Canada Cries Wolf, Market Crash Yes or No? Margins, Gold - Bitcoin

Welcome and thankyou to all the new, smart, savvy and contrarian investors who have joined my substack. I am small here so please share and spread the word. My experience is predicting market cycles up and down as well as the precious metals market and energy.

Canada Cries Wolf

For anyone who does not know the old fable, a boy ran into the village numerous times crying 'wolf' that was supposedly attacking a herd of sheep. The villagers ran out to help the sheep but the big bad wolf cry was false, the boy was doing it for fun and mischief. Than when a wolf really attacked the sheep, nobody believed the boy and did not run out to help.

The Canada government and their media shills have been crying wolf about a lot more tariffs to come from the big bad orange man. It was false as Trump did not enact anymore tariffs on Canada. The sheep (people) are safe but most of them do not realize as the Canadian government and their media shills keep crying 'wolf'. Basically Canada has similar tariffs that Trump went with on his first term, the 25% on steel and aluminum, but the 10% on oil is an additional. As I pointed out, there has been no affect on oil prices. There are a handful of items outside the USMCA trade agreement but it won't amount to much, most trade is under USMCA. Alberta summed up best.

Alberta Premier Danielle Smith called the new announcement by the White House an “important win for Canada and Alberta,” noting that the United States has decided to “uphold the majority of the free trade agreement [USMCA]. ”

“It means that the majority of goods sold into the United States from Canada will have no tariffs applied to them, including 0% tariffs on energy, minerals, agricultural products, uranium, seafood, potash and host of other Canadian goods,” Smith said in a social media post on Apr. 2.

Of course all the far left governments scorned Trump on tariffs enacted on a global level not seen in modern times. He really went after Asia, China that already had 20% so now at 54% total.

Wednesday’s order implements duties on Chinese de minimis (small) packages starting May 2 at 12:01 a.m., citing China’s role in synthetic opioid trafficking into the United States, particularly fentanyl. U.S. has to setup infrastructure to handle this.

It is notable that Israel dropped their tariffs on the U.S. so there was no tariffs on Israel. I heard the same thing about Vietnam even though they show on the list above. It will take time to see how this plays out. More could drop tariffs on the U.S. or retaliate. China will definitely hit back, perhaps restricting exports of rare earths as well?

Still crying wolf, PM Carney said U.S. President Donald Trump’s latest announcement “preserved a number of important elements of our relationship,” but he took issue with the other tariffs remaining in place. He said Canada is retaliating with its own tariffs. “The series of measures will directly affect millions of Canadians. We are going to fight these tariffs with countermeasures. We are going to protect our workers, and we are going to build the strongest economy in the G7,” Carney told reporters in Ottawa on April 2.

The prime minister also said Trump plans to impose additional tariffs related to “so-called strategic sectors” in the United States, such as pharmaceuticals, lumber, and semiconductors. “So we’re in a situation where there is going to be an impact on the U.S. economy, which will build with time ... but the series of measures will directly affect millions of Canadians,” he said.

The liberal government has to keep up their propaganda campaign to create a diversion from the real problems that Canada has, caused by Liberal government policies of the last several years. Can Canada really afford a 4th term of far left socialism?

The White House said that if the fentanyl and illegal migration issues are resolved, Canada would default to the new reciprocal tariff regime where USMCA goods would continue to have “preferential treatment” and other goods would have a 12 percent reciprocal tariff.

Markets Crashing

Markets are crashing to new lows today as they seemed to be surprised at how high the tariffs are.

The levies will total 10, 20 and even 50 percent, depending on the country. It is definitely an escalation in a trade war. There is no reason why markets can't go a lot lower. One risk is that investors were buying the dip with margin so there could be a lot of forced margin call selling for a while. Note how margin debt increased in January and February. No March data yet.

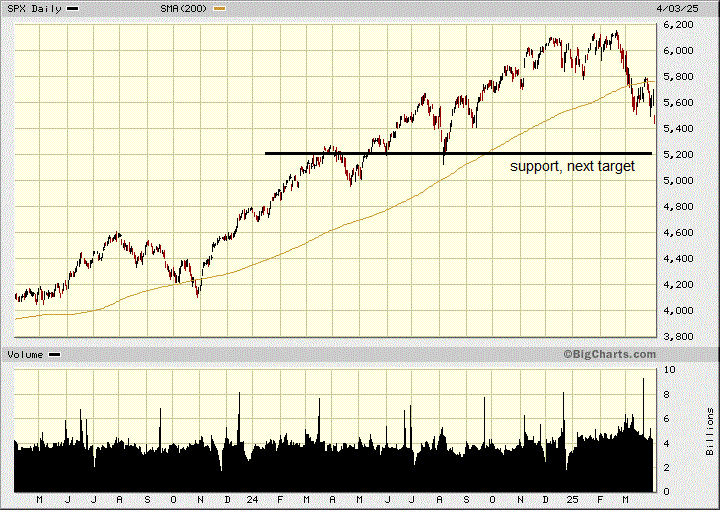

I don't see much support in the S&P 500 to around the 5,200 level and is probably where the market is headed to.

None of my readers should be surprised at this and hopefully most of you raised cash levels. There will be bargains ahead.

Once again Bitcoin acted as a speculative asset, dropping from around $88k to $82k about a -7% drop. Gold sold off this morning too, but acted as a great hedge only falling far less than -1% or about -$25 as of this writing.

Tomorrow will be interesting with the job numbers, but regardless good or bad, investors may fear holding stocks over the weekend as retaliatory tariffs and such could be announced.

We are in a profit position with our Bitcoin and Moderna shorts so I may suggest profits tomorrow. Lets see how things unfold but it is not a market to hurry out of short positions.

Paid Advertisers at playstocks

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.