Birth/death rate Model is 148% of Job #s, Silver Bull Market & First Majestic

This report on Silver and First Majestic went to paid subscribers yesterday, but the stock price has not changed much this morning. I added this comment on the job numbers this morning. And welcome to the new smart, savvy and contrarian investors to my substack. I am still very small here so please share and subscribe!

U.S. employers added 142,000 jobs in August as hiring bounced back at least partly after temporary hurdles curtailed payroll gains the previous month. Economists surveyed by Bloomberg previously estimated 163,000 jobs were added last month.

The unemployment rate fell from 4.3% to 4.2%, the Labor Department said today.

A little weaker than consensus, but the perfect Goldilocks number so the Fed can cut rates ahead of the election. The birth death rate model has been used extensively to pad job numbers higher this year. This is where the BLS estimates how many jobs are created with new business and lost with closed business. For August they estimated 100,000 so without this guesstimate, jobs numbers would have come in at only 44,000. However, the estimate in previous months was way higher with 246k in July. June was only 59k but 231k for May and 363k for April.

If we avergage these numbers for the last 5 months we have a total of 999k so basically 200,000 jobs a month for the birth death rate model. With the downward revisions the BLS reported 89K for July, 118K for June, 216k for May and 108k for April and with August’s 142K preliminary estimate we have a total of 673K or 135K per month.

The birth death rate model accounts for 148% of the job numbers.

The BLS is notorious for lagging with this birth death rate model, because when the economy slows and there is less or even negative job growth with small business, the BLS is still estimating as if the economy is booming.

Canadian Job Market Probably Worse

Canada's unemployment rate edged up to 6.6 per cent in August, scaling a peak last seen more than seven years ago excluding the pandemic years of 2020 and 2021, data showed on Friday.

The economy added a net 22,100 jobs in August, fully driven by part-time employment, Statistics Canada said.

Silver’s New Bull Market

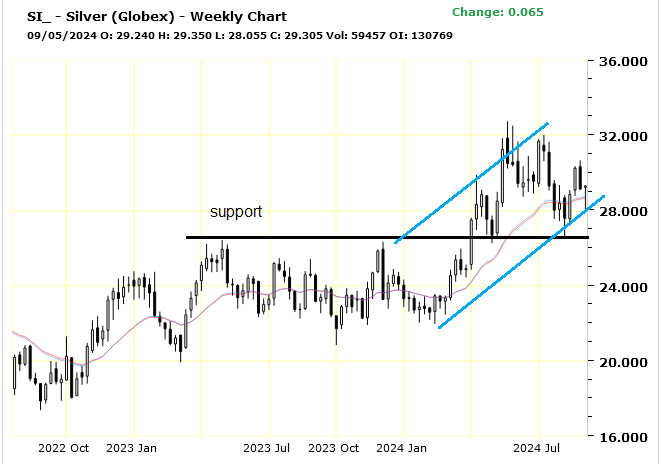

Silver is in a new bull market climbing about 77% from the 2022 lows and currently up just over 60% from 2022. There is really not much resistance on the chart and a close above $32, a higher high would be next.

Long term silver has broke out of a cup and handle pattern. This is very bullish in the long run. I expect we could see a test of $50 this year or early 2025.

My April 2, report “Silver Breakout Imminent was perfect timing. Back then I added Pan American Silver and Mag Silver to the selection list. They both ran up in price and are currently with decent gains. Today I want to add on First Majestic.

We got stopped out of First Majestic last year at $6.90 and the stock did rally to $11 this year but has come right back down with some poor financial results and as silver prices corrected, not holding up like gold. This is because Central Banks buy gold and not silver. Silver prices depend more on industrial buying and retail interest that has been lack lustre this year. That will change and when it does, silver often out performs gold. I want to take advantage of weaker prices in First Majestic today, to add back on our Selection list.

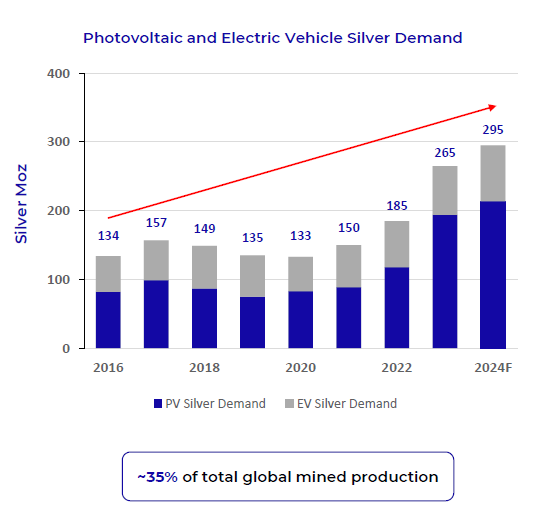

The chart above is from First Majestic presentation and you can see that industrial demand is strong and growing led by EVs and solar. Retail demand has picked up some but still at low levels. I found my regular coin dealer is a good barometer. They are sold out of scrap silver for the first time in a couple years at least. Glad I bought a bit more. However they still have fairly large stocks of Silver maple leafs and US silver eagles. When these run out, I know retail demand is back.

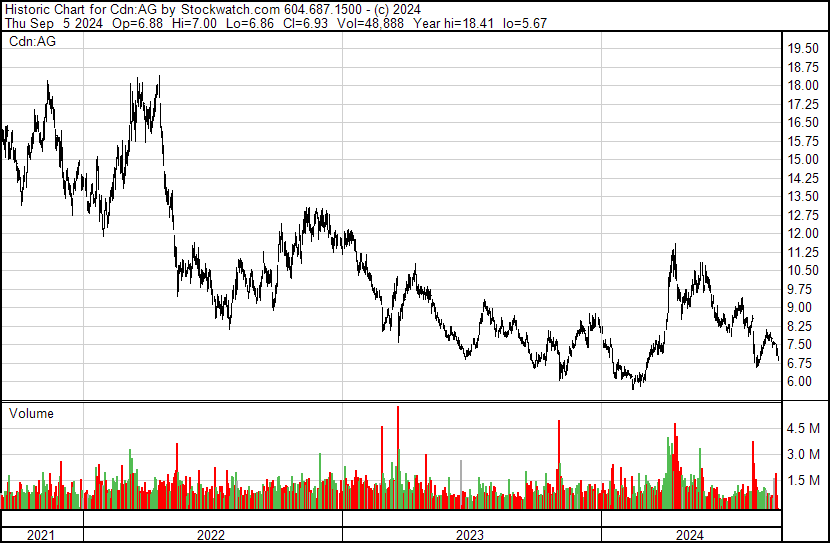

First Majestic Silver, TSX/NYSE: AG - - - Recent Price – C$6.56

52 week range $5.67 to $11.59

Shares outstanding 298 million (post merger 475 million)

As a refresher, here is a snap shot of AG's projects and mines. Production was suspended at Jerritt Canyon in March 2023 and the plan is to explore to increase resources for an eventual restart of the mine. The higher gold price is a definite aid as this is a gold mine and still has 1.69 million ounces of M&I resources.

Sept 5, First Majestic and Gatos Silver, Inc. (NYSE: GATO) (TSX: GATO) announced they have entered into a definitive merger agreement, pursuant to which First Majestic will acquire all of the issued and outstanding common shares of Gatos. Gatos is a silver dominant producer with a 70% interest in the Los Gatos Joint Venture, which owns the producing Cerro Los Gatos underground silver mine in Chihuahua, Mexico.

Adds a third cornerstone, long-life, low-cost, producing underground mine with exploration potential to the First Majestic portfolio

Bolsters anticipated annual attributable production by approximately 6 million ounces of silver and 9 million ounces of silver-equivalent based on Gatos' 2024 production guidance

Keith Neumeyer, President & CEO of First Majestic, commented, "The acquisition of Gatos Silver is a highly compelling and transformative transaction that meaningfully enhances First Majestic's operating platform through the addition of 70% of Cerro Los Gatos - a high quality, long-life, unencumbered, free cash flow generating asset in the mining-friendly state of Chihuahua, Mexico. Mexico is a country that First Majestic has operated in for over 20 years, and we are extremely excited to deploy our operating expertise within these mining districts to deliver operational synergies and exploration success for our shareholders. We look forward to working with the operating team at Cerro Los Gatos and with our new joint venture partner Dowa Metals & Mining Co., Ltd. ("Dowa"), and we are pleased to welcome all Gatos shareholders as they transition into being shareholders of First Majestic going forward."

For Q2 2024 reported August 1st:

Quarterly revenues of $136.2 million, compared to $146.7 million in Q2 2023. The 7% decrease in revenue was driven by a 15% decrease in the total number of payable AgEq ounces sold due to higher silver inventory levels held at quarter end, lower production levels at San Dimas and La Encantada, and the temporary suspension of mining activities at Jerritt Canyon in March 2023, partially offset by increased production at Santa Elena and an increase in the average realized silver price.

The Company held 712,539 silver ounces in finished goods inventory as of June 30, 2024, inclusive of coins and bullion. The fair value of this inventory, which is not included in Q2 revenues, as of June 30, 2024 was $20.9 million.

Improved mine operating earnings of $15.5 million compared to $1.1 million in Q2 2023. The year over year increase in mine operating earnings was primarily attributed to an increase in operating earnings from Santa Elena and a decrease in operating losses from Jerritt Canyon, partially offset by higher operating costs at San Dimas and La Encantada.

Operating cash flows before movements in working capital and taxes amounted to $23.8 million.

