Why my Substack

I have learned and spent a long time analyzing cycles. It is important to be on the right side of trends for long term success. I pointed out a bottom and new up turn for gold in October 2023 so we have been positioning on the right side of this cycle. I have warned and pointed out a bubble and major top in general equities, see my Outlook in February so have been positioned for this. I have a track record where my stock picks out perform their benchmarks. I must warn past success does not guarantee so in the future. I am not biased, say the sell word often and fortunate to have a network of over 20 colleagues to source investment ideas. I also follow geopolitics and any issue that could effect investment markets. And I am very small here so you know what you read from me is not main stream.

Thankyou for considering.

I posted a new video interview on Zefiro Methane yesterday, Interesting just 15 minutes

The short positions in gold stocks is starting to rise up to the levels we saw in mid 2022. At that time gold and gold stocks soon saw a correction. However, I don't think we will see that this time, because in 2022 is when the Central Banks started buying hand or fist and there are no signs that this is easing any.

You can see the strong Central Bank buying below for the last 3 years and it has continued at a similar pace in Q1 2025. Now we have U.S. Bullion Banks buying and for the first time in over 2 years, the ETFs. Gold and gold stocks will not correct much, there will be buying of the dip.

My favorite gold stocks at this time are B2Gold, Equinox and SSR Mining.

Make your voice heard, buy physical gold and silver. It is used in every economy everywhere. Your fiat money is useful in one place only, your own country (US$ used in many countries though).

Staying in paper currency is your choice and your vote to stay in government garbage fiat money, that they are printing in record amounts.

With gold and gold stocks moving, it has been pretty quiet at the playstocks $$Lounge Don't be shy, what are you buying and thoughts these days???

Ramp Metals - - - CSE:RAMP - - - - Recent Price - $1.47

Entry Price $0.47 - - - - Opinion – take part profits

Yesterday, RAMP reported intersecting semi-massive and massive sulphides with chalcopyrite and sphalerite mineralization at their Rush target in all three drill holes thus far. We have a triple in the stock now and should take some part profits. Selling 1/3 of positions will get back all your original investment. Often stocks run up ahead of actual drill results and then sell off on results. This is a new discovery and early days so we want to maintain a position too, because nobody knows how big and how good it might end up.

The Rush target is a northeast-southwest-trending conductive anomaly over 1,100 metres in length. Rock samples from the October, 2024, field program returned values of up to 1.61% copper, 0.79 g/t gold and up to 113 g/t silver across different samples. In addition, soil geochemistry samples taken above the anomaly returned values up to 798.5 parts per million copper and 21,152 parts per billion silver (21.15 g/t).

Drilling to date has intersected semi massive and massive sulphide mineralization in all three drill holes at Rush. The presence of sphalerite and chalcopyrite has been confirmed with a Thermo Scientific Niton XL5 Plus hand-held XRF analyzer.

Rush-001 was drilled to 177 metres, and intersected disseminated sulphide and stringer mineralization from approximately 12.5 m to 30 m in depth. Semi-massive sulphides were intersected from approximately 31.5 m to 33.25 m. Massive sulphides were intersected over 3.2 m from 61.50 to 64.69 m.

Rush-002 was drilled to 123 m and intersected semi-massive and massive sulphides over 2.7 m from 69.25- to 71.95-metre depth.

Discontinuous sections of semi-massive sulphides were also encountered from approximately 76 m to 91.25 m downhole on Rush-002.

The company has decided to extend the drilling program to a total of 19 or 20 holes to follow up and continue the successful drilling at Rush.

Ranger Discovery

The company has completed seven holes at its Ranger target on the Rottenstone SW property.

Of the seven holes completed at Ranger, six were drilled in the vicinity of the Ranger-001 discovery hole, which returned values of 73.55 g/t over 7.5 m, as seen in the June 17, 2024, news release. Quartz diorite was intersected in all six holes over significant widths. Mafic dikes crosscut the quartz diorite intrusion. Potassic and hematite alteration was noted along with carbonate stringers.

The stock broke out on the chart yesterday so I expect it could move up some more today.

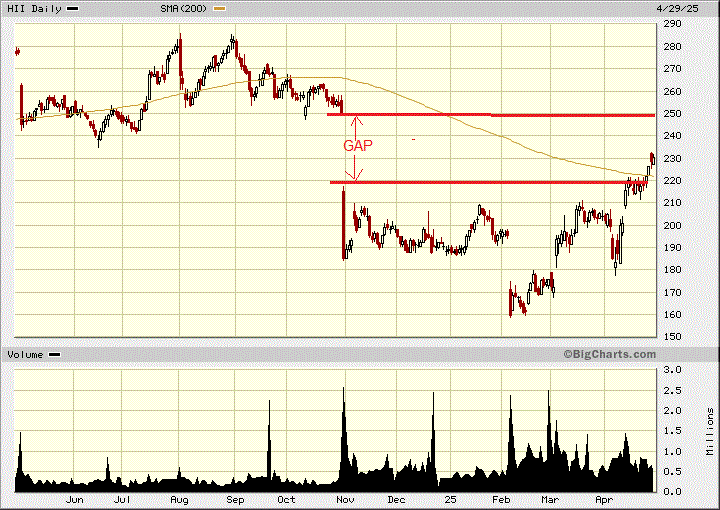

Hunginton Ingalls - - - NY:HII - - - - - - Recent Price - $230

Entry Price $187.54 - - - - - - - Opinion – hold

Joe's pick HII has broken out on the chart and also broke above the 200 day MA. I expect it will fill the gap and move up to $250 area.

Keep an eye on Giant Mining CSE:BFG, $0.20 cent stock comes free trading tomorrow and drill results will be out soon. Perhaps a chance to buy on weakness if some of the $0.20 stock sells.

Also .

Fitzroy Minerals TSXV: FTZ will soon have drill results out, look for it to break above $0.34 on the chart. We have over a nice double now, but they have a new discovery so this can go a lot higher.

Paid Advertisers at playstocks

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.