Welcome and Thank you to all the new smart, savvy and contrarian investors who have joined my substack. I urge you to share and join as I plan to keep this free for a while longer.

Doctor Copper

For a long time copper has been described with a PhD in economics. It is tied so much to all industries that it's demand cycles can mirror economic cycles.

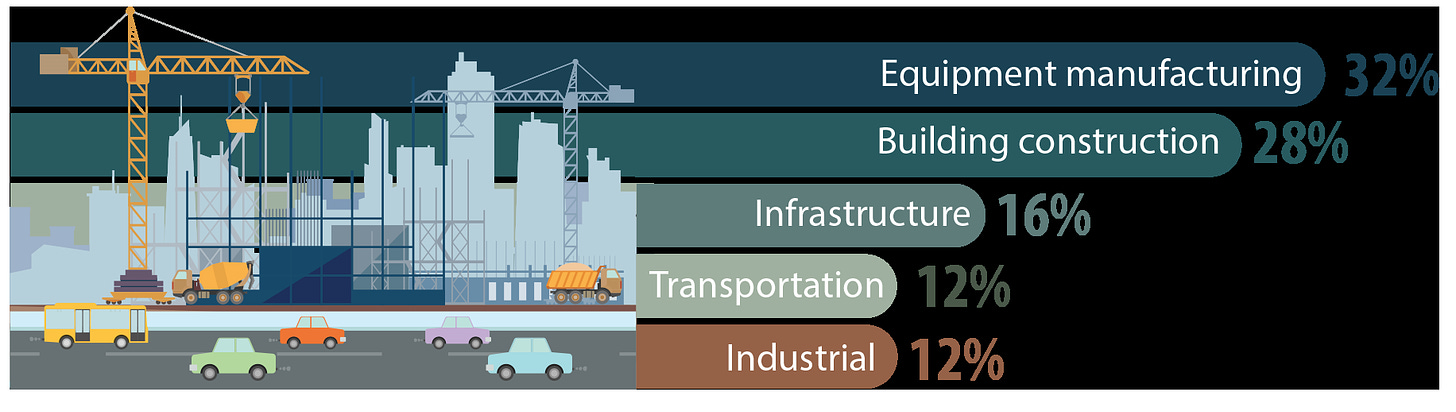

As most of the world seeks to reach net-zero targets and transition to cleaner, renewable forms of energy, copper is a big requirement. However, the amount of copper needed to successfully facilitate the energy transition is staggering. Nearly 70% of all copper produced is used in electrical applications, which is why it’s so important to the energy transition.

While the average internal combustion engine vehicle contains approximately 48 pounds of copper, a typical EV contains nearly four times that amount. Solar Technology uses about 5.5 tons copper/MW of electricity and wind about 4 tons/MW onshore and 10 tons/MW offshore.

Jerome Leroy, vice-president of the Canadian business unit of cable supplier Nexans, worries that copper mines won’t be able to keep up. This concern partly stems from the fact it takes many years to secure regulatory approvals for new mines. Moreover, ore grades at existing mines have long been in decline. (Production is concentrated in Chile, Peru and China.) Mr. Leroy points to forecasts suggesting production capacity will grow to 27 million tonnes a year by the end of this decade, whereas demand could rise as high as 35 million tonnes. A shortfall could materialize as soon as next year, he warns.

“I start to see it happening at the power utility level,” he said. “People are requesting more and more cable. The likes of BC Hydro and Hydro-Québec, and others, say that probably they will need at least 5-per-cent more cable every year starting from now.”

Blair DeBruyne, the director of operations, inventory and fleet services at SaskPower, points out that copper is a major ingredient in transformer coils and almost every power line. But he’s worried about all mined materials because order lead times are being pushed out.

Last year, IHS Markit (a market research firm owned by S&P Global) projected that copper demand could double in little more than a decade – from 25 million tonnes today to 50 million by 2035.

“The chronic gap between worldwide copper supply and demand projected to begin in the middle of this decade will have serious consequences across the global economy,” an IHS report warned, “and will affect the timing of net-zero emissions by 2050.”

Demand for copper in energy transition applications is expected to climb about 8.2% over the next decade, outstripping a projected 2.9% increase in copper demand in that period for traditional uses such as construction, infrastructure, machinery, and transportation, said Mohsen Bonakdarpour, executive director of economics & country risk for Market Intelligence.

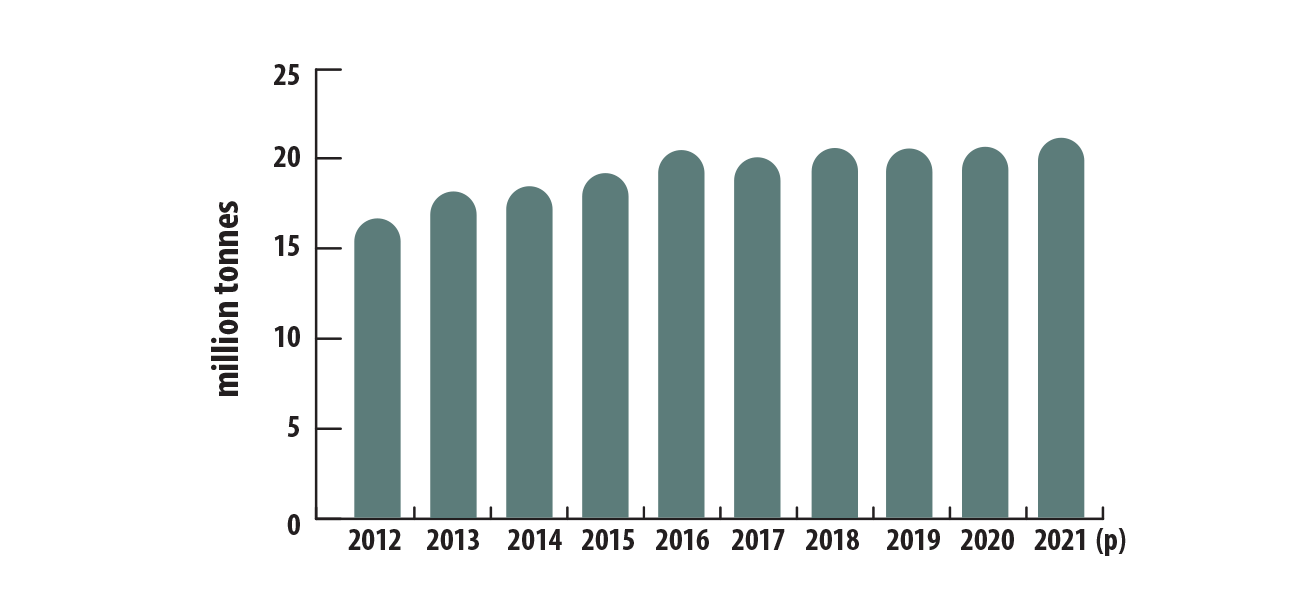

My take - I am not as bullish as many on the speed to electrification and EVs, but if demand even grows at half of the projections, there will be shortages. You see, the problem is really on the supply side, mainly because years of under investment in mining. The chart below on copper production shows that growth has been flat since 2016.

The global copper industry needs to spend more than $100 billion to build mines able to close what could be an annual supply deficit of 4.7 million tonnes by 2030, Erik Heimlich, head of base metals supply at CRU said in 2022.

The supply gap for the next decade is estimated at six million tonnes per year, as the clean energy and electric vehicles sectors ramp up. This means the world would need to build eight projects the size of BHP’s (ASX: BHP) Escondida in Chile, the world’s largest copper mine, over the next eight years. Such task, Heimlich said, seems questionable?

“Many of the projects currently developed have been in the making for almost three decades, and with exploration activity relatively limited in recent years, supply increases may fade from 2025,” experts at BoA said.

