Copper Will Soar - CS, MMA , ZON, GSPR, AZT, Junior Bear/Bull cycles

Struthers Report V30 # 1.5

Copper prices are the strongest among the base metals with increased electrification demand and supply shortages looming. Analysts are projecting copper to soar 75% in the next two years. As I have commented in the past, I expect the EV demand to be about half of the projections, but even still that will cause copper shortages.

“The positive view for copper is more on macro factors,” Bank of America Securities’ head of Asia -Pacific basic materials, Matty Zhao, told CNBC, citing likely Fed rate cuts and a weaker U.S. dollar.

Additionally, at the recent COP28 climate change conference, more than 60 countries backed a plan to triple global renewable energy capacity by 2030, a move that Citibank says “would be extremely bullish for copper.”

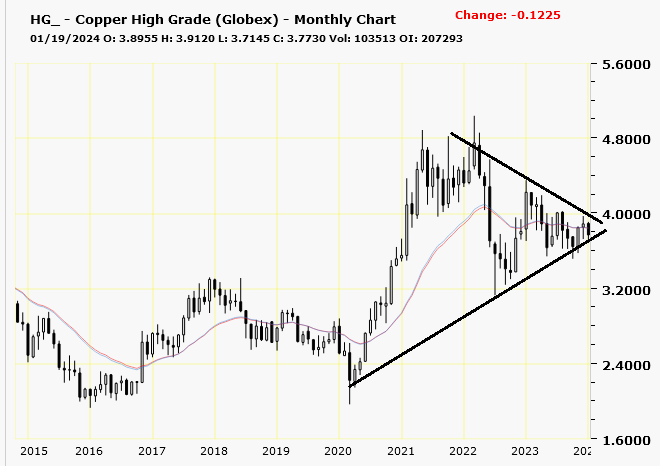

Here is a long term chart of copper and you can see, unlike most base metals it has not come down much in price. The long term wedge pattern is still in play and I expect an upside break out.

There is no recent news on our latest copper pick Capstone TSX:CS. I picked $5.90 as our entry price, the average of the close the day my newsletter went out, Dec., 12 and the close the following day.

Midnight Sun - - - - - TSXV:MMA - - - - - - Recent Price - $0.30

Entry Price - $0.27 - - - - - Opinion – buy on weakness or breakout above $0.33

The stock has moved up lately and is showing some strength, something might be coming. It is a buy on weakness or if it breaks out above resistance at $0.33. I am going to see if I can do a video update with management.

Zonte Metals - - - - TSXV:ZON - - - - - Recent Price - $0.08

Entry Price - $0.09 - - - - - Opinion – buy

I spoke with CEO, Terry Christopher briefly and he is back in NFLD sending last of drill core in. So we should see two sets of assay results. Because mining is so depressed, I don't think labs are as busy, so we could see first results in 2 or 3 weeks. I think Zonte needs to get good enough results to attract a major, the property is too large and too many targets for a junior.

GSP Resources - - - - - - TSXV:GSPR - - - - - - Recent Price - $0.10

Entry Price - $0.25 - - - - - - - - - - - Opinion - buy

GSPR completed drilling at their past producing Alwin Copper Mine in BC's Highland Valley Copper Camp in late November 2023. All five 2023 drill holes exhibited visual sulphide mineralization intervals interpreted to be part of or adjacent to the historic 4 Zone, assay results of the drilling are pending for release in early 2024. Dependent on results, I might suggest to average down.

Element 29 - - - - TSXV:ECU - — - - - - - Recent Price - $0.18

Entry Price - $0.63 - - - - - - - - - - - - Opinion – hold

ECU has done a financing and they previously had close to $2 million cash so I am expecting them to announce a drill program soon.

