Why read and subscribe to my substack?

You just don’t gain insight of my analysis but also add in over 20 colleagues in my close circle that provide me insight and ideas. I am unique and unbiased. I can be a bull and a bear. I report on stocks I follow when they are up or down and often say the ‘sell’ word. I suggest stocks to buy and sell. I am not afraid of controversy and unpopular topics that are detrimental to gaining readership. When Covid-19 first struck I was among the few to report and analyze government and public health data for what it was, not the main stream narrative. I back my findings with links and outside expert opinions. I have a strong track record of beating benchmarks and notorious for picking tops and bottoms in various markets. My worst fault is I might might be too early sometimes. I have a very small following so what you get from me, you know that very few see this perspective.

I hope you enjoy reading, please share and subscribe!

Comex Gold Physical Deliveries Soar

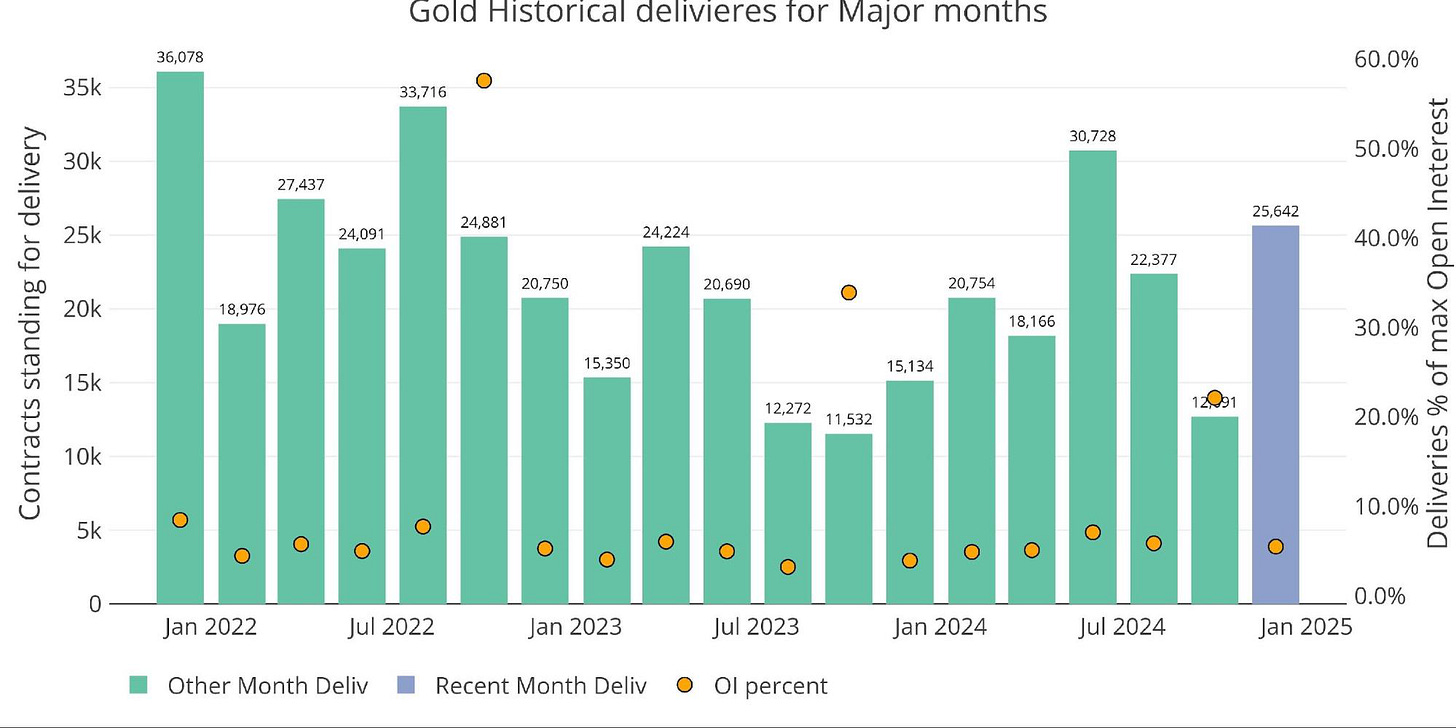

Not long ago I commented about the large volumes of gold moving from London to NY Comex and I said the Central Banks would start sucking physical out of Comex. Now we have the proof with the charts below from a report by Peter Schiff. December saw massive delivery volume in gold with 25,642 contracts delivered, which was the second highest delivery volume since August 2022.

January is normally a quite month for gold deliveries but as you see that this January is huge compared to other normally quite months.

The volume was net new contracts coming in throughout the month. These are contracts that open and settle immediately with delivery. Silver deliveries are also up. This is probably not all Central Bank buying but a good portion.

Most Retail Investors Buy the Top

As I commented yesterday, most of the retail investors jump in at the top and U.S. households’ stock allocation hit a record 49% in October, surpassing the 2000 dot-com peak. However, according to JPMorgan, in 2024, retail investors saw returns of just +3.7% by November 2024, far behind the S&P 500’s impressive +25%. I have also noticed a huge surge in assets of Robin Hood accounts in 2024.

Judging by that, you can see it is too early for retail to jump into precious metals, but as they slowly realize the returns are much better, even a shift of 1% or 2% into precious metals will create huge demand and push precious metals stocks way higher. This one year chart shows the S&P 500 with a gain of just over 20% which is huge by historical averages. However in the same time period gold is up +43% and the gold stocks in the HUI index up +57%. Most investors are missing out.

Once retail investors realize that it is not the price of things going up like housing, groceries, eggs etc. but it is the value of their currency being debased and the only proven protection for that is gold, more might wake up. Paper currencies are going down. This is why Central Banks around the world have been bailing out of the dollar and into gold like never before.

AYA Gold & Silver - - TSX: AYA; OTC: AYASF - - Recent Price - $11.52

Entry Price -$11.43 - - - - - - - Opinion - buy

Today AYA announced production of 491,310 ounces of silver in Q4-2024 at its Zgounder Silver Mine, in Morocco. In addition, AYA reported production of 383,515 oz of Ag, in Jan. 2025. As you can see this production is 78% of the entire Q4 so we can expect much high production/revenues in Q1 2025. The stock is down some on a bit of correction in gold/silver, so providing a good buy price.

Production Highlights

Silver (“Ag”) production of 491,310 oz in Q4-2024 and 383,515 oz in January 2025, the latter of which represents an increase of 77% over December 2024.

Processed 113,310 tonnes in Q4-2024 and 88,868t of ore in January 2025, the latter of which represents an increase of 53% over December 2024.

Silver recovery of 85% in Q4-2024 and 87% silver recovery in January 2025, the latter of which represents an increase of 6% over December 2024.

Combined mill availability of 88% in Q4-2024 and 95% mill availability in January 2025, the latter of which represents an 8% increase compared to December 2024.

Mine production of 102,485t in Q4-2024 and 50,403t of ore mined in January 2025, which represents a 29% increase compared to December 2024, as per Aya’s mine ramp up plan.

"I am pleased to announce Q4-2024 and January 2025 production results, achieving 2024 production guidance and highlighting a significant step-change in output and an 77% month-over-month increase from December 2024 to January 2025. This strong performance is driven by improving recoveries and the successful ramp-up of the new Zgounder plant, which is operating above nameplate capacity, alongside the open pit, which continues to exceed expectations,”stated President & CEO Benoit La Salle. “Month-over-month improvements across the integrated operations at Zgounder reflect disciplined execution and operational strength, positioning us for sustained production growth and record profitability in 2025.”

Calibre Mining - - TSX: CXB; OTCQX: CXBMF - - Recent Price - $3.00

Entry Price - $1.63 - - - - - - Opinion - buy

Today Calibre announce additional discovery diamond drill results from its expanded 100,000 metre drill program at the Valentine Gold Mine, Newfoundland, Canada. Previous drilling highlights the considerable prospectivity to the southwest of the Leprechaun Pit at the Frank Zone. New drill results reveal shallow, broad zones of continuous mineralization, expanding the volume of high-grade gold intercepts to surface. These results align with previously released high-grade trenching and grab sample data. All results discussed in this release are well outside of known mineral resources.

Drill Highlights from today’s release include:

3.08 g/t Au over 48.2 metres Estimated True Width (“ETW”) in Hole FZ-24-062;

At surface, 97.87 g/t Au over 3.9 metres ETW and 1.62 g/t Au over 44.6 metres ETW including 2.58 g/t Au over 22.8 metres ETW and 10.11 g/t Au over 0.9 metres ETW in Hole FZ-24-064;

1.94 g/t Au over 36.4 metres ETW and 1.25 g/t Au over 19.1 metres in Hole FZ-24-066;

1.00 g/tAu over 56.1 metres ETW including 12.67 g/t Au over 0.9 metres ETW in Hole FZ-24-050;

0.87 g/t Au over 78.3 metres ETW in hole FZ-24-055;

and 2.87 g/t Au over 5.4 metres ETW including 11.09 g/t Au over 0.9 metres ETW and 1.28 g/t Au over 20.7 metres ETW and 3.47 g/t Au over 12.6 metres ETW including 31.37 g/t Au over 0.9 metres ETW in Hole FZ-24-047.

Darren Hall, President and CEO of Calibre, stated: “Follow-up discovery drilling at the Frank Zone, located one kilometre southwest of reported Mineral Resources, continues to return broad intervals of gold mineralization. Importantly, drilling has now traced mineralization to surface, highlighting the potential for another open pit. These new intercepts geologically align with ore from the Marathon, Berry and Leprechaun open pits. While exploration of the Frank Zone is still in its early stages, current data indicates that the zone remains open to the southwest and to the north and has now been traced for over one kilometre along strike and to a depth of approximately 500 metres. Historically, drilling at Valentine has mainly focused on the 8-kilometre stretch from Leprechaun to Marathon Pit, along the Valentine Lake Shear Zone. This 32 km long structure remains highly prospective for discovering additional gold resources and represents only a small fraction of the broader 250 km2 land package. With construction progressing on plan, Valentine remains on schedule to achieve first gold in Q2 of this year, positioning Calibre into a mid-tier gold producer with annual production of 450,000 to 500,000 ounces.”

The stock just made a major breakout over the 2020 high when gold was just $2,000. Calibre will also see a huge production increase when Valentine comes into production in Q2. The stock has yet to value in the much higher gold price and much higher production coming in 2025. I still see it as a buy if you do not own a position.

Paid Advertisers at playstocks

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.