Thank you and welcome to the smart and contrarian investors who have recently joined my playstocks substack. It is currently free so please share.

Bill Gates, Jeff Bezos and Eureka Lithium are new Neighbours.

Eureka Lithium - - - - CSE:ERKA - - - - OTC:SCMCF - - - Recent Price - $1.06

Entry Price $0.80 - - - - Opinion – strong buy

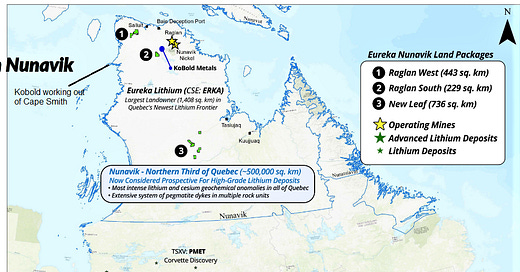

As I have pointed, the famed prospector, Shawn Ryan has vended his most prospective lithium properties in Northern Quebec to Eureka Lithium. Shawn chose the Raglan area in northern Quebec because it has seen very little exploration for lithium. He then analyzed the government's lake sediment data that is quite extensive. He analyzed all the elements that are associated with lithium and only picked up the very high grade locations, basically those in the top 97% to 100% percentile (grades). Furthermore these are large areas that just don't contain some dykes but likely

host large systems where multiple discoveries could be made.

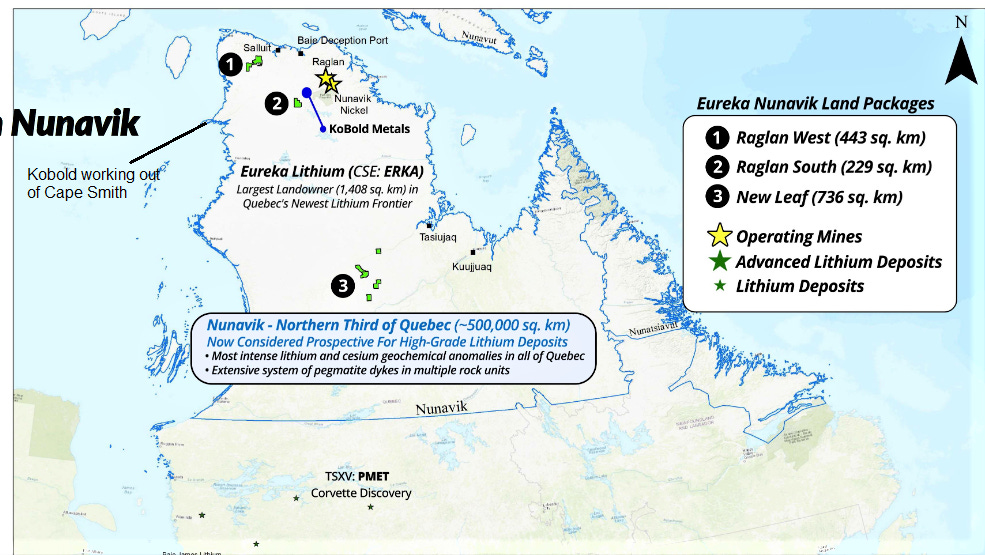

KoBold Metals is the Unicorn of junior mining with a $195 million raise that gave it a $1 billion valuation and has not even made a metal discovery yet. They got funded by Bill Gates, Jeff Bezos backed Breakthrough Energy Ventures and Andreessen Horowitz. They also raised money from Apollo Projects, Bond Capital, BHP Group and the Canada Pension Plan Investment Board.

They are touting the use of AI to find battery metal deposits, but really doing the same thing geologist do, but crunch and combine data sets with computers. They have 60 exploration projects and basically use a giant metal detector moved around with a helicopter, looking for Lithium, Nickle, Cobalt and Copper. They are not public but their website claims they have already spent $100 million in exploration and R&D in 2023 alone. No discovery yet so we will see how their system works. For now, I am betting with the proven prospector, Shawn Ryan.

In June 2022, six Boeing 737s—fully loaded with tents, food, satellite Internet equipment, drones, geophysical survey gear, drilling equipment, and a team of experienced geologists—flew to a remote airstrip in northern Quebec. The geologists were hunting for major deposits of the minerals needed to power a clean-energy future. You can check out the story here about Kobold. This is astounding with 6 jets of equipment, I guess big money speaks.

