Biden just like Trump, Sticky Inflation, Buy Zonte - ZON

I had personal family matters to deal with last week, so was away. I came back to the office on the weekend only to find my computer dead. I am on my backup but I have not used it since 2019. It will probably take most of the week to get back to normal. I will certainly put out any updates on sells and buys on our selection list. Today, I will touch on last weeks most important economic news and today we hear.

Biden Like Trump

The NY Times say. “President Biden and President-elect Donald Trump now agree on one thing: The Biden Justice Department has been politicized.”

Biden pardoned his son Hunter last night, brushing away two federal convictions and granting his son clemency for any wrongdoing over the past decade. In his statement announcing the pardon, Biden complained about selective prosecution and political pressure. And he questioned the fairness of a system that he had, before now, defended.

Biden’s decision to wipe his son’s convictions on gun and tax charges came despite repeated statements that he would not do so. This past summer, after Hunter Biden was convicted, he said, “I will accept the outcome of this case and will continue to respect the judicial process.” The statement he issued last night made clear he did not accept the outcome or respect the process.

Trump has long argued that the justice system was “weaponized” against him, and that he is the victim of selective prosecution, much the way Biden has now said his son was.

“While as a father I certainly understand President @JoeBiden’s natural desire to help his son by pardoning him, I am disappointed that he put his family ahead of the country,” Gov. Jared Polis of Colorado, a Democrat, wrote on social media.

Now that Biden is headed out the door, I guess it is now alright to admit the truth.

Inflation Sticky

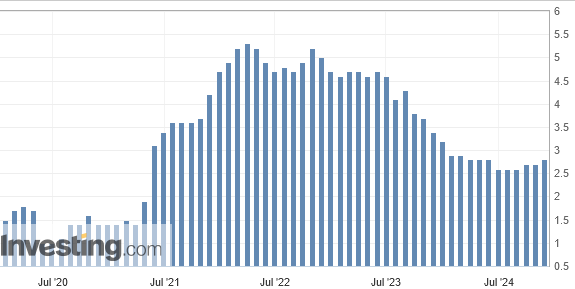

I have been commenting numerous times that I don't think inflation is beat, we simply had a down draft in oil&gas prices that brought the numbers down probably temporarily.

The Federal Reserve's primary inflation rate, tied to the core PCE price index, ticked higher in October, muddling prospects for a December rate cut. The core PCE price index rose 0.3% in October, meeting forecasts. The 12-month core inflation rate picked up to 2.8% from 2.7%, also in line with estimates.

Core PCE inflation is running at a 2.8% annualized pace over the past three months, the highest since April. As you can see on the chart next page, the drop with inflation has stopped and actually inching higher. If energy prices rise much at all, it will be more bad news for lower rates.

New Home Sales Plunge

New home sales dropped 17.3% in October from the previous month to a seasonally adjusted rate of 610,000 units, the lowest level in about two years as mortgage rates remained elevated during the month and hurricanes took a toll on housing activity.

Analysts surveyed by Bloomberg had expected a pace of 725,000. "October's weak sales came alongside increases in mortgage rates throughout the month," Colin Johanson, US macroeconomic research analyst at Barclays, wrote in a note after the release.

The rose colored glasses will say it is temporary with hurricanes but I beg to differ. Hurricanes were a factor but the bigger problem I have been commenting on is the interest rates that affect mortgage rates has been increasing. The market is concerned with high deficits and government spending. Trump has inherited a mess and it won't be quick or easy to fix. In the 10 year treasury yield chart here, you can see that rates did start to come down as the Fed lowered short term rates but they have shot right back up again and are not much below the peak.

There was significant news with one of copper explorers, Zonte last week.

Zonte Metals - - TSXV:ZON, OTC:EREPF - - - Recent Price $0.06

Entry Price - $0.08 - - - - - - - Opinion – strong buy

The strong buy is based on the low stock price and the potential of this next drill target K9.

The K9 target area is one of 12 target zones within the Cross Hills Copper Project. Recent drilling success at the K6 target has provided important insights into the copper mineralizing system that led to this discovery. Leveraging the knowledge gained from K6, the Company is advancing several nearby large targets south of K6 including K6S-K7, K8, K9, and K10, to drill-ready status, pending supporting data.

The Company has now completed and compiled all the geochemical and geophysical data through the K9 target area. The re-processing of the geophysical data has identified a large gravity anomaly which is spatially coincident with a magnetic anomaly, copper-in-soils and rocks, sitting in a fault structure, with mapped IOCG alteration. This anomaly now deemed a high-priority target, measures 1275 metres in length, 875 metres in width and extends to depths exceeding 750 metres.

This target is huge, way bigger and stronger than K6. Sure it would have been nice to see the big drill hit on K6 as it was the first target that was drill ready, but I believe K9 has much stronger potential. With at least 12 targets to drill it is only a matter of which one has the first big drill hit.

Terry Christopher, President and CEO comments; “The identification of this very large gravity anomaly at K9, spatially associated with bedrock copper mineralization and elevated copper-in- soils, presents the Company with a significant large-scale drill prospect. The Company is also advancing the compilation and processing of data for the remaining targets south of K6. Pending soil data from the lab for these remaining target areas will be integrated with other datasets upon receipt, with results to be shared in an upcoming press release.”

Very interesting and bullish developments on the long term chart. There is strong support at 5 cents with only a brief dip below this when flow through funds dumped their stock last year. For the most part, these funds are only invested for the tax break and just rotate money into new finance deals. That long term support (black line) with the blue down trend line is forming a wedge pattern that the stock will break out from. I have no doubt will be to the upside.

The flow through funds are pretty much done selling. There was about 3 million flow through shares that became free trading around mid September and their immediate selling whacked the stock down from the 9 cent area to the current 6 cents. TD has also been a seller last few months as quite a few retail investors bailed at the bottom here. Interesting is Raymond James has been a big buyer, usually meaning U.S. buying. There might be a little fund share selling left and we might see some tax loss sellers. Tax loss selling usually peaks around December 15th, so between now and then is an excellent time to accumulate.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.