C$ falling, Canada Basket Case, Copper Stocks - BFG, GSPR, MMA

Everything is selling off today probably on some inflation fears. The core PCE price index ran a touch too hot in September, as the key inflation gauge remained moderately above the Federal Reserve's target amid robust consumer spending. I will continue to warn, inflation is not beat yet. Big tech reported good earnings but investors are worried about the heavy investment into AI and if it will pay off. I am planning on whole newsletter on this AI topic but for today we have the C$ loonie about to break down and I will highlight a couple more of dozens of broken things in Canada.

I have been warning about a drop in the loonie that will thwart the Bank of Canada effort to bring down inflation. As the loonie falls the cost of everything here that is priced in loonies goes up.

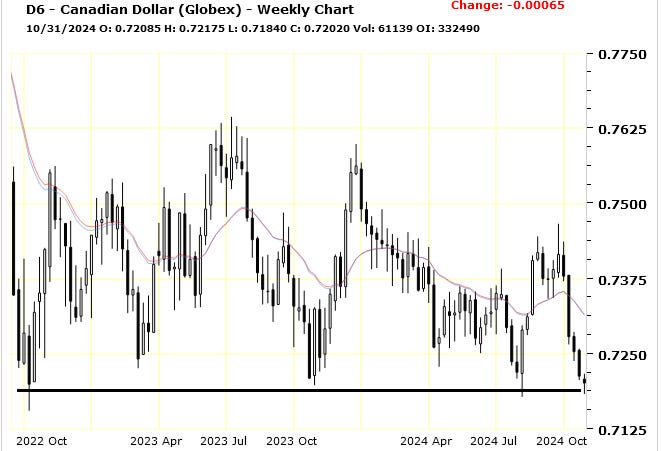

This is a weekly chart and you can see the loonie is at a critical support level. This sub 72 cent area has held for 2 years but I am certain it will break down. The next level would be 68 cents and that is a major bottom. I expect that will give way within the next year as well.

The reason is Canada is broken as a country, the economy has been in recession for almost 2 years masked by phony government manipulation. Canada has become a 3rd world country, just most don't realize to it yet. It is just too negative, but as I have said before, if the truth hurts, let it hurt. I am now going highlight two more broken things among dozens, our food supply chain and government computer systems.

Canada Food Supply Chain Broken

Food inflation is a major problem today but in Canada we throw almost half our food supply away as record number of people pile into food banks to survive. Canada is discarding 46.5 percent of its annual food production at an estimated cost of more than $50 billion every year, according to a newly released report.

This is the worst in the world by leaps and bounds and just proves another broken system and government incompetence. Other 3rd world countries like Cuba and Venezuela have food crisis because they don't have enough supply, not because they throw it away. This ludicrous, disgusting and sad. The info below is pulled from the report with not much editing.

The food system disposes of 21.1 million tonnes of the food it produces annually and, according to a report from non-profit group Second Harvest, 8.8 million tonnes—or 41.6 percent—of that waste could have been “rescued” to feed more than 17 million Canadians per year.

The cost of the wasted food comes in at an estimated $58 billion, which is enough money to pay for the groceries of 3.7 million Canadian families for a year, Second Harvest said in its report.

“The environmental and financial costs of food waste are staggering, especially in light of the current food affordability crisis,” Second Harvest CEO Lori Nikkel said in a press release. “We must act now and work together to reduce food waste at every level.”

Food affordability issues have led to record levels of food insecurity, with many Canadians relying on non-profits to access food, the report said.

A recent Food Banks Canada report verifies that assertion, noting record food bank use in 2024, with a high of more than 2 million food bank visits in March. Food bank usage has risen 90 percent since 2019 and is up more than 6 percent since 2023, the Food Banks Canada report said.

Best-before dates play a huge role in avoidable food waste, the report noted. They account for 23 percent of the 7.24 million tonnes of total avoidable food waste from processing to purchase.

Best-before dates were introduced in Canada in 1976 for short-shelf-life foods, the report said.

They were originally intended to manage inventory and guide consumers, not reflect a product’s actual shelf life or safety. But all too often they are confused with expiry dates.

“They can mislead consumers into discarding perfectly good items like canned vegetables, rice, pasta, dairy and fresh produce,” the authors wrote. “Only foods with a shelf life of 90 days or less require BBDs, yet they’re found on almost everything.”

I believe this was done by grocers to encourage you to throw out food items so you have to buy them again. More profit for them. Canned and dried goods will last years after said best before dates.

Expiry dates apply to only five food types in Canada—meal replacements, nutritional supplements, infant formula, formulated liquid diets, and foods for low-calorie diets—and must be strictly followed. Best before dates, however, serve as general guidelines for freshness, taste, and nutritional value.

That confusion leads four out of 10 people to throw out food past its best-before date at least once a week, according to a survey conducted by Léger. In fact, the second most frequent reason why people discard food at home in Canada is because it was not consumed before the date, the survey found.

These are easy to fix problems, lets see if this 3rd world country can do it.

Canada Government Computer Systems Broken at All Levels

I have highlighted a number of times how scammers and those from outside Canada stole 100s millions in Covid relief money, a lot of that the CERB benefit. Even Revenue Canada employees scammed that system.

At the height of this year's tax season, the Canada Revenue Agency discovered that hackers had obtained confidential data used by one of the country's largest tax preparation firms, H&R Block Canada. Imposters used the company's confidential credentials to get unauthorized access into hundreds of Canadians' personal CRA accounts, change direct deposit information, submit false returns and pocket more than $6 million in bogus refunds from the public purse, an investigation by CBC's The Fifth Estate and Radio-Canada has found.

January 2024, Canadian authorities are investigating a prolonged data security breach following the "detection of malicious cyber activity" affecting the internal network used by Global Affairs Canada staff, according to internal department emails viewed by CBC News.

In a report tabled February 2024, privacy commissioner Philippe Dufresne describes how the lapse at the Canada Revenue Agency and Employment and Social Development Canada in summer 2020 allowed hackers to fraudulently collect payments.

March 2024, several weeks after a ransomware attack disrupted IT systems in Hamilton (a large city in Ontario) and disabled several online services on Feb. 25, the city is still dealing with the fallout. No timeline has been set for when the city’s systems are expected to be fully restored.

Earlier in March before Hamilton, Canada’s national anti-money laundering agency, FINTRAC, was forced to take its corporate systems off-line following a cyber attack.

That attack followed other recent incidents involving Trans-Northern Pipelines, Toronto Zoo, Toronto Public Library, the Memorial University of NFLD and the RCMP, which was targeted last month.

Cyber threat actors from the People’s Republic of China (PRC) have been implicated in multiple breaches of networks associated with government of Canada agencies and departments, according to a report from the national cybersecurity agency.

“Over the past four years, at least 20 networks associated with Government of Canada agencies and departments have been compromised by PRC cyber threat actors,” said the National Cyber Threat Assessment 2025-2026, released Oct. 30 by the Canadian Centre for Cyber Security.

The cyber centre identifies China as the top threat actor targeting Canada, noting that its cyber operations are “second to none” in scale, technique, and ambition. Beijing’s objectives include espionage, intellectual property theft, malign influence, and transnational repression.

Chinese hackers have compromised and maintained access to multiple government networks over the past five years, collecting communications and other valuable information, the report said.

“While all known federal government compromises have been resolved, it is very likely that the actors responsible for these intrusions dedicated significant time and resources to learn about the target networks,” the report reads.

China probably knows more about you than your neighbour. You have way more attacks on government agencies than private. I believe the main reason this occurred because our government is totally incompetent and vulnerable. It is like were advertising with huge bill boards, come hack us, we are stupid. I have no doubt the other issue is woke policies and these government agencies are hiring based on race quotas and are likely hiring our adversaries right into their IT departments to help compromise them.

I could go on with many more securities issues with government agencies, but I spelled out enough to prove that sector is broken and are really 3rd world systems. We would be better off if we went back to paper and filing rooms.