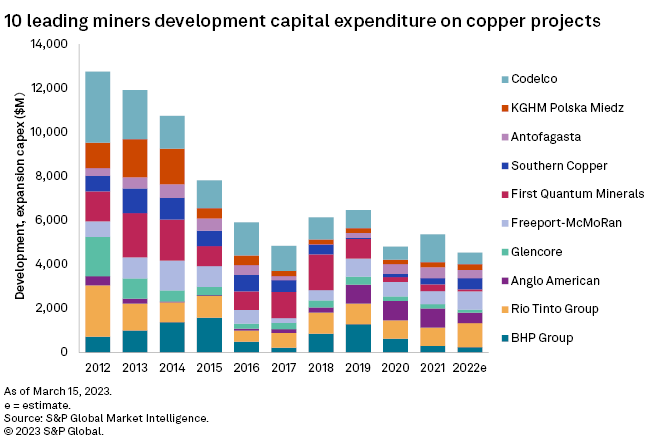

Global development and expansion capital for primary copper mines peaked in 2013 at $26.13 billion, almost halved in subsequent years and has not recovered since. Capital spend on copper projects is estimated to have been only $14.42 billion in 2022, based on Mine Economics' universe of coverage. A further decrease of 18.7% is projected for 2023. This chart is just the top 10 companies.

Mine expansion activities rose in 2021, with some major announcements in Chile, Indonesia and Mongolia that will add 3 million tonnes (mt) over the next four years. Most miners continue to allocate a major portion of budget to expansion of existing mines, while grass root share was 34% in 2021. Over the last decade, there have been 19 major grass root discoveries but only three in the past five years, adding just 5.6mt to the total production. Latin America (LatAm) remains the top region in terms of total discoveries; however, over the past decade, new supplies have come more from Africa and Asia. In particular, between 2012 and 2021, around 56% of the top 10 discovered deposits were added by the Kamoa-Kakula deposit in the Democratic Republic of the Congo in 2014 and the Onto deposit in Indonesia in 2013.

Catch 22 - the climate activists want to electrify and go green but don't want new copper mines – Dah!!!!!!!

The changes in LatAm royalty taxes add to the regulatory uncertainty prevailing in the region. The Chilean government is considering a modified version of a 2021 bill to impose a 1% sales tax for copper companies producing less than 200 kilotonnes per annum (ktpa) and up to 3% for companies with output exceeding 200ktpa. However, the companies producing under 50ktpa are exempted from this tax. Similarly, tax changes and local community protests in Peru have impacted production from major mines in the region. This is likely to impact new project pipeline over the coming years.

Freshwater usage is another major concern for copper mines, especially in Chile, Peru and the southwest United States. Peru has been rocked by protests since former President Pedro Castillo was ousted in December 2022 in an impeachment trial. The South American nation accounts for 10% of the global copper supply.

Shares in First Quantum have dropped a whopping 2/3rds (66%) since opposition to a mining contract on their massive copper mine went viral in Panama. The mine is about 1/2 their copper production, so the stock might be getting over sold. Let's see where it bottoms.

Their contract deal, gave the company the right to mine the site for at least the next two decades in exchange for $375 million US a year to the government. It has become have a flashpoint for local protesters. That opposition has escalated into broader anti-government protests that officials say are costing Panama $80 million US a day.

The mine faces legal and constitutional challenges from the country's top court, and citizens may get a chance to vote on the contract extension in a referendum next month. Because of the blockade, Quantum announced November 23rd that they suspended production at the mine.

Conclusion

There is no way that supply will ramp up enough to meet rising demand, even if demand increases are half of what is expected. Bringing new mines on stream is becoming more difficult with regulation and climate activists. The major mining companies are mostly focused on expanding and improving profits at their existing mines. The two main results are higher copper prices, that will likely go to new highs and a huge focus on junior copper explorers. Not by investors yet, but the majors who are watching these like hawks and will be jumping on discoveries and promising projects.

First, a long term chart on copper. Prices have not gone crazy but the 2011 highs were tested in 2021 and 2022. Since then a wedge pattern has developed. A breakout will occur and I would bet to the upside.

