Economy, Tariff Bullet on Oil, Gold Record, GRB

Economy Hobbling Along, Not so Great

According to the Institute for Supply Management (ISM), the Manufacturing PMI climbed to 50.9 in January from 49.3 in the previous month, beating market predictions of 49.8.

U.S. job openings fell in December, a sign that the labor market is cooling but still healthy.

Openings fell to 7.6 million, from 8.2 million in November, the Labor Department reported Tuesday. They were down from 8.9 million a year earlier.

New orders for U.S.-manufactured goods dropped in December. Factory orders tumbled 0.9% after a revised 0.8% decline in November, the Commerce Department's Census Bureau said on Tuesday. Economists polled by Reuters had forecast factory orders would fall 0.7% after a previously reported 0.4% drop in November.

Canada Dodges a Tariff Bullet

I am glad to see that Canada dodged a deadly bullet, at least for now. Trump tariffs are delayed for 30 days to see if a final deal can be hammered out. Trudeau agreed to send 10,000 troops to the border and a program to significantly increase border security, declare cartel groups terrorist and appoint a Fentanyl czar. A czar is a person who has a lot of power in a particular activity. Perhaps the most promising is a joint task force to fight Fentanyl. It is about the same deal as Mexico.

Under the Biden and Trudeau administration open border policy, things got too far out of control. We know excess illegal immigration and refugees caused many problems, especially Canada that proportionally brought in way more than the U.S. Now things at the border are moving to the other extreme. Lets see where the dust settles in a couple years, hopefully at a controlled medium. It is pretty bad when your neighbour and ally has to apply this kind of pressure to fix your problem. I don't think Canada really wanted to fix it, Trudeau just wanted to bring in more and more refugees, illegal immigrants, foreign workers/students and the bad that comes along for the ride.

You can hate Trump or Trudeau, but in Trump's case there is nothing we can do because he is here four years. It is best to figure out what is really going on and prepare for it as investors and citizens. The legacy media is totally out to lunch as they are so far left they just spend their time bashing and criticizing. The world is changing and very few know what is really happening.

I know this because - over the past few months I have talked to countless people, studied expert opinions, dug deep below the surface on many topics about Trump, tariffs, borders, security and it is a big complicated puzzle but basically there is a new cold war and world order unfolding. You need to prepare for this and I am going to do my best to put the big picture together as I have discovered it. This will probably take the rest of the month to complete

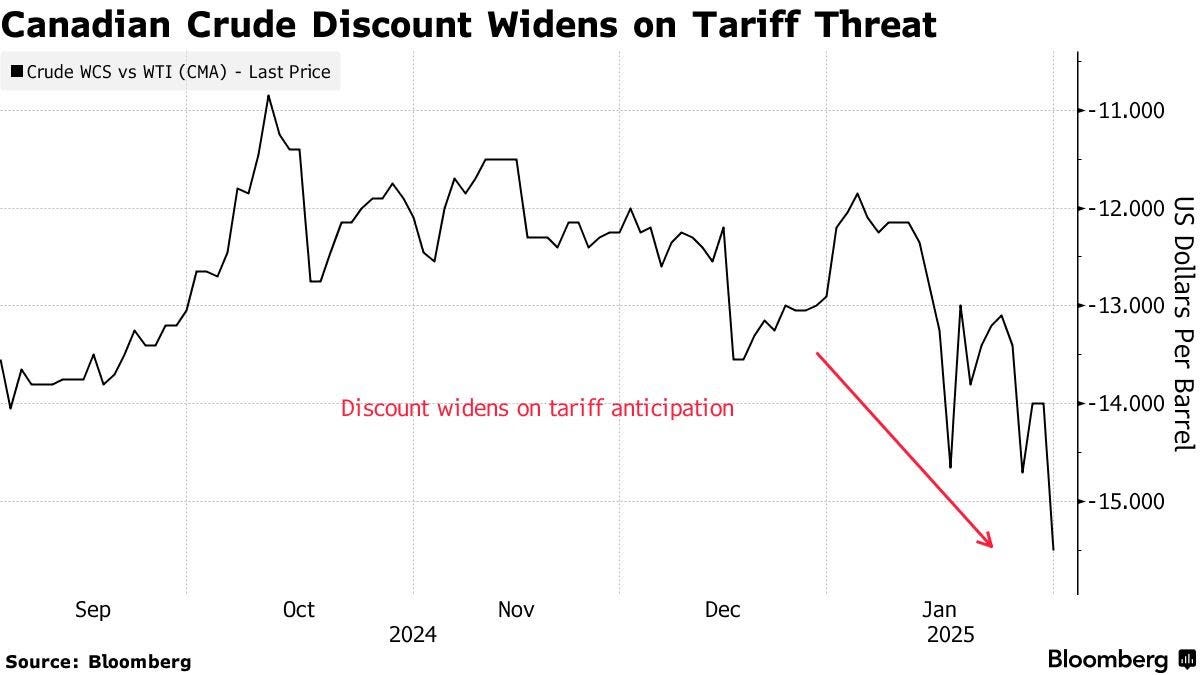

Canadian Oil prices with Tariffs

Interesting that the discount of Canadian oil was increasing with Trump's tariff threat. This indicates that the tariff would not cause an increase in U.S. prices but just hurt Canadian exports.

Almost all of Canada’s 4 million b/d flow to the United States, with some 65% of those exports taken in by refiners in the Midwest, a region that has no other supply route because infrastructure in the Gulf Coast is geared towards exporting light barrels from the US.

According to Oilprice.com - Analysts have found that Canadian tariffs would have the biggest impact on US Atlantic coast gasoline markets, with a 25% tariff on imports hiking prices by $0.50 per gallon to $2.5/USG. However, proposed tariffs were only 10% and it looks like Canadian oil prices were dropping almost -20%.

In other tariff developments Beijing retaliates with oil and gas tariffs Trump’s across-the-board 10% tariff on any Chinese products. China’s State Council imposed a 15% tariff on coal and liquefied natural gas imports from the US, and a 10% tariff on crude oil and heavy machinery.

Juniors Turn is Coming

I believe the junior market will start it's revival this year. It is looking like the TSXV index wants to break higher and as I commented before, I want to see a break above 660. I also see that volume is a little bit better over 20 million/day.

It is official for me that gold has broke out to new highs on the chart. Silver also appears to be breaking above the early December high.

Greenbriar - - - TSXV: GRB, OTC Pink: GEBRF - - Recent Price - $0.60

Entry Price - $0.77 - - - - - - - - Opinion - buy

Today Greenbriar announce that it has executed a binding agreement to acquire the 1,361 Acre Cordero Ranch project located in Cedar City, Utah. From the news release

“Mr. Tommy Sullivan, Chairman of our real estate advisory board and an investor in Greenbriar, purchased the Cordero Ranch property in 2002 in Cedar City, Utah and comprised of 1,361 acres. The property was annexed into the city in 2008 in exchange for Mr. Sullivan gifting adjudicated water rights to the city. On December 7th, 2009 the city executed a Master Plan Development Agreement for Cordero Ranch that is still in full force and effect today, approving and authorizing the construction of 6,726 homes and with the city providing full water, sewer and ancillary services. The 6,726 homes in the Master Plan comprise 2,034 acres with 4,501 of these fully approved homesites within a 1,361 acres keystone center parcel.

The company has engaged Watson Engineering, who will prepare a revised Master Plan that will augment the original plan above with a new south campus space for SUU (Southern Utah University), and include retail, offices, married student housing, and small sustainable entry-level homes, (average approximately 1,000 SF) starting at $300,000+. From the community side, our master planning and approval process is supported by Matt Hall, Director of International Affairs for the LDS, Senator Evan Vickers of Cedar City, and Ric Hollman, the former city manager for 16 years of Cedar City. We will update everyone when the revised Master Plan is filed. Once complete, the approval process in Utah is less than six (6) months for full approval of the new plan.”

This can move ahead way faster than California because of far less bureaucracy. Once Greenbriar files the revised Master Plan and negotiates the lease agreements with SUU, they will finalize related cash acquisition details and subject to mutual approvals. Meanwhile, I expect Sage Ranch to get the final approval in the months ahead. I know it has been frustrating waiting for this but Bureaucrats eventually get some work done.

I would just be patient with bids, don't chase the stock.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.