Bullish Bitcoin, GoldLake GLM, Zonte ZON, NEM

Most economic news this week did not change much from last month except jobless claims fell to 227,000 from 245,000 the previous week. The 2 recent hurricanes have had an effect on these numbers so I am not paying much attention to this data until that settles out.

I have become bullish on bitcoin because of the chart and election outlook. We currently have a short trade on with BITI and I think we should take the loss and go long. On October 10th bitcoin dropped to under $60,000 and BITI jumped to $8 and I was about to put out a sell alert with a nice 7% gain, but this dip only lasted about an hour or so. I decided to wait for another dip but that did not happen, instead it has gone to new highs since the triple bottom.

The chart is bullish and polls continue to predict a Trump win. A Wall Street Journal poll out today on registered voters puts Trump 2 points ahead of Harris on a national poll. This is unprecedented because the Democrat candidate usually leads nationally because of the huge influence of NY and California states that are mostly democrat.

Trump said at a crypto conference he would set up a government reserve for bitcoin. John F Kennedy Jr. was even more bullish but as an independent that could not win, he could say anything and not have to deliver, but now since he joined the Republicans he could have more influence. We also know Elon Musk now a big republican supporter with influence is also favourable to crypto.

These bureaucrats will say almost anything to get votes and elected so they may not actually embrace bitcoin in any significant matter. Regardless, the crypto market is very bullish on a Trump win and believes Republicans will get behind crypto. Now if there are some Democrat actions to remove or block Trump from the presidency (assuming he wins) than bitcoin could crash. That said, this would be some kind of delay after the election and I think we can take profits before or at election day.

I think Trump might in a very small way get behind bitcoin, but remember their allegiance is to the paper fiat US$.

Sell IBIT $6.96 and buy leveraged long etf BITU at $28.71

Gold and silver are seeing some healthy consolidation after recent record highs and we got a glimmer of hope for the TSX Venture juniors. The index briefly got up to the May highs but not a solid break out yet. We also had a few days of higher volume of over 40 million a day. This is still very low volume.

Now don't get excited, we are still down at a bottom on the long term chart and is why I said a glimmer of hope. We are still not much above the 2016 and 2020 all time lows. The recent high was a gain of +21% from last November low so technically we have started a new bull market.

We have to see a clear break above 660 and than I will be convinced and willing to add on some new junior explorers. There has been some news with our old junior picks.

Golden Lake TSXV:GLM - - Recent Price - $0.65 - - Opinion - buy

Golden Lake announced yesterday that they completed the fall drill program on the Jewel Ridge property, Nevada. The property is immediately adjacent to successful, high-profile exploration programs currently being undertaken by North Peak Resources Ltd. and i-80 Gold Corp. on their neighbouring Prospect Mountain and Ruby Hill properties, respectively.

A total of 1,756 metres of reverse circulation drilling comprising 5 holes were completed in the subject drill program at Jewel Ridge (JR-24-51 to JR-24-55).

Drill targets included induced polarization (IP) anomalies (generated from 2024 surveys) situated within favourable geological and structural settings, hosting both Carlin-type disseminated gold deposits and carbonate replacement deposits, which are prominent in the immediate area of the district, known as the South Eureka gold belt. Other targets included historic mines yielding high precious and base-metal assays, exploited at shallow depth that have seen no historic drilling.

Drilling encountered several zones of heavily oxidized gossanous material over variable widths in all drill holes. JR-24-54 yielded several gossanous intervals containing iron oxide minerals in strongly altered rocks. In particular, a 7.6-metre-long interval in this hole yielded a visually promising intensely oxidized interval (95 per cent iron oxide minerals) in karsted terrain within the Hamburg dolomite. The Hamburg dolomite is a very important lithotype for hosting CRD, as well as disseminated gold mineralization in the Eureka district.

I am expecting very good drill results as seen in the past. In this better market, I expect the stock will break out of it's base on the news or before hand.

Zonte Metals - - - TSXV:ZON, OTC:EREPF

Recent Price $0.06 - - - - Opinion – buy

This week Zonte put out news on further developments on other targets. Remember this is a huge property, they just don't have some possible copper deposits but have a whole new copper belt in a stable jurisdiction and near major infrastructure. So far there are 12 targets and although it would have been nice to hit on the first one, that is not always the way Mother Nature doles it out.

In IOCG systems, various types of copper mineralization can be encountered. To date, drill core logging at K6 indicates that the majority of the copper mineralization is Iron Sulphide Copper (ISC), a common variant in IOCG systems. The K6 mineralization, primarily consisting of hypogene bornite and chalcocite, occurs in a highly fractured, potassic altered unit that lacks a consistent gravity or magnetic signature. This suggests that the mineralization is controlled by structural and rheological factors, as confirmed by core logging. Notably, although this unit is exposed at the surface, no visible copper mineralization was observed in the outcrop.

Based on drill core log observations at K6, in addition to the ISC-style mineralization, drilling has also intersected classic IOCG-style mineralization, which consists of chalcopyrite, chalcocite, and bornite associated with iron oxide alteration.

Zonte is going to start testing the large targets on the Cross Hills Copper Project. The recent drilling at K6 has been successful in terms of testing their dataset and hitting copper. K6 is an Iron Sulphide Copper (ISC) variant in the IOCG system, which they will continue to drill. ISC’s generally are smaller tonnage, but can generate multiple close-by deposits, with the potential for higher grades. Zonte plans to continue to drill and explore this area and see if they can discover something like the Duchess corridor in the Mt Isa district, which hosts numerous ISC deposits.

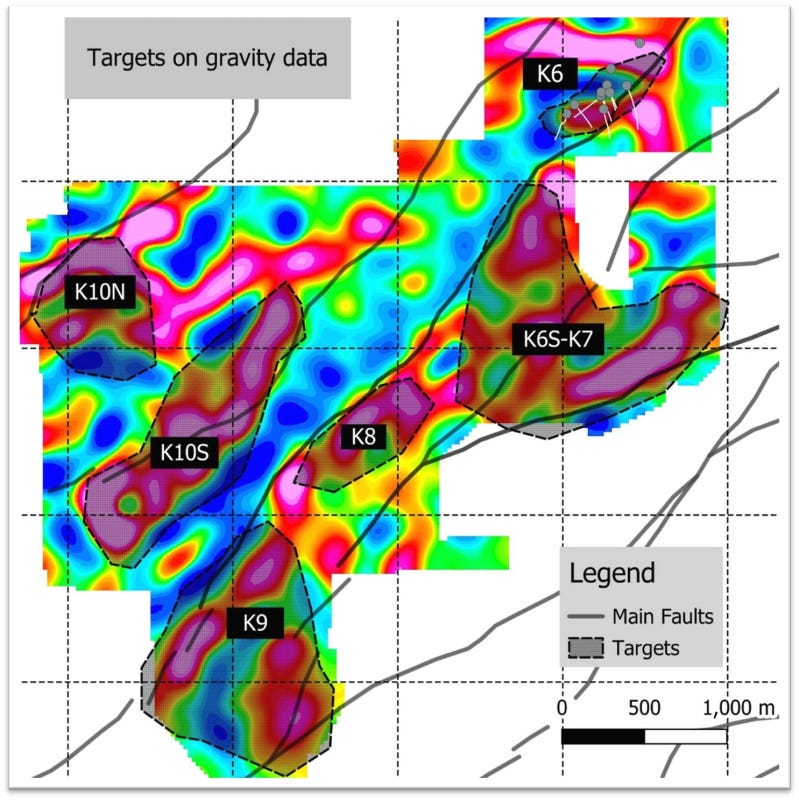

Presently, Zonte has a big push on a series of large-scale targets, applying the same techniques that helped them intersect copper at K6. These IOCG targets are large and defined by large gravity signatures with spatially coincident magnetic anomalies, copper-in-soils and rocks and structural zones. These targets offer large tonnage/long life assets, upon success. Zonte has a lot of work already completed and hence can bring most targets to drill stage in short order.

The immediate focus is the area south of K6, which includes the K9 and K10 targets, where significant gravity anomalies have been discovered alongside additional supporting copper signatures. These targets represent much larger prospects, with some measuring nearly 2,000m by 500m and gravity signatures traced to thickness exceeding 500 metres, in one case.”

These targets encompass a bit over 4 kilometers and there is 25 kilometers of targets so far. These targets are basically in lower 1/2 to 1/3 of the property where the road access begins. This is basically Zonte's biggest challenge is the shear number of targets. Which ones will be discoveries and which ones will be duds? K6 has not proven economic yet but not a dud either. Higher grades could be deeper or nearby. Note above how much smaller K6 is to these others.

It is going take drilling on all these targets eventually but Zonte will probably focus on the first one that hits potentially economic numbers. I am looking forward to this fall/winter program and see what these larger targets give us. I believe it is not if Zonte makes a big discovery but when.

I know many of us have been in the stock a long time. We need a bit more patience as the market is finally turning up after 12 year bear market if you rule out the 1 year 2020 bounce up and collapse again. Zonte has come a long way in this bear market considering the poor access to funding.

The stock is a good buy here, because it is cheap near the very bottom of it's historic trading range.

I also note the 2017 pop was in a much better junior market that you can see in the TSX Venture chart previously.

Newmont - - - NY:NEM - - - Recent Price - $42.23

Entry Price - $32.50 - - - - Opinion - hold

Shares fell as much as 9.1% on Thursday, the biggest intraday decline since July 2022. The stock drop came a day after Newmont posted third-quarter results that missed analysts' estimates on adjusted earnings, costs, and revenue. Newmont fell short of expectations with higher costs.

Expectations are high for Q3 results with gold companies because of gold's price rise and Newmont did receive $177 more per ounce over Q2. They are now paying a $1.00 annual dividend and reduced debt in the quarter by $233 million.

Despite the missed expectations, Newmont posted its highest quarterly profits in five years -- raking in $922 million in net income for the quarter. We are in at much lower prices so can afford to hold as the shares will bounce back up in time.

Paid Advertisers at playstocks

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.