Next chart, short term on the next page, the recent move up and then back was a test of resistance and support levels.

There are virtually no pure copper producer plays but perhaps one and the big copper producers also produce other base metals so are no where near a pure copper investment. One option is the junior copper explorers and I will highlight three of my favourites before I touch on the best pure producer play.

Midnight Sun - - - TSXV:MMA - - - Recent Price $0.20

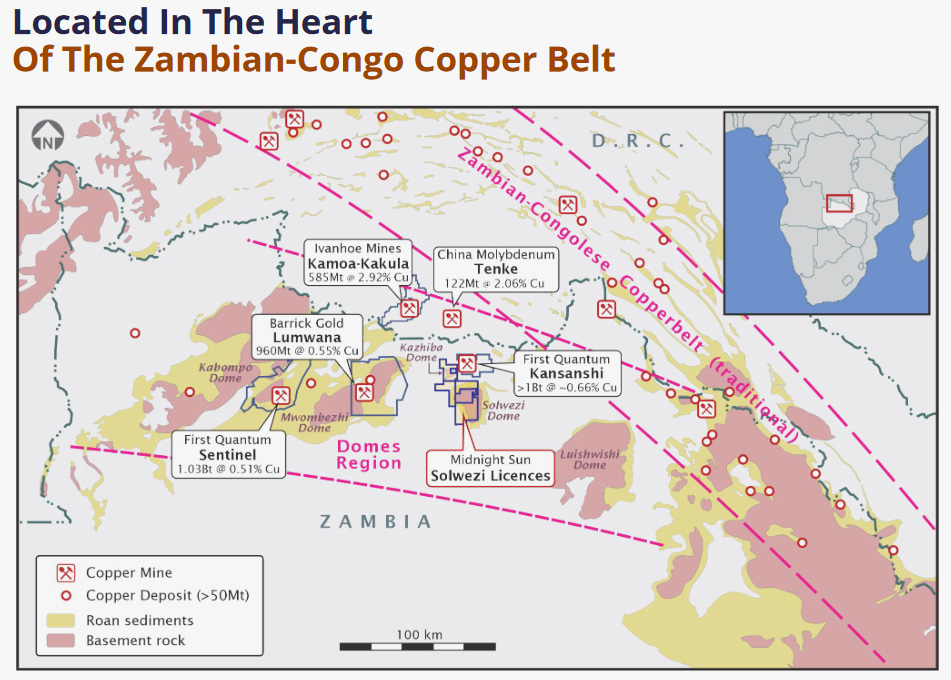

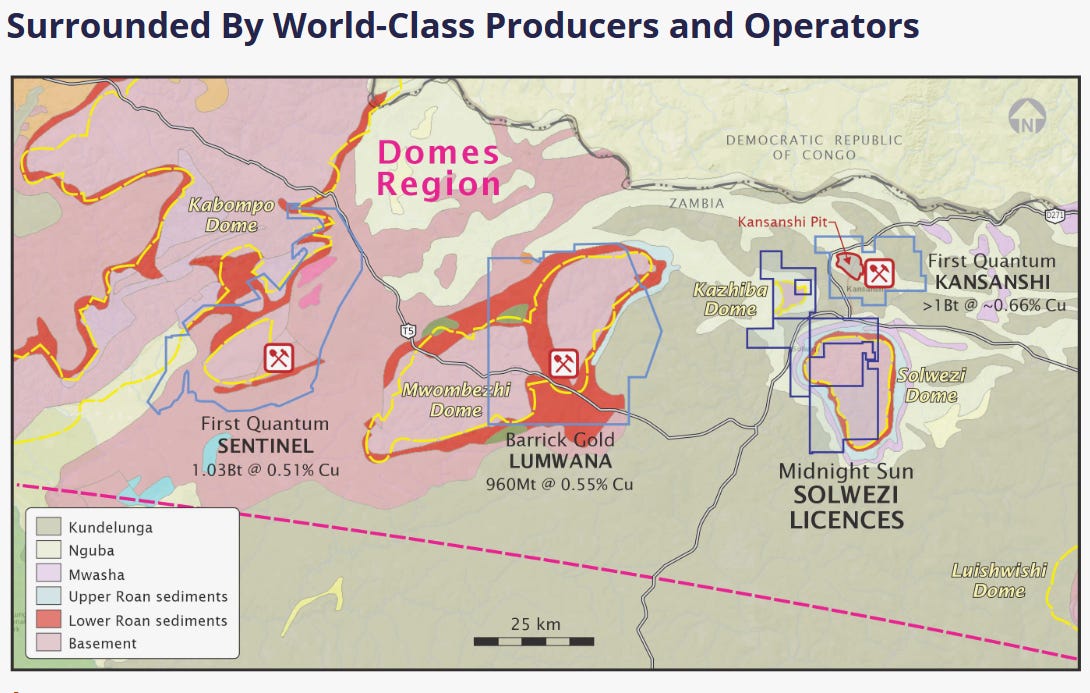

Midnight Sun has done a lot of exploration work on their Solwezi mineral exploration licenses in Zambia that are located directly adjacent to the largest copper mine in Africa – Once again, First Quantum Minerals’ Kansanshi copper/gold mine. Midnight Sun has a copper discovery there and needs further work to prove up.

With Midnight Sun it is all about location. The Zambian-Congo copper belt is host to some of the world’s richest mines, with operators that include Barrick, Rio Tinto, Glencore, Ivanhoe Mines, and First Quantum and a lot of them surround MMA.

This graphic shows a better closeup

MMA has four main targets named Dumbwa, Kazhiba Dome, Mitu Trend and Crunch Zone.

Dumbwa is a continuous high-grade copper-in-soil anomaly for over 20 km along strike and about 1 km wide with peak values up to 0.728% copper.

Kazhiba Dome has multiple high grade hits in the 22 zone with the discovery hole running 11.3 meters grading 5.71% copper. Other intercepts include 21 meters of 3.26% copper and 6.4 meters of 5.08% copper.

The Mitu Trend shows similiar style minerilization as the Sentinel Mine with associated cobalt and nickle Drill hits include 11.6 meters of 3.44% copper and 11.5 meters of 1.41% copper.

The Crunch Zone has a newly identified structural target with a largely untested VTEM conductive anomaly. It occurs on the same stratigraphy as First Quanum's Kanasanshi Mine.

MMA has a large 506 sq km property and already has two high grade discoveries. They are in the right place and have caught the attention of the major miners. I expect we will see some type of JV deal on one or more of their target areas and/or some more great results in the next drill program.

They have 118 million shares out and at $0.20 the market cap is just around C$24 million, quite cheap for their location and discovery. The company is run by CEO, Al Fabbro who I have known many years and made good returns on his last deal RoxGold.

The stock bottomed in 2022 with the correction in copper prices. Since then it recovered but has been stuck in a range between $0.20 and $0.32. It is a good buy here at the bottom of this range.

