Can Trump Save Canada? More Trudeau Scams, ET Profits, ENDR

Can Trump Save Canada and Trudeau's Latest Scandals

The shot answer is no. Trump is going to have his hands full implementing his planned policies in America while fighting strong opposition to these policies from the far left. Trump's threat of tariffs should help bolster Canada's weak borders so that will be the best short term affect over the next couple years.

The head of the RCMP unit responsible for fighting organized crime says Canada is not just a significant producer of fentanyl — we also export it. "Sadly, Canada is a producing country of fentanyl and synthetic opioids. Not only are we a producing country, we're an exporting country," Bertrand told host Catherine Cullen.

Bertrand, chief superintendent of Serious and Organized Crime & Border Integrity at RCMP Federal Policing, said that while Canada has a problem with fentanyl imports, domestic production is what alarms police most at the moment. A law enforcement roundtable in 2021 noted a tenfold increase in precursor chemicals seized by the Canada Border Services Agency, and said that most of the chemicals come from China and Hong Kong.

A huge amount of fentanyl comes into Canada from China and also the chemicals that are used to make fentanyl come from China. At this point about 80% of the chemicals used are legal. Canadian gangs than smuggle the fentanyl to the U.S. and abroad. In 2022, Australian officials made their largest-ever seizure of illicit fentanyl: 11 kilograms of the drug had been shipped from Canada.

The total length of the Mexican continental border is 3,145 kilometers. In contrast the Canada–United States border is almost 3 times longer and is the longest international border in the world at 8,891 km. Much of it is very remote and not watched at all. Around half of this is a water border, with 1,197 kms of the St Lawrence river and when you include the Great Lakes, the water border is about the same size as the entire Mexican/U.S. border. It is very easy to smuggle drugs by water.

Furthermore, Canada has practically no enforcement at our sea ports. A recent National Post article noted easy smuggling through the Port of Vancouver, which has not had a dedicated police force since 1997 (the Port of Seattle, with comparable shipping volumes, has over 100 officers and 50 support staff). As the RCMP cannot fill this enforcement gap, fewer than one per cent of shipping containers entering the port are searched.

The toxic drug crisis is killing an average of 21 people every day in Canada. And who knows what the total deaths are if we could include that from the toxic drugs Canada smuggles to the U.S. and abroad.

Canada's economy is no longer connected as it once was to the U.S.

Canada use to benefit from a strong and growing U.S. economy, but no longer. Since the Trudeau government appeared in 2015, investment has been fleeing the country at a growing pace. This pic is from a very good 15 minute youtube video. This investment outflow increased further in 2023 and no doubt will be more so in 2024.

The video highlights the Canadian regulatory system that makes it 3 times harder to invest here. Canada leads the world in lack of investment per employee. We also see this in plunging labour production.

Canadian labour productivity plunged in the third quarter. Output per hour worked in the business sector fell 0.4 per cent in the July to September period, compared with gentler declines of 0.1 per cent and 0.2 per cent in the second and first quarters, respectively, Statistics Canada reported. Labour productivity has now dropped in 13 of 15 quarters since the start of 2021. The country has not recovered from the Covid plandemic and Trudeau's migration experiment added to problems.

Total hours worked outside of the government sector increased 0.5 per cent in the third quarter, but inflation-adjusted output by businesses grew only 0.1 per cent. In effect, companies were working harder to stand still. Canada is suffering from chronically weak business investment that has left the country especially vulnerable to Trump’s tariff threats.

Out of 113 countries that track the speed and efficiency of trading ports, Canada ranks 103.

Hosing represents about 40% of Canada's GDP. It is the last straw in the economy and it is starting to bend and will soon break. Another big part of the problem is Canada has the highest debt to Income ratio in the world. And as about half of real estate mortgages come due in 2024 and 2025, this will see another jump up. Third world countries might not have much income but they have very little debt as well, with most not owning a credit card. Imagine becoming a 3rd world country with enormous debt. Canadians will find out!