Because Kobold is private, they don't have to give out a lot of information, but they say in the article linked above that Kobold has staked an 800 square kilometer claim in the region and Eureka slide below shows 929 sq. kilometers. Eureka has the largest lithium focused claims at 1,408 sq. kilometers. I also learned Kobold is working out of Cape Smith, Nunavit Quebec so their properties are nearby.

That puts them as neighbours with Eureka's Raglan West and Raglan South properties.

In fact this map shows Eureka with Kobold and others.

Today Eureka announced they started this years exploration program. A sizable, highly trained team for Nunavik will be sampling pegmatite outcrops across Eureka's vast holdings. Zones of interest will be surveyed by drones producing high detail imagery and 3-D models to completely map the mineralized systems on surface as they are identified for follow-up program planning. This strategy will quickly vector toward the most prospective areas for a targeted drilling program this summer using a lightweight and mobile rotary air blast GT RAB Drill for initial drill testing, leading to high confidence diamond drilling of the top priority targets. The samples collected during this program are being initially scanned and sorted in the field by using a hand-held SciAps LIBS analyzer and selected samples will be sent to the laboratories for analysis.

This method will really hasten the 1st phase exploration because they will not have to wait on lab results in most cases.

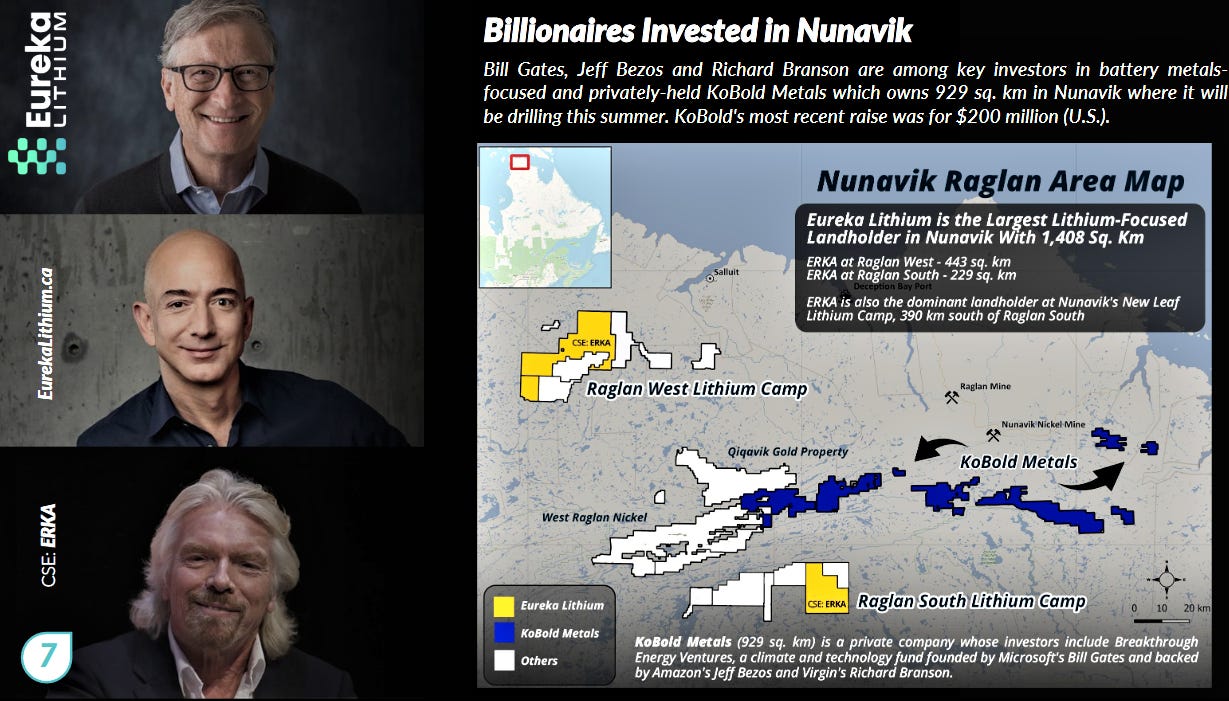

This next graphic is from a Kobold video and shows their projections of the metal shortages. It assumes 100% of the metals are recycled, but we know in reality it is far less than that.

Kobold is private, we cannot invest with the billionaires, but we can invest in Eureka as a very good proxy. Kobold will be drilling this summer, they don't have to report drill results so I will rely on my contacts on the ground. The stock has broke out to new highs and the sky is the limit. Markets are taking a shellacking this morning so some overall weakness could help to buy positions.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication