Welcome and thank you to all the new, smart, savvy and contrarian investors to my substack. If you like outside the box thinking, a humble analyst that has spent his career studying market and economic cycles, picked numerous tops and bottoms, someone not afraid of controversial topics and can be a bull and a bear, your at the right place. Please share and subscribe.

Economic news this week is mixed and nothing too good other than the ISM Services index.

Applications for US unemployment benefits rose slightly to a level that is consistent with limited number of layoffs. Initial claims increased by 6,000 to 225,000 in the week ended Sept. 28. The median forecast in a Bloomberg survey of economists called for 221,000 applications.

ISM service index climbs to 54.9% from 51.5%. The service side of the economy grew in September at the fastest pace in a year and a half, suggesting the U.S. is in no danger of recession. Beware that one month does not make a trend.

New orders for U.S.-manufactured goods unexpectedly fell in August, while business spending on equipment appears to have pulled back in the third quarter. Factory orders dropped 0.2% after a slightly downwardly revised 4.9% increase in July, the Commerce Department's Census Bureau said on Today.

Earlier this week news was companies added 143,000 jobs in September – more than the 120,000 gain predicted by LSEG economists. The report also revised August's jobs gains upward from 99,000 to 103,000.

ADP found that workers' pay gains, which can contribute to inflation, slowed to a year-over-year increase of 4.7% for job-stayers, while job-changers saw a greater decline from 7.3% in August to 6.6% in September.

Economic activity in the manufacturing sector contracted in September for the sixth consecutive month and the 22nd time in the last 23 months, say the nation's supply executives in the latest Manufacturing ISM® Report. The Manufacturing PMI® registered 47.2 percent in September, matching the figure recorded in August.

Construction spending fell 0.1% in August, the Commerce Department reported Tuesday

Tomorrows job numbers will be the big focus. However, just before the election, I expect some Goldilocks numbers that will be not too high nor too low. The most significant news of late is that oil has broken out to the upside. The market has started to catch on the Middle East war is going to expand and probably into a regional war. This is something I have been warning about for months, but no attention was paid until Iran launched around 200 missiles at Israel. I am sure you know that news.

After sitting on the fence, I turned bullish on oil September 26th after warning of a possible month end sell off that came just like clock work. It has made no sense that oil has been this weak with U.S. inventories at multi year lows and a Middle East war raging. I suspect market intervention to get better inflation numbers ahead of the election. If this is true, we will probably not see any more month end take downs, because it won't matter come end of this month.

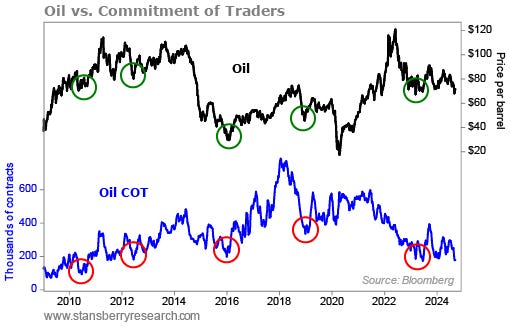

Another reason I am so bullish is my contrarian nature. Sentiment recently fell to one of its lowest levels in recent history. And that usually means a major rally will soon start. A nice chart by Stansberry shows futures traders are the most bearish they've been on oil since June 2023. And before then, we hadn't seen this kind of sentiment since 2010.

Similar COT lows have a history of happening at bottoms for oil. The average rally from that has been 62% over 12 months. I believe with the fundamentals, this rally will be above average.

Today's jump got a boost form a Biden comment on the Middle east. When asked by a reporter if he would support Israel targeting Iran's oil facilities, Biden responded, "we're discussing that." This statement fueled market fears of potential disruptions to oil supplies from the region. Additionally, Biden indicated that he did not expect Israeli retaliation against Iran to happen on Thursday.

I hope many of you jumped on the 3 oil stocks I suggested in my September 26th substack. Cenovus, APA Corp. and Permian Resources.

The junior exploration market remains depressed but he have tons of drill activity on our juniors. Our 4 junior coppers are drilling and soon results with Zonte, Giant Mining and Midnight Sun. GSP Resource will start drilling Alwin this fall.

GSP Resource - - TSXV:GSPR - - - Recent Price - $0.12

Entry Price – 0.25 - - - - - Opinion - buy

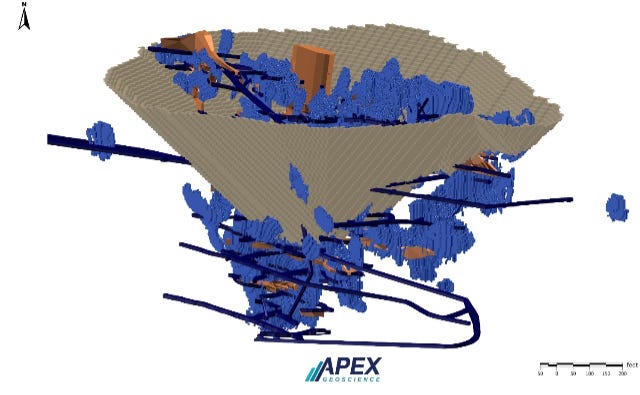

GSP announced that the exploration target block modelling has indicated open pit potential at their Alwin Mine Copper-Silver-Gold Project.

The recently completed exploration targeting modelling, and conceptual open pit and stope optimization indicates that the Alwin Mine copper mineralization is potentially amenable to an open pit model. Modeling has yielded a conceptual open pit that extends to a depth of 180 metres (600 feet) with potentially mineable stope shapes continuing at depth a further 90 metres vertically and over a strike extent of approximately 300 metres (1,000 x 300 feet).

With 60000m + of historic drill data, and used only 45,000m of it (copper only) to build a block model showing that a large open pit model works as opposed to previously only UG mining. Alwin is less than 1km from Highland Valley Copper Mine Area Boundary !

This is the FIRST TIME anyone has considered Open Pit for Alwin – and it appears to work – on Copper Alone. GSP does not have enough Gold/Silver Assays to add to the model. yet (historically very little Gold/Silver assaying done because of costs and low PM prices in the 1960s and early 1970s.

However – when they did assay for gold – got great numbers (29.5m of 4.7gpt Au composite average- shallow) – see this new release: GSP Resource Geological Compilation and Modelling Reveals Historic High Grade Gold Assays at Alwin Mine Copper-Silver-Gold Project - GSP Resource Corp.

Drilling more gold and silver in the Pit shell and underground should improve the economics and likely make the Pit Bigger

Biggest potential pit constraint is property Line with TECK – and they have had positive drill results just outside GSP ground just to the EAST on strike with Alwin.

GSP WILL BE DRILLING THIS FALL!!! looking for higher grade Cu/Au/Ag Targets – and expanding along strike to make the PIT bigger and more attractive

This Open Pit concept is a true game changer for GSP which as of October 1 has a market cap of only $3.65mm Canadian. This is the catalyst that could launch GSPR to a higher valuation?

They are cashed up to drill – closed 650K (Drilling in BC is cheap near Kamloops) and the 4-month hold doesn’t expire until Late January! We can expect to have results out well before 4 months hold expiry.

Figure 1: Oblique View of Alwin Mine Exploration Target Model Conceptual Pit Shell and Stope Modelling (blue), historic underground development (navy blue), and back filled stopes (orange).

Golden Lake - - CSE:GLM, OTC:GOLXF - - - Recent Price C$0.06

Opinion – strong buy

Golden Lake announced that it has expanded its current drilling program to include drilling on the high-grade Sterling Tunnel mine. The additional drilling is supplementary to Golden Lake's current ongoing program on its flagship Jewel Ridge

Grab sampling of mine dump and outcropping mineralization by Golden Lake personnel and Homestake Mining at Sterling Tunnel, returned the following high-grade assays:

29.49 g/t gold, 181.00 g/t silver, 0.89% lead & 0.40% zinc1

11.69 g/t gold, 333.00 g/t silver, 4.00% lead & 0.61 % zinc

7.95 g/t gold, 223.00 g/t silver, 0.92% lead & 1.44% zinc

7.70 g/t gold, 209.00 g/t silver, 3.76% lead & 8.46% zinc

0.30 g/t gold, 42.00 g/t silver, 0.35% lead & 9.53% zinc

Ramp Metals - - - TSXV: RAMP - - - - Recent Price C$0.62

Entry Price - $0.47 - - - - Opinion – buy on weakness, around $0.55

Ramp Metals announced the receipt of necessary permits to continue exploration at the Company's Rottenstone SW project. The Company will focus on its Ranger target where 73.55 g/t Au over 7.5m was discovered. Mobilization of the field crew for the mapping and sampling program will occur on October 7, 2024.

"The Ramp Metals team hit a world class gold intercept after only one exploration season on site. Historically, the Rottenstone SW property has not been explored in detail. Saskatchewan is very underexplored in general, which shows the potential for a new gold district. The team will use the data from this mapping and sampling program to help prioritize areas for drill targeting," commented Jordan Black, CEO and Director of Ramp Metals Inc.

The Company is currently permitted for mapping, sampling and geophysics until December 2025. An amendment to allow up to 5000m of drilling has been submitted to the Saskatchewan Ministry.

Aztec Minerals - - - - TSXV:AZT - - - - Recent Price $0.18

Entry Price $0.40 - - - - Opinion - buy

Reverse circulation drilling has commenced at Aztec's Tombstone project, Arizona. The stepout drilling program under way is targeting shallow zones identified as prospective for high-grade oxide gold-silver mineralization associated with recently completed surface exploration results and 3-D geological modelling.

The primary objectives of the drilling program are to: expand the known mineralization horizontally and downdip to the west beyond the holes drilled by Aztec in 2020 to 2023 at the Contention pit with stepouts to enlarge the shallow, broad, bulk tonnage gold-silver mineralization discovered there; and to explore new targets identified in the Westside area that were identified from the results of the 2024 surface exploration and research program. The program is designed to focus on targeting the following zones and styles of high-grade oxide gold and silver mineralization.

A. Contention zone: The drill holes collared around the Contention pit will continue to be drilled with the same systematic orientation pattern as before with inclined drill holes designed to cross the mostly north-northeast-trending, steeply west-dipping quartz porphyry dikes and associated breccias and structures at a perpendicular orientation to best identify their true thickness.

B. The Westside area: This portion of the drill program will test multiple mineralized structures of known, historic underground production and surface reconnaissance work, including the Westside anticline, Westside fissure, Arizona Queen anticline and the Sulphuret dike-Arizona Queen fissure intersection.

C. Additional Westside area structures: The Westside area has other mineralized structures, including, but not limited to, the Ingersol anticline, Boss dike, Tribute fissure, Tribute dike, and the B&B anticline.

The intersections of these mineralized structures can have large vertical extents, such as for the Westside fissure with the Westside anticline mined for 240 metres vertically and the Westside anticline with the Arizona Queen fissure with over 200-metre extent vertically. The Westside fissure and the Sulphuret stope were noted historically for strong, average silver and gold grades.

The following are highlights of recent drilling intersections supporting the conceptual exploration model for mineralized footprint growth:

TR21-22: 2.44 grams per tonne gold and 66.56 g/t silver (3.39 g/t gold equivalent) over 65.5 metres (including 16.80 g/t Au and 374.36 g/t Ag over 7.6 m);

TR21-03: 5.71 g/t Au and 40.54 g/t Ag (6.28 g/t AuEq) over 32.0 m;

TC 23-01: 3,477 g/t Ag over 1.52 m from a zone of 733.9 g/t Ag over 7.6 m within 125 m of 1.63 g/t AuEq;

TR21-10: 1.39 g/t Au and 56.40 g/t Ag (2.20 g/t AuEq) over 96.0 m;

TR21-13: 1.8 g/t Au and 36.9 g/t Ag (2.33 g/t AuEq) over 70.1 m;

TR21-17: 1.73 g/t Au and 56.20 g/t Ag (2.53 g/t AuEq) over 64.0 m;

TR21-08: 2.09 g/t Au and 47.1 g/t Ag (2.76 g/t AuEq) over 39.6 m;

The stock has been trading sideways between $0.14 and $0.24. I expect it will break above this range when they announce drill results like in the past but in a much better gold market today.

Paid Advertisers at playstocks

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.