I would like to wish everyone a Merry XMAS, a great holiday and happy New Year. I doubt I will put much out next week, unless there is a very good buy or sell opportunity among things I follow. And sorry there will be no Santa Claus rally this year. I believe this is part of a major transition in the economy and markets that is upon us and it won't be pretty.

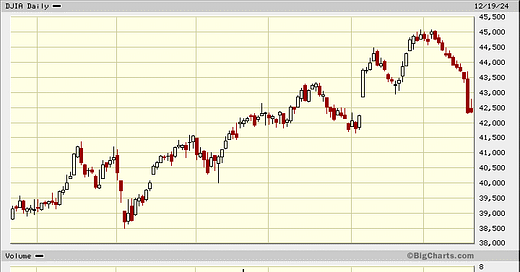

The record for the number of down days in a row for the Dow Jones is 11, in late September and early October 1974. As of Thursday we matched that 11 day record which was also in a period of stagflation. The DOW is rebounding today so looks like we won't see a new bear record by the close. The index is around a support level and a break below 41,500 would be bearish.

Over the years, I have pointed out the typical year end weakness in the gold price. It happens in about 7 or 8 years out of 10, usually in December but some occasions October/November. Previously I highlighted in November, the low looks to be November, but a test of the low, this month is no surprise. This is a buying opportunity as I have no doubt we are headed to record highs in 2025.

It is going to be a continuation of the same driver, mostly Central Bank buying. There is a strong move out of US$ reserves into gold as high debt, high inflation and dollar weaponization are weakening the dollar against gold. The other important factor that hardly gets mentioned is gold became a Tier One asset in January 2023. It is treated as equal to the the Yen, Euros, US$ etc. or their treasuries and bonds on bank balance sheets. It is actually better as it is nobody else liability and has a long history as a store of value over fiat currencies.

That said, most western investors have not caught on to this gold bull market yet, they are kind of in disbelief so it is likely they will start feeding this bull market sometime in 2025. As I have commented before, often when weakness hits equity markets, it provokes diversification into gold, plus it is an inflation hedge.

There is a lot of talk about Trumps Tariffs, and really is just become more part of weaponizing the dollar, the huge mistake Biden started. Even if Trump eliminates the freeze on Russia assets in some peace deal, BRICs countries and others will never trust the dollar again. The conversion of US$ to gold is going to continue at a relentless pace.

Note this next chart from Goldman Sachs how less than 2 years of CB buying is 5 times that of the previous 16 years.

Goldman Sachs has a $3,000 target for gold in 2025 and their analysis points to significant room for growth in central bank gold reserves, particularly in Emerging Markets. While developed economies such as the U.S., Germany, and France hold approximately 70% of their reserves in gold, China’s allocation remains strikingly low at just 5%. The Bank cites the World Gold Council’s 2024 survey, that I previously pointed out as well where "81% of respondents expect global central bank gold holdings to rise over the next 12 months, with none anticipating a decline."

India is a case in point. So far in 2024, the RBI has added 72.6t to its gold reserves significantly outpacing the 16t added in 2023 and the 33t in 2022. Gold now represents 10.2% of the RBI’s forex reserves, up from 7.8% a year ago. Charts from World Gold Council.

And their is strong retail and investment demand. Initial reports suggest that gold imports saw a significant surge in November, reaching record levels. According to data from the Ministry of Commerce, imports in November amounted to US$14.8bn, more than double the previous month's total and over four times higher than the same period last year.

The U.S. Central Bank is now the only CB short gold trying to defend the US$. The physical market driven by CB demand is setting the price as the Comex Futures market is losing it's influence. The CME to launch new 1 oz gold futures on January 13th in a desperate attempt to create more paper gold supply. A big downfall is the contracts cannot be delivered with physical so who will fall for this diversion. I doubt this new future contract gains much traction.

And not to forget silver. I am hearing that China is absorbing huge amounts of physical silver and expect a break out in price will probably come in January. Silver has lagged gold and still not reached it's past highs around $50. That said, I have commented a number of times that it is normal for silver to lag gold but when it does get going it can out perform gold. This will probably occur in 2025. Here is the long term chart where silver hit 11 year highs in late October.

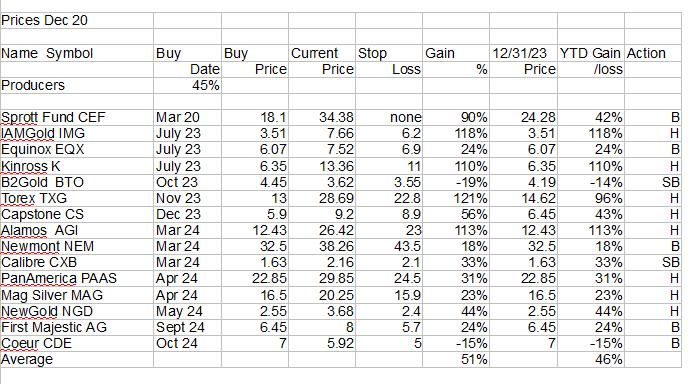

I updated our list of gold and silver producers with what I see as the best buys – B=Buy, SB=Strong Buy, H=Hold. We were up about 70% at the peak so a decent correction.

Equinox- - - December $6 Call - - - - Recent Price $1.50

Entry Price -$0.85 - - - - - Close out

Today is the last day of trading for this Call Option. I missed last week, I thought the stock was going to continue higher after the break out. However the breakout was in C$ not a break out in the US$ price. Something we have to watch now with the drop in the Canadian loonie.

Bitcoin and ETFs - - - - - Sell SBIT at $12.00

Bitcoin traded down to support early this morning, before market hours around 8AM and I wanted to close out our short trade. SBIT was around $12.25 so we could have caught about an 8% gain. However, these Bitcoin ETFs are seeing considerable volume after and pre market. SBIT made over 1,600 trades in pre market today.

Investors may trade in the Pre-Market (4:00-9:30 a.m. ET) and the After Hours Market (4:00-8:00 p.m. ET). Participation from Market Makers and ECNs is strictly voluntary and as a result, these sessions may offer less liquidity and inferior prices. Stock prices may also move more quickly in this environment. If you intend to trade during these times I strongly advised to use limit orders. It is to our advantage to trade outside market hours but I don't want to send anyone signal messages at crazy hours. I think to 8pm is fine but 4am is too early so I will limit early morning to 7am.

If SBIT gets back up to $12, later today, before 8pm, I would sell

GSP Resource - - - TSXV:GSPR - - - - Recent Price $0.09 - - Buy

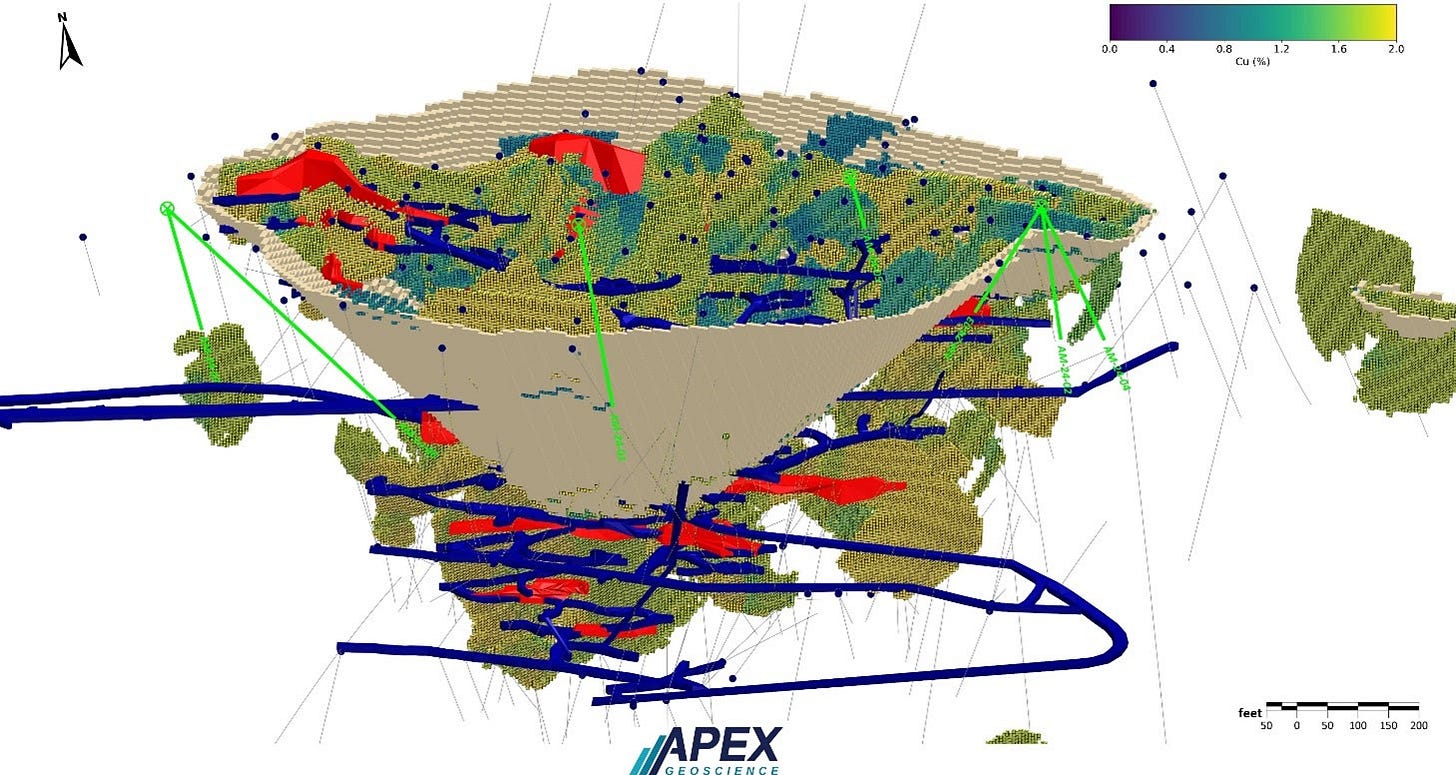

GSPR has completed its surface diamond drill program at the Alwin mine project. The 2024 drill program consisted of seven drill holes totalling 812 metres designed to target potential extensions of known high-grade copper and gold zones

All seven holes intersected visual signs of chalcopyrite-bornite copper sulphide mineralization. Three drill holes intersected significant width visible copper sulphide mineralization: including 35 metres (m) core length, 6.5 m, 5.5 m and 6.5 m. Drill hole AM24-06 is of particular significance given that the mineralized intercept occurs to the northwest along strike of the deposit and outside of the current Alwin project mineral resource pit shell.

The green lines indicate the new drill holes. It is a quiet time of year and the stock is down at a low price so a good time to buy. I think we will see a nice surprise here, early in the New Year with drill results.

Paid Advertisers at playstocks

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.

Midnight Sun got some good news. The never ending license extension finally was approved by the Zambian government. Up over 35% today. Good call when it was around .22 cents.