As you know, I have been bullish on oil, believing the middle east conflict will intensify and these far left governments attacking oil&gas in the name of climate change will cause shortages.

Oil broke out on last Thursday with a higher high. It was also a break out to the upside from the wedge pattern as I expected. I believe the correction in oil is over and we are in a new bull phase.

I will have a new oil&gas pick out by Wednesday. I believe it is the best oil&gas stock I have found in a long long time, on a risk/reward basis. There is practically no down side risk but huge upside.

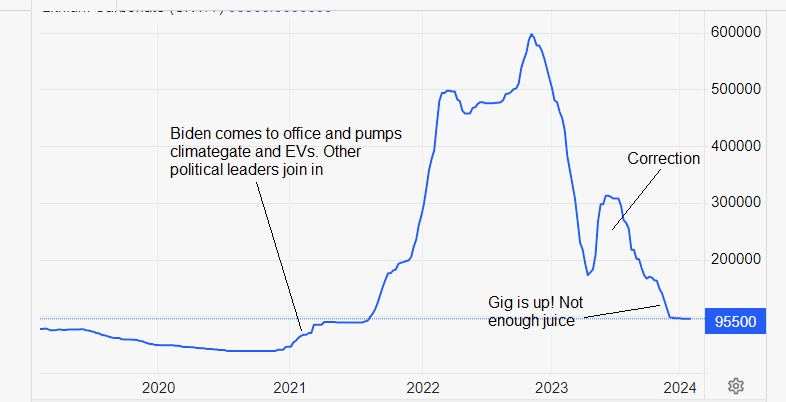

I am no longer going to pick any battery metal related stocks like lithium or graphite etc. And will probably sell the few on our list. When the marijuana mania was all the rage, I warned it was over with my articles called 'Up in Smoke' for climategate and EVs, perhaps I will call it 'Not Enough Juice'.

As I commented many times, there is absolutely zero evidence that carbon emissions cause climate change. I am not saying there is no climate change, there is and we have gone through many climate cycles on earth over the centuries. These cycles or climate change are caused by changes with the sun and earths changing orbits and tilt of the planet towards the sun. Ocean currents, cloud cover and volcanoes. All this climate change they harp about is not based on science but climate computer models that cannot even successfully test backwards in history. Another thing I was surprised to learn is mostly all and maybe everyone of these models does not even factor in cloud cover. The models are based on clear skies all the time. Anyone with solar panels could easily discover their output drops when clouds block the sun.

I have had this bookmark of massive volcano, Hunga Tonga explosion in January 2022. I believe and so do many scientist that it could be the main cause of higher temperatures this past year or so. What is unique is that this volcano was under the ocean about the perfect amount to spew a massive amount of water vapour into the atmosphere.

This was unprecedented and estimates were enough water vapour was spewed into the stratosphere to fill more that 58,000 Olympic-size swimming pools “We’ve never seen anything like it,” said Luis Millán, an atmospheric scientist at NASA’s Jet Propulsion Laboratory in Southern California. He led a new study examining the amount of water vapour that the Tonga volcano injected into the stratosphere, the layer of the atmosphere between about 8 and 33 miles (12 and 53 kilometers) above Earth’s surface.

The study calculated that it added 10% to the total water vapour in the stratosphere and could take years to dissipate. Hello warmer climate and good bye climategate.

I have been critical on the EV battery technology for years and have warned about the effects of cold climate on batteries. Not only does it effect battery performance and charging, the batteries have to be used to run a heater for the passengers and keep the wind shield defrosted. That drains the battery more so. What is so sad about this is that a lot of EV owners did not know this. They were told a bunch of propaganda. Anyway the recent cold spell was a harsh reality as EV charging stations became graveyard parking lots for EVs. This was all over main stream media. It was like a mass awakening. An EV owner in Chicago said, “This is crazy. It’s a disaster. Seriously.”

These EVs are simply not practical for a country like Canada with about 5 cold months in a year, but Trudeau wants everyone to buy one. That should have been the first clue that something was wrong with them, when governments got behind the move to EVs.

Repairs are expensive and to replace the battery that will eventually die, just as your cell phone does, it costs about the same amount as the car. I have also heard stories of customers waiting many months, even years for parts.

Another huge factor is they cannot be recycled. It is a catastrophe waiting to happen. With a fossil fuel car, you drain the gas tank and oil out of the engine and all the metal and plastic can be recycled. There is no way, I have heard of to recycle the old lithium batteries, they are going to be a toxic nightmare to dispose of. China already has mass parking lots of dead EVs.

EV sales are plummeting, nobody wants them, the 'gig is up'.

In Wimbledon, UK, an electronic bus exploded. In Scotland a very expensive electronic ferry is now running on diesel because the battery failed and can't find spare parts. In the U.S., GM had to buy out over half of their Buick dealers so they will accept EVs. I already told you the news that Hertz rental is giving up on EVs. Ford reported over half their dealers rejected a certification plan to be able to sell F-150 Lightning EV trucks.

