Copper Bull Market, Fitzroy Minerals, FTZ

Thank you and welcome to all the new, smart, savvy and contrarian investors who have joined my substack. I am still quite small here so ask your help to share and subscribe while this is still free.

This forecast in a graphic from the EIA gives an excellent picture why copper prices will go way higher. It is all about rising demand while mine supply falls.

Demand projections encompass both clean energy applications and other uses, showing two IEA Scenarios – the Announced Pledges Scenario (APS) and the Net Zero Emissions by 2050 (NZE) Scenario. Supply projections are based on a detailed review of all announced projects.

I doubt Net Zero will happen, but just based on pledges countries have announced so far will create a large demand/supply gap. Even if there is very little or no progress on the energy transition, falling supply from lack of investment is going to create a significant demand/supply gap.

When you look at the EIA risk assessment it is all about the various supply issues. A copper bull market is one of the easiest and most fool prove projections one could find. This is why most of the billionaires are all over this, including tech billionaires like Bill Gates, Amazon's Jeff Bezos, Alibaba Jack Ma, Virgin Group's Richard Branson, Bridgewater Associates' Ray Dalio and AH Capital's Andreessen and Horowitz. They formed Kobold Metals and are working with top copper producers BHP and Rio Tinto as well as dozens of PhDs in the company. I have previously talked about Kobold on their deal with Midnight Sun, one of the handful of copper juniors I am excited about.

Long term the copper price chart is quite bullish. There is a long term up trend with a new record high in late May. Short term we have a correction mostly driven by short term China demand fears that are beginning to subside. That has formed a short term wedge pattern in the last half of 2024 that I am sure will break to the upside.

China, a major player in the copper market, witnessed a mild recovery in its physical market during August 2024. Adding on to this was China’s stimulus package, announced in September that represents a significant injection of liquidity totaling 3.95 trillion yuan ($560 billion), equivalent to over 3% of China’s GDP. The size of this package is substantial, nearing the level of support provided during the Covid-19 crisis

Bloomberg says mined supply could have a bumper 2024, up 4-4.5%, but the benefit of greenfield and brownfield projects, many initiated over a decade ago, may start to dissipate from 2027.

I have already suggested the best pure copper mining play, Capstone Mining (CS) that we have big gains in, but what the industry really needs is new mines from discovery, so the next best angle is to buy a handful of the most promising junior explorers and Fitzroy is one of these.

I have been following Fitzroy Minerals for a while and they just made a game changing acquisition. I expect this stock will do very well. I have known the Executive Chairman, Campbell Smyth for over 20 years. He is very successful, knows how to execute, finance and promote a junior mining company. I also know the qualifying Geo, Dr. Scott Jobin-Bevans a bit longer. Management teams don't come much better, some more on this below.

Fitzroy Minerals - - TSXV:FTZ, OTC:FTZFF - - - Recent Price - $0.15

Shares Outstanding 221.5 million - post financing - Management/Insiders own approx. 57%.

Fitzroy is focused on one of the most well known regions and #1 for copper mines, Chile. They also have a very good gold project close to the Chile border in Argentina.

Fitzroy announced the acquisition Ptolemy Mining Ltd. On October 30th, a UK private company. Ptolemy's chief asset is the Buen Retiro project in Chile.

The project is close to the Candelaria deposit in the Punta del Cobre iron-oxide-copper-gold (IOCG) district of Copiapo, Chile. High-grade copper oxide ore was mined from 2005 to 2009 at Manto Negro (part of Buen Retiro) and trucked 60 kilometres to a processing plant in Copiapo. The Manto Negro open pit is just five km from the Pan American Highway and high-voltage transmission lines. The Buen Retiro project has a wealth of information, including assay data from 28,290 metres of historical drilling records; core and data from 4,895 m of recent diamond drilling; and raw and interpreted data from extensive geophysical surveys.

The acquisition of Ptolemy also brings a very significant addition to management and expertise.

Matt Gordon is the principal shareholder and founder of Ptolemy. He has 30 plus years in global banking and marketing. Most important he is owner of CRUX Investor and Family Office investor.

