Economy Stumbles, Bubbles, Trudeau - Hello to my Little Friend,Tax losses

U.S. Economy Stumbles Along

Business activity held steady in New York State in December, according to firms responding to the Empire State Manufacturing Survey. After rising sharply last month, the headline general business conditions index retreated thirty-one points to 0.2. Consensus was a reading of 10.0.

PMI a good news bad news story

A huge part of the U.S. economy expanded at the fastest pace in more than three years as businesses looked forward to a business-friendly Trump White House. The S&P flash U.S. services PMI jumped to a frothy 58.5 in December from 56.1 in the prior month, Standard & Poor’s said.

The flash U.S. manufacturing PMI, on the other hand, dipped to a three-month low of 48.3 in December from 49.7 in the prior month. The downturn in manufacturing the past two years is the worst since 2009.

Retail sales jumped 0.7% last month after an upwardly revised 0.5% gain in October, the Commerce Department's Census Bureau said. Economists polled by Reuters had forecast retail sales, which are mostly goods and are not adjusted for inflation, advancing 0.5% after a previously reported 0.4% rise in October.

That said, retail sales increased 3.8% year-on-year in November which is basically keeping pace with reported inflation.

US industrial production unexpectedly declined for a third month in November on weaker utility output and mining.

The 0.1% decrease in production at factories, mines and utilities followed a downwardly revised 0.4% drop a month earlier, Federal Reserve data showed Tuesday. The median estimate of Bloomberg survey of economists was for a 0.3% increase.

Manufacturing output rose a disappointing 0.2% after a downwardly revised 0.7% slide a month earlier. Despite resolution of a machinists’ strike at Boeing Co., aerospace equipment output declined, largely due to a decrease in aircraft parts production, the Fed said.

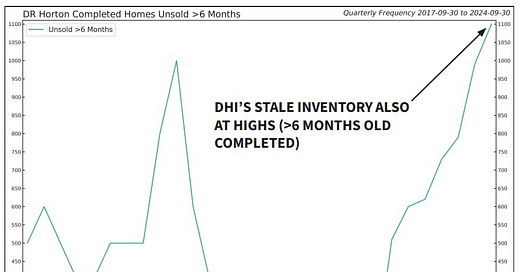

DR Horton’s (America’s largest homebuilder) completed homes that have gone unsold for more than 6 months has now hit a multi-year high. This is not a sign of a good economy and is screaming that new homes are too expensive or interest rates are too high, but probably both.

And the delinquency rate for commercial mortgage-backed securities (CMBS) tied to office properties reached 10.4 percent in November, approaching the 10.7 percent peak reached during the 2008 financial crisis. The ascent is the fastest two-year increase on record, with rates climbing by 8.8 percentage points since late 2022. Below more S&P over valuation.

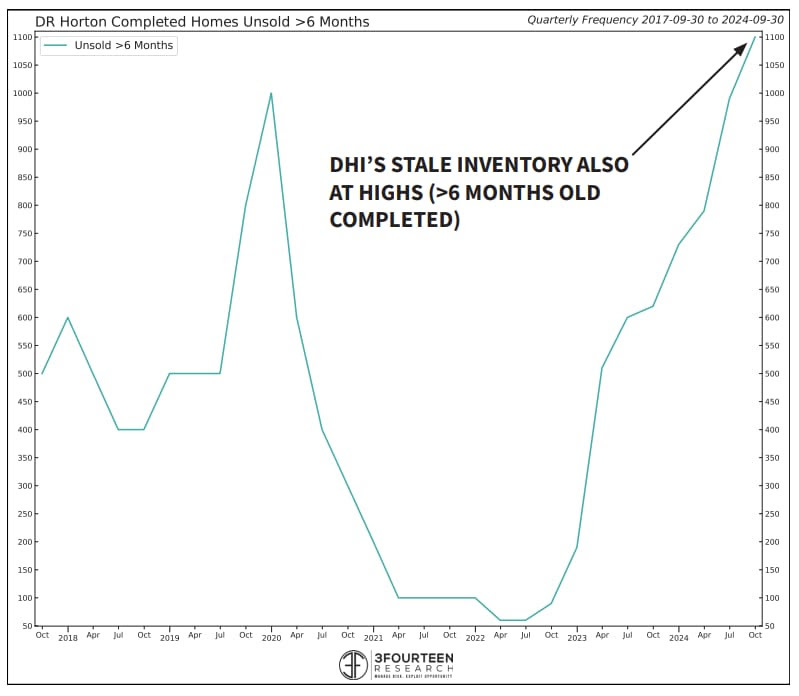

I recently warned about the frothy valuations with P/E ratios on the S&P 500 with a chart showing they are getting to the 2,000 dot com bubble highs. I saw the above chart from barcharts yesterday. The S&P 500 $SPX has reached its 2nd most expensive valuation (forward p/e) since 1999.

