TSX Venture Market Hits New Highs

Dear investor, a short update, we are taking some holiday time this week and next. We suffered an unprecedented bear market with Canadian junior stocks that hobbled down at a bottom for 3 years after their fall. There has never been anything like it and I know many of you suffered through with junior stocks.

I commented many times that this market would bounce back as buying in the precious metal bull market would move down the food chain and that it has. I was watching for a break above 660 and since that happened the market has been moving straight up. It is still early days and my 900 target should be quite easy to make and then go further from there.

Volume is still low and this is a tiny market. If the average TSXV stock is $0.20 and daily volume is around the current 40 million shares, this is only $8,000,000 in daily trading. Another observation, is just one stock in the U.S., Nvidia has a higher value than the entire Canadian market.

So far the buying has mostly been in the advanced juniors with discoveries, like Blackrock BRC and Goliath GOT that I updated earlier this week and included below. Other advanced juniors have moved up too, like Amex Exploration and Rio2 on our list and on the tech side too with Gatekeeper GSI.

There is not much of a move yet with the exploration plays, like Zonte ZON, Golden Lake GLM, Inomin MINE and Providence PHD on our list, but their turn is coming. I expect that in September time frame.

We have seen some movement with new junior stories with good drill results, like Ramp Metals and Fitzroy Minerals on our list. By this fall I expect we will be firing on all cylinders. I think there is very good odds, our selection list of some 50+ stocks can see an average 100% plus gain in 2025.

Copper Pops to Record Highs, but Copper Miners Fall

Trump announced possible tariffs on copper that drove prices higher but the copper miners went down. I think there is a lot of confusion and misunderstanding with tariffs. They have nothing to do with the miners as they simply sell their copper at the prevailing world prices. Perhaps there is some fear tariffs could disrupt markets, but even so the miners will sell all their copper some where.

In the longer run, this will be short term noise in a multi year bull market. Many countries have huge AI plans that will never be met because the electrical grid and power infrastructure required cannot be built big enough and fast enough. It all takes copper and sooner or later markets will figure this out. $10 copper will not surprise me.

Here is an update on Gold, Goliath Gold, AYA Silver and Blackrock I put out early this week on the paid list.

Back in early May, I highlighted a consolidation area that I expected gold to trade in. I did not say how long, but it is still in consolidation. I expect it will stay there with thin summer trading and a likely break out in September.

There has been some excellent drill results this week with a few of our juniors

Goliath - - - -TSXV:GOT - - - - Recent Price - $2.42

Entry Price - $1.22 - - - - - - Opinion - hold

Monday Goliath released new sampling and re-logging of drill hole GD-24-280 that assayed 8.31 g/t Au over 23.00 meters, including 15.69 g/t Au over 11 meters, including 37.45 g/t Au or 1.20 oz/T over 4 meters in a third rock package within the high-grade gold Bonanza Zone,

The significance is they are assaying parts of previous drill holes in a rock type and sections that previously were thought not to contain gold. The more recent revelation is that significant gold mineralization is hosted by subtle quartz stockwork veins hosted within a series of near vertical dikes is quickly taking shape.

June 23rd Goliath released results for re-logged and assayed Drill hole GD-22-64. It assayed 6.31 g/t AuEq Over 14.35 Meters Including 11.36 g/t AuEq Over 7.85 Meters from a gold-rich intrusive feeder dyke

There are several more drill holes that they re-logged with assays pending.

This is adding ounces to the deposit and greatly expanding the area of confirmed mineralization for the current drilling on the Surebet high-grade gold discovery. It remains wide open and 9 drill rigs are now at work.

The stock upward trend continues and a test of the $2.80 highs is not far off.

Aya Gold, TSX: AYA, OTCQX: AYASF - - - Recent Price - $12.14

Entry Price - $11.43 - - - - - - - - - Opinion – buy

Aya announce new high-grade drill exploration results from its 2025 program at Boumadine in the Kingdom of Morocco. Yesterday's results also extend the Imariren mineralized trend to 1 kilometer (“km”) and confirm high-grade continuity along the Boumadine Main Trend. In addition, Aya has identified a new mineralized high-grade at-surface zone to the west.

New prospective high-grade Asirem zone identified to the west of Boumadine Main Trend, with grab samples including 3.34 grams per tonne ("g/t") gold (“Au”) and 4.0% copper (“Cu”).

High-grade intercepts on the Boumadine Main Trend (5.4km):

BOU-MP25-038 intercepted 258 g/t silver equivalent (“AgEq”) over 3.3 meter (“m”) (2.85 g/t Au, 27 g/t silver (“Ag”), 0.1% zinc (“Zn”), 1.0% lead (“Pb”) and 0.05% Cu, including 563 g/t AgEq over 1.3m (6.13 g/t Au, 65 g/t Ag, 0.3% Zn, 0.2% Pb and 0.1% Cu

BOU-MP25-028 intercepted 286 g/t AgEq over 4.3m (3.27 g/t Au, 19 g/t Ag, 0.3% Zn, 0.1% Pb and 0.1% Cu), including 460 g/t AgEq over 2.1m (5.46 g/t Au, 26 g/t Ag, 0.05% Zn, 0.1% Pb and 0.1% Cu)

High-grade intercepts on the Tizi Zone (2km)

BOU-DD25-547 intercepted 248 g/t AgEq over 9.0m (0.42 g/t Au, 80 g/t Ag, 3.6% Zn, 1.8% Pb and 0.04% Cu

BOU-DD24-540 intercepted 480 g/t AgEq over 2.0m (3.27 g/t Au, 53 g/t Ag, 1.1% Zn, 5.2% Pb and 0.2% Cu

Extension of Imariren strike length to 1km

BOU-DD25-503 intercepted 876 g/t AgEq over 1.0m (9.92 g/t Au, 49 g/t Ag, 1.6% Zn, 0.2% Pb and 0.1% Cu)

BOU-DD25-529 intercepted 365 g/t AgEq over 2.0m (3.66 g/t Au, 52 g/t Ag, 0.5% Zn, 0.5% Pb and 0.1% Cu)

AYA has completed 79,732m of drilling at Boumadine year-to-date in 2025.

The stock was knocked down when they announced a public offering of common shares at a price of $13.35 per share, for aggregate gross proceeds of approximately $143.75-million. The stock is not much above our original entry price and a good buy here, below the finance level.

