Biotech Stocks Break out, Nugen Medical, NGMD, 5th Winner in a Row?

Welcome and Thank you to all the new, smart, savvy and contrarian investors who have joined my substack. I am small here so please share and subscribe while this is free.

As I have commented before, Biotech stocks ran up with the Covid-19 pandemic and then they fell by 60% from early 2021 to late last year. This helped put in a triple bottom and now, the sector has picked up steam with a clear break out on the chart. The S&P Biotech SPDR, XBI which tracks biotech stocks, is up over 60% this year, trading around $100/share. In contrast, the S&P 500 is up by 23%.

We have done extremely well buying under valued cash rich bio techs. TRML, NKTX, ACET and NKTR made it 4 in a row with an average gain of +126% in a matter of months. Two we still own and will likely rise further. I suggested selling TRML for a +190% gain and NKTX for a 240% gain. I am going for 5 in a row and this one could have the largest gain because it is from such a low price. If you have not taken profits in the other bio techs, it would not hurt to do so and buy a little of this.

Nugen Medical Devices - - - CSE:NGMD - - OTC:NGMDF - - - Recent Price - C$0.13

52 week trading range $0.09 to $0.31

Shares outstanding 205.5 million

Nugen is a leading developer of needle-free devices to administer therapeutics subcutaneously. Currently they are marketing and selling their next-generation InsuJet needle-free injection system designed to improve the lives of millions of diabetics.

Nugen has very disruptive technology in the medical field. There is a number of companies and numerous continuous glucose monitors but not non invasive while some could be described as minimally invasive. However, when it comes to injecting insulin for high glucose readings there is virtually no competition for Nugen's InsuJet at this time. InsuJet is approved for sale in 42 countries around the world. They have first to market advantage and have already started to penetrate the market in a big way with numerous sales agreements, potentially worth 100s of millions.