Like I have been saying numerous times, the battery technology is not good enough yet. I estimate it has to improve by about 100% and some how be able to deal with cold climate. And a recycle plan. There is one way we can view the EV gig is up on a chart.

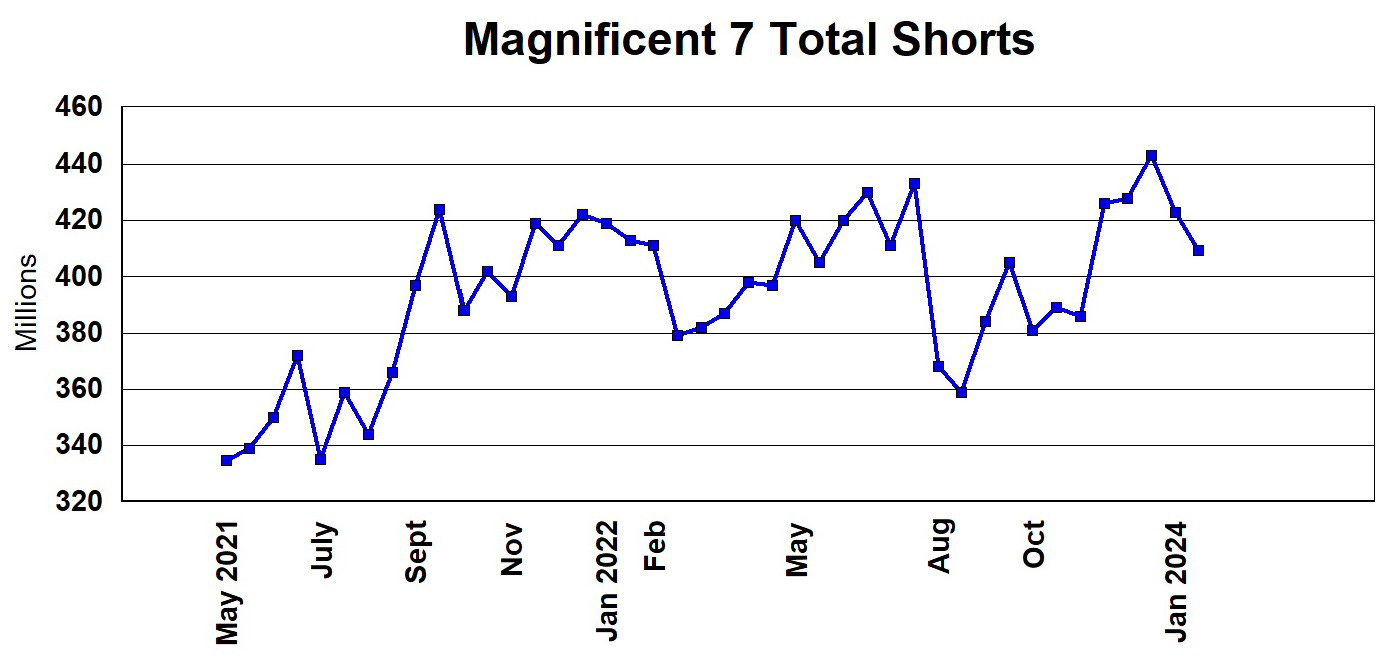

The reality is also going to set in with oil and prices will go much higher. Reality will set in with inflation and gold will go up too. The other reality is the stock market. I have talked about the January effect but the top 13 stocks have driven the whole of the S&P’s YTD upside with the top five contributing about 70%. If January finishes up at least 2% the year will be bullish, or this year does it mean just the magnificent 7 stocks? I have changed my FAANG short barometer to the Magnificent 7 short barometer. The last time the short position was as high as this past December (around 440M), a market correction soon followed and shorts covered. Lets see this time?

The other break out was in the markets, the S&P 500 is now up about +4% in January.

We are in uncharted territory and perhaps I am too bearish for 2024, but all the risk and uncertainty I pointed out is still there. I believe it is still best to be cautious for now.

I follow Ed Yardeni, founder of Yardeni Research, and he sees a "Roaring 2020s" scenario as a base case, drawing parallels between the Spanish flu pandemic and COVID-19, while projecting the S&P 500 will reach 5,400 in 2024. "Our basic premise is that a chronic shortage of labor is forcing companies to use technological innovations to boost their productivity growth, which started to improve last year, according to the government's quarterly data. As a result, inflation remains subdued, while real GDP growth, real wage growth, and profit margins all get boosted. The Fed is likely to ease, but won't have to cut the federal funds rate by much. Stock investors do very well."

Perhaps he is right and maybe I will change my outlook. That said it is a lot different than the 1920s. We look to be starting wars while WWI had ended in 1918. The government debt was not as horrendous back then as it is today. There was an industrial revolution back then, but is there a technical revolution now? Sounds like it could be closer to an end with EVs failing and AI has already been around 10 years or more and now just getting recognized.

Anyways, it sure is interesting times.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.