Some news with our copper juniors

GSP Resource - - - TSX-V: GSPR - - - Recent Price - $0.11

Entry Price - $0.25 - - - Opinion – buy, average down to $0.15

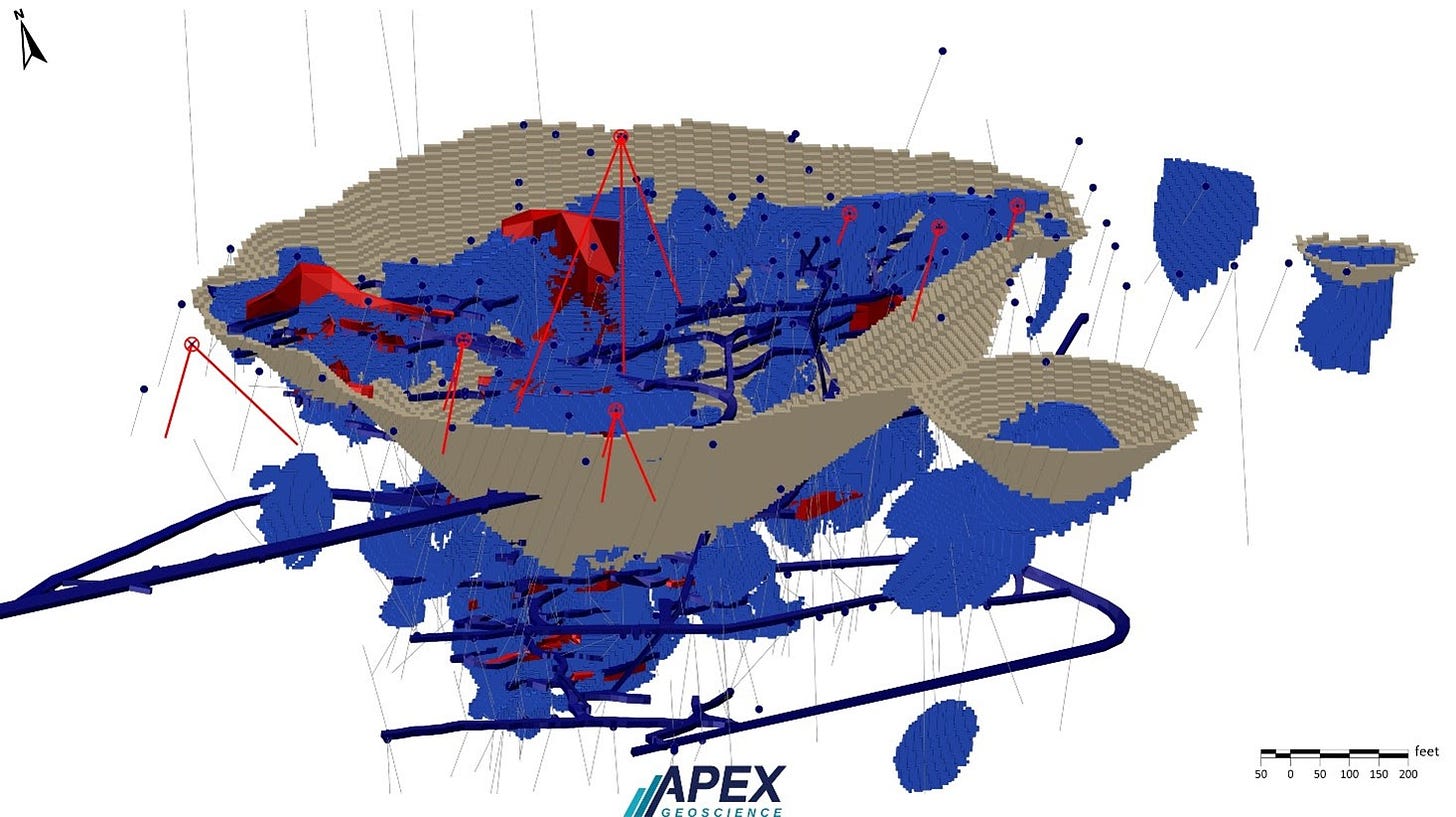

Today GSPR announced that diamond drilling has commenced at the Alwin Mine Copper-Silver-Gold Project. The drill program currently underway is expected to consist of 6 to 8 diamond drill holes and is designed to expand the shallow, open pit mineralization potential of the recently completed exploration target block modelling exercise.

The drill program is advancing the Alwin Mine project utilizing the results of GSP’s recently developed exploration model. The company has been able to prioritize expansion targets relative to their potential to be accretive to the modelled mineralization as constrained by the conceptual open pit shell. It is important to note that historic mining at Alwin focused on high-grade copper shear zones having width and grade characteristics sufficient to support relatively higher cost underground mining. The development of the conceptual open pit shell has now provided for the identification of a broader range of near-mine mineralization targets that had not been fully evaluated, historically.

High-priority drill targets include 10+ near surface exploration targets along strike and within the hangingwall and footwall of the Alwin copper-silver-gold shear system. The drill holes and planned targets are on the following graphic.

It is time to average down ahead of drill results from this drill program. We are entering a better market for juniors and I think the market will respond to good results that we will surely see from Alwin. The chart looks excellent too with a strong long term base built. Once the stock breaks above $0.13 it could quickly go to the $0.20 area and maybe higher depending on results.

Giant Mining - - - TSXV:BFG - - - Recent Price - $0.18

Entry Price - $0.80 - - - - Opinion - buy

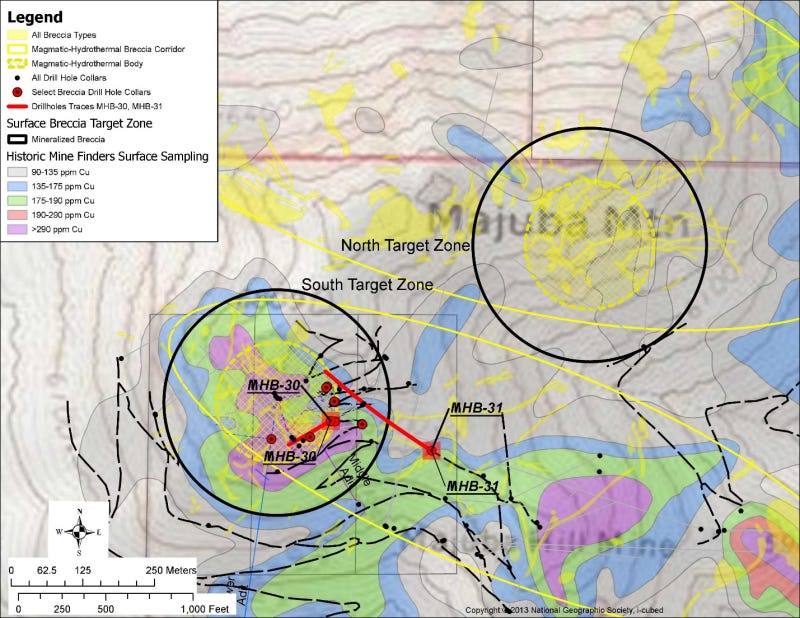

Today BFG announced an expansion of the surface exploration to focus on high-grade copper-bearing breccia zones at its Majuba Hill copper-silver deposit, Nevada.

In the news they highlighted the last drill intersect from late September High-grade copper was sampled from core hole MHB-30 that was clearly associated with a magmatic-hydrothermal, copper-bearing breccia zone. The breccia zone returned 218.0 feet (66.4 metres) of 1.35 per cent copper and 73.4 grams per tonne silver, including 74.0 feet (22.6 metres) of 2.6 per cent copper and 30.1 grams per tonne silver.

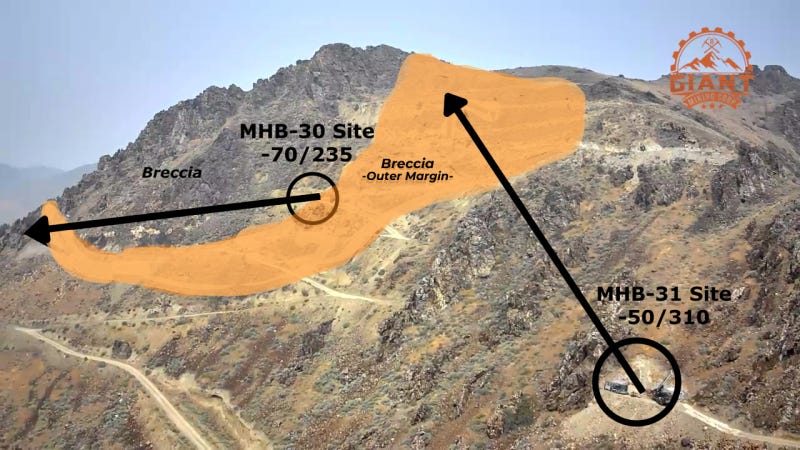

They also showed some drill core for the next drill hole MHB-31 that also had intersects of some breccia so I am expecting more good drill results here. The news also had a number of graphics and I want to show some of these to give you a better understanding of the project.

I like this photo from a drone. It gives you a good idea of the target and terrain.

This map shows the property targets and the current drill hole plan. The red dots are targeting breccia and the black dots the other drill collars. This is a strong mineralized system and more probable than not, the North Target will be similar to the South Target. We will get a better idea with the planned surface exploration and 2 or 3 drill holes are planned on part of this target.

On the chart if we ignore the price spike ahead of the financing shares becoming free trading, there is a wedge pattern that has developed. I would bet the break out is to the upside. You can also see the stock is at the bottom of the range so downside is very little.

There are only 23.5 million shares outstanding and at 18 cents, the valuation is only $4.2 million. Ridiculously cheap for the property BFG has. The current market for juniors is still out of touch with reality. Take advantage of the cheap prices on these stocks. In a year from now we are going to look back and wish we bought more. Don't be one of those woulda coulda.

Midnight Sun - - TSXV:MMA- - Recent Price $0.52

Entry Price - $0.27 - - - Opinion hold, buy

This is one of our copper juniors that is performing. Although the stock is up a fair bit, it is still a buy if you don't own any and if you do, continue to hold. There is a lot more potential upside here.

There is a video interview yesterday at KinVestor. It is excellent highlighting how strong and the potential of their copper discovery is. I could make a dozen highlights about it, but I encourage you to watch the 25 minute video. It is pretty easy to grasp.

Paid Advertisers at playstocks

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.