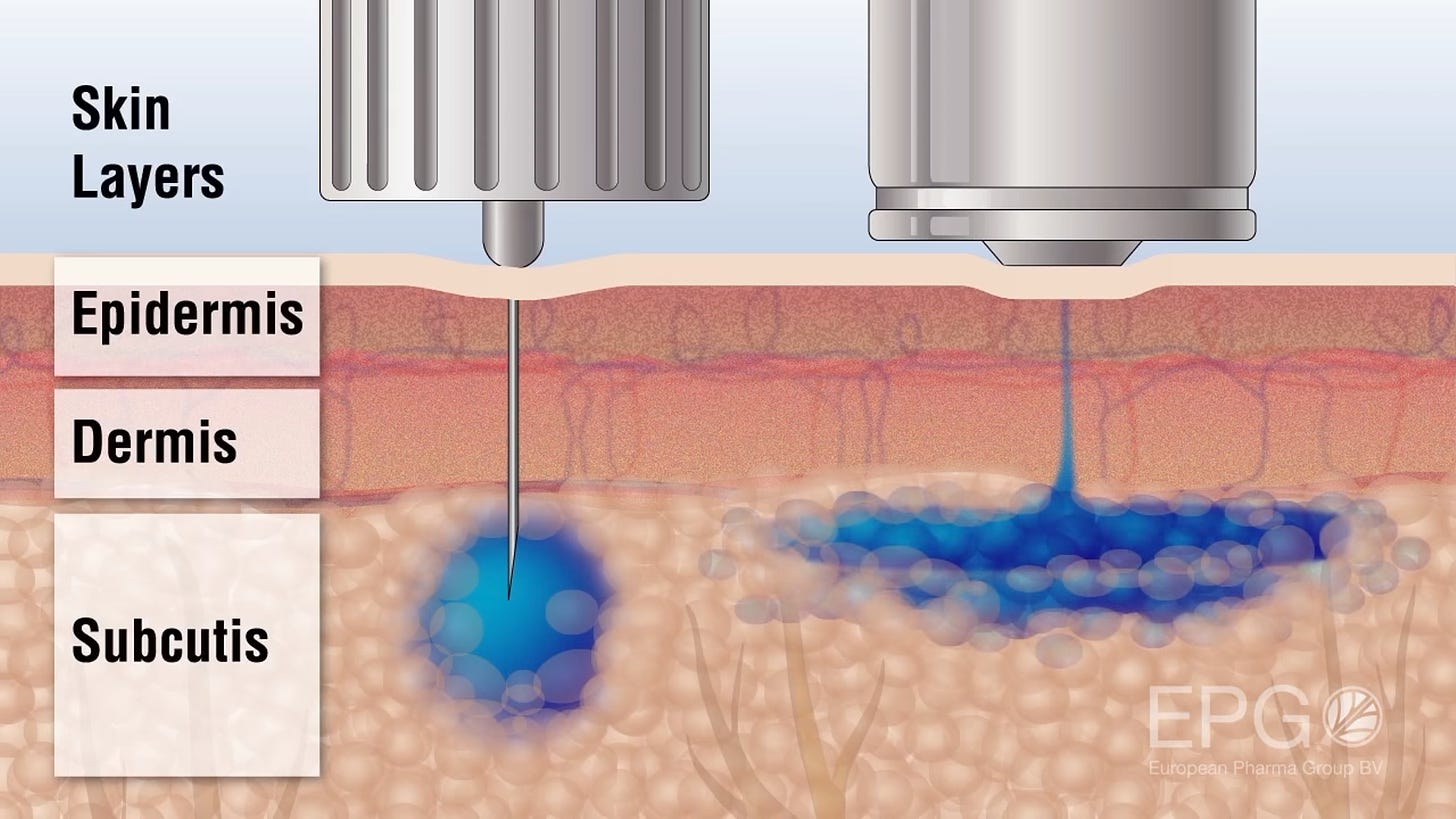

The devices is simple to use, as shown in this 1 minute video. Nugen expects to generate the majority of revenue from the sale of associated (required) consumables including nozzles & adapters. This recurring revenue is just like the old “razor-razor blade” model. This next graphic illustrates the difference of InsuJet and a needle injecting through the skin. The InsuJet injection disperses more broadly without a needle and is absorbed faster than a needle injection for more flexibility in timing for the diabetic patient.

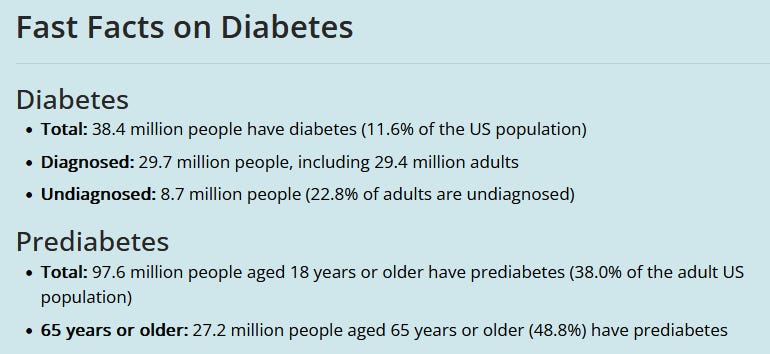

The market for Nugen's solution is huge, so even if they capture 5% or 10% of it would mean enormous revenues. Lets take a quick look at this potential market.

Diabetes/Insulin Market is Huge

Globally, there are over 700M diabetics, ~92% are Type 2 (+ other) and about 8% are Type 1. Not all Type 2 have to take insulin but Type 1 are dependent on it or they die. Of those that take insulin, 2 to 4 daily injections are the norm.

The insulin required to treat type 2 diabetes is expected to increase by more than 20% from 2018 to 2030.

Key facts from WHO

The number of people with diabetes rose from 108 million in 1980 to 422 million in 2014. Prevalence has been rising more rapidly in low- and middle-income countries than in high-income countries.

Diabetes is a major cause of blindness, kidney failure, heart attacks, stroke and lower limb amputation.

Between 2000 and 2019, there was a 3% increase in diabetes mortality rates by age.

In 2019, diabetes and kidney disease due to diabetes caused an estimated 2 million deaths.

Nugen is working on FDA approval for the U.S. market and this in itself is a huge opportunity. This graphic is from the U.S. Centre of Disease Control (CDC).

Clinical evidence and efficacy of InsuJet – Management All the Right Stuff

Clinical evidence of InsuJet is supported by four peer-reviewed clinical studies published in academic journals from 2011 to 2016. The efficacy of InsuJet shows improved insulin uptake of upward of 40 per cent. Clinical studies, certificates and InsuJet reports are found at the InsuJet website.

