The U.S. Treasury has lowered its borrowing estimate for the current quarter on higher revenue expectations, but still a record amount compared to prior fourth quarters. It expects to borrow $776B during Q4, $76B lower than its previous forecast, and $816B during Q1 2024 - also a record for that period. “In total, over those two quarters, marketable debt will have increased by $1.59T! This will continue to exert rate pressure on bond markets.

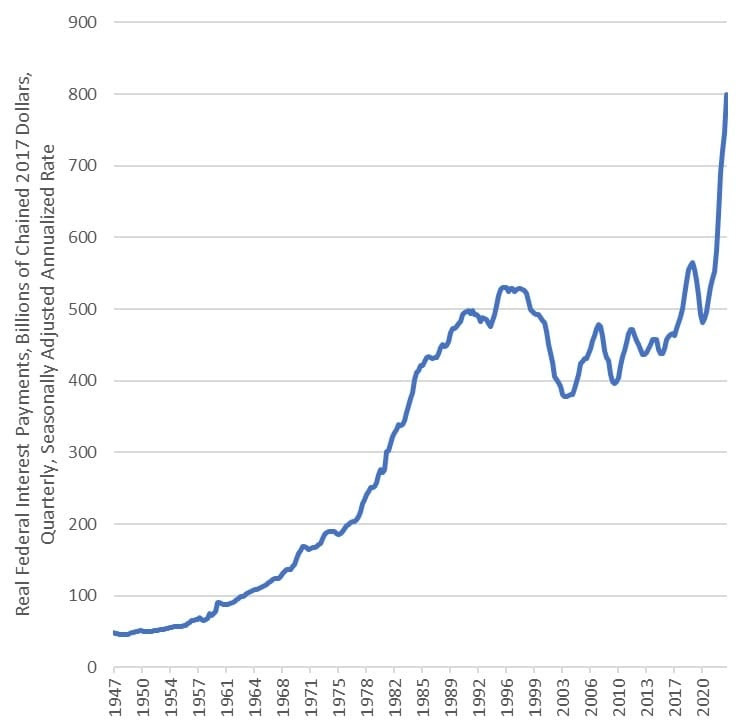

Interest cost on the U.S. debt is soaring. Note on the chart that it soared in the 1970sand early 80s, but note it basically went sideways from then until 2020 as interest rates dropped from around 17% to close to zero. This rise will only continue and is very inflationary in the medium to longer run.

Source: Bureau of Economic Analysis

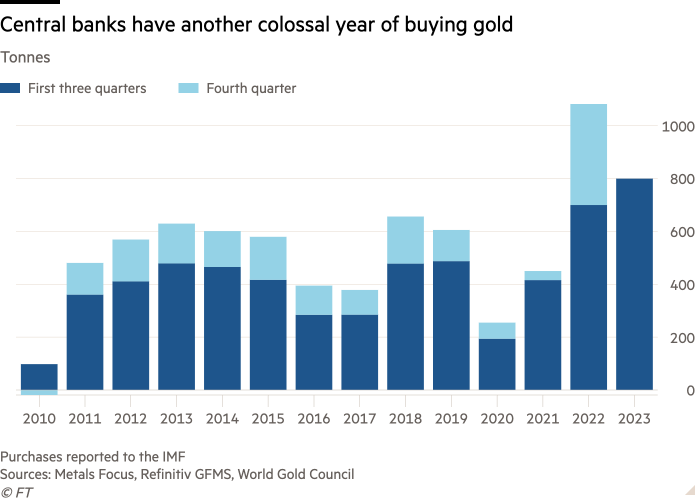

Central Banks have long figured out that it is wise to build gold reserves but investors are still way behind the eight ball, Q3 investment demand of 157t, although 56% higher y/y, was weak relative to its five-year average of 315t. Global gold ETFs lost 139t in Q3 – a far smaller outflow than Q3’22 (-244t). As a whole, foolish investors continue to sell gold while the banks gobble it up, and more.

Central banks have bought 800 tonnes in the first nine months of the year, up 14% year-on-year, according to a report by the World Gold Council. And a new record for the 1st 9 months of a year.

It is very useful to look at long term charts now and then. In the past, once gold broke above highs of the previous bull high, it went up several 100% to the next peak. The recent break above the 2011 highs will be no different. When investment demand comes into the market, gold will soar.

All major bull markets in commodities and gold or oil are driven by investment demand. Fundamentals do not matter much until they get to a point of creating strong investment demand. I believe those days are soon approaching with the high inflation, looming debt problems and further rising geopolitical tensions. It is only the exact timing that is in question and I will be watching these signals closely. As I pointed out above, the investment demand is still weak and Gold ETFs were net selling in Q3.

As I suspected, Managed Money has covered all their 26,000 plus gold short positions and are now long over 55,000 contracts. They can easily get to over 200,000 long and from there, we would need to see a big rise in open interest. That said, the next big bull move will also be driven by physical demand as well. A lot of large countries like India and China are still more physical demand driven, while in North America we tend to buy more futures and ETFs.

