Thank you and welcome to the new smart, savvy and contrarian investors to my substack. I am very small here so please share and subscribe.

It's Friday so lets catch a wave. I visited the North shore Maui Island, Hawaii many years ago because it was known for huge waves. The beach is marked dangerous and there was huge waves but just one surfer. I asked a local who it was and I forget his name now, but the local called him a machine to handle such waves.

I never saw Jaws. Jaws is the biggest wave (40 to 70 feet) in Hawaii.“The Hawaiian name is Piahi,”

"Tsunami" by Andrew Shoemaker. (Courtesy of Andrew Shoemaker). This next photo is Andrew as well.

Things just don't seem so great with the US economy and is probably already in recession.

Housing starts are weak with single-family home building dropping to near a 1-1/2-year low in July, reported today. The fifth straight monthly decline in home building suggesting the housing market remained depressed. Single-family housing starts, which account for the bulk of home building, tumbled 14.1%. This just adds to the shortage of affordable homes.

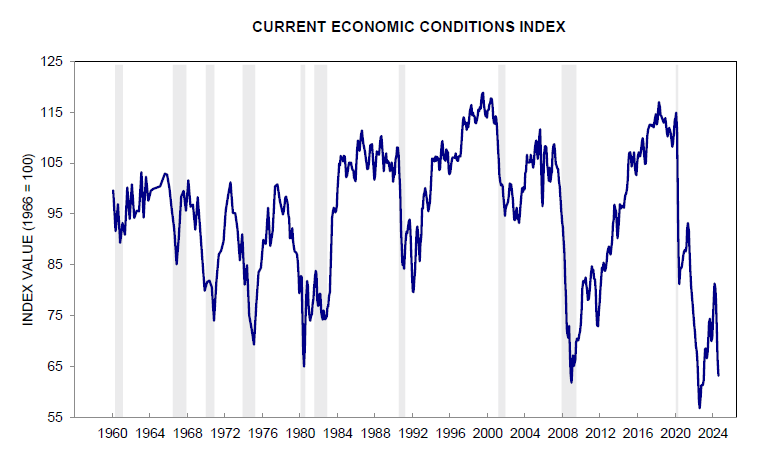

US Consumer Sentiment Increases for First Time in Five Months with the University of Michigan sentiment index at 67.8 vs 66.4 but consumers outlook on Current Economic Conditions are saying recession. The index just bounced off 50 year lows and at levels where past recessions occurred.

Things just don't make sense. Retail sales were reported up but consumers are saying the economy sucks and retail stores are closing hand over fist.

This week I mentioned Macys was closing 150 stores. Last week, Big Lots announced plans to close nearly 300 stores. Rite Aid once a retail powerhouse has gone bankrupt and under their restructuring they plan to close 780 stores.

The list goes on and on. CBS News, reports U.S. retailers have announced the closing of more than 3,000 locations in 2024 a 24% increase from a year ago, according to a report from retail data provider CoreSight. Sure there are always new store openings, but there are 4 percent fewer location openings this year than when compared with 2023, according to CoreSight's data. And the kicker, this number was of only mid May, not even half way through the year.

It seems to me the masters of economic data want a good narrative ahead of the election.