Migration policies have helped destroy the country as Canada's immigration rate per capita is 10 times larger than the U.S. Canada’s population increased from 38 million in July 2020 to an estimated nearly 41.9 million as of Dec. 6, 2024. And Trump thinks they have an immigration problem.

I have been commenting all year that Canada is in a recession, but the GDP numbers are padded from Trudeau's insane immigration policies. Now the former Bank of Canada governor Stephen Poloz who served as Bank of Canada governor from 2013 to 2020 agrees with me/

He said Canada’s economy is in a recession, with its weak economic growth being propped up by large-scale immigration. “I would say we’re in a recession. I wouldn’t even call it a technical one,” Poloz said during a Dec. 3 webinar. He continued the technical definition of a recession—two consecutive quarters of negative GDP growth—is a superficial one. He said Canada’s economy has not hit this definition because Canada has brought in a large number of immigrants who boost. I have used this chart before.

When you look at GDP per capita, it barely rebounded from the government Covid policies and started heading back down again. We are basically down to where we were in 2015 so under Trudeau there has been no GDP growth. To bring insult to injury, the Trudeau government calls this a 'vibecession'. It is not real, it is all in your head. This is just so disgusting and insulting to Canadian's intelligence. What idiots are running this country or are they really this stupid?

However, Stats Can reported in its weekly review published Nov. 29 that the country’s per capita GDP had declined for the sixth quarter in a row, falling by 0.4 percent in the third quarter of 2024.

There is no way businesses go under at this rate shown in the next chart, unless the country is in recession. They have been up sharply since mid 2023. Covid relief money and delay or forgiveness on debt payments kept numbers down in 2020 to 2022. Really just a delay affect. Timing of Business going under coincides with the GDP per capita decline.

More Trudeau Scams

The federal government’s response to a bad economy? GST rebates and a sprinkling of helicopter money, measures that might momentarily dull the pain but ignore the disease.

However this was not the real reason Trudeau introduced a two month GST holiday to start December 14th and a $250 check next year to working Canadians. You see Trudeau is a master at deceit, diversion, illusion and fraud. Canadian Parliament was at a stand still since sometime in September because the Trudeau government would not hand over documents to the RCMP on their Green Slush Fund. That became the nick name for the government environmental fund and it was revealed it was subject to fraudulent funding of various projects and entities, to the tune of 100s of millions.

Conservative House Leader Andrew Scheer noted since late September. “They’re literally keeping some documents away from the RCMP and hiding, covering up, and redacting many of these documents,”, referencing a letter received from the House law clerk.

“The Speaker has ruled that no other business can take place until this order has been complied with,” he said. “The Trudeau Liberals are choosing not to comply with this order, so it’s really up to them.”

Government was at a stand still as Trudeau refused to release documents, probably because the documents would reveal he was involved in the fraud. So for a diversion he comes up with the GST holiday and handout. If parliament did not debate and approve this, they could be accused of not helping Canadians and hurt their election hopes. The House Speaker who is a liberal by the way, has also ruled that parliament must vote on a spending bill, perhaps that can happen later this week? Next will come the Christmas break and Trudeau will hope the Green Slush Fund problem is forgotten.

Indigenous Procurement Scam

The Trudeau government has tripled the amount of money it spends on Indigenous issues from $11 billion annually in 2015 to more than $32 billion earmarked for 2025. In addition, the Trudeau government has pledged to award five per cent of its procurement contracts to Indigenous-owned businesses, a program called PSIB for short. It has recently been over 6%. A Global News investigation, in partnership with researchers at First Nations University of Canada, uncovered significant loopholes with the PSIB and alleged fraud.

A Liberal Minister was directly involved with the scam. November 21, former employment minister, Randy Boissonnault has stepped away from the Liberal cabinet after days of fierce criticism over his shifting claims regarding his family’s Indigenous heritage. A company co-owned by Boissonnault unsuccessfully bid on two federal contracts in 2020 while identifying itself as “Indigenous” and “Aboriginal owned.”

There are numerous questionable contracts that have been awarded with scammers setting up Indigenous shell companies.

Trudeau secretly tries to change the elections act to scam pension money.

Assistant cabinet secretary Allen Sutherland testified the Liberal and NDP parties held closed-door meetings to amend the Elections Act, a move that Conservatives argue aims to ensure parliamentary pensions for dozens of MPs.

Conservatives have raised concerns that proposed amendments to the act would change the date of the next federal election from Oct. 20, 2025, to Oct. 27, 2025. While Section 1 of the act stipulates that a general election must be held on the third Monday of October.

The Members of Parliament pension plan stipulates that MPs 55 years of age and older qualify after six years of service. A previous Trudeau change that reduced it from 8 years to 6. The original election date would have meant MPs elected on Oct. 21, 2019, would fail to qualify.

In a lame excuse the Liberals and NDP claimed a lot of cultural and religious observances take place in the fall, referencing the Sikh and Hindu holiday of Diwali. Since when should any country change election dates based on a foreign holiday? Besides anyone wanting to celebrate that event could vote in advance polls. This is clearly an attempt to scam undeserved pension money from tax payers.

More waste of Tax Payers $$

The federal government is putting up $700 million to finance the construction of data centres in Canada, and will also back the building of a giant supercomputer in the country as it tries to shore up the burgeoning artificial intelligence sector.

Ottawa, last Thursday announced its plans to spend $2 billion allocated for AI compute, the processing power needed to train and run machine learning models. Half the money will go to building “public” infrastructure accessible to researchers, companies and the government’s own operations.

Why is the private sector not investing in this as in the U.S.? That is because all of our tech talent migrates to the U.S. just like the investment dollars. This will just prove out to be another shameless government boondoggle with the funds probably ending up with Trudeau friends.

Finally the NDP, Trudeau's partner in scams has been highly critical of Trudeau and ripped up their support agreement. It was all for show and only a political ploy. Yesterday another non confidence vote was defeated because the NDP voted against it with the Liberals. They are just going to hold on to get their pension money. It is all about them, not Canadians

Conclusion

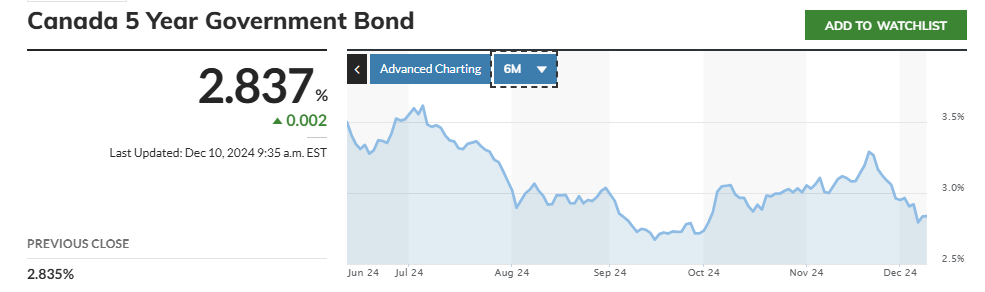

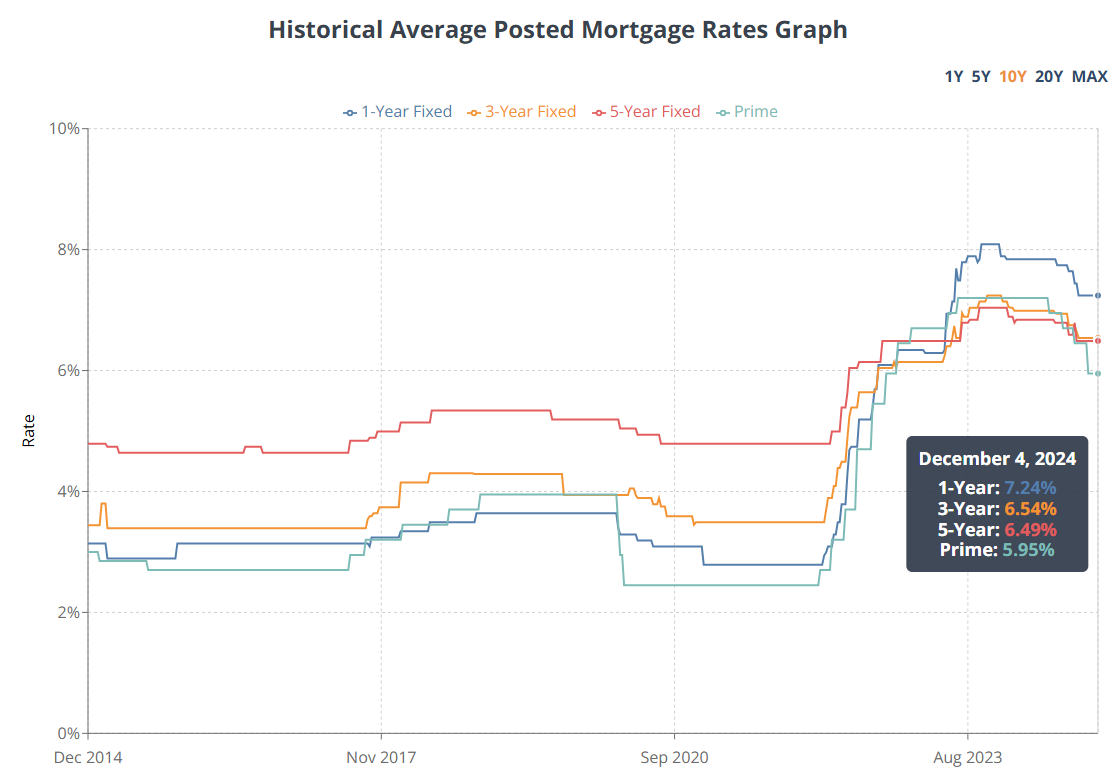

The Canadian economy will continue to go down hill but the positive is lower interest rates. Because of excess debt the 5 year bond had been going higher until about 2 weeks ago. As markets came to grips with my scenario of a recession, the 5 year bond rate has come down sharply. The unemployment rate rose to 6.8%, the highest in almost eight years. The BOC previously cut rates by 50 basis points in October, citing labour market softness and concerns about economic growth.

The Bank of Canada will announce its final policy rate decision of the year on Wednesday, with markets anticipating a 50 basis point cut, lowering the rate to 3.25%. This is good news for mortgage renewing, but not enough to alleviate a rate shock. The C$ is also down to around 70 cents U.S. and the Bank of Canada will have to do a high wire balance act so not to ignite inflation with a falling Canadian loonie

A lot of mortgages coming due were around 3% to 4% in 2020/21 and will be going to 6% and higher, still a significant jump. Those with 5 year terms won't be shocked as much because they were around 5% and can renew for around 6.5%. Regardless, it is going to suck money out of the economy and put downward pressure on house prices.