I have followed the company for a few years and it needed some cleaning up and better direction. That started to happen when Tony Di Benedetto Executive Chairman got involved and many of you may remember his name from Drone Delivery. He left Drone Delivery 3 or 4 years ago, but while he was there, the stock went from around $0.15 to over $2.00.

He is a Canadian technology entrepreneur with over 30 years of hands-on experience in building, operating, and divesting technology companies. Most recently, Mr. Di Benedetto was the co-founder of Drone Delivery Canada (TSXV:FLT), which he took public and successfully raised over $120M in equity financing, achieving market capitalization in excess of $550M.

Another important management change was announced Nov., 1, 2023 as they appointed Ian Heynen as the company's new chief executive officer, effective Nov. 1, 2023.

Mr. Heynen is recognized in the med-tech industry as a top-performing industry executive with decades of experience leading technology-driven organizations, including operational start-ups, turnaround situations and accelerated growth companies. Mr. Heynen has experience leading and managing P&Ls (profits and losses) for North American and international businesses with multisite divisions and gross revenues of up to $600-million-plus.

Most notably, Mr. Heynen was integral to the launch and growth of the start-up Sentinelle Medical, attracting the multinational buyer Hologic Inc. At Hologic, he held multiple positions, culminating in the role of acting president, where he was responsible for Europe, the Middle East and Africa, Canada, Latin America, and the Asia Pacific regions, leading an international business with multisite divisions and over 1,000 key associates, generating gross revenues of $600-million-plus.

Mr. Heynen holds a CMA-MBA combined program (graduate gold medalist) from Wilfrid Laurier University (Toronto, Ont.), and a master in applied sciences in chemical engineering from the University of British Columbia (Vancouver, B.C.). He also holds a bachelor of applied science in chemical engineering from the University of Waterloo (Waterloo, Ont.).

From the November press release "I saw an incredible opportunity with Nugen to quickly grow the company globally. My experience and expertise fit perfectly with the trajectory of Nugen and its management team. As a seasoned med-tech company builder of over 20-plus years, I am excited to make a difference and fired up with the opportunities ahead," commented Mr. Heynen.

Nicky Canton, COO, has a background in industrial design engineering as well as business administration with more than 13 years of experience in product development, manufacturing, and regulatory compliance of healthcare products, and more particularly, needle-free injection systems. Nicky has been involved from the early development of the current InsuJet™ needle-free injector and has been responsible for both development and production scale up.

Louise Cresswell Commercial Lead – United Kingdom has extensive experience in the healthcare sector, starting her career in the NHS where she qualified as a Registered Nurse. For a few key points, her commercial career began with Ethicon, J&J, as a sales representative progressing to regional manager and business development manager. Then the role of sales director for BD Medical (UK) specializing in injection and infusion technologies progressed her commercial and management skills and leadership experience of both clinical, sales and marketing teams. She worked on supply chain efficiency for the supply of products into NHS Supply Chain warehouses through her leadership of a UK and European multi-disciplinary supply chain optimization project.

I had an extensive conversation with Tony Benedetto and new CEO Ian Heynen. I really like the direction Mr. Heynen is taking the company. He is working on collaboration agreements with Pharma companies and the Government Health agencies in numerous countries to get InsuJet as a sponsored and recommended medical device.

For example, in the UK Nugen’s InsuJet is the only needle-free device approved by the country’s free national healthcare system (NHS), there’s no cost for diabetics to switch from needles to InsuJet, and no cost to use it. They just need a prescription from a doctor for the device.

Sales are growing and just starting to ramp up.

Nugen announced a number of sales agreements in the last half of 2023.

As of Dec. 17, 2023, Verrue Consulting Group BV, a limited liability company in Belgium, became an official distributor for Nugen's needle-free InsuJet device. The term of the distribution agreement with Verrue is five years and Nugen estimates sales to be approximately $2.4-million if target quantities of 7,300 devices over the term of the agreement are met.

As of Dec. 12, 2023, Advance Medical Life Co. Ltd., a limited liability company domiciled in Bangkok, Thailand, became the exclusive distributor for Nugen Medical Devices Inc.'s needle-free InsuJet device aimed at improving the delivery of care and life for-millions of diabetics worldwide. InsuJet is approved for sale in Thailand as a medical device.

