Welcome and thank you to all the new savvy investors that have joined me on substack. Please subscribe to ensure you don't miss anything and this will also allow you direct chat with me here, that I will soon activate.

Lots happening these days and some crucial market developments I will delve into.

Banking Crisis continues

As you know, I have been commented for quite some time that this banking crisis is far from over. Yesterday TD Bank called off the merger with US Bank First Horizon. TD has likely figured that they can just wait and pick up a US bank for pennies on the dollar. Pacific Western Bank (PACW) collapsed further yesterday on investor concerns with the bank and the sector in general.

I have followed Ambrose Evans-Pritchard out of the UK for about 20 years. I don't always agree with him but he is among the best analysts and writers when it comes to the economy and markets. His latest article cites that half of American Banks are insolvent as “US commercial real estate and the US bond markets have collided with $9 trillion uninsured deposits in the American banking system. Such deposits can vanish in an afternoon in the cyber age. “

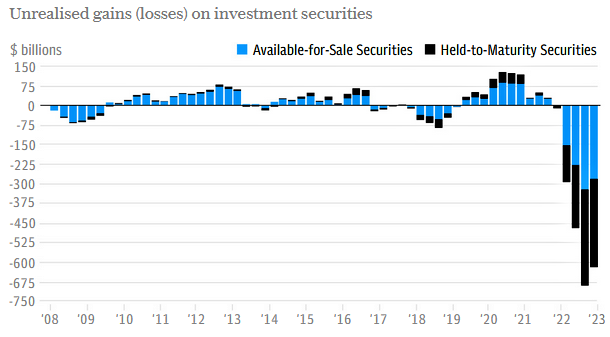

What I really like with the article is this chart that was illustrated. I have explained many times in the past that it is the magnitude of change from a very low interest rate that would cause a problem, If rates are 4% and you go up to 6% that is a 50% increase, but if rates are 1/2% and you go to 5%, that is 1000% increase. You can see how that is illustrated in the chart below. When the plandemic hit and they lowered rates from around 1.5 - 2% down to 0.5% to zero you can see a modest increase in 2020/21 in the value of US treasuries, bonds and mortgages that the banks held. However when rates moved from just above 0% to the current 5.0 – 5.25% these values plummeted. Many banks hedged their portfolios or it would have been worse. And as I mentioned before, there was no excuse not to hedge because this increase in rates was so well telegraphed, you simply had to be incompetent not to hedge or sell these assets over a year ago.

US banks are sitting on huge net losses from bonds and debt securities

However, there is no going back now and it is what it is. These banks are suppose to be run by financial experts but it seems they all act together in a herd and make the same mistake. And I must say hats off to the ones that sold out or hedged a year and a half ago. That said hedging really just transfers losses, as the bank that wrote the hedge and sold to the other bank takes the loss.

In the latest bank failure, white knights probing a possible takeover of First Republic retreated once they discovered the scale of real estate damage. “No buyer would take First Republic without a public subsidy,” said Krishna Guha from Evercore ISI. He warns that hundreds of small and mid-sized banks will batten down the hatches and curb lending to avoid the same fate. This is how a credit crunch worsens.

Hoover Institution report by Prof Seru and a group of banking experts calculates that more than 2,315 US banks are currently sitting on assets worth less than their liabilities. The market value of their loan portfolios is $2 trillion lower than the stated book value. Yup that is trillion, with a ‘T’.

U.S. officials are looking into whether "market manipulation" has prompted the recent volatility in banking shares, according to Reuters, with short sellers raking in nearly $380M in paper profits on Thursday alone. Remember 2008, they can change rules at anytime and ban short selling bank stocks.

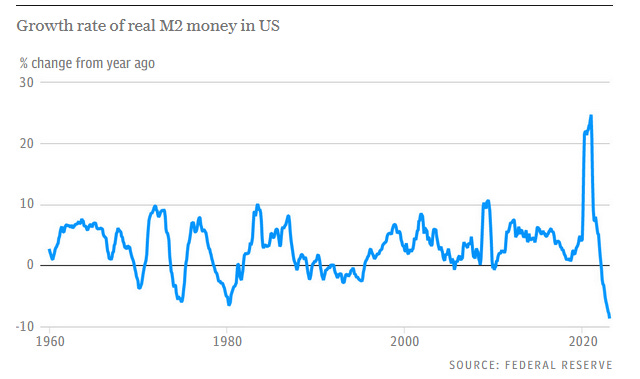

I have shown a M2 chart like this below on a couple of occasions but it is worth looking at again to see how it has progressed or worsened. The whole problem is caused by this wild swing that is evident in monetary policy measuring M2 below. From insane Covid-19 money printing to the Fed now trying to reign in the inflation it has caused. Like I always maintained, Covid-19 policies were the major factor in economies.