That covers our copper stocks and Aztec just announced some good drill results

Aztec Minerals - - - - - TSXV:AZT - - - - - - - Recent Price - $0.19

Entry Price - $0.40 - - - - - - - - - Opinion - hold

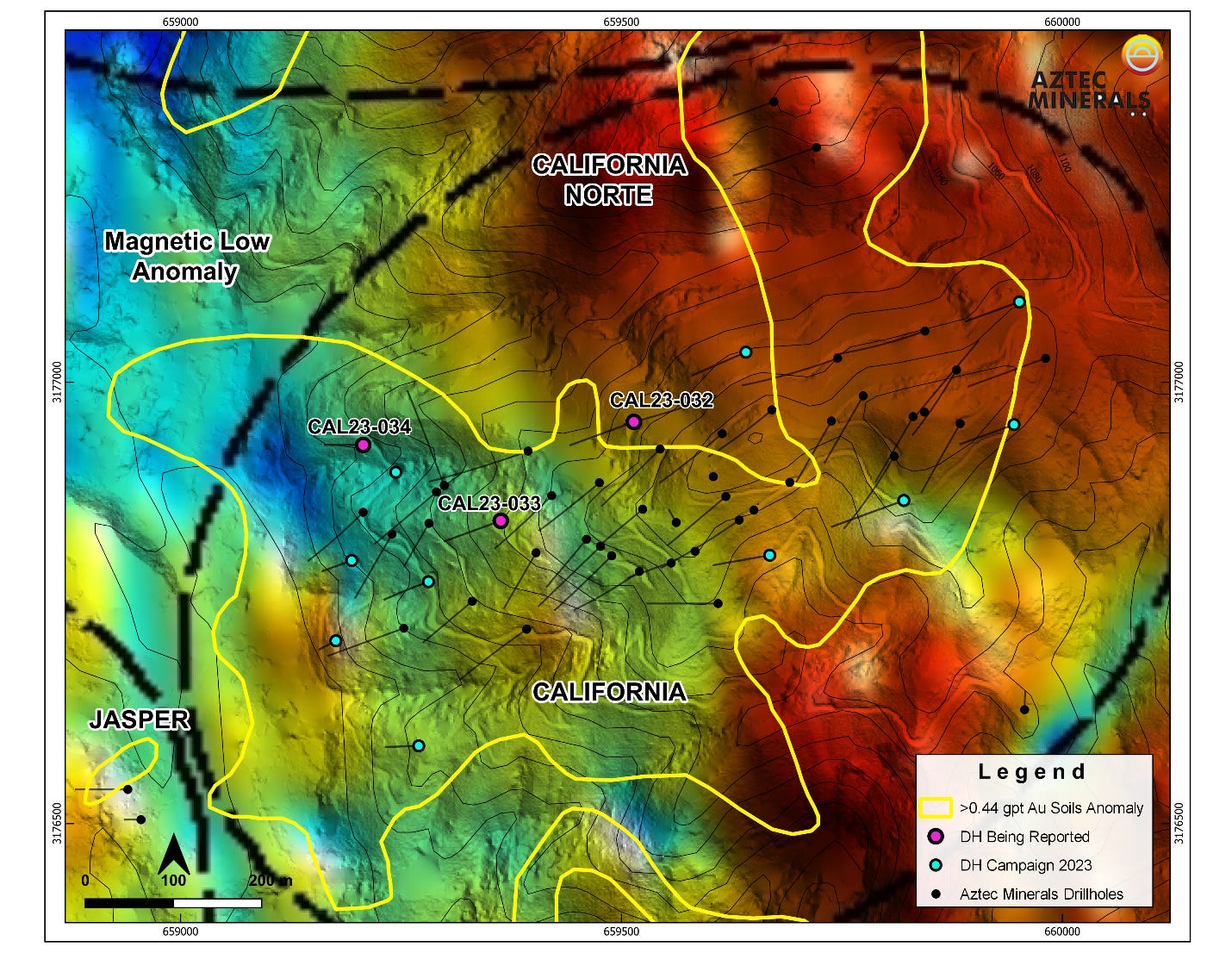

Aztec Minerals Corp. has released the initial gold results from the recently completed reverse circulation (RC) exploration drilling program conducted in Q4 2023 at the California gold zone of the Cervantes project in Sonora, Mexico. The results of the first three of the total thirteen RC drill holes, CAL23-032 to 034, continued to intersect gold mineralization in the altered California intrusive porphyry complex extending the California gold zone to the West, North and to depth.

Results for hole CAL23-034, a step-out extending the California zone to the Northwest, returned 30.4m grading 1.03 g/t Au including a high-grade intersection of 13.8 g/t Au over 1.52 m. This drill hole is the farthest test of the northwestern area of the California gold zone

The results from all three initial RC drill holes encountered the gold mineralized and altered California intrusive complex. The California zone as drilled measures approximately 1,100 meters long E - W by 730 meters wide, with demonstrated, continuous mineralization of up to 170 meters depth. The porphyry gold-copper mineralization is still open in all directions. The drill map shows the 3 announced drill holes in relation to the zone and other drill holes.

Aztec is growing a very nice discovery here, it is just that few of the junior explorers are getting much respect. The stock has moved up some from these drill results.

I thought I would show the bull and bear cycles on the TSX Venture index chart. We are due for another bull cycle and it is coming off very low levels. I am expecting a strong rally in the miners starting this year and since this is off such a low level for the juniors, gains can be huge. Although the Bull markets since 2015 on this chart look small, percentage wise they were +88% and +200%. My 2024 outlook should be out this weekend or Monday.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.