It is no surprise after such a strong run that we see a correction in the gold price. It is healthy market action. The biggest question is how far down will the correction take us? My plan is to add another one or two gold stocks to our list on this correction.

It is hard to say how far gold will pull back. The chart shows a doji star reversal pattern, but as I have commented many times, candle sticks are not reliable on a continuously traded instrument. Opening and closing prices are very important with candle sticks, so what I look at is the prices around 9AM as the open and the closing price at around 5PM. That does not show a doji candle but a small green candle, a little smaller than the far right green candle. It still is a reversal pattern, but not as strong as the doji reversal. That said, RSI hit 80 which is an over bought reading as well.

There will be a correction to some level. The most bullish case is mild support holds around $2160 and a bigger correction would be into the $2100 to $2120. That is what I expect because the market has been so bearish, it will probably not change quickly. But one never knows? I have no doubt we are in a new bullish move, but patience may still be required.

The gold stocks, measured by the HUI rallied about 17% so a lot better than golds 7% rally, so that leverage was good to see. However, the gold stock move was muted and still weak. The HUI around 235 still has a long way to go to reach 280 last May when gold went to the $2140 area. Near term we need to see a higher high close at 260 or better.

AI, The Next Big Thing

On February 21st, I thought Nvidia's – NVDA stock price was ahead of itself and we would see a further pull back. That did not happen and instead the stock ran from $750 to $950 in the next few weeks. It is a telling sign how strong this AI craze is. However, it is really a big thing and goes far beyond Nvidia, so in time, AI will be recognized in 100s of companies. Think back to the internet boom, it started small too, but it evolved into way more than just 7 stocks or so, but ended up being 100s. We are beginning to see news on AI in numerous places and after all, AI has already been around a long time, but is just now getting wings because of the advancement in computer power.

IBM announced job cuts in its marketing and communications team on Tuesday. The move is part of IBM's ongoing shift towards AI, highlighted by CEO Arvind Krishna's efforts to upgrade employee AI skills significantly. This follows an earlier decision to replace nearly 8,000 jobs with AI and a reduction of 3,900 positions last year. Remember decades back, IBM's deep blue AI could only manage a chess game. AI will displace millions of human jobs in many industries. It will be most interesting how the economy and job market evolves.

Jackpot Digital the Best AI stock in Gambling/Casinos

TSXV:JJ - - - - - - OTC :JPOTF

This AI stock is ridiculously cheap for how far it has advanced. I have followed the company for about 6 years. Jackpot started putting their AI poker tables in Cruise ships before Covid-19. The Cruise ship industry was among or probably the hardest hit industry by Covid locks downs. Over 50% of startups and small business, did not survive the government lock downs and I thought Jackpot would be one of those so figured it was time to sell in 2020/21.

However, Jackpot survived and not only that has come out a shining Knight. This speaks volumes for the company to survive Covid and the lock downs. Small companies don't have the resources like big companies to survive major set backs. Jackpot has moved far beyond the cruise ships now.

In addition to Jackpot's cruise ship customers, which include Carnival Cruises, Virgin Voyages, Princess Cruises, Holland America, AIDA and Costa Cruises, Jackpot has announced land-based installations or orders in 12 states and territories in the United States and growing, including California, Kansas, Louisiana, Michigan, Minnesota, Mississippi, Montana, Nevada, Oregon, South Dakota, U.S. Virgin Islands, Washington, as well as several international jurisdictions.

Most recent February 13th, Jackpot signed a licensing agreement to install Jackpot Blitz dealerless multiplayer electronic poker table at the Acropolis Gaming Lounge, located in Kingston, Jamaica, further expanding its growing Jackpot Blitz casino footprint. The company has already obtained the required certifications for the jurisdiction, and is now scheduling installation at the property.

Jackpot now has 80 tables installed and will soon be 100. Each table brings in approximately $3k in revenue each month. This solution for casinos, is far more efficient, save costs, staffing problems and is loads of fun to play. I believe Jackpot is reaching an inflection point with a decent base now and strong growth to propel it to the next level. I believe we will see numerous new sales agreements in the coming weeks and months. The stock won't stay at these prices long.

I strongly recommend you watch this short 2 minute video on Jackpot Blitz by Jimmy Johnson of NFL fame. You will get all the key points in 2 minutes.

In 2021, the market size of the casino and online gambling industry worldwide reached a total of US$231 billion. The global gambling market is expected to reach US$912 billion by 2027.

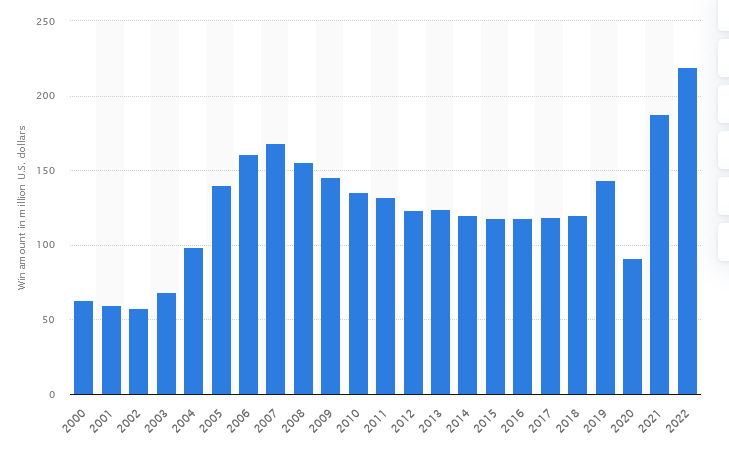

Win amount of casino poker games in Nevada USA, 2000 to 2022

The drop in 2020 with lock downs is no surprise, but the recovery is a surprise and very strong. We have not seen this kind of growth since the mid 2000s. This is a strong back drop for Jackpot.

The stock has built a strong base between 6 and 8 cents so I see little downside. Once it breaks first resistance around 10 cents it could quickly move into the $0.20s.

This is a cheap stock because it is totally unknown. Jackpot Digital is an advertiser at my website playstocks.net and I do own shares.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.