The Fed is really in the proverbial rock or a hard place. Lower rates and ease too soon and inflation remains so rates cannot come down too much or hold rates up until the current banking crisis intensifies and we enter a severe recession. Now some are saying this inflation is a one off event and that could be true but the Fed is not taking this chance. If they are doing what I suspect and that is keeping rates up to cause more banking turmoil that will help slow the economy more and cause a severe recession to bring back deflationary forces. I believe it is the only way they can bring rates back down to 1% to 2% and that level is the only way the current debt laden system can go a while longer.

And the rock and hard place saga continues today as job creation in the US accelerated last month, in a sign that the labour market remains surprisingly resilient in the face of rising interest rates, major bank failures, inflation and economic uncertainties across the world. Total employment rose by a surging 253,000 jobs in April. That was far above what economists had projected (178,000), and an increase from the brisk 236,000 new jobs created in March. And remember that jobs data is a lagging indicator. By the time jobs has slowed or there are losses, we are in a recession. Gold is retreating on the news with oil and equities up.

GOLD

World Gold Council reports that Q1 gold demand (excluding OTC) was 13% lower y/y at 1,081 tonnes (t). Inclusive of OTC, total gold demand strengthened 1% y/y to 1,174t as a recovery in OTC investment – consistent with investor positioning in the futures market – offset weakness in some areas.

Demand from central banks experienced significant and record growth during the quarter. Official sector institutions remained keen and committed buyers of gold, adding 228t to global reserves. Central Banks continue to buy at a record pace should be telling investors something and that something is very bullish.

Gold took off on the Fed rate increase news yesterday, I guess a case of selling before and covering (buy) on the supposedly bad news. And perhaps hope that this was the last increase. Gold hit new record highs but we did not get the close above $2070 that I was looking for, so we are still in my trading range. Down further on the chart than shown below with the jobs news.

It is only a matter of when that gold breaks to a higher trading range and the gold producers get a little more respect. We might also need to see a further collapse in general equity markets and Crypto for investors to start realizing the gold sector will offer upside for their hurting portfolios.

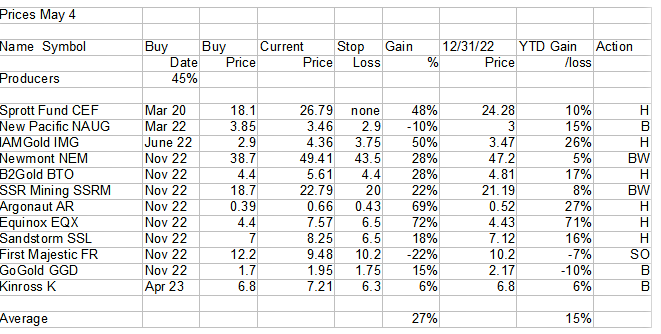

Our timing to buy Kinross was good, but still it is only up +6% and in general the gold stocks are still way under valued and under owned. Here is our selection list of gold producers as of May 4 prices. B=Buy, H=Hold. BW=buy on weakness, SO=stopped out.

SSR Mining just popped on good financial results so why I have a buy on weakness. We got stopped out of First Majestic, but I will probably add it back on soon and if we see some more consolidation in the gold price, I will look for another undervalued producer. Up 15% on the year is not bad.

