Why my Substack

I have learned and spent a long time analyzing cycles. It is important to be on the right side of trends for long term success. I pointed out a bottom and new up turn for gold in October 2023 so we have been positioning on the right side of this cycle. I have warned and pointed out a bubble and major top in general equities, see my Outlook in February so have been positioned for this. I have a track record where my stock picks out perform their benchmarks. I must warn past success does not guarantee so in the future. I am not biased, say the sell word often and fortunate to have a network of over 20 colleagues to source investment ideas. I also follow geopolitics and any issue that could effect investment markets. And I am very small here so you know what you read from me is not main stream.

Thankyou for considering.

Climate Gate and Carney

Another one of the world's renowned scientists has come out and tells us carbon has nothing to do with climate change. Nuclear scientist Digby Macdonald has written thousand of papers, a noble prize winner, fellow of Royal Society of Canada among other accolades. He is currently at Berkeley University and a member of the CO2 Coalition . He says said that carbon dioxide (CO2) is not the primary driver of global temperature changes. Blaming CO2 is not scientific but political.

The EPOC Times put out an article with Macdonald and you can watch a 40 minute interview here.

Historically CO2 is currently at a low level of about 420, the best level for plants is 1,200 ppm. CO2 is not a pollutant but plant food.

Scientific data proves in ice core that CO2 rises as a result of higher temperature, not the other way around.

He highlights keeping carbonated drinks cold (beer) as it holds the CO2 longer when opened.

Over 100 years ago or so, people were skating on the River Thames in London. That was a mini ice age so the world is recovering from that so no way but up.

In the Roman period, temperatures were 2 to 4 degrees higher so we have a long way to go up.

We are about 1/4 way up from the low side to high side with temperature.

He states that one of the reasons for the change in climate is the Milankovitch cycle—the regular variations in the elliptical path the earth travels around the sun. I have shown this before and this graphic shows the cycle along with the shorter Precession Cycle (pole wobble).

He said that cycle changes over a period of every 100,000 years and an ice age occurs when it’s the most elliptical because the earth is receiving a lot less solar radiation and heat.

Why do they spend trillions on the climate change agenda? Because it is a huge propaganda effort.

As I always say, once you understand that climate change is about taxes and government forcing changes on society you will understand it all better. Macdonald comments about numerous debates between scientists and climate activists, the scientists win every time.

I don't doubt there is climate change, it has been changing ever since the earth was in existence, but the change has nothing to do with humans and carbon.

This is one of the reasons I call Mark Carney 'Con Man Carney'. He has been and still is one of the biggest proponents of carbon and climate change on the planet. In reality he is promoting a scam, exactly what he is doing with the Canadian election. If he gets into power, he will heavily promote the climate change and carbon narrative along with the objectives of the World Economic Forum, to force Canada into a far left socialist state, run by government with little rights for citizens.

Forget promises he made in the election campaign, they will all go by the wayside. If in power again, Carney and the Liberals believe that will give them enough time to transform Canada so they will remain in power forever.

Remember, Canada does not have a 8 year term for the PM like the U.S. for President and Canada does not have a mid term elections like the U.S. to change power in the government. After 10 years of the Trudeau Liberals, if elected we will have exactly the same bunch for another 5 years, at least.

Gold Soaring and Gold Stocks Still Cheap

Gold is up over another $100 so far today and most retail investors are blind sided and in denial. Central Banks have been driving this gold bull market for over 2 years and just in the last few months the US Bullion Banks have joined in. They will next bring in Institutional clients. In a Bank of America global fund manager survey last week, 42% of respondents expected gold to be the best performing asset class in 2025, up from 23% in March.

Retail investors are just starting to hear some noise of bullish reports from the US Banksters. That said, many are still shorting gold stocks, through ETFs, like the 2 times short DUST. Note the surge in volume in April.

This next chart is gold (GLD etf) compared to GDX, the senior gold producer etf as well as stocks Newmont and Barrick, from the point I called a gold bottom. Note the higher volume into GLD in April and the GDX is starting to outperform as it should do. Barrick and Newmont have not. They are favorite Institutional stocks so a sure sign that Institutions are not big buyers YET!

The US$ clearly broke down on the chart today. This is the latest bullish development for gold and bullish for all commodities. It will also help Trump's trade initiatives as long as interest rates don't rise if there is too strong a move out of US$.

There are still lots of great bargains with the gold stocks. I will highlight one favorite

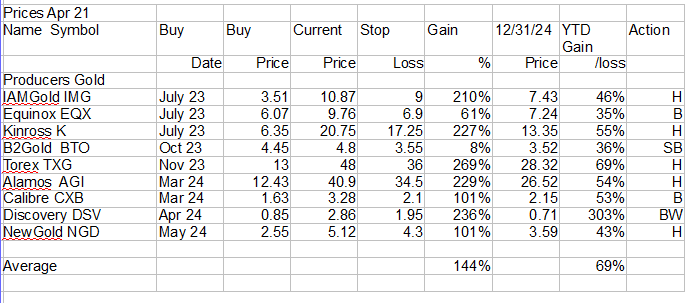

B2Gold - - - TSX:BTO, NY:BTG - - - - - Recent Price - C$4.73

Entry Price - $4.45 - - - - - - - Opinion – strong buy.

Recently B2Gold received TSX approval that allows the company to purchase up to 65,980,840 shares, representing 5 per cent of the issued and outstanding shares as of March 20, 2025, over a period of 12 months commencing on April 3, 2025. The NCIB will expire no later than April 2, 2026.

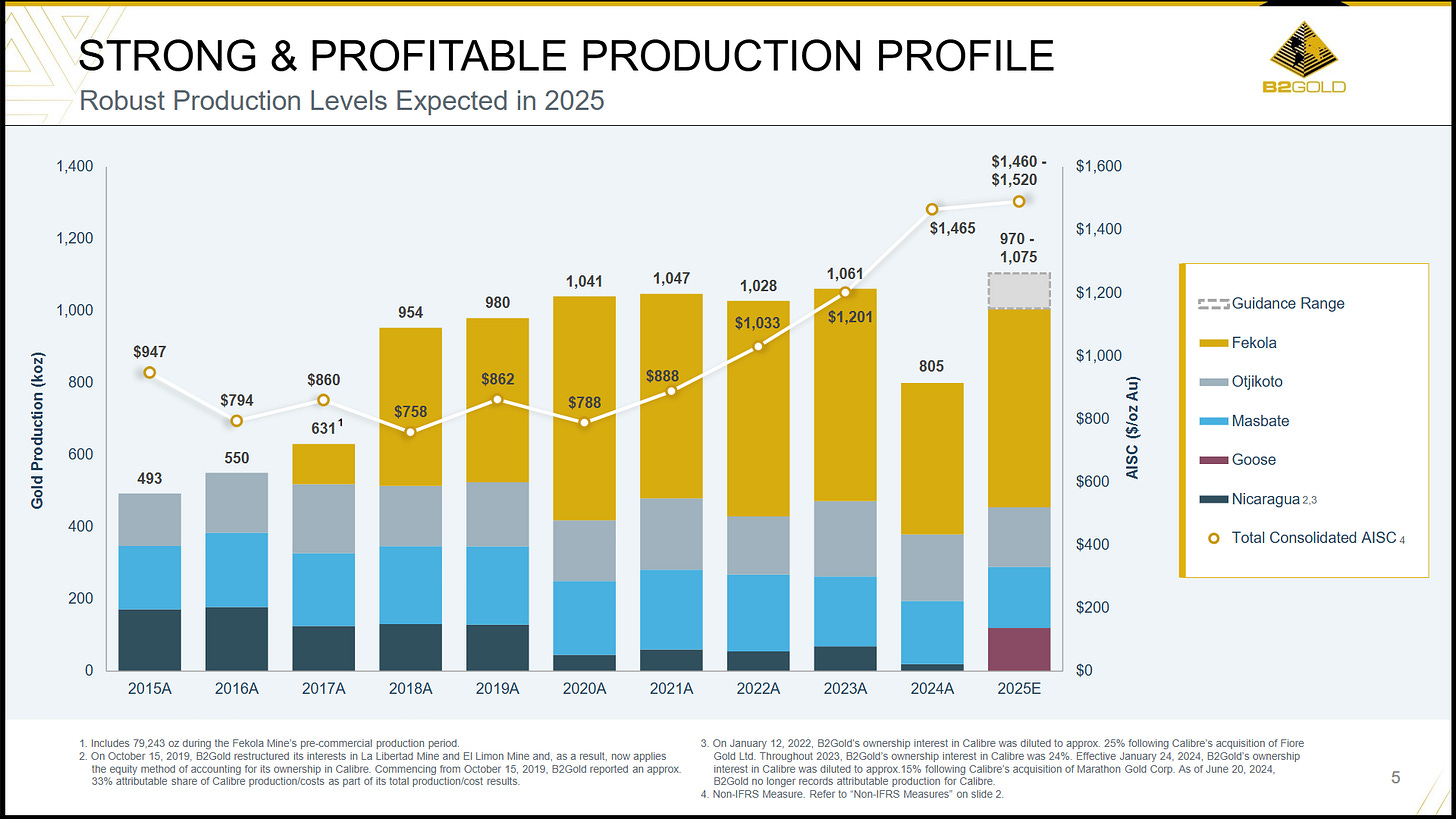

They are on track for first gold pour at the Goose Project in the second quarter of 2025 followed by ramp up to commercial production in the third quarter of 2025.

In 2024 B2Gold produced around 800,000 ounces gold. Total gold production in 2025 is anticipated to be between 970,000 and 1,075,000 ounces, a significant increase from 2024 production levels primarily due to the scheduled mining and processing of higher-grade ore from the Fekola Phase 7 and Cardinal pits made accessible by the deferred stripping campaign that was undertaken throughout 2024, the expected contribution from Fekola Regional starting in mid-2025, the commencement of mining of higher-grade ore at Fekola underground and the commencement of gold production at the Goose Project by the end of the second quarter of 2025.

B2Gold Corp. will release its first quarter 2025 financial results after the North American markets close on Wednesday, May 7, 2025. In Q4 2024 B2Gold realized a selling gold price of $2,658 per ounce and now gold is almost 30% higher. Financial results will reflect much higher gold prices in Q1 and higher still in Q2, plus higher gold production. B2Gold will benefit from quintuplet whammy positives in 2025. A low stock price, a stock buy back, growing production, higher gold prices and chart technical break out.

The market use to price in future events but has not been so efficient in recent years. With B2Gold, the market is still pricing in the past of 2024 with lower production and higher costs. Take advantage before the market figures it out. By the buying volume this year, some have started to.

I have bought call options on B2Gold. Right now I like

The January 2026 $5 Call around $0.60 on the Canadian side

The January 2026 $4 Call around $0.40 on the U.S. side

I will list both on the Selection List Speculations

I have broken down the Selection List, separating the Gold producers and Silver producers. Here are the gold stocks on our list. I have also updated stop/loss levels. B2Gold is a strong buy and Equinox and Calibre that will merge are a buy too.

Discovery Silver was listed with the silver stocks, but they just became a gold producer of about 285,000 ounces per year. They still have large exposure to Silver with their Cordero silver deposit in Mexico. I have them listed as a buy on weakness.

On April 16, Discovery Silver completed the previously announced acquisition of Newmont Corp.'s Porcupine operations based in and near Timmins, Ont., Canada.

Tony Makuch, Discovery's CEIO, commented "Our recently released technical report estimated average annual production of over 285,000 ounces of gold for the next 10 years, with total production extending to 2046. We expect to improve on the estimates in the report by investing in the assets to grow production, extend mine life and lower costs at existing operations. We also have a strong commitment to exploration, with there being multiple attractive drill targets at each asset and significant regional exploration potential.”

The stock is now more responsive to the gold price as you can see.

On my note above about the US$ and interest rates. The bond sell off is about a recession coming and credit quality, not about Trump tariffs as a lot of media harps. Investors are concerned about bond quality, even government bonds with these consistent high deficits. Bonds, I am meaning longer terms, like 2 years and higher. If China and investors were simply bailing out of the U.S., they would not be buying truckloads of short term government debt as this chart shows. There is a move from longer term to short term.

The concern is credit risk in the longer term with a recession and there is some trade concern with tariffs. However, most countries are negotiating trade deals, only China and Canada have responded with their own tariffs. Makes you wonder what side Canada liberals are really on. But they are using it as election propaganda.

Interesting, in the same Reuters article, at the same time, investors poured $6.44 billion into U.S. equity funds last week, in a reversal from $10.83 billion worth of net sales a week ago. The 'buy the dip' crowd is still alive, which is another sign that this market has further to fall.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.

No, the government is their partner and I believe it is just slow government process to get the final paper work. I don't think they would be proceeding with other spending, like the solar plant if they had a big concern of the permit

Are you not concerned that there is still no permits from Fekola?