Bio Tech on Steroids - Hemostemix HEM, HMTXF

Why read and subscribe to my substack?

You just don’t gain insight of my analysis but also add in over 20 colleagues in my close circle that provide me insight and ideas. I am unique and unbiased. I can be a bull and a bear. I report on stocks I follow when they are up or down and often say the ‘sell’ word. I suggest stocks to buy and sell. I am not afraid of controversy and unpopular topics that are detrimental to gaining readership. When Covid-19 first struck I was among the few to report and analyze government and public health data for what it was, not the main stream narrative. I back my findings with links and outside expert opinions. I have a strong track record of beating benchmarks and notorious for picking tops and bottoms in various markets. My worst fault is I might might be too early sometimes. I have a very small following so what you get from me, you know that very few see this perspective.

I hope you enjoy reading, please share and subscribe!

I put this out to paid subscribers early Wednesday and the stock is moving so did not want to wait longer to report here. As of Tuesday evening -

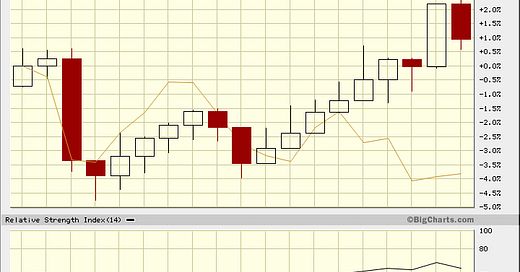

There seems to be some action in bio-techs again, even Canadian ones. While markets have been correcting the NY Bio-tech index BTK has been going up in 2025. In fact the last month, the S&P 500 is down about -4% and BTK is up +2%.

Bright Minds Bioscience CSE:DRUG went public October 15th and went from $3.44 to $49, on it's first day of trading and then to $108, yes a Canadian CSE listed bio-tech. The next day (Oct 16) they announced Firefly Neuroscience Inc. was collaborating with them to analyze the data from its first-in-human phase 1 study of its lead compound, BMB-101.

And speaking of, yesterday Firefly Neuroscience NASDAQ: AIFF popped from $2 to almost $6 on heavy volume. They announced the advancement of research to assess a patient’s brain age - an estimation of the biological age of a person's brain – via its FDA-cleared BNA™ technology platform.

A lot of bio tech startups are listing in Canada because of the high predatory short selling on NASDAQ. Note above on Firefly as it traded about 130 million shares in one day but only has 8.5 million shares outstanding. No the float did not turn over 15 times on Tuesday, this can only occur with heavy naked short selling. Finra reported almost 57 million shares of short volume that day. Probably much higher adding those that did not or are required to report.

Another Canadian bio-tech I have been watching for a few months jumped higher the last few days from 12 cents to 24 cents. I am betting this is only the start of the move. They have a very promising stem cell therapy treatment that is well advanced through trials and will soon be treating many patients.

Hemostemix Inc. - - CSE:HEM, OTC:HMTXF - - - Recent Price - C$0.20

Shares Outstanding 145 million

In layman terms a vile of blood is withdrawn from the patient, like any other kind of blood withdrawal and is then sent to a lab, currently in Puerto Rico. This lab is a collaboration with CytoImmune Therapeutics an expert in cell therapy manufacturing.

This blood is used to make stem cells with the patient’s blood thus their own DNA, called ACP-01 therapies. It only takes several days. CytoImmune is very bullish on the potential of this therapy so will mostly be taking stock for payment in the initial collaboration.

The ACP-01 therapy is able to build new blood vessels and repair blood vessels so it has been successfully used in three different diseases.

Vascular Dementia – In many cases Dementia is caused by plaque build up in the brain that blocks blood vessels. ACP-01 is injected in the spine, travels to the brain and repairs blood vessels and builds new ones. This increases blood flow and oxygen to deprived parts of the brain and significantly improves the patient.

Heart Disease - The basic function of the heart is to pump blood and in healthy people the volume efficiency is 60% or higher. With heart disease of various kinds this can be drastically reduced as low as 15% to 20% and at that point a patient does not have long to live and a heart attack is imminent. Injecting ACP-01 therapy into the heart can improve the heart rate efficiency around 27%, according to trails.

When I talked with the CEO Thomas Smeenk he gave me the example of a friend of his and why he got involved with the company back when it was private. Back then it was a novel treatment but his friend was given just 6 months to live because of heart disease. He tried ACP-01, his heart significantly improved and 13 years later, still beating.

Peripheral Arterial Disease including Chronic Limb Threatening Ischemia (“CLTI”) - Many people lose circulation in their limbs, especially the legs. Often surgeries can be done but it often eventually gets down to amputation perhaps the leg, often the CLTI causes severe pain and severe skin and tissue damage on the feet. ACP-01 is injected into the leg and improves blood circulation. It saved up to 93.5% of limbs in a Phase 2 trial.

Hemostemix’s patented technology is based on more than 15 years of clinical data demonstrating the ability their patient’s cell product to regenerate diseased and damaged ischemic tissue and organs. ACP-01 is very safe likely because it is derived from the patients own blood.

Published in Stem Cell Research & Therapy, November 2023, the mean improvement in the volume of blood ejected with each heartbeat was 27% (p<0.003), comparing the pre-procedure LVEF% of all the patients with the final follow-up at 12 months. In its Phase II clinical trial, as published in the J Biomed Res Environ Sci, February 2024, ulcer size in the treated group decreased significantly (p = 0.01) by 3 months, as compared to placebo group, (p < 0.54). Moreover, the rate of amputation (4.8%) and death (4.8%) in the treated subgroup was substantially less than the placebo group which exhibited an amputation rate of 25% and 1 death (12.5%).

Saving a limb is saving a life. Whereas the five year mortality rate of patients suffering from CLTI is 60%. ACP increased the survival rate of patients in the Phase II clinical trial followed by the University of Toronto and University of British Columbia, who published that 83% of patients followed for up to 4.5 years experienced healing of ulcers, resolution of pain, and no major amputation.

The Company’s cost-effective manufacturing platform is designed to generate up to 240 therapeutic batches ($12 Million) per month from one manufacturing cell and scale by 240 treatments with each additional manufacturing cell.

CytoImmune's engineering team is advancing Hemostemix's patented automated cell therapy system with robotics. This robotics-based manufacturing platform is designed to produce up to 2,880 ACP-01 therapies annually per 10-foot-by-10-foot clean room. Scaled to 10 production cells operating at 80-per-cent efficiency, the system could deliver up to 23,040 ACP-01 therapies annually, each priced at $37,000 (U.S.). "CytoImmune is very bullish on Hemostemix's equity for good reason," stated Thomas Smeenk, chief executive officer of Hemostemix. "Our automated production system will allow us to produce therapies at scale, transforming access to innovative treatments for cardiovascular diseases."

Dr. Jose E. Vidal, chief executive officer of CytoImmune, added: "With over 200 years of combined biologics and cell therapy manufacturing experience, our team is equipped to scale Hemostemix's ACP-01 globally. This partnership reinforces our commitment to advancing cell therapies and creating meaningful economic impact in Puerto Rico."

I had almost an hour discussion with the CEO yesterday and am going to do a follow up, but I wanted to get this out to you ASAP as the bio-tech market seems to be hot, especially things like stem cell research.

I am going to give you more details in future updates as there is a lot of news in the pipeline. However as they acquire patients and they have been working on building that pipeline and the manufacturing ramps up, based on 10 robotic labs, annual revenue could reach US$852 million.

There is quite a bit of liquidity with 147 million shares out.

I do own shares as I bought positions Wednesday and Thursday.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.