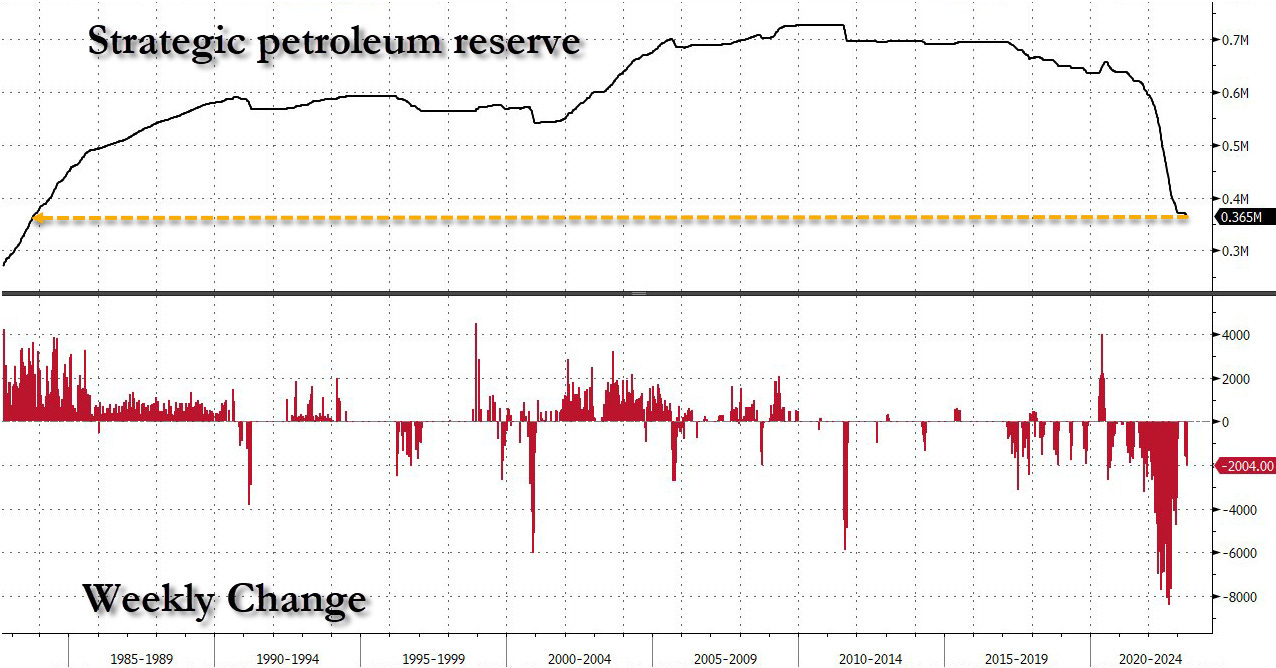

Oil prices really got hammered on recession fears and slow growth in China, but there is really a lot of manipulation here to keep inflation down and try to hurt Russia. OPEC cuts production and the US responds by letting even more out from the strategic reserves.

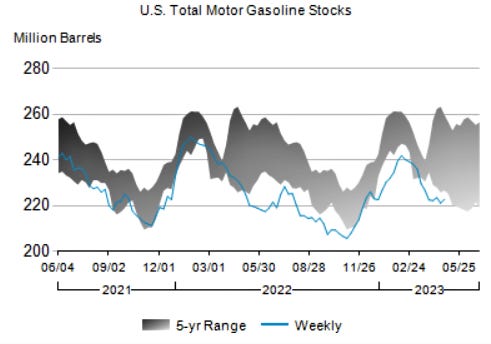

New EIA data confirmed a rise in Cushing and gasoline stocks, while distillates drew down for the 5th consecutive weak. Meanwhile, a 5th straight weekly draw from the White House pushed Strategic Petroleum Reserves down to its lowest level since October 1983. This chart from Zerohedge

What I am watching most closely is gasoline inventories as we approach the summer driving season. These levels have been very low and if they continue, it could mean much higher prices and more inflation coming back.

It certainly looks like oil prices bottomed yesterday with a hammer candle stick down to the March lows. Also heavy volume on 3 days of selling and increasing open interest which probably means not much short covering but fresh buyers.

‘I Didn’t Understand It’

The US has finally lifted their Covid/Vaccine restrictions at the border as of May 11th. Kate Moylan, who lives in a Yukon town bordering Alaska, said the “great relationship” the cross-border communities had with each other was “ripped apart” by the COVID-19 border restrictions and vaccine mandates.

“The whole irony of it was that unvaccinated Alaskans were allowed to travel the Alaska Highway, but unvaccinated Canadian citizens were not allowed. So I could never understand the mandate,” she said.

Well I hate to tell you Kate, but if you understand their motive was a control experiment and make fortunes selling vaccines, PPE and extra health care fees than it makes sense.

And today, The World Health Organization said that COVID-19 no longer qualifies as a global emergency, marking a symbolic end to the pandemic

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication