As you may know, I spend a lot of time analyzing economic and investment cycles, because being on the right side of a cycle or trend can make huge differences with your finances.

In 2021 and 2022, I began warning of a real estate bubble in Canada driven by zero interest rates and all the Covid relief money. The bubble was basically caused by government Covid-19 policies.

I predicted the bubble would soon peak and real estate prices would fall between -30% to -40% depending on your location. Most people said I was wrong or crazy, real estate never falls. And that is true most of the time and over the long run it always goes higher because it is a hard asset. Not so much that real estate rises but our currency depreciates.

Now back to 2022, I put a newsletter out on April 15th that year and highlighted rising inflation and interest rates that were headed much higher, but most of the newsletter was on what I called “The Great Canadian Real Estate Bubble.”

I presented a lot of charts and data but started off with “My previous comments were about a market peaking out. I can comfortably predict now that the top is pretty much in, the next big move is down. The US has been raising rates and this past Thursday the Bank of Canada rate was increased 1/2% and more increases are coming.”

This chart is from the St Louis Fed so quite independent. It uses national average prices and is adjusted for inflation with the index starting at 100 in 2010. Actual prices not inflation adjusted would be higher. From the peak to end of 2023, real prices are down about -20%. The next leg down is now starting that will get down to -30% to -40% and I predicted, using both real and inflation adjusted prices.

In my 2022 report I also commented - “Many Ontario cities had housing price increases between 45% and 55% from 2020 to 2021. This is insane bubble activity.”

The report was very in depth and you may want to review it again with it's numerous charts. I commented then -”These next charts should scare the s_ _ _ out of real estate and Canadian bank stock investors.”

My prediction of the top was within 2 weeks of the actual top, maybe a bit of luck to be so close. That's enough of back then, what about now

When interest rates rose and there was an initial decline from the peak, the real estate market kind of stabilized and even rebounded a bit as shown in the chart above. I compared this to the Wile Coyote in the old road runner coyote show who ran off the edge of the cliff and was hanging in mid air, looking in the rear view mirror and not yet aware of the inevitable fall.

You see with Canadian real estate the majority of mortgage renewals from pandemic extra low rates come for renewal in 2024 and 2025. This where there are huge mortgage payment increases that will lead to many forces sales.

I used this example recently in a major Canadian news outlet. Canadian family bought a house in 2021 for $800k in Toronto. They secured a 3 year fixed rate mortgage at 3.2%. Bank is now offering the family 7.1% which translates to a leap from $3000 to $5100 per month. The husband is working 70+ hours a week. He only comes home to sleep. New normal. Sad

A few months ago, Wile Coyote started to look down and now he is falling.

Greater Toronto Area (GTA) housing market saw a dip in home prices in July 2024 as sales continued to fall behind new listings. In July 2024, the GTA's benchmark home price decreased 1.2% month-over-month to $1,097,300, a 5.0% decrease year-over-year from July 2023.

The average GTA home price was $1,106,617 in July 2024, a 4.8% decrease from the previous month’s price of $1,162,167 in June 2024. On an annual basis, the GTA’s average home price is down 1.1%.

The median home price, often considered a more transparent indicator of market trends, was $950,000 in July 2024. This is a 4.0% decrease month-over-month.

When prices are falling 4% to 5% in just one month, my -30% to -40% target will come quick.

Now granted this is the GTA and prices vary a lot by location, both stronger and weaker. However, in general price activity feeds outward from the major Canadian cities.

Here is a real example from the Toronto Real estate Blog.

According to its listing, this four-bedroom, three-bathroom home boasts 3,100 square feet of living space, a heated pool, coffee station, breakfast bar, wine rack, upgraded hardwood flooring, and renovated bathrooms. The detached home first sold in February 2022 for $1.73 million (very close to the peak),

Two years later, the home was listed for just under $1.5 million, marking the first attempt to resell the home. In April 2024, the home was put back on the market for just under $1.4 million, and again in June for $1.388 million. Finally, the home was sold in July 2024 for $1.3 million — representing a loss of $430,000 when compared to its price just two and a half years earlier.

This is a -25% decline so the market is closing in on my 30 to 40% decline.

Other cases include an Oakville townhouse that sold at a significant $316,000 loss in July, and a three-bedroom home in Toronto's Silverthorn neighbourhood that sold at a loss of $207,500 in June.

There is always a lot of variation by location and averaging Canada as a whole, prices are just starting to ease.

Real estate activity across Canada in June showed a drop in both sales and housing prices compared to June 2023, says the Canadian Real Estate Association, though sales perked up a bit compared to May 2024. The average home price in Canada for June 2024 was $696,179, which is a drop of 1.6 per cent compared to the year before.

A couple other tid bits.

Canadian mortgage borrowers are finding out fast that Toronto real estate isn’t always a path to riches. Equifax data shows Toronto mortgage delinquencies climbed in Q1 2024, and now sit at the highest rate in 8 years.

Sales continued to weaken while inventory climbed, as investors try to lighten their market exposure in key regions like Toronto.