CRUX is the world's largest natural resource platform with an audience of over 250,000 retail investors, Family Offices and HNWIs.

Gilberto Schubert who was an advisor to Fitzroy with 30 years experience. From 1992 to 2013 he worked for Vale, culminating in eight years as Country Manager, Chile. Gilberto holds a B.Sc and an M.Sc in Geology from the Universidade Federal do Rio de Janeiro; an MBA from Fundação Dom Cabral, Belo Horizonte; a Diploma in Mineral Economics from Universidad de Chile, Santiago; and an MSc in Mining Economics from Curtin University of Technology, Perth.

Merlin-Marr Johnson is the CEO of Fitzroy and also a founder of Ptolemy has 30 years experience, including geologist for Rio Tinto and an analysts for HSBC. He holds an honors degree in geology from Manchester University and a Master’s Degree in Mineral Deposit Evaluation from the Royal School of Mines, Imperial College.

and Irene del Real Contreras, an expert in IOCGs of Punta del Vobre, Chile. She is a former consultant to Lundin Mining at Candelaria, has a Ph.D from Cornel University, B.Sc Geology University of Chile and M.Sc from University of B.C., Canada.

Fitzroy will acquire Ptolemy Mining for 88 million shares that will be in escrow along with work commitments on Buen Retiro of US$7 million within 4 years. To date $1.54 million of this has been spent. In year 5 the option can be concluded for 100% interest with an additional $4 million payment. The property is subject to a 2% NSR which 1.0% can be bought for $4 million.

The project also includes the Sierra Fritis option where US$2.6 million must be spent within 4 years with $500,000 in year one. To date $460,000 has already been spent on this option. In year 5 a US$50,000 payment is required to conclude the option agreement for 100% interest with a 2% NSR.

Buen Retiro is potentially a world class copper deposit. It has been de-risked with historical drilling and recent exploration and drilling as well as past production. The oxide material mined at the property is estimated at 1.3 million tonnes at 1.2% copper. Of note, the vendors of the property are the Vacchiola family that own a private Chilean company that provides engineering, construction, production and equipment leasing to the mining and energy industries.

Mr. Campbell Smyth, Executive Chairman of Fitzroy Minerals summed in the news release, "We continue to make progress on the acquisition of Ptolemy. The Buen Retiro Project is a transformational asset for Fitzroy Minerals and it is a potentially significant IOCG deposit in a copper-rich district in Chile, the world’s leading copper-producing country. There is a real shortage of large open-pittable copper deposits with excellent infrastructure in established mining jurisdictions. Buen Retiro offers Fitzroy Minerals shareholders significant discovery leverage into a copper bull market.”