Zonte Metals - - - - TSXV:ZON - - - - Recent Price $0.08

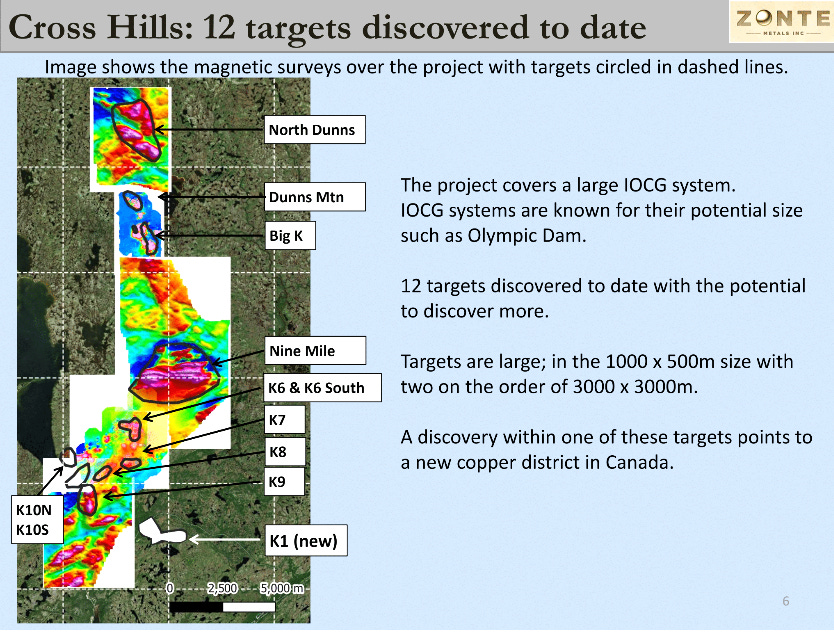

Zonte is in a great location as well, miner friendly NFLD Canada. Year around road access, high voltage power at the one end of the property and near tide water at the other end. There has been a gold rush there with Newfound Gold's high grade discovery at their Queensway project. There has not been much copper exploration although NFLD was the world's 4th largest copper producer back in the WW2 era. However, I think this will soon change as Zonte has discovered a grass roots new copper district, an Iron Oxide Copper Gold (IOCG) system. These can produce huge and higher grade copper/gold mines and Zonte has done a lot of tedious work over the past several years and has discovered 12 priority targets so far. I expect multiple mines could be discovered.

Zonte did some drilling, testing magnetic and gravity highs and from this learned that potential deposits are likely adjacent to these anomaly highs. Their soil sampling and rock sampling in the last two years appears to confirm this. They did make one high grade hit at their Dunns Mountain target, but it was narrow. It was 0.43 meters with 14% copper, 15 g/t gold and 352 g/t silver.

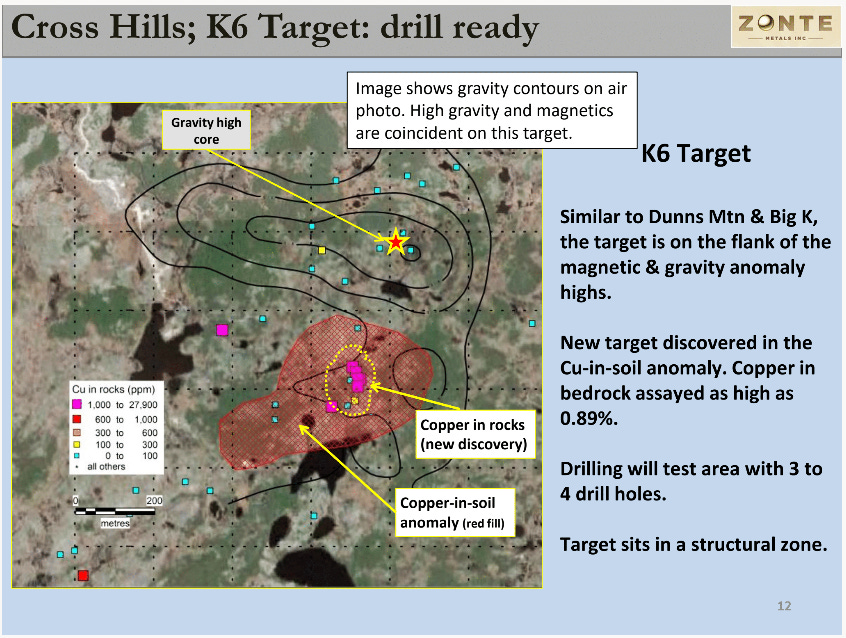

With their new exploration approach, they are currently drilling the K6 target. In the graphic you can see that the copper soil anomaly sits adjacent to the gravity and magnetic highs. It is also proven with copper in rocks. Zonte has drilled 4 holes there so far and I expect results in the New Year.

The stock just bottomed at historic lows in October, but needs to break the down trend channel. There is only mild resistance around 8 cents with stronger resistance around $0.13.

I did an 18 minute interview with CEO Terry Christopher and we went over in detail, the exploration on the K6 target. It is well worth watching at this youtube link.

Zonte also has a gold project in the Yukon that is adjacent to Victoria Gold's mine. Victoria Gold has been advancing a 2nd discovery there and has been conducting sampling and drilling right up to Zonte's property boundary. I have little doubt that it extends onto Zonte's property. Zonte also had a drill discovery on this property in 2015 that is on trend. Zonte has about 70 M shares outstanding and at current prices has a market cap of just over $5 million.

Element 29 - - - TSXV:ECU - - - - Recent Price - $0.15

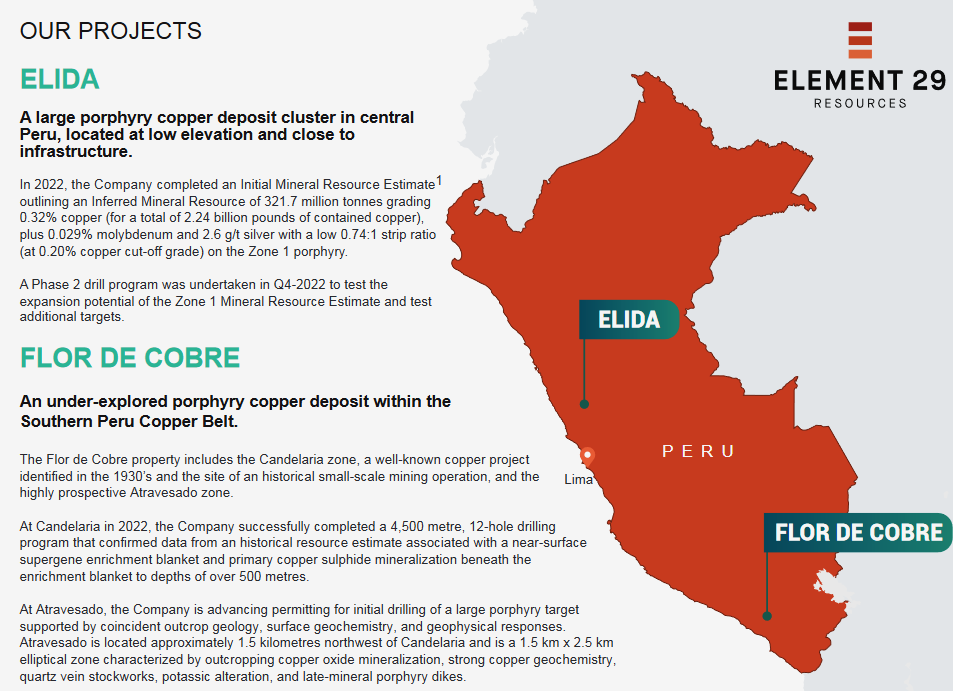

Element 29 is advancing two new, high-quality copper projects in Peru - Flor de Cobre & Elida - each with excellent potential for resource growth and development. They have 100% ownership in these projects and are at a favourable lower elevation < 2,700 meters and with good infrastructure.

ECU's Elida project is in an advanced stage but things have been quiet with the company. However, they just closed a $2.8 million financing in the middle of September so I expect they will soon announce a new exploration and drill program.

ECU has 106 M shares outstanding so at $0.16 has a market cap of about $16 million.

Conclusion

All 3 of these junior explorers are ripe for either a JV deal or buyout from a major. Of the 3 juniors Zonte is the cheapest with a market cap of $5 million compared to $16M (ECU) and $24M (MMA ) of the other two and has an active drill program, so an additional catalysts to move the stock. I suggest owning all three stocks with a focus first on Zonte, if you don't own any because they will have drill results in early 2024. For a copper producer, I think the best play is:

?

Be sure to share and subscribe - I will publish a report on the pure copper producer tomorrow.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.