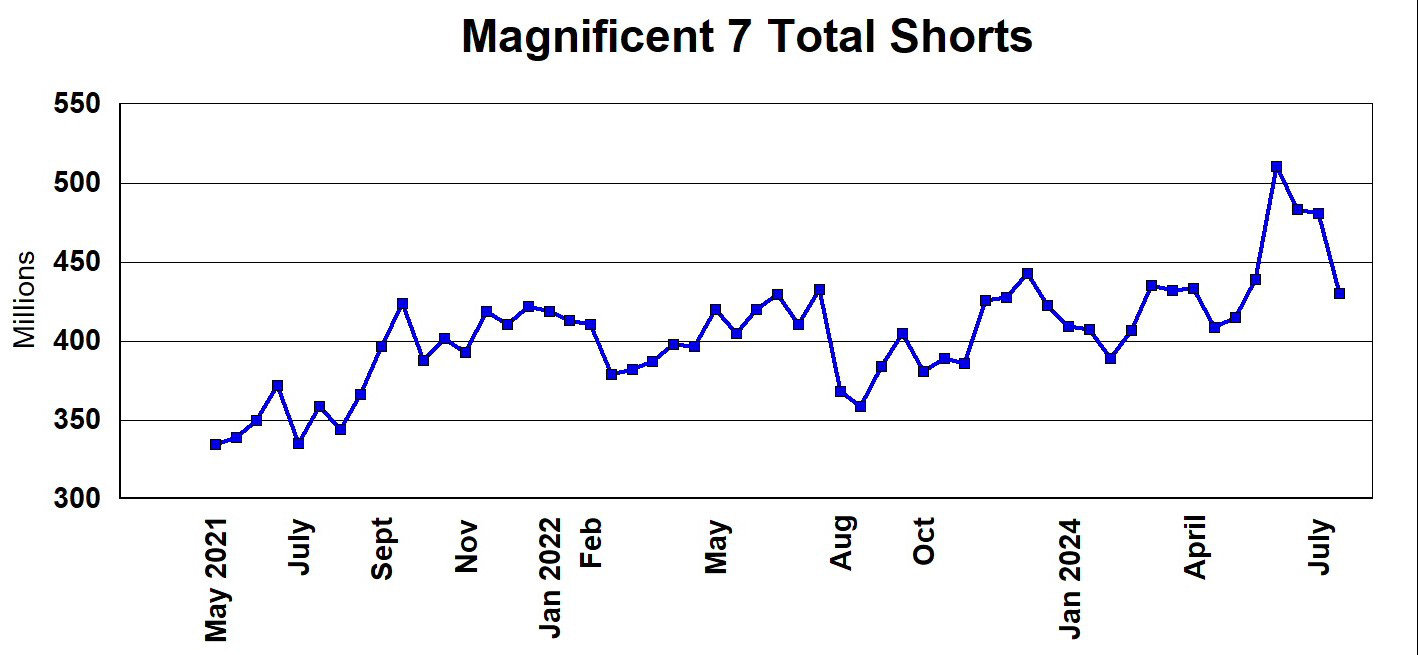

There was significant short covering on the Magnificent 7 stocks as of the July 31 report and this was before the big market dive on August 2nd and 5th. That data shoule be out in another week or more.

Short covering has helped recovery from the correction and the S&P 500 easily broke above resistance in the 5450 to 5500 area. A test of July highs is in the cards, but I am still cautious on the months ahead.

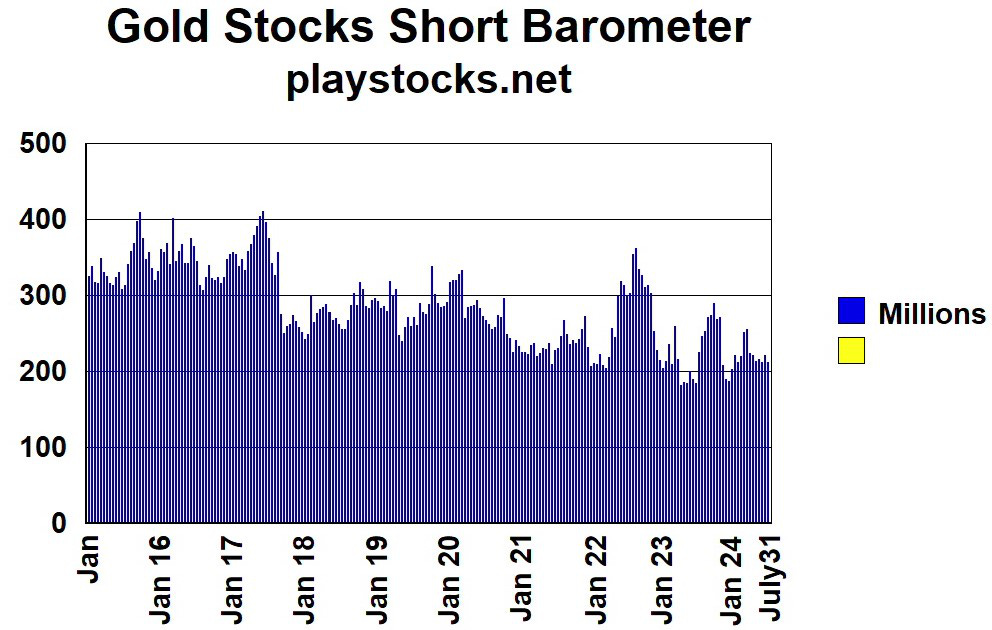

I have done a make over on my gold stocks short barometer as the old style of the chart was getting too cluttered with the years of data. The number of shorts is not much above 10 year lows, indicating improving sentiment for the gold stocks.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.