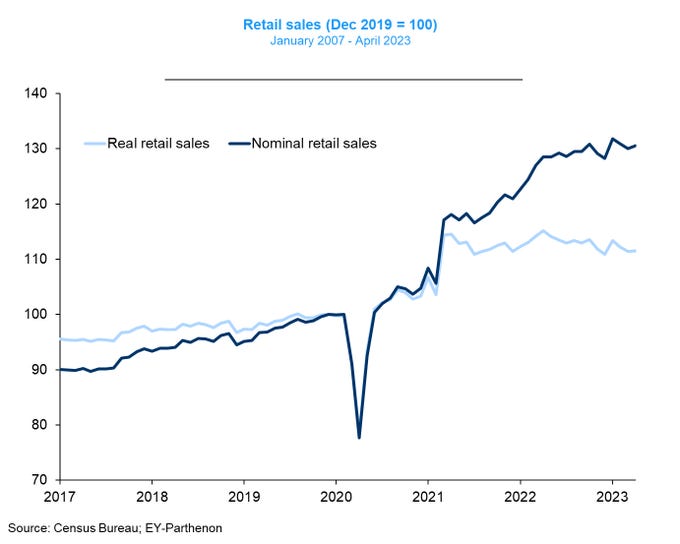

Credit card debt hit a record $1 trillion in America. The average household carries $10,000 on their card - another record. In the chart below, US retail sales remain strong, even adjusted for inflation they remain elevated. Obvious, consumers are piling up debt to continue on a buying binge. I suppose they are taking their cue from governments still spending like drunken sailors on drugs.

Canada’s household debt, which already exceeds the size of the country’s economy and leads G7 nations, is seeing even greater increases as interest rates rise, according to a report published by the Canada Mortgage and Housing Corp. The May 23 report said concerns about fallout from high household debt, around three-quarters of which comes from mortgages, are most pressing for those with lower incomes because they also tend to be more highly indebted.

Canadian Banks stocks on the verge of break downs on the chart. The Big Six banks which reported second-quarter financial results last week have all boosted their loan-loss provisions, setting up expectations for more soured loans and dented earnings in the future. TD Bank, Royal Bank, BMO and Scotiabank fell short of analysts' earnings expectations, while CIBC topped expectations. This is a chart of ZEB, an ETF that holds the 6 Canadian bank stocks. A break down or a triple bottom?

Bank of Montreal has broke down on the chart and the others are close. We did well shorting the banks with Put options last year. I am planning on doing this again some time in the next couple months.

Canadian economy grew at an annualized rate of 3.1 per cent in the first quarter, outperforming expectations while adding pressure on the Bank of Canada to raise interest rates again, perhaps as early as next week. Bay Street analysts had expected annualized first quarter growth of 2.5 per cent, while the BOC expected 2.3-per-cent growth. Despite eight consecutive interest-rate increases in 2022 and early 2023, consumers have continued to spend, while businesses have continued to hire workers, keeping the unemployment rate near a record low.

The biggest surprise in the GDP report is the spending of the Canadian consumer. Household consumption was up nearly 6 per cent annualized in the quarter, a strong rebound after posting little growth in the two prior quarters. It pushed consumer spending to its highest share of GDP since records began in 1961.

It appears consumers in the US and Canada are giving the central banks the finger.

U.S. May job numbers are a booming 339,000 as the labour market continued to shrug off high interest rates and persistent inflation. Economists surveyed by Bloomberg had estimated that 195,000 jobs were added last month. Employers posted a historically high 10.1 million job openings in April, up from 9.7 million the prior month and reversing a recent slowing trend. At the same time, the number of people quitting jobs fell to the lowest level in two years.

Looks like Cleveland Fed president Loretta Mester will be right saying there’s no “compelling” reason to wait before hiking interest rates again. The June 13th CPI report could just be the icing on the cake for another Fed rate increase.

You might find this as some surprising info. Forget about going electric, we will not be able to keep the current grid going, let alone expand it and the US buys oil from Russia.

The US has not built a major refinery in 40 years. In Q1 40% of diesel imports into the US NE were from India, that gets their oil from Russia, makes a joke about sanctions on Russia. Another joke is the talk of the US military going electric. What would be the battery size for an Abram Tank? How do you move electricity across the battlefield to recharge? And furthermore China owns the supply chain for critical and battery minerals.

A huge challenge for the US and Canadian electrical grid is transformers and guess who makes them. China of course. There is a chronic shortage of transformers and in a letter to federal lawmakers in November, the electric utility sector sounded the alarm.

“Throughout 2022, the electric sector and representatives from residential and commercial building sectors have been calling attention to the unprecedented supply chain challenges both industries have been facing in procuring equipment used to maintain and grow the electric grid. Specifically, electric utilities continue to have significant problems in procuring basic equipment – particularly distribution transformers – needed to operate the grid, provide reliable electric service, and restore power following severe storms and natural disasters. In housing construction, this is further exacerbating their ability to address the housing affordability crisis facing our nation….

Between 2020 and 2022, average lead times to procure distribution transformers across all segments of the electric industry and voltage classes rose 443 percent. The same orders that previously took two to four months to fill are now taking on average over a year. This is a serious threat to reliability.”

Transformers play an essential role to transport electricity over distances and locally. Some of you will remember David Tice as we did well with his Prudent Bear fund a long time back. He has created his 2nd film that I am aware of and this new excellent video is called 'Grid Down Power Up' by David Tice

https://griddownpowerup.com/watch-gdpu/ Also of interest, Tice expects China to invade Taiwan before the Biden Administration ends. This video is a must view. We need to prepare.

Zonte Metals - - - TSXV:ZON - - - - OTC:EREPF

Opinion – Buy at 8 and 9 cents

About 2 weeks ago, I suggested averaging down with Zonte from $0.15 to $0.12 but be patient with bids at $0.08 and $0.09. Yesterday the patience paid off as the stock traded 234,000 down to 8 cents. Last week it traded 55,000 down at $0.95 to $0.09 so I have officially listed our entry price at $0.12 now. As you can see and the chart below, the stock trades thin at these prices so I would continue with bids at 8 and 9 cents, the drill program has not been announced yet.

Liquidity will increase once in the $0.15 to $0.20 range.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication