Welcome to the new smart contrarian investors who have joined my substack. I plan on keeping this free until I reach somewhere over 5,000 subscribers and I only have around 1,000. Please share this with family and friends as I cover many topics, such as the economy, markets, commodities, real estate, geopolitical events along with medium and long term cycles that pertain to these. I make individual stock, ETFs and option suggestions to buy and I use the ‘sell’ word a lot too.

This is my last missive before the long weekend. Hope Canadians have a great Canada day and celebrate with Trudeau’s carbon tax increase. And American’s please enjoy the July 4th weekend. All keep in mind that long weekends often have surprising news announcements, so I bought more gold (GLD) at these lower prices.

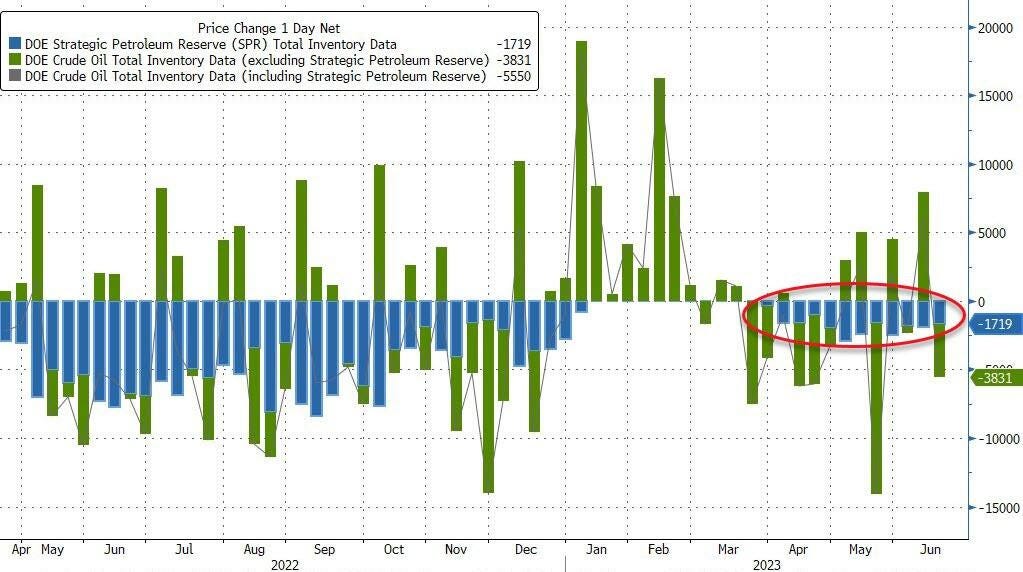

Last week, I reported that the Biden Administration is planning to buy back 12 million barrels of oil for the Strategic Petroleum Reserve (SPR) but they are doing the opposite and still withdrawing for the 12th straight week as this chart shows from zerohedge/bloomberg. It goes back to the old saying 'do as I do not as I say'.

Then this week, it was reported yesterday That US stockpiles fell the most in 2 months led by a 9.6 million barrel drop in crude inventories. The Biden administration also drew from the Strategic Petroleum Reserves for the 13th straight week.

Previously, the Oil price decline was blamed on a surprise 50 point rate increase in the UK and increases elsewhere in Europe. Recession fears are rising. It makes little sense that Biden is still drawing down the SPR other than pure price manipulation. There is enough oil around right now.

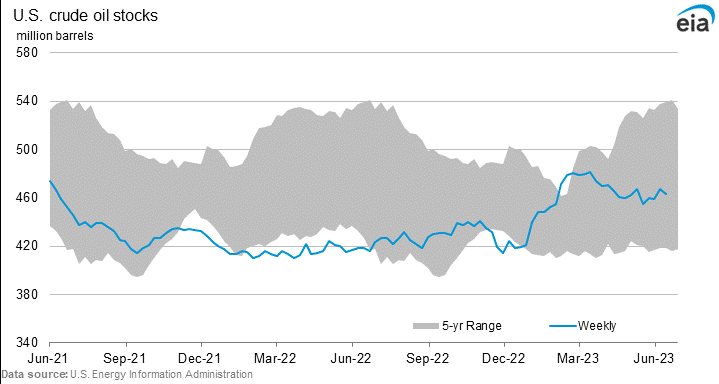

U.S. crude oil inventories at the Cushing, Oklahoma, storage hub have risen to their highest in two years, as outages at Midwestern refiners crimp demand and higher flows from Canada add to supply.

