Canada, Bad News Good News, Record Markets and AZT

Canada reported good inflation numbers as I expected because the carbon tax came off gas prices. This brought gas prices down about -18% with lower oil prices helping too. This resulting of inflation of just 1.7% in April, but core inflation was higher, around 3.0% and food prices up 3.5%. As I have been commenting, the inflation problem is not resolved yet.

Furthermore, the new Carney government says they will cap immigration at 5% population growth. This is still very high and will add to price pressure on everything. Not much news on what else the new Carney government will actually do, but markets are optimistic.

The TSX index has been setting new record highs and up about +16% from the April bottom compared to about +19% for the S&P 500 that is still about 200 points from new highs.

This is a clear break out on the Toronto market. Maybe it's a Carney honey moon but could also be because of oil prices have firmed back up and gold has had a strong bounce back up from it's correction. Gold up about +$60 today on the June Comex to $3293.

We also have a new higher high on the TSX Venture index today as well. The market is not far off the bottom, but finally moving in the right direction since the break out. I am quite confident that new life is being breathed into this junior market. The advanced juniors are moving, with Amex Exploration TSXV:AMX up about +20% today. Our switch from NFG to AMX is working well.

Aztec Minerals - - - TSXV-AZT , OTC: AZZTF - - - Recent Price - $0.20

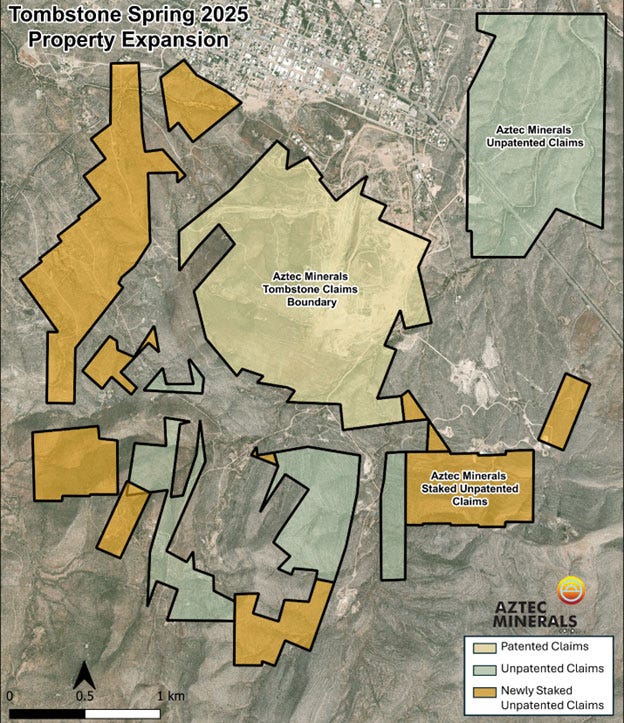

Aztec announced the staking and filing of 31 new unpatented lode mining claims in the Historic Tombstone Silver-Gold Mining district in Arizona, totaling 211 hectares (522 acres). This increases the overall Tombstone Project JV land package by 46.7% from 452 hectares to 663 hectares (1,639 acres).

The Tombstone Property JV management committee also announces that the respective partners’ participating interests have been adjusted, with the new joint venture participating interests recalculated to 78.7% Aztec (from 77.7%) and now 21.3% Tombstone Partners.

The new unpatented claims are near or adjoining the Tombstone Property core patented and unpatented claims in a semi-circle from the east clockwise to the northwest (see map below), consolidating further the Tombstone JV’s ownership in the mining district and expanding opportunities to explore new targets in the historic Tombstone Silver-Gold District. The new unpatented claims were staked on open ground and have no underlying royalties or work commitments.

The new unpatented claims cover several historic mine shafts and prospects. Several of the mines have dumps of significant size. The historic workings explored and /or exploited oxidized CRD related deposits, including MnOx-rich replacement bodies and quartz stringer fissure lodes. These are hosted (B.S. Butler, et.al., 1933) in the multiple horizons of oxidized to mixed-supergene mineralization hosted in Mesozoic Bisbee Group clastic sediments, and underlying thick (>2 km) Paleozoic limestones, and Tertiary quartz-feldspar porphyry dikes.

It seems, all the ducks are lining up for AZT. They have raised money for drilling, have new strategic investors, the stock is moving up off a recent bottom and now they have increased their land holdings and ownership. And also important is an improving junior market. Our timing to average down in the stock a week ago seems to be working well.

Paid Advertisers at playstocks

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.