Consolidated cash costs of $15.29 per AgEq ounce and all-in sustaining costs ("AISC") of $21.64 per AgEq ounce represented an improvement of 2% and a slight increase of 1%, respectively

Gatos Silver has been one of the best performing silver stocks. They have a 70% interest in the Los Gatos Joint Venture (“LGJV”), which in turn owns the Cerro Los Gatos (“CLG”) mine in Mexico. Reported Aug 8th the mine's Q2 2024 results were excellent compared to Q2 2023 (100% basis):

Record revenue of $94.2 million, up 62% from $58.3 million

Cost of sales $32.0 million, up 24% from $25.8 million

Record net income $20.5 million, up from $0.7 million

Record EBITDA $54.1 million1, up 101% from $27.0 million

Record cash flow from operations of $54.5 million, up 59% from $34.3 million

Record free cash flow $40.8 million1, up 107% from $19.7 million

Silver production 2.30 million ounces, up 15% from 2.00 million ounces

Silver equivalent production of 3.88 million ounces2, up 18% from 3.30 million ounces

By-product AISC of $6.571 per ounce of payable silver, down 54% from $14.32

Co-product AISC of $15.261 per ounce of payable silver, down 13% from $17.55

Gatos Silver Q2 2024 results compared to Q2 2023:

Net income of $9.2 million, up from net loss of $3.6 million

Basic and diluted earnings per share of $0.13, up from loss of $0.05

EBITDA of $8.2 million1, up from a $3.5 million loss

Cash flow provided by operating activities and free cash flow of $11.8 million1, compared to cash flow used by operating activities and free cash outflow of $3.8 million1

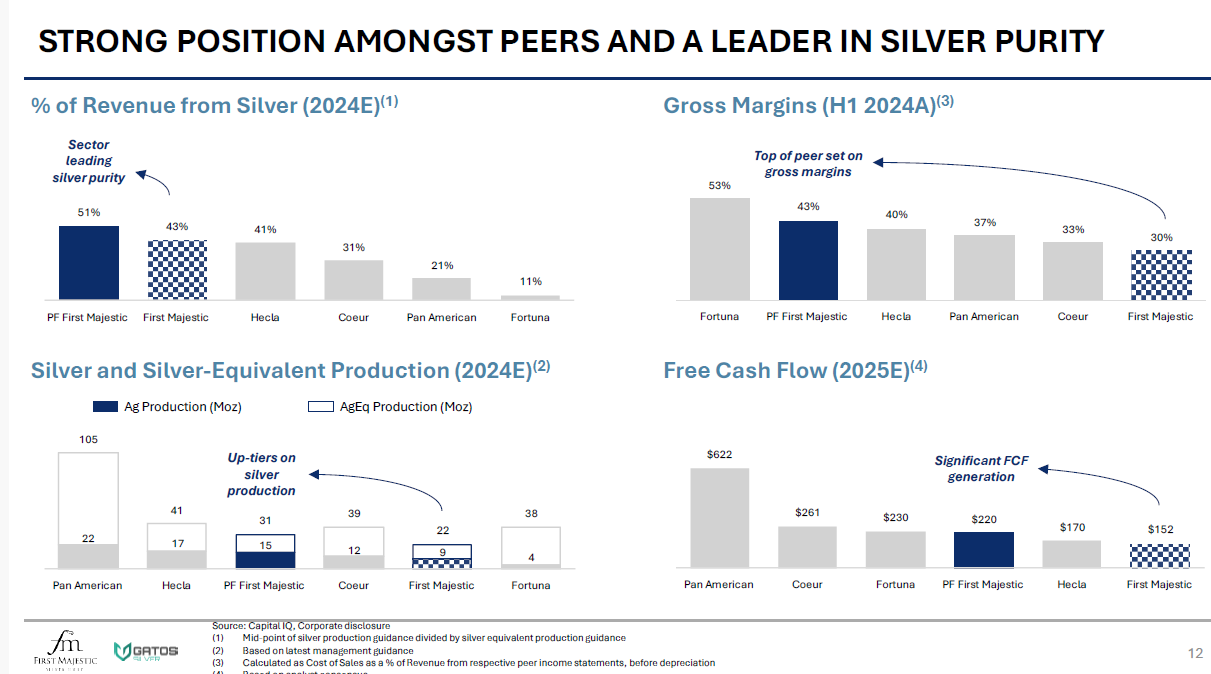

I believe the combined entity of First Majestic and Gatos will do very well. This slide is from the Gatos presentation and shows an easy to see picture of a great silver producer compared to peers.

The stock is also at an excellent buy level, driven to a double bottom with the down tic on the acquisition. It went from a bull market to a bear this year, basically driven down by poor financial results in Q1 and Q2. A lot of the negative effect on financial s is temporary like foreign exchange losses and holding higher silver inventory. Mine operations improved in Q2 and I believe we will see further improvement and adding Gatos into the equation is going to make results much better.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.