Cyber Attack at Baltimore Bridge, Gold and Argonaut Takeover

Just a short update today as one of my favourite gold stocks, Argonaut announced yesterday they were being bought out by Alamos Gold. First a look at the collapse of the Francis Scott Key Bridge in Baltimore. Very tragic incident but the odds and evidence highly suggest this was a Cyber attack. And a very strategic attack that took out major infrastructure because it shuts down much of the i95 corridor for traffic and closes a major seaport and for a long time This will take 4 or 5 years to rebuild and open.

We know the ship went off course and lost power, just at the right time to cause the tragedy, this is too much of a coincidence. If this happened a few minutes sooner or later there would be no bridge collision.

The ship has a 48M beam. The main span of 1,200 feet (366 m) was the third longest span of any continuous truss in the world, and the total length was 8,636 feet (2,632m) long. A total collapse of the bridge would only occur if one of the two main supports were hit. Any construction engineer would know this. These supports are about 10M wide so the target to destroy the bridge is 20M but we have to consider the beam of the ship of 48M because it would not have to hit these dead on, so we have a 68M wide potential destructive target. This part of the bridge is 366M so the destructive target is 18.5% of this span. If the ship veered anywhere else in the other 81.5% of the span it would have missed all the supports or hit a smaller support that would have probably been less damage. So the odds were just less than 1 in 5 to hit the main supports. More coincidence or bad luck?

I would not expect an admission of a Cyber attack because it would reveal incompetence in the Biden Administration and Homeland Security. People need to understand that we are at war and this time it is not some 3rd world power and weak military, it is Russia and China that are super powers. Unfortunately most of those in government don't seem to realize this war for what it really is.

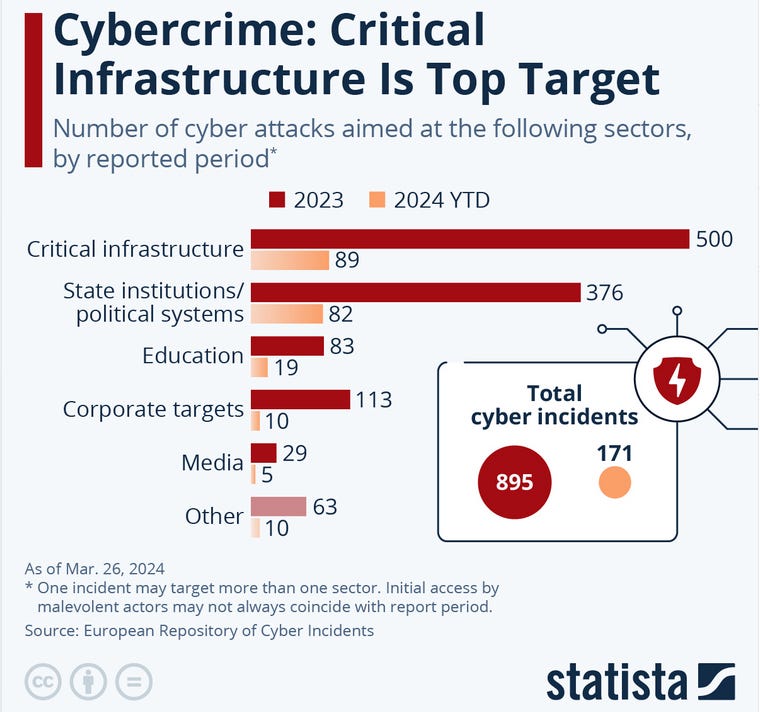

The other thing that sways the odds towards a Cyber attack is the huge number of them on infrastructure in 2023 and a great number already in 2024. Check out these statistics. Back in 2022 Russia warned it could implement Cyber attacks and the Biden Administration warned of it too. The same thing with China, the warnings were out there.

It is not 100% certain this was a Cyber attack, but I would put the odds at 80% to 90%. Too many things had to happen precisely for this damage to occur. I expect the Navigation system was hacked that put the ship a bit off course and then power cut so a course correction could not be made. Weather reports at the time said the water was calm and the winds were light so seems less likely the wind solely cause the ship to drift off course to the west.

Gold

The Comex gold price closed at a new record high on Wednesday and it is significantly higher today. Another up leg in the new bullish trend has started. We need about another $30 higher to reach official bull market status.

Argonaut Gold - - TSX:AR - - - OTC ARNGF - - - - Recent Price – C$0.40

Entry Price - $0.39 - - - - - Opinion – hold, take Alamos shares and Spinco

Alamos has signed a friendly agreement to acquire Argonaut in an all-stock transaction worth about US$325-million or Cdn 40 cents per share. Argonaut investors are set to receive 0.0185 of an Alamos common share, and one share of a spin-out company that will hold Argonaut's U.S. and Mexican operations. Alamos is paying a 34-per-cent premium based on Argonaut's closing share price Tuesday on the Toronto Stock Exchange. Alamos's main motivation for buying Argonaut is to combine its own Island Gold operation in Northern Ontario with Argonaut's Magino mine. The two deposits are located right next to each other. By combining them, Alamos says it hopes to realize $515-million (U.S.) in cost savings over time by sharing mill and tailings operations.

Alamos has been one of the best performing gold stocks and is at all times high. At the current price of Alamos we are getting almost C$0.37 per share for our Argonaut shares, plus I expect the spinout company to be valued close to 10 cents so our total return should be near $0.50.

This will take months to close so we will be participating in the upside of Alamos that should continue higher as gold goes higher. The real winner here is Alamos, buying out Argonaut in a weak market for the gold stocks. However, this is typical of what you see at market bottoms and when they are turning back up.

For Alamos that we will be shareholders of, the transaction creates of one of Canada's largest, lowest-cost and most-profitable gold mines -- combined Magino and Island gold mines are expected to produce approximately 280,000 ounces in 2024, and increase to over 400,000 ounces per year at first-quartile costs, following the completion of the phase 3-plus expansion in 2026. The two deposits contain mineral reserves of 4.1 million ounces, and total mineral reserves and resources of 11.5 million ounces, supporting a mine life of more than 19 years, with significant exploration upside.

The SpinCo will own the Florida Canyon mine in the United States, as well as the El Castillo complex, the La Colorada operation and the Cerro del Gallo project located in Mexico. Upon SpinCo going public, Alamos has agreed to subscribe for a further $10-million (U.S.) to obtain a 19.9-per-cent interest in SpinCo. So another positive as Alamos will be a major shareholder in the spinout.

Here is the 5 year chart of Alamos that I estimate we will own at a cost base of about $16 based on the Argonaut transaction.

Hope everyone has a happy Easter long weekend!!!!!!!!!!!!!!!!!

It won't be so happy for Crypto crook Sam Bankman-Fried as he gets his prison sentence set today. He is a lying, deceitful crook and he deserves the 40-50 years that some expect. However he ended up getting 25 years.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.