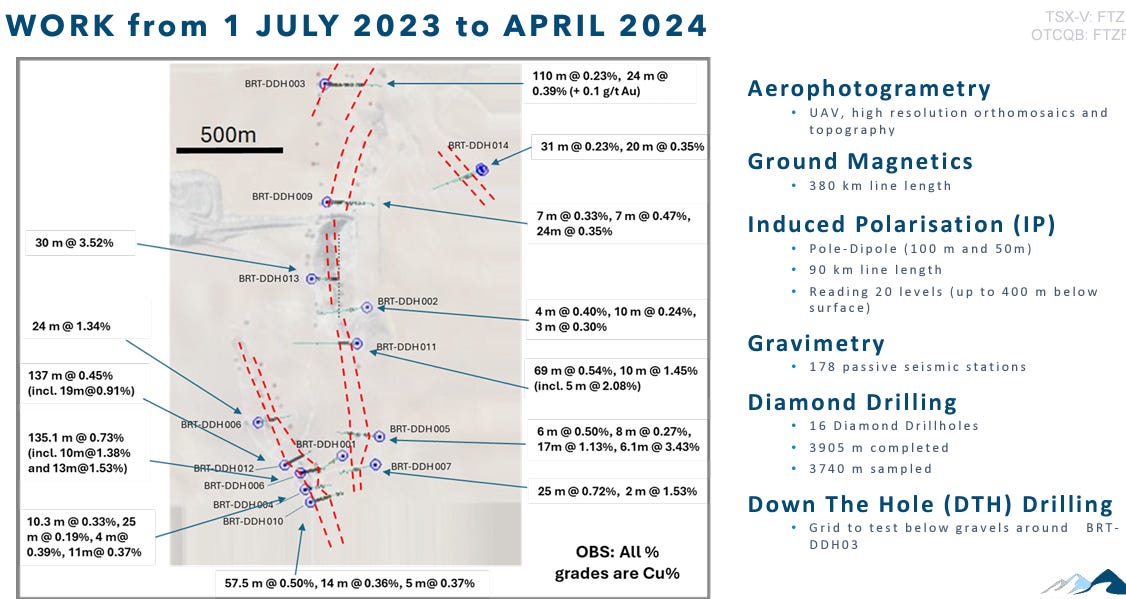

Below is a couple slides from their presentation that provide highlights of the project and the exploration work and drilling from the past year.

Note some of good long intersects like 138.1 meters of 0.73% copper and 137 meters of 0.45%.

The first round of drill results were excellent with an averaged weighted grade of all intersects of 0.61% copper. The median intersect is 35 meters of 0.52% copper. DDH13 had a nice high grade hit of 38 meters at 3.33% copper. There is a large 3km X 2km copper footprint and with 1300 meter potential strike to NE and 2700 meter potential strike to S and SW. There is also early mining potential by trucking surface copper oxides that was done in the past. Pucobre the vendor is short oxide material for their Biocobre SX/EW plant.

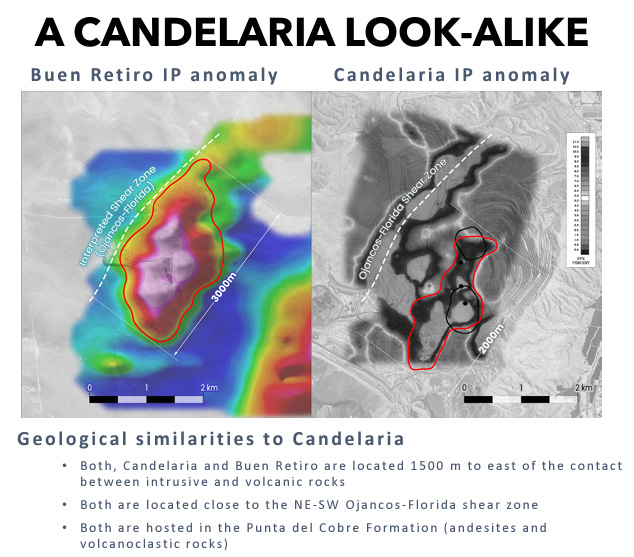

The project is just 43 km southwest of the huge Candelaria mine. It has Proven and Probable Reserves of 676 million tonnes of ore grading 0.53% copper, 0.13 g/t gold, and 1.79 g/t silver; containing 3.58 million tonnes of copper, 3.0 million oz of gold and 39 million oz of silver. Lundin Mining bought an 80% stake in the mine for US$1.8billion in 2014.

Fitzroy's Buen Retiro is on the same structures and geology and is a true look alike, but actually has a bigger foot print.

Polimet UA-CU-AG

Buen Retiro is not the only project that will see drilling in the first half of 2025. It will get about half the budget and around half split between Polimet and Caballos Copper.

Polimet is another location location location story and also high grade potential. It has only been scratched on the surface with an untouched epithermal system below 1600 metres. It is sticking out on top a large hill, so will be easy to start to mine.