The term of the distribution agreement is five years and Nugen estimates the sales to be approximately $4.9-million if target sales of 29,000 devices over the five years are met. The company expects a gross margin of 72 per cent.

November 2023, Nugen learned that the Mexican government has completed the registration of Nugen's needle-free InsuJet injection device for sale throughout the country as a medical device. In May, 2023, Nugen received its first bulk purchase order from Science-Link Trading SAPI de CV, a health and wellness company in Mexico, for the Mexican market for 500 units of the company's needle-free InsuJet injection device, followed by an additional 2,000 units and consumables. At target, the total transaction value for 2023 and 2024 orders is estimated to have a lifetime value of $6.2-million (U.S.) to 2027 as previously reported by the company on June 2, 2023.

July 2023, Nugen entered into a distribution agreement for its needle-free InsuJet medical device and consumables with Sol-Millennium Medical Inc. (Sol-M) of Chicago, Ill., for a term of five years which Nugen estimates the value at approximately $204-million with estimated gross margins of 72 per cent. Sol-M is one of the world's largest designers and distributors of needles, syringes and diabetic supplies,

Sol-M is now the preferred distributor of InsuJet in Canada, Brazil, France and Spain where Sol-M has an extensive existing business footprint in the safety syringe and the diabetic supply business and where InsuJet is approved for sale as a medical device. Sol-M will be required to fulfill minimum yearly purchases to maintain its five-year distribution rights which Nugen estimates to be approx, $132-million.

Once Nugen gets FDA approval in the U.S., this agreement with Sol-M will have more value.

Conclusion and Beyond Insulin

Single use needle injections are hazardous waste and costly. Used needles need to be disposed of in special containers as it must be segregated & incinerated.

Daily use of needles can cause bruises, soreness, itchiness, scarring, numbness and areas of discolored skin. Imagine if needles could be avoided entirely? No pain, infections, fear / apprehension, no bruises, soreness or discolored skin, no “sharps disposal” headaches.

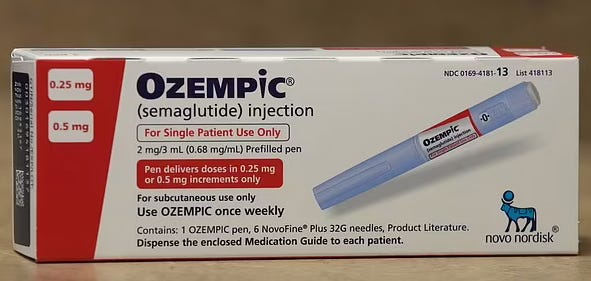

Insulin is merely a start or stepping stone to multiple drugs. What is all the craze now is these weight loss drugs that are expensive injections. The one I hear constantly advertised is Ozempic, they even have a nice jingle in their ads. Also check this article out in the UK's Daily Mail and Nugen already has good inroads in the UK medical market.

Goldman Sachs reports that up to 70M Americans could be using weight loss drugs by 2028, nearly 8 times the number of insulin users in the U.S. I estimate that just 5.0% penetration of that segment would be 3.5 M people using Nugen's needle free system.

The Ozempic injection pens will give out 4 to 6 doses so will use 4 to 6 needles. That seems like a lot of costly and hazardous waste. The Nugen system could potentially last a Ozempic user years with no needles and only needing a supply of dosage cartridges as appropriate. Keep in mind, I am just speculating as Nugen is not approved for Ozempic or any other weight loss drugs yet. I am just pointing out future potential.

There will be resistance in some areas to change. Some companies make a lot of money selling single-use, disposable needles. By far the biggest player is Becton, Dickinson & Co. R&D for needles is quite low. Companies like Becton have little incentive to risk its cash cow needle business, especially as needle-free would cannibalize its franchise but that will happen in a matter of time. Sometimes, in case like this, they buy out the competition. So consider Nugen to be a take over target down the road.

Remember there is risk for a small company to execute sales and they may have to do future financing that could be dilutive to shareholders.

All this considered and the current stock price and stock chart, I believe the risk/reward looks very compelling here.

On the chart, there is strong support around 10 cents and first resistance is at 15 cents so it would not take much for a upside break out. There is also a strong base between 10 and 13 cents.

I do own shares of NGMD and Nugen Medical is a paid advertiser at playstocks.net

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.