.135 to break resistance, This could happen any time as the drill is now turning. Most investors will now hold for hopeful results.

Ramp Metals - - - TSXV:RAMP - - - - - Recent Price - $0.56

Entry Price $0.46 - - - - - - Opinion – buy on weakness at $0.46 or less

Ramp released the rest of their assay results yesterday and there was nothing very significant, some lower grade intersects. That takes nothing away from the fact they made a high grade gold discovery, but some more fire works would have been nice.

This is a new company with not much trading history so difficult to know where the stock might trade. For now, I see it as a buy at our entry price or lower.

Recon Africa - - - - TSXV:RECO, OTC:RECAF - - - - - Recent Price - $1.37

Entry Price - $0.56 - - - - - - - Opinion – buy around $1.32

It looks like it was the typical sell the news, as the stock corrected when they announced the first well was spud. It is just a knee jerk reaction, but has brought the stock down to support at $1.30 and a good buying opportunity. Interest in Namibia is on the rise and would not surprise me if Shell ends up a partner of RECO. Shell (SHEL) is seeking the South African government’s permission to drill up to 5 offshore wells off the country’s west coast, to the south of its prolific Namibia discoveries.

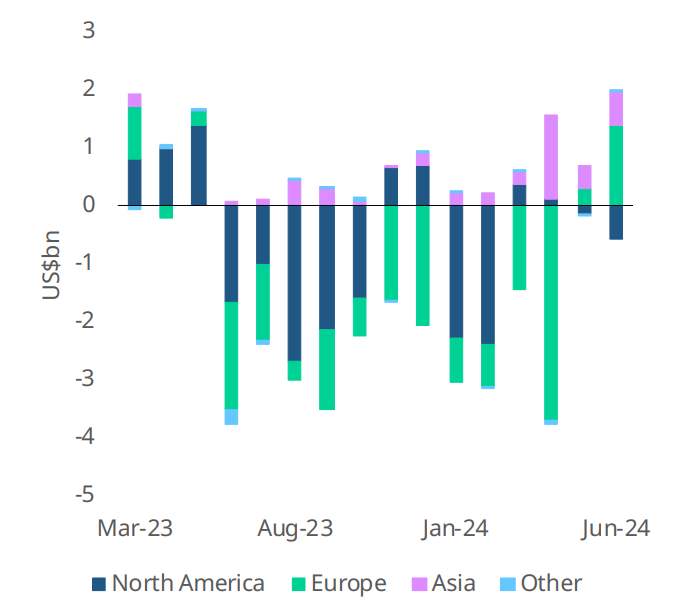

Global gold ETFs have now seen inflows two months in a row; in June, notable European and Asian buying offset outflows from North America. Although June and May inflows helped limit global gold ETFs’ y-t-d losses to US$6.7bn (-120t), this remains the worst H1 since 2013 – both Europe and North America saw hefty outflows while Asia was the only region with inflows. Retail investors have not clued into this new gold market yet. Consensus expects a big correction to occur from this years run up in price. Central Banks have another idea.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.