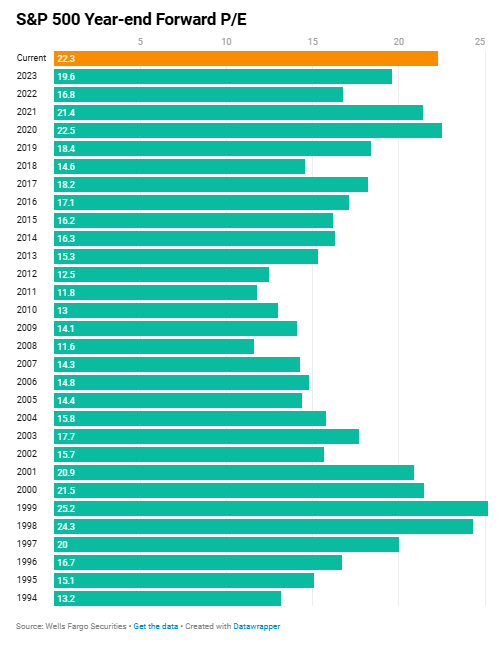

In yet another sign of a bubble top, is the insane inflow into U.S. ETFs and mutual funds. It’s been $186 Billion over the last 9 weeks, the largest inflow in history!

Perhaps the market's honeymoon with Trump will soon end. January will be a very interesting month on the economic front and markets. And December for Trudeau.

The only thing left for Trudeau is to "Say Hello To My Little Friend." Scarface (1983)

In a single day, the prime minister lost his deputy PM and finance minister, his housing minister, a byelection, and the support of several MPs in his caucus. Conservatives won Langley City B.C. byelection with about 65% of votes and Trudeau's liberals a distant 2nd with about 17%. That is the kind of blood bath the Trudeau liberals should face and probably will. So we see more rats jump off the ship.

All I can say is what has taken so long. Crystia Freeland resigning in the dying days after she just nodded her head and went along with Trudeau in the last 8 years is simply a rat abandoning the sinking ship. Let's hope Trudeau goes down with it, he should have been in jail years ago.

Let's hope it is time to cue up the string players to perform ‘Nearer, my God, to thee’,

The federal government blew through the economic guardrails it promised for 2023-24, revealing in its 2024 Fall Economic Statement that the federal deficit at $62 billion will be nearly $22 billion more than promised.

Tech Stocks

I am going to review these at a later date as for the most part they all have momentum and are growing revenues, but for the first time I am suggesting to sell one of our Millennium stocks as a tax loss

BCE Inc. - - - TSX:BCE - - - - Recent Price - $34 Sell

When the stock got to around 10 year lows around $52, it looked like there was good upside. They were expanding their fibre network but that turned out to be misleading advertising. It was not fibre but they called it 'fibe'. I know because I tried it and the BCE (Bell) internet was slower than my previous provider.

The other factor is Canada is going into a deep recession so that will further hurt BCE and there is now talk of cutting the dividend. I am afraid this could turn out to be another Canadian tech failure despite BCE's long profitable history.

With growth looking challenging, BCE in November announced that it is acquiring Ziply Fiber, a fibre-Internet provider in the U.S. Pacific Northwest, for about $5-billion in cash and the assumption of $2-billion of debt. BCE said it plans to maintain its annualized dividend at the current level of $3.99 for the year ending Dec. 31, 2025, and "intends to pause dividend growth until BCE's dividend payout and net debt leverage ratios are tracking towards our target policy ranges, subject to review annually by the BCE Board of Directors."

So BCE's dividend won't rise any time soon and their deceptive nature could mean that it might be cut. The company's disappointing third-quarter results, which reflected intense price competition in the wireless business, further reveals the challenges it is facing. Now they are going to venture into the U.S. which is a far more competitive market than Canada.

I am afraid in the U.S. they will get their head handed to them in a basket. I have been following AT&T NY:T for a couple years as a potential for the Millennium Index and am kicking my butt for going with BCE, probably another Canadian failure or at least for shareholders.

I made a chart here with BCE compared to U.S. AT&T when I suggested BCE last October and you can see why I am kicking my butt so much. BCE started off good as I expected but the deception did not last. As of now BCE is down -30 while AT&T is up +60%. What a disaster. BCE can only do decent and compete in Canada because we have little competition and pay high cell, media and internet rates.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.