Stockpiles at Cushing, the delivery point for U.S. crude oil futures, have climbed for eight consecutive weeks after falling earlier this year. Total crude inventories are shown in this chart and they are about the mid way point of the 5 year average.

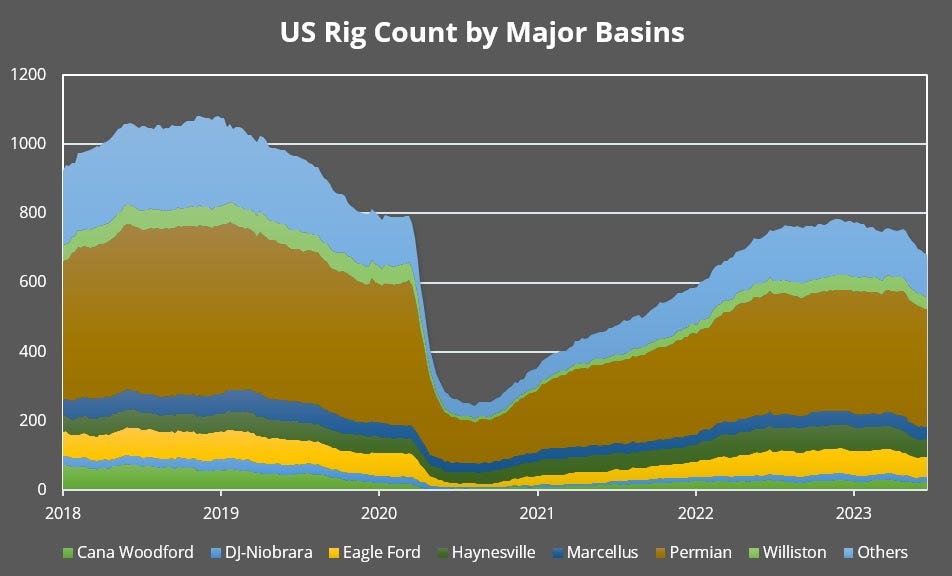

Data last Friday also showed rig counts in the US dropped for the 8th consecutive week. Still a long way up to pre Covid levels.

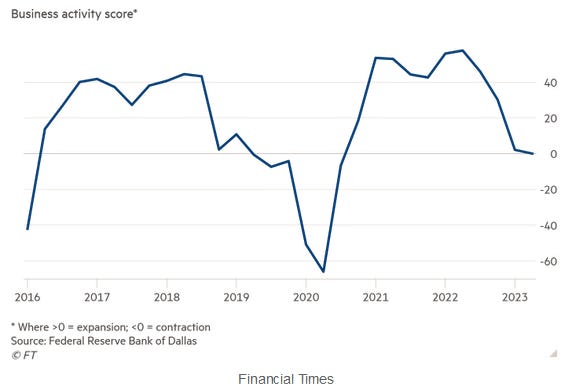

A Dallas Fed survey of ~150 US O&G companies posted a zero for business activity growth in Q2. It certainly seems that prices are too low to spur development and crude levels will keep falling in the near and mid term. Perhaps a drop back below 5 year averages is in the cards.

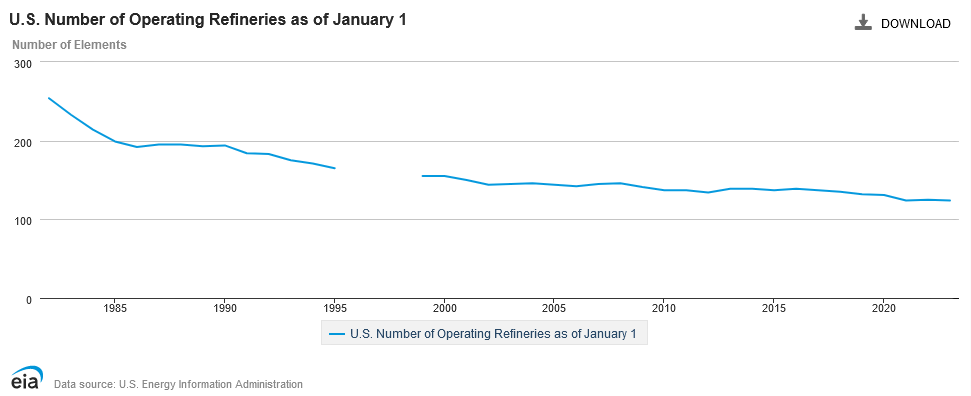

The issue may not be crude supplies but refinery capacity. The US has not built a refinery in something like 50 years. This chart from the EIA shows the steady decline. There were 135 refineries in 2020 and now 129 in 2023.

From the news link above "We're going to be sending more (oil exported) abroad," said Phil Flynn, an analyst at Price Futures Group. "The supply side continues to remain tight if you look at the big picture."

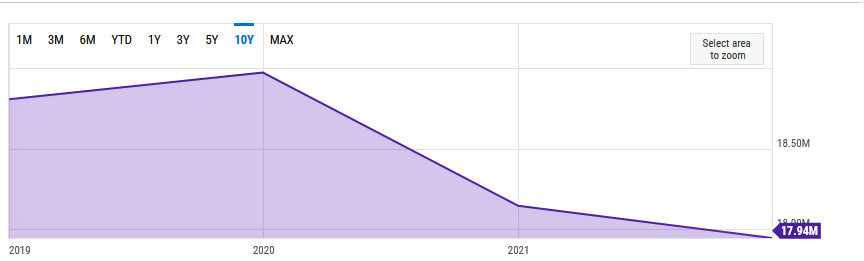

A spate of unexpected refinery outages in the Midwest have added to the inventories, which rose to 42.1 million barrels in the week to June 9, the highest since June 2021, Energy Information Administration data showed. This chart shows refinery capacity in millions of barrels. The industry has not recovered from Covid and never will. It has probably been permanently shut.

The United States has emerged as the top destination for refined petroleum products from India in the month of November 2022. Notably, most of these goods were processed from Russian crude oil that the Asian country imported at a discount. The US imported oil products worth $588 million in November, increasing imports to the highest levels in that fiscal year.

There has been an increase of 23 per cent in imports of petroleum products by the US as against last year as the country purchased $3.62 billion worth of petroleum products in the eight months to 30 November, 2022. Notably, it was the highest buying by the US in the past five years.

I could not find much data for 2023 but India is shipping more Russia refined oil to Europe as well. Reuters reports Europe typically imported an average of 154,000 barrels per day (bpd) of diesel and jet fuel from India before Russia's invasion of Ukraine. That increased to 200,000 bpd after the European Union banned Russian oil products imports from Feb. 5, Kpler data showed. You have to give India credit as they buy discounted Russian oil and sell high priced refined products to make a strong gain.

However, it really makes mockery of the sanctions against Russia.

Lithium is still a thing

The junior mining sector has been very dismal but there is still a little action with lithium juniors.

Global Battery Metals - - - TSXV:GBML - - - Recent Price - $0.17

Entry Price - $0.09 - - - - Opinion – hold

Yes, you are seeing correctly, a junior that is actually up. GBML moved higher after June 7th news about drilling at their Leinster lithium project in Ireland. Successive holes will be targeting different parts of the anomalous deep overburden geochemistry grid. The Company has started to transport pegmatite core samples to ALS Laboratories for analysis.

"So far, our initial drill holes have delivered very promising pegmatite intercepts that have the on-site teams excited," said Michael Murphy, CEO of Global Battery Metals. "While there's still more work to accomplish, we are making good progress hitting close-to-surface pegmatite intercepts and processing core for analysis. We will continue to follow what we are finding and optimize our drill plans accordingly."

Significant sampling and mapping across the Knockeen Prospect has been conducted, with the potential discovery of up to six LCT pegmatite dikes (see March 20, 2023, press release) and the most recent assay results of 66 rock samples released by ALS Laboratories returning Li2O% lithium contents ranging up to 3.75 % Li2O / 17,410 ppm Li.

The stock seems to be responding to news and if we see a move to $0.24 I would be taking profits.

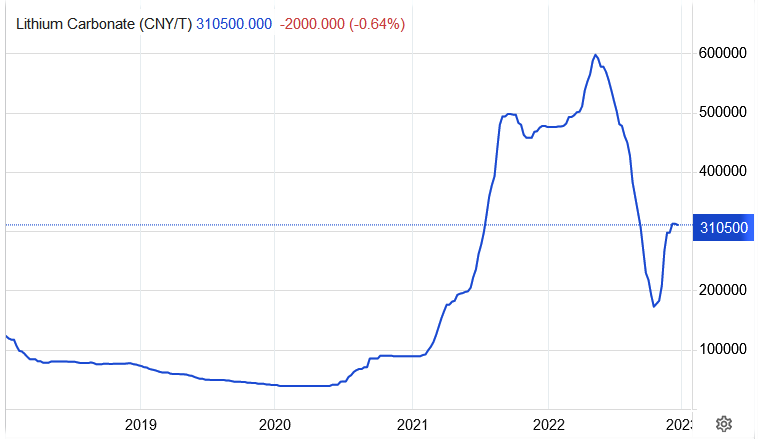

On April 14th, I commented that “While lithium prices have corrected, these low prices will not last long.” The bottom was April 25th around 160700 on the chart. The data does not show well on the chart but these are prices to June 23rd.

I am not convinced lithium will go a lot higher, but these are still very good and elevated prices.

On April 14th I suggested buying Scout Minerals a Shawn Ryan deal, that just changed the name to:

Eureka Lithium - - - CSE:ERKA - - - Recent Price - $0.93

Entry Price - $0.80 - - - - - Opinion - buy

The stock went up $0.22 the day I put my initial alert out and closed at $0.77 and the next day at $0.83 so I picked an even $0.80 as our entry price. Usually once the name is changed, a financing raised and exploration starts, promotion and getting the word out occurs. Eureka has raised about $6.6 million at $0.50 per share with flow through shares at $0.60 and Quebec super flow at $0.65

I am going to do a full report on ERKA but wanted to send this out as another heads up because I believe the stock is going to move higher. Junior companies typically do promotion and start getting the word out after they have got the corporate ship on course, like name change, financing and are about to start exploration. This week ERKA announced the closing of their financing.

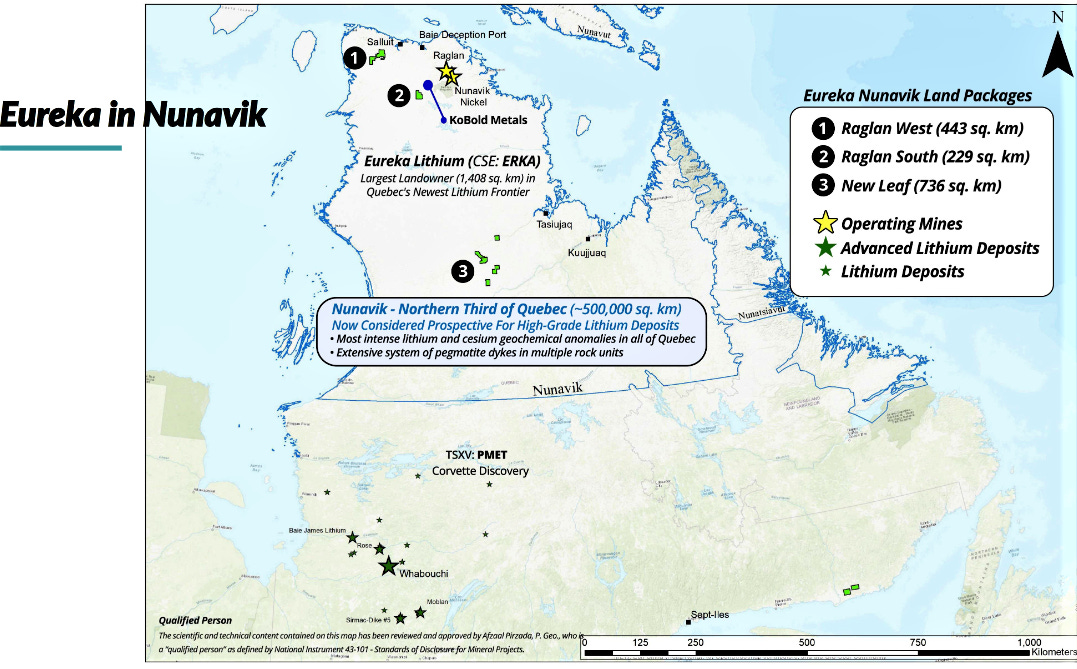

Eureka is the largest lithium-focused landowner in the northern third of Quebec, known as the Nunavik region, with 100% ownership of three projects comprising 1,408 sq. km in the emerging Raglan West, Raglan South, and New Leaf Lithium Camps. These claims were acquired from prospector Shawn, in a region that hosts two operating nickel mines with deep-sea port access.

From this week's press release - Mr. Jeffrey Wilson, Eureka CEO, commented: "We are pleased to complete this financing and close the offering with over $6.6M in aggregate gross proceeds. The closing of this offering provides the Company with the financial capacity to initiate and conduct an aggressive initial campaign of mapping, prospecting, and sampling across all projects within the Company's project portfolio, including highly prospective areas of known concentrations of elevated lithium values, as reported in Quebec government lake sediment sampling results. We look forward to keeping investors informed as field work commences and initial results become available."

A lot of the same investor group that financed Atlas Salt are in the recent financing of Eureka and Atlas ran from $0.75 to over $4.00. Atlas also had news out this week, more of an update.

Atlas Salt - - - - TSXV:SALT - - - - Recent Price - $1.12

Entry Price - $0.80 - - - - - - Opinion - buy

It think the stock has bottomed and is poised for a summer rally. It was last summer when the stock had it's big run to over $4.00. The stock completed a morning star doji reversal last Friday.

Today's news indicates they are getting close to finding a new dynamic CEO that can take Atlas to the next level. And Remember that Atlas Salt is the largest shareholder of Triple Point Resources Ltd. (TPR), a company formed from the Atlas spinout of the Fischell’s Salt Dome in 2022. Atlas owns 27.5 million shares of TPR or approximately 27% of the company. The Triple Point board continues to evaluate the timing and method of creating liquidity for current TPR shareholders.

Today, current CEO Rowland Howe stated: “After being mine manager at the world’s largest underground salt mine for many years, I can’t emphasize enough how significant this Great Atlantic Feasibility Study will be in the context of a broader Eastern North America road salt sector that’s grappling with a domestic production shortfall. Great Atlantic would be the first new North American salt mine in more than 20 years and the only one that’s electric-based and accessed through ramps as opposed to vertical shafts. Conservative assumptions in the PEA outlined a compelling low-cost producer. More data and continued evaluation since the PEA will give us a Feasibility Study that will be a threshold event for Atlas Salt with the establishment of economic reserves from the billion plus tonnes of mineral resource.”

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.