Blackrock Silver - - TSXV: BRC, OTCQX: BKRRF - - - - Recent Price - $0.52

Entry Price - $0.14 - - - - - - - Opinion - hold

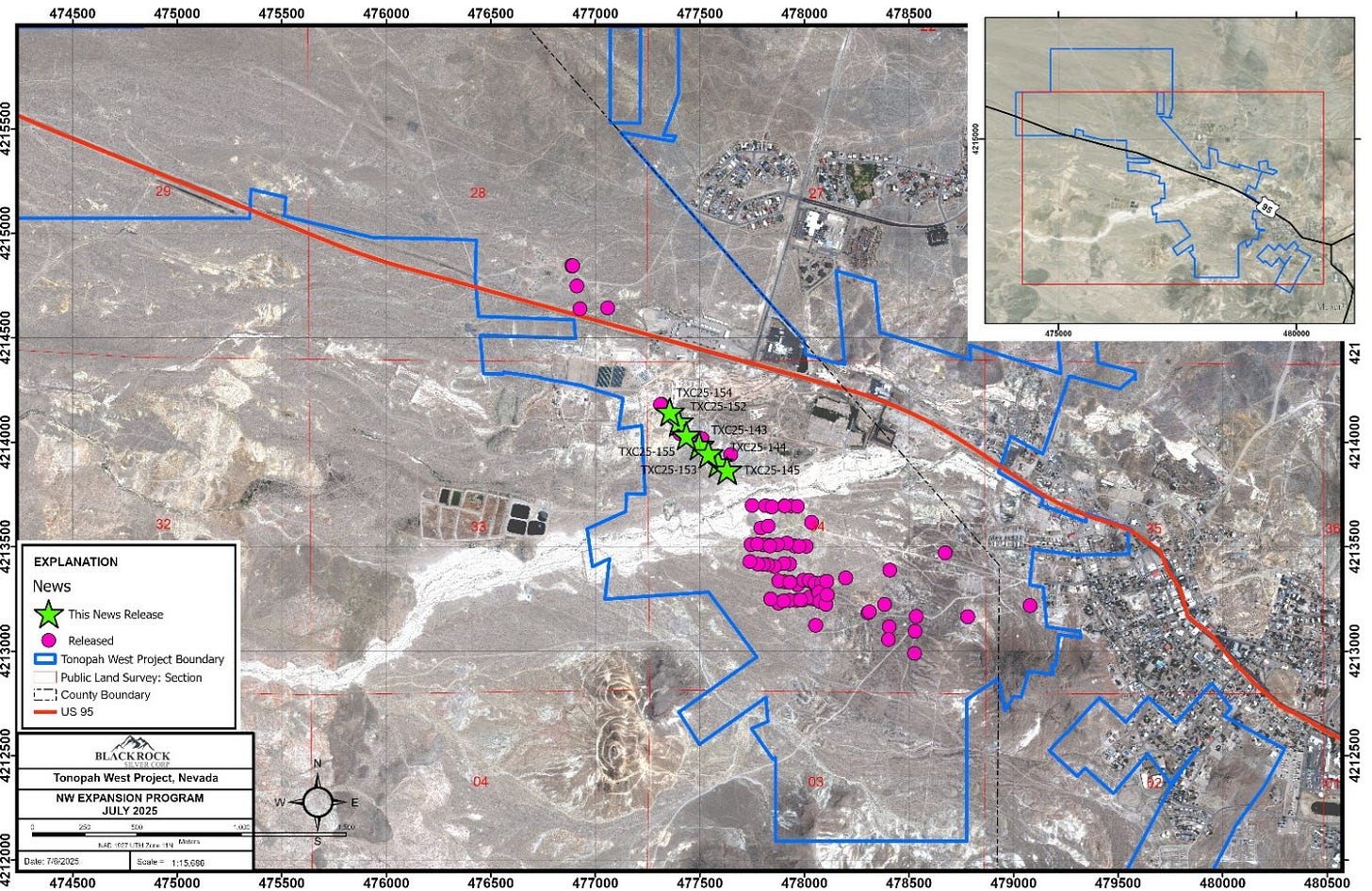

Today BRC announced the final set of assay results from its Resource Expansion Program showing significant width and high-grade silver and gold drill intercepts in step-out drilling at its 100% owned Tonopah West project, Nevada.

HIGHLIGHTS:

TXC25-144 cut 10.12 metres grading 467 grams per tonne (g/t) silver equivalent (AgEq) (283 g/t silver (Ag) & 2 g/t gold (Au)), including 3.51 metres of 1,020 g/t AgEq (620 g/t Ag & 4.43 g/t Au);

TXC25-145 encountered multiple zones of high-grade mineralization which included 0.67 metres of 3,264 g/t AgEq (2,008 g/t Ag & 13.93 g/t Au) within 11.58 metres grading 327 g/t AgEq (186 g/t Ag & 1.56 g/t Au) and 2.32 metres grading 401 g/t AgEq (242 g/t Ag & 1.76 g/t Au);

TXC25-153 drilled 0.7 metres of 724 g/t AgEq (437 g/t Ag & 3.18 g/t Au) within 5.73 metres of 156 g/t AgEq (96 g/t Ag & 0.67 g/t Au);

Step-out drilling has established continuity of high-grade gold & silver mineralization over significant widths that runs 500 metres along drill-defined strike from the existing DPB resource shell to the northwest. Targeting is now underway to bridge mineralization on remaining 500 metres of vein corridor to NW Step Out resource area. This map shows recent drill results and you can see the 500 meter gap to the NW of that to b drilled.

The deposit has just over 100 million silver equivilant ounces and this is going to add significant ounces to the resource. It is a high grade deposit at 569 g/t silver equivilant in the mine plan. This type of deposit with a high IRR and in a favorable jurisdiction should be valued much higher. The stock almost broke out on this news but failed. It is only a matter of time.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.