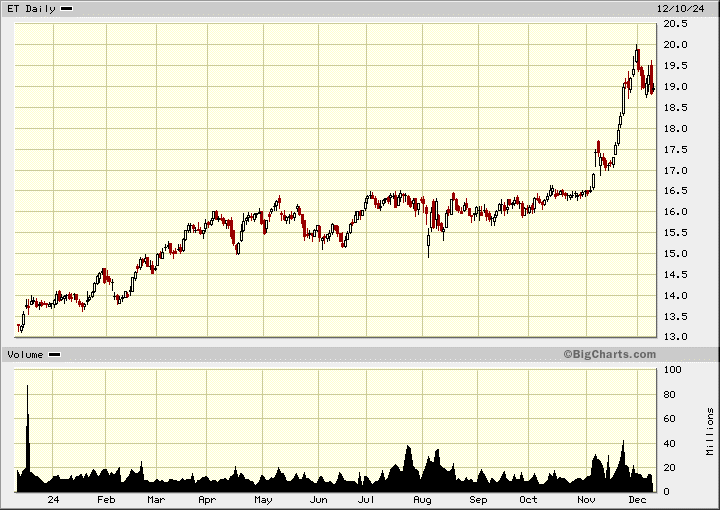

Energy Transfer - - NY:ET - - - - Recent Price $US19.00

Entry Price - $6.95 - - - - - Opinion – take part profits

ET owns and operates one of the largest and most diversified portfolios of energy assets in the United States, with more than 130,000 miles of pipeline and associated energy infrastructure. Energy Transfer’s strategic network spans 44 states with assets in all of the major U.S. production basins. The stock has made a significant jump recently but is still yielding 6.7%

Last week they announced reaching a positive final investment decision (FID) for the construction of an intrastate natural gas pipeline connecting Permian Basin production to premier markets and trading hubs. The new large-diameter pipeline, previously called the Warrior Pipeline, is being renamed in honour of Hugh Brinson and will now be known as the Hugh Brinson Pipeline. The pipeline will provide much needed transportation capacity out of the Permian Basin to serve growing natural gas demand.

The Hugh Brinson Pipeline is expected to be constructed in two phases with the first phase including the construction of approximately 400 miles of 42-inch pipeline with a capacity of 1.5 billion cubic feet per day (Bcf/d). Phase II of the project would include the addition of compression to increase the capacity of the new pipeline to approximately 2.2 Bcf/d. Depending on shipper demand, Phase II could be constructed concurrently with Phase I.

Combined costs of Phase I and Phase II are expected to be approximately $2.7 billion. The project is backed by long-term, fee-based commitments with strong investment grade counter parties.

We are up about 175% so should not ignore these profits despite a nice dividend yield and solid long term potential. I would suggest selling 1/3 positions but there is nothing wrong with just holding either.

It has been a while since I updated Enduro, it has been whacked down with all the juniors.

Enduro - - - - TSXV:ENDR - - - - - Recent Price - $0.17

This week, Enduro announced it is merging with Commander Resources (CMD). It really is a unique financing. The proposed transaction represents a modest (under 5 per cent) premium to Commander's cash position of $4.2-million as at Sept. 20, 2024, at a challenging time for raising capital for junior exploration companies. That 5% is less than a junior would pay in commission for a financing.

The proposed transaction will position Enduro as a multiasset company with a focus on copper-gold porphyry exploration in British Columbia. While Newmont Lake will remain the priority, Commander's Burn and October Dome properties will allow for year-round exploration activity and more efficient utilization of the combined group's exploration capability.

Late November ENDR announced results of drilling consisted of four oriented diamond drill holes, totalling 1,248 meters, in the NW Zone of the McLymont Fault. The holes were planned to test a reinterpreted model of structural controls on gold mineralization at the NW Zone; one of several zones of gold mineralization along the McLymont Fault.

The best hole was NW24-02 at 10.01 g/t Au, 12.12 g/t Ag, and 0.37% Cu over 12.45m starting at 44.00m, within a broader interval of 24.70m grading 5.17 g/t Au, 6.34 g/t Ag, and 0.20% Cu starting at 44.00m. All drill holes intersected gold associated with mineralized structures an more importantly proved structural controls.

Cole Evans, CEO of Enduro Metals commented, "The four holes drilled at McLymont in 2024 tested a new structural interpretation of controls on gold-mineralization based on detailed mapping and orientation studies of structures in previously drilled core. Our analysis of the program's results suggests that structures have an apparent dip of 60-80 degrees to the north west. If this is correct, drilling to-date has largely missed these structures, which creates a real opportunity to materially expand the gold system at the NW Zone and beyond.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.