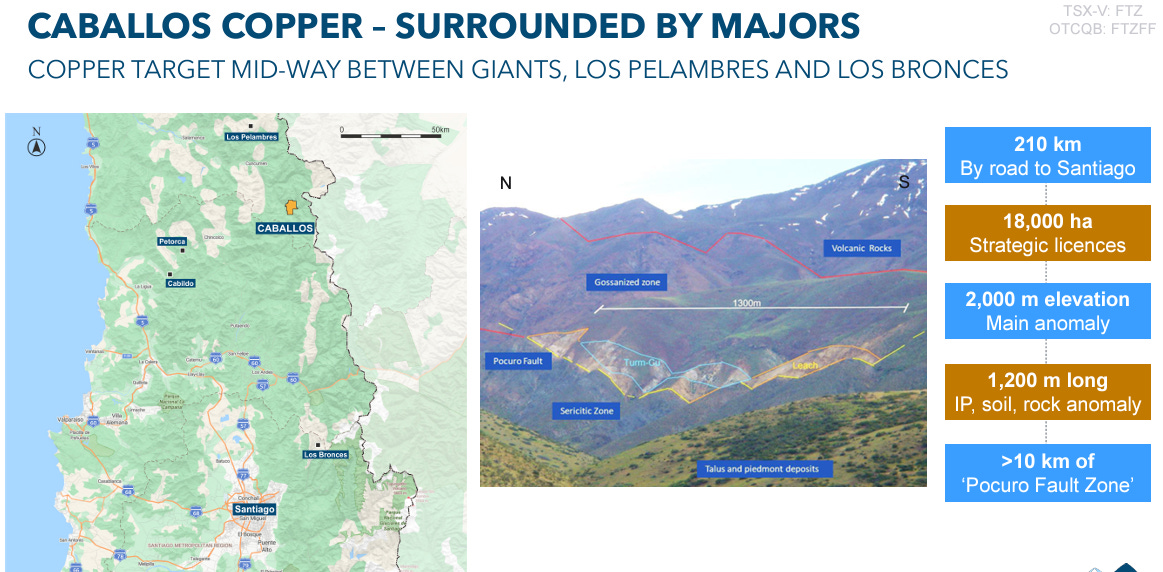

Caballos Copper

And again another great location story that will see drilling in the first half of 2025. Caballos is located over an important regional fault system, the Pocuro Fault Zone. There have been numerous anomalies identifies with geophysical, geochemistry and IP surveys. Last company to work it was BHP in 2011 that carried out rock-chip sampling in the northern portion, and new stream sediment sampling in the southern part of the property.

Financial

Last financial statements reveal almost $1 million in cash and no debt. Since then, in September FTZ closed a $1.7 million financing at 15 cents per unit and in October another $2.1 million at 15 cents per unit. FTZ is also doing another $2.5 to $3 million financing with this Ptolemy acquisition, again at 15 cents per unit

The warrants on these financings are at $0.25 cents and this is going to give FTZ over $6 million for work programs and drilling.

Conclusion

Fitzroy is an exceptional junior with excellent management, a strong cash position and superb properties in some of the best locations in the world. It is a much stronger story and much stronger potential with this Ptolemy acquisition.

It is also worth noting the potential reward to FTZ and shareholders with a Pucobre (the vendor) possible buy back option. Pucobre is a strong local partner and only listed Chilean copper producer. They can buy back 30% of Buen Retiro by paying three times 30 per cent of the addition of the following amounts: (i) a fixed amount of $300,000 (U.S.) and (ii) all the investment made by Ptolemy in relation to the Buen Retiro option. Following completion of any clawback, Pucobre will finance the project on a pro rata basis or be diluted.

There are very few juniors, if any that will conduct three drill programs on three high potential properties in 2025. There is going to be a lot of news and catalysts that could move the stock much higher. What is more, you can buy the stock for the same price most have bought in at, down at support on the chart and not much above the 2024 lows.

I believe it is perfect timing to buy with the recent correction in miners, year end tax loss selling and the current financing have brought the stock down to a very attractive level.

I like the chart. The stock trades good volume and has come down to a strong support level because of the reasons I outlined. The stock did take a brief drop below this support level in June when markets and the junior mining market began a summer correction. January is typical a strong month for juniors and I don't expect the stock to remain here in the New Year. FTZ would be a good alternative to buy with any of your own tax loss accumulations.

I have bought into the current financing and Fitzroy is now a paid advertiser at playstocks.net

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.