Moderna - - - - :MRNA = = = = Recent Price - $75

Opinion – sell November $110 Puts on drop below $70

Moderna will put out their Q3 results Thursday Nov. 2nd and I believe the market is not pricing in how bad it will be. Moderna is totally relying on Covid shots and they will not do better than Pfizer

Tuesday Pfizer reported its first quarterly loss since 2019, as demand fell for its COVID products and it recorded a hefty charge from the U.S. government returning millions of its antiviral treatments, Paxlovid. The company recorded a $5.6 billion charge in the third quarter related to Paxlovid and vaccine Comirnaty, most of which was disclosed earlier this month, as I also pointed out.

Comirnaty revenues of approximately $11.5 billion, down 70% from 2022 results...

In contrast to previous years, guidance for both products is no longer based primarily on expected deliveries under existing signed or committed supply contracts, but now also includes, among other things, for Comirnaty, transition to traditional commercial market sales in the U.S. in September 2023; and for Paxlovid, expected transition to traditional commercial markets in the U.S. in November 2023, with minimal uptake of New Drug Application (NDA)-labeled commercial product expected before January 1, 2024. Paxlovid revenues of approximately $1 billion, down 95% from 2022 results.

Wow, their section on risk with covid-19 vaccines was greatly expanded and is now about 3 pages of small print, here is just a small sample of it. I spaced with bullets for easier reading. It appears to me that they are preparing the market for a looming recall of the EUA Covid shots.

the ability of Comirnaty, any vaccine candidate or any future vaccine to prevent, or Paxlovid or any future COVID-19 treatment to be effective against, COVID-19 caused by emerging virus variants; the risk that use of Comirnaty or Paxlovid will lead to new information about efficacy, safety or other developments, including the risk of additional adverse reactions, some of which may be serious;

the risk that pre-clinical and clinical trial data are subject to differing interpretations and assessments, including during the peer review/publication process, in the scientific community generally, and by regulatory authorities; whether and when additional data from the BNT162 mRNA vaccine program, Paxlovid or other COVID-19 programs will be published in scientific journal publications and, if so, when and with what modifications and interpretations;

whether regulatory authorities will be satisfied with the design of and results from existing or future pre-clinical and clinical studies; whether and when submissions to request emergency use or conditional marketing authorizations for Comirnaty or any future vaccines in additional populations, for a potential booster dose for Comirnaty, any vaccine candidate or any potential future vaccines (including potential future annual boosters or re-vaccinations), and/or biologics license and/or EUA applications or amendments to any such applications may be filed in particular jurisdictions for Comirnaty, any vaccine candidates or any other potential vaccines that may arise from the BNT162 program, and if obtained, whether or when such EUA or licenses, or existing EUAs, will expire or terminate.

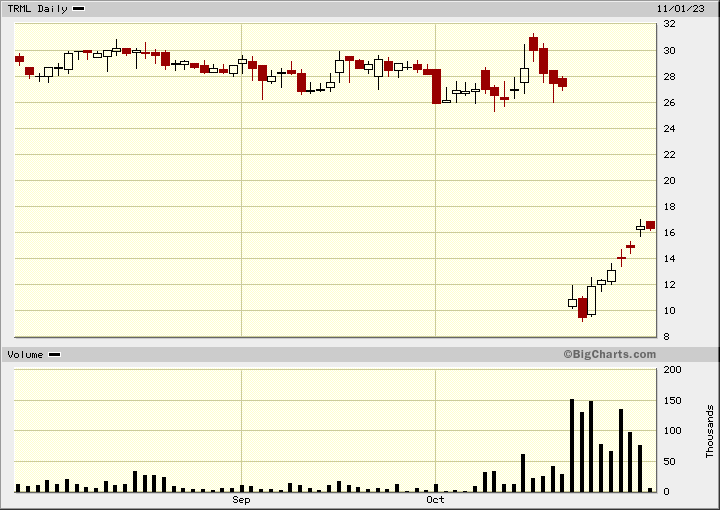

Tourmaline Nasdaq:TRML - - - - Recent Price - $16.25

Entry Price $6.90 - - - - Opinion - hold

The stock has moved much higher as expected, and it could go more so. I still believe the discount given the Talarus merger is too big. We are now through bad September and scary October, so a rally in the markets from the recent correction could be in the cards. This will also help TRML stock, so I am suggesting to hold longer, until it looks like the current rally is exhausting itself.

Aztec Minerals - - TSXV:AZT OTC:AZZTF - - - - - Recent Price - $0.17

Entry Price - $0.24 - - - - Opinion - buy

Aztec has started drilling their Cervantes property in Mexico that should continue for about 2 months. Last year they had intersects of 1.5 g/t gold over 137 meters and 1/g/t over 165 meters. I am expecting more good results. The following map shows the past drill holes and the step out area they intend to expand into.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication..