Economic News, Pepsi and Gold, Torex TXG , Oil and Baytex BTE

All eyes will be on the Friday's job numbers. Consensus is 214k, a big rebound from October's 12K. I suspect my thesis of padding the numbers ahead of the election will be correct and the number will surprise on the downside. Anxiously waiting for what sleight of hand will be used Friday.

Reported today U.S. businesses created 146,000 new jobs in November, paycheck company ADP said,. Economists polled by the Wall Street Journal had forecast a gain of 163,000 new jobs in the ADP’s November survey.

The number of new private-sector jobs created in October was revised down to 184,000 from 233,000. Below consensus and a significant down revision perhaps points to a weaker job number on Friday.

Also reported today, service-oriented companies in the U.S. grew in November at the slowest pace in three months, reflecting uncertainty about how the incoming Trump administration will affect the economy.

The Institute for Supply Management’s survey of service companies slid to 52.1% last month from 56.0% in October. Any number above 50% signals expansion.

Orders for manufactured goods rose 0.2% in October, the first increase after two straight monthly declines, the Commerce Department said Wednesday. The gain in October was in line with forecasts of economists surveyed by the Wall Street Journal.

“The manufacturing sector seems more or less stuck in a holding pattern,” with sluggish global economic growth, high interest rates and uncertainty surrounding the incoming Trump administration’s economic policies, said Richard Moody, chief economist at Regions Financial Corp.

It will take a few months of data to really get a handle on where the economy really is and how much manipulation was done ahead of the election. That said I am quite sure the theme for 2025 will be stagflation. Economic growth will be slow and inflation very stubborn. To be clear, inflation is not coming down as the media often reports, simply the rate of increase has come down

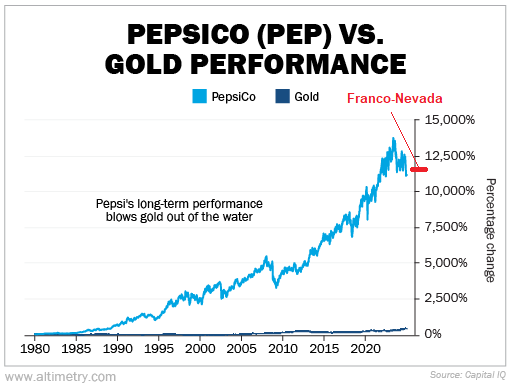

Pepsi or Gold? How about Franco-Nevada

I saw a recent comparison of gold to Pepsico (PEP). Kind of silly and not a real comparison but the point was that gold just sits there, it is static while Pepsico is dynamic and can grow much faster. Since 1980 gold is up 390% in 44 years, pretty good but Pepsico is up 11,300%. And remember, 1980 was a high price for gold.

The fella that wrote this article or comparison is very successful, bang on and his analysis was very accurate. I am sure he is an excellent analyst of markets and stocks. However, in my opinion it is simply a very poor comparison, it would not even be near as good as apples to oranges. I would also note that investors did not pile into gold so much, it was mainly Central Banks and very few funds.

I would say you could compare Gold to the Pepsi in the can as both are physical. The Pepsi would not even last anywhere near 44 years as it would be flat and the can long ago rusted out.

A more fair comparison to a successful consumer stock like Pepsico would be a successful gold stock like Franco-Nevada that got started in 1982, very close to the 1980 date in the Pepsico chart above.

In 1982, Pierre Lassonde co-founded, along with his business partner Seymour Schulich, Franco-Nevada Corporation, the first publicly traded gold royalty company. It began as a penny stock worth about $8 million. In 1985, Franco-Nevada acquired for US$2 million a royalty on a small mining operation in the heart of the Carlin gold belt of Nevada. Two years later, the property was acquired by Barrick Gold, who discovered the world class Goldstrike deposit. Goldstrike initially had gold reserves of 600,000 ounces, but in 1989, a discovery increased Goldstrike’s reserves to 20 million ounces, making it one of the world’s largest gold mines.

In June 1999, they merged Franco-Nevada and Euro-Nevada to increase liquidity and financial capacity and improve clarity for shareholders. The combined companies had a market value of C$3.5 billion at the time. It was a poor gold market then but still very good value for Franco.

In 2001 Franco became part owner of Normandy (20%) for their sale of the Ken Snyder mine. Later in 2001, AngloGold made a bid for Normandy. Seeing the potential for a better alternative transaction, Seymour and Pierre struck a deal with Newmont to acquire both Franco-Nevada and Normandy. When the transaction closed in 2002, Franco-Nevada was valued at close to US$3 billion. In 2001 that would be about C$4.5 billion so a decent jump from 1999.

From inception to February 2002, when the company was sold to Newmont Mining for US$3.2billion, Franco-Nevada provided its shareholders a 36% annualized rate of return.

Franco-Nevada came back

In 2007, Newmont made the decision to divest its portfolio of royalty assets. Pierre Lassonde, David Harquail and a small team led by management of the original Franco-Nevada, launched an initial public offering on the Toronto Stock Exchange and acquired the royalty portfolio from Newmont for US$1.2 billion. The offering remains the largest mining IPO completed in North America and was the birth of Franco-Nevada Corporation (FNV). The value was about 1/3 of it's previous self because the royalties depleted some over the 6 years.

Franco-Nevada went back to it's old model of acquiring royalty assets and as of 2024 has 347 compared to 190 at the IPO. Today the market cap is $95 billion which is a 11,857% return since 1982 beating Pepsico's 11,300% and in 2 years less. And that does not include dividends for Franco-Nevada. It is very difficult to find dividends from way back but Franco-Nevada has them on their presentation since 2008.

I am not going to calculate reinvesting dividends but simply adding on the approximate $2.5 billion Franco-Nevada paid since 2008 gives a 12,187% return, almost 1,000% better than Pepsico.

Conclusion – For investors things go better with gold.

Franco Nevada and Euro Nevada were among my top picks in the 1980s and 90s return thousands%. Bring back the good old days.

Despite the gold correction, some of our gold stocks keep on going, like Equinox back to this years high and Torex making new highs.

Torex Gold - - TSX:TXG - - - Recent Price - $31.96

Entry Price - $13 - - - - - Opinion – hold for further gains

This week news that drilling was very successful at their Morelos project in Mexico. They are extending the mine life of ELG Underground by identifying new zones of higher-grade mineralization, expanding resources, and replacing and growing reserves.

Drilling results through the first nine months of 2024 demonstrate the potential to upgrade Inferred Resources to Indicated Resources with the year-end 2024 reserve and resource update in each of the identified mineralized trends, as well as the ability to expand Inferred Resources.

El Limón Sur Trend

At the El Limón Sur Trend, Resource Delineation drilling has delivered compelling results with intercepts returning higher than anticipated grades, particularly within the north ore shoot. The best results from drilling in this area include drill hole LDUG-350 (27.72 grams per tonne gold equivalent ("gpt AuEq") over 18.8 metres ("m")), LDUG-351 (45.16 gpt AuEq over 3.1 m), LDUG-356 (94.30 gpt AuEq over 6.1 m, including 151.67 gpt AuEq over 3.7 m), and LDUG-390 (23.51 gpt AuEq over 5.1 m). These results support upgrading Inferred Resources to Indicated Resources.

The Advanced Exploration program at the southern ore shoot continues to extend mineralization to the south as shown by the intercepts reported in drill holes LS-332 (10.37 gpt AuEq over 3.5 m) and LS-339 (6.35 gpt AuEq over 6.3 m). The mineralized intercepts of drill holes LS-339, LS-342 (18.67 gpt AuEq over 2.4 m), LS-343 (5.25 gpt AuEq over 10.0 m), and LS-344 (9.44 gpt AuEq over 5.6 m) confirm mineralization extends at depth, which will be further explored through infill drilling in 2025.

Drilling at El Limon Deep Trend, Sub-Sill Trend and El Limon West Trend had very good numbers.

You can see on the chart that the stock is breaking out and I think it is going to test all time highs back in 2016 of just over $35

Torex has budgeted $12 million towards drilling and exploration for ELG Underground in 2024. Drilling is progressing well with six rigs currently working in the area. As of the end of September, 29,442 m of the 43,200 m of drilling forecast for the year was completed. So more results will be out.

Jody Kuzenko, President & CEO of Torex, stated: "Results from the ongoing drilling program at ELG Underground continue to demonstrate the long-term potential of the deposit following an impressive track record of success delivered over the last several years. The latest assay results highlight the ability to upgrade Inferred Resources to Indicated Resources and support our target of replacing most of the reserves mined year-to-date.”

Baytex Energy - - - TSX/NY: BTE - - - - Recent Price - C$3.80

Entry Price $4.18 - - - - - Opinion - hold

Baytex was doing just fine but sold off today after their 2025 budget announced yesterday after the close. The sell off does not make much sense as the company is practising the same frugal exploration of most oil&gas companies by keeping production about even and returning $$ to shareholders. Perhaps also weighing on the stock is Trump's tariff threat as Baytex has 44% of production in Canada. Also oil is down just over $1.00 today.

"Our 2025 budget demonstrates the strength of our oil-weighted portfolio as we target continued strong performance in the Eagle Ford, further progression of the Pembina Duvernay and capital efficient heavy oil development. We are focused on disciplined capital allocation to prioritize free cash flow while maintaining a strong balance sheet. In the current commodity price environment this means moderating our growth profile and delivering stable crude oil production," commented Eric T. Greager, President and Chief Executive Officer.

2025 Budget

The Board of Directors has approved a budget for 2025 exploration and development expenditures of $1.2 to $1.3 billion, which is designed to generate average annual production of 150,000 to 154,000 boe/d. The 2025 budget is based on a US$65/bbl WTI price and generates stable production compared to 2024.

Based on the mid-point of our production guidance of 152,000 boe/d, approximately 56% of our production is in the Eagle Ford with the remaining 44% in Canada. Their production mix is forecast to be 85% liquids (44% light oil and condensate, 28% heavy oil and 13% natural gas liquids) and 15% natural gas, based on a 6:1 natural gas-to-oil equivalency.

To illustrate Baytex's sensitivity to changes in WTI, based on a constant US$65/bbl and US$85/bbl WTI price, over the five-year outlook, they expect to generate free cash flow(1)(2) of $1.5 billion and $4.5 billion, respectively.

The stock has broke support on the chart and is why I am cautious with a hold for now. I want to see where it bottoms out and probably buy again from there. It is simply going to just be a better bargain.

Another influence on Baytex and energy stocks is obviously the oil price and the chart is quite interesting. With multi year low oil inventories and uncertainty of the middle east war, oil prices can't decide what to do. However a wedge pattern has developed and oil will resolve itself with a break out of this later in the month or January. I am betting to the upside for now.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.