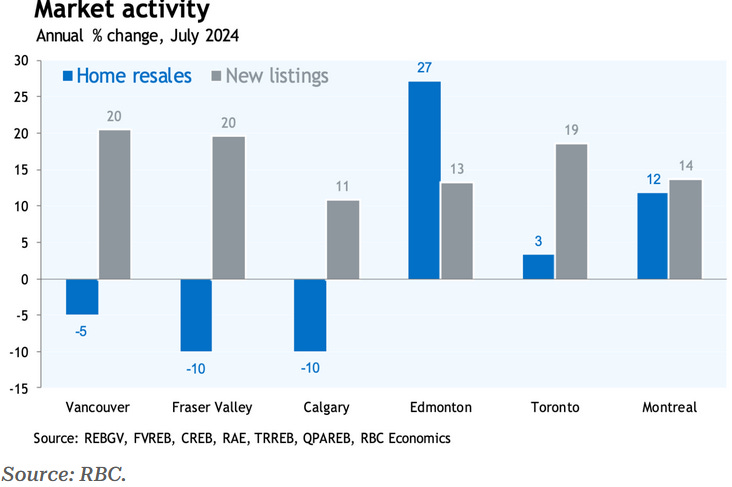

As you will see in this next chart, new listings are soaring but sales are slow. That will equate to still lower prices.

There are 4 main factors at work here. Investors buy about 30% of Canadian real estate with anticipation of profit from higher prices. If they see prices no longer rising many will start to sell. Homeowners brain washed by all the happy talk in the media and real estate industry thought interest rate drops would help and that would be a better time to sell. Rates have started to fall so many started to list their homes, but it is not the bed of roses they thought it would be. Thirdly forced sales with mortgage renewals are starting to increase. Even another full point drop won't help many of these situations. Finally, job losses, a weak economy adding to the pile.

As you can see, only Edmonton has sales outpacing new listings. I heard from a 40 year veteran in real estate who said it is the worst market he ever saw. Maybe 40 years is not just long enough because the big problem is affordability. Canada housing has not been so affordable since the soaring interest rates of 1980/81. I remember well as I bought a house at that time and the bank took a total loss on the mortgage they held on the property.

The economy is a lot weaker than portrayed by most government data. Canada may not technically be in a recession, but some economists argue the country's declining per-capita output mimics trends of prior downturns. Canada has the third-lowest growth in gross domestic product (GDP) per person from 2014 to 2022, coming 28th out of 30 other countries, according to a report published by the Fraser Institute.

I see the signs everywhere of small business struggling and failing. It will spread to larger business too. Statistics Canada reports wholesale sales down 0.6% in June. Real Estate is a huge factor in the Canadian economy and it is staring to slide too

US Economy weakens except retail sales

The New York Fed’s Empire State business-conditions index, a gauge of manufacturing activity in the state, stayed in contraction territory for the ninth straight month in August. The general business-conditions index picked up 1.9 points — to negative 4.7 from negative 6.6 in July.

U.S. industrial output fell for first time in four months in July Production drops 0.6%, biggest decline since January, due in part to Hurricane Beryl

US retail sales accelerated in July by the most since early 2023 in a broad advance that perhaps points to a resilient consumer.

The value of retail purchases, unadjusted for inflation, increased 1% in July and helped by a sharp snapback in car sales, Commerce Department data showed Thursday. Excluding autos and gasoline stations, sales were up 0.4%.

Ten of the report’s 13 categories posted increases. Car sales bounced back strongly after a cyberattack on auto dealerships led to a sizable drop in June.

June retail sales were pretty good too at 0.8% increase.

I am speculating the better retail sales might because more people are staying home and not travelling this summer. According to Deloitte's 2024 Summer Travel Survey, almost one-third (32%) of non-travelers are planning to stay home due to the current costs of travel, an increase of 8 percentage points from summer 2023.

No Real Estate Problem in U.S.

It is a far different market in the U.S. as prices did not spike near as fast and high as Canada. Also a lot of U.S. home owners have 30 year mortgages so they aren't faced with renewals in the current higher interest rate. Although this has curtailed listings and sales because they want to keep their low rate mortgage.

U.S. mortgage refinancing witnessed the largest increase since the early days of the pandemic. The refi index surged 34.5% over the course of one week, according to data from the Mortgage Bankers Association, and was up an astounding 118% when compared to the same week a year ago.

The latest housing-market data shows that the median U.S. home price hit $426,900. That's a new all-time high. And it's up 4.1% versus a year ago. The housing market might be in bad shape in terms of activity levels. But there's still plenty of pent-up demand to support prices.

The other key factor is supply. New-home construction in the U.S. plunged after the housing bust more than a decade ago. And it stayed at extreme lows for the better part of a decade. Earlier this year, Realtor.com released a study on U.S. housing supply. It estimated the country faces a shortage of about 7.2 million homes.

Our U.S. real estate play

Greenbriar Sustainable Living TSXV:GRB, OTC:GEBRF

Recent Price - $C0.50

Will benefit from a strong real estate market for their Sage Ranch development. The company is on the last hurdle and home construction should start in the coming months.

Sage Ranch is a real estate community of 995 exceptionally located entry-level homes in the heart of Tehachapi Valley, a community located in southern California with 38,000 residents, just 30 miles from Los Angeles County and 80 minutes from the City of Los Angeles.

There is a significant and well-reported housing shortage in the state, and in particular in the southern portion. The current Tehachapi housing market has an average price of USD 447,000, an average home age of over 20 years, and would require repair work for a new buyer. Approximately 750 houses trade each year. Sage Ranch’s brand-new units will have an average price just below that at USD 437k, with a range between USD 299k and USD 549k, and Greenbriar will be selling an average of 150 units per year over the 6.5-year sales cycle for the property. Proximity to major regional employers and government installations provide ample would-be buyers.

Summary Economics: Present value of corporate free cash flow of USD 134.2 MM (CAD 181 MM). The stock is valued at only C$18 million. The project is fully funded for development with debt financing.

I believe the stock is down with the correction in the junior market, summer doldrums and tired investors who sold waiting for construction to start. I say buy low when others are afraid.

Paid Advertisers at playstocks

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.