Economy Teetering, Gold Record, Gold Stocks Cheap, K, NGD, Bitcoin

Welcome and thank you to all the new, smart, savvy and contrarian investors to my substack. If you like outside the box thinking, a humble analyst that has spent his career studying market and economic cycles, picked numerous tops and bottoms, someone not afraid of controversial topics and can be a bull and a bear, your at the right place. Please share and subscribe!

Weekly applications for unemployment insurance in the US increased unexpectedly. The seasonally adjusted number of initial claims rose by 2,000 to 230,000 in the week ended Sept. 7, according to the Department of Labor. The consensus was for a 227,000 level in a survey of analysts compiled by Bloomberg. The previous week's reading was revised up by 1,000 to 228,000.

The producer price index for final demand increased 0.2% from a month earlier following a flat reading in July, according to a Bureau of Labor Statistics. The median forecast in a Bloomberg survey of economists called for a 0.1% gain.

Everywhere I look, the U.S. economy appears in trouble and Canada is already a basket case.

Chicago is freezing hiring and curbing other expenses to help close more than $1 billion in budget shortfalls through next year for the nation’s third-largest city. Chicago is limiting non-essential travel and overtime expenses outside of public safety spending, budget director Annette Guzman said in an emailed statement. Chicago is staring down an estimated $222.9 million deficit this year and another $982.4 million projected gap next year.

The Democratic mayor of Phoenix recently declared the US housing crisis an “all hands on deck challenge.” Her counterpart in Columbus, Ohio, lamented its toll on “every rung of the socioeconomic ladder.” The mayor of New York City bluntly proclaimed, “We have to get in the business of building housing.”

They think they got it bad, they should visit Canada with the highest immigrant increase in the world. Also the highest corporate tax and carbon tax in the world. I am sure personal tax is right up there too, but I have not investigated those numbers yet.

The drop in oil is screaming recession and gold broke to fresh record highs today also signalling troubles ahead. I commented I would add 1 or 2 new gold picks if gold broke out, so stay tuned.

Our timing to buy First Majestic on the dip with the merger news was perfect. I sent my report out late day September 5th, so I picked the closing price the next day as our entry price at C$6.28. The stock also closed at $6.29 the following Monday.

First Majestic - - TSX/NY:AG - - - Recent Price - C$7.79

Entry Price - $6.28 - - - - Opinion - buy

September 10th AG announced a 10 million share buy back. Although we are already up +24% in a few days, the stock is till cheap and way below its $25 highs in 2021, so why I still have as a buy.

I commented that I expect we could see $3,000 gold this year or early 2025. We are getting closer.

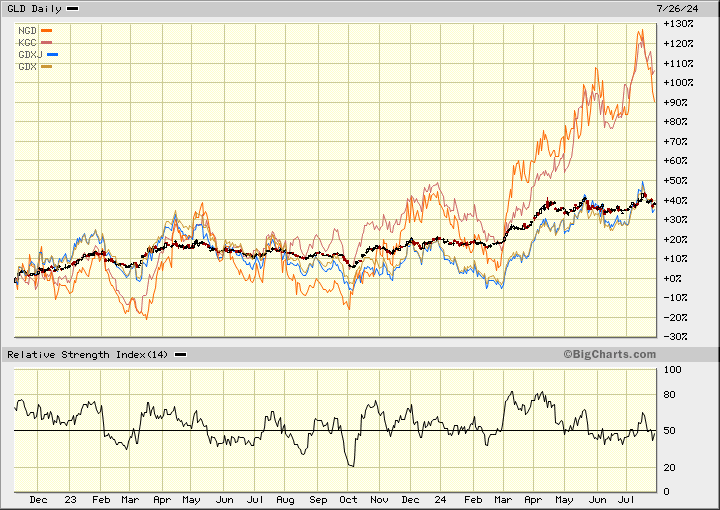

This next chart is from November 8, 2022 when in my 'All is Golden Report' I called the bottom in gold. I am comparing to gold stocks, the GDX and GDXJ etfs. Also Kinross and NewGold.

We can see that gold stocks have caught up to gold with the two etfs. I want to highlight why it is important to be a stock picker and my experience is something you can benefit from. Kinross and NewGold are two of my picks among many that have outperformed the market. I did not pick these stocks at the bottom in November 2022 but in 2023 and early 2024 before they took off.

From our buy price, we are up 109% on Kinross and 51% on Newgold. The average gain of my 11 gold producer stocks so far this year is +68%. We are beating the benchmarks by a long shot with GDX just up +37% and GDXJ only up +33% so far this year. Like I said a couple times in the past few months, we could have another one of those triple digit gain years.

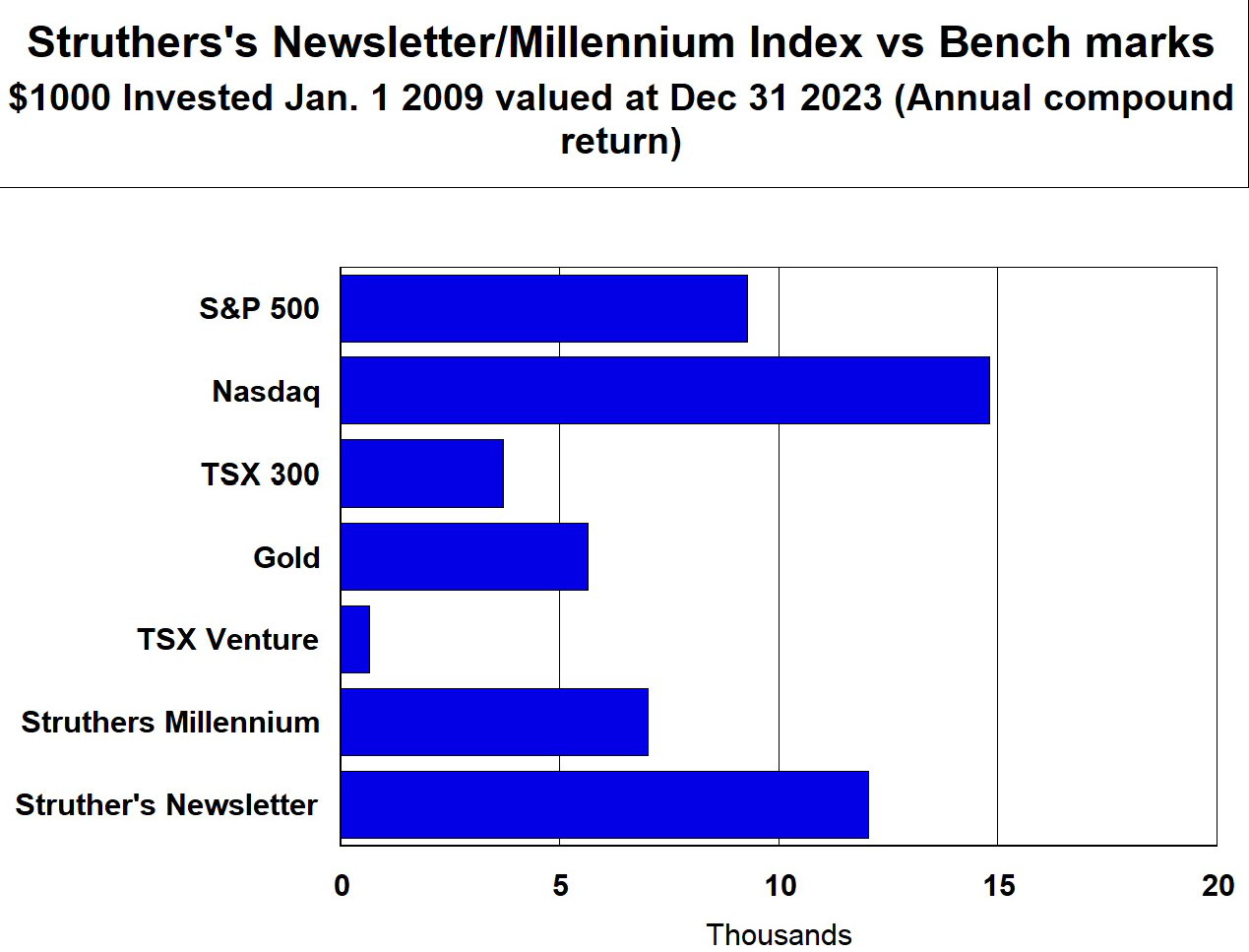

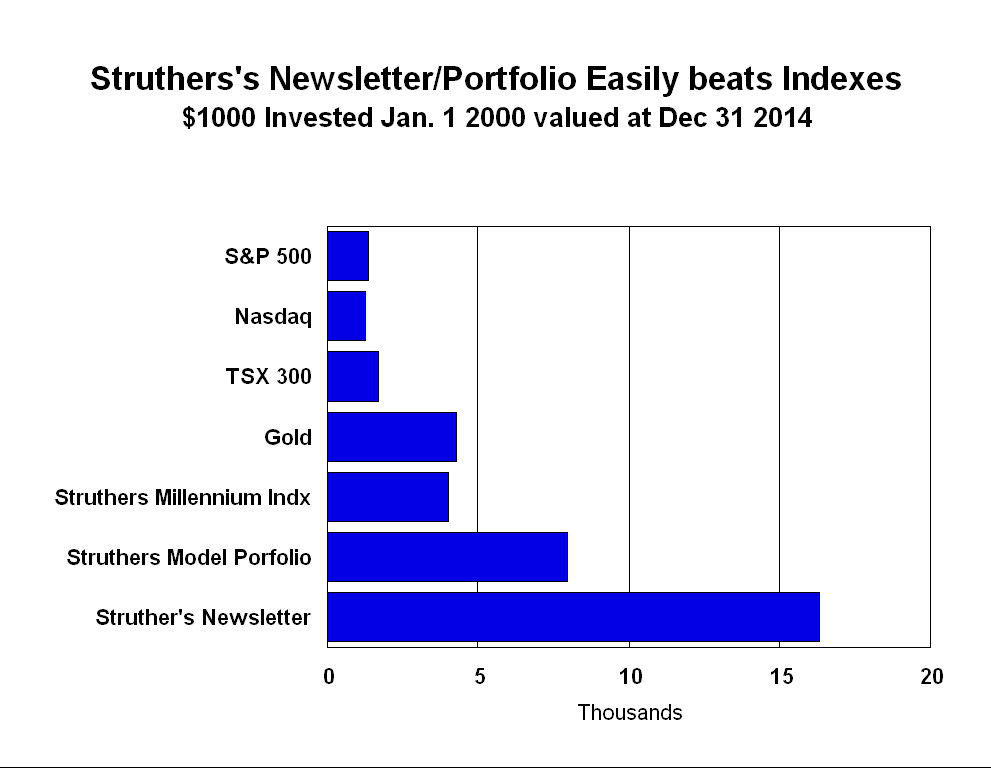

Above is my long term performance to benchmarks as I just got them up on the new website. My newsletter has a much higher weighting of gold and resource stocks as compared to tech stocks. With the recent tech bubble, for the first time the Nasdaq has pulled ahead as it was up +43.4% in 2023. I would bet that performance reverses at the end of 2024 numbers. I might add our tech stocks were up +27% in 2023 but it does not have a big impact on the newsletter average. My other comparison is 2000 to 2014, a better period for resource stocks.

New Gold - - TSX/NY:NGD - - - Recent Price - C$3.89

Entry Price - $2.55 - - - - Opinion – hold, new target $5.00

The stock hit 6 year highs today with an update on its ongoing Rainy River exploration program. Over the first eight months of 2024, exploration drilling at Rainy River has proven successful in advancing the Company's exploration objectives to expand existing resource envelopes, confirm the continuity of potential new mining zones, and grow the mineralized footprint through new near-mine discoveries. These results are expected to have a positive impact on Rainy River's mineral resource estimate at year-end 2024.

Underground Drill Highlights

Intrepid Strike-Extension drilling highlights:

3.26 g/t gold and 7.22 g/t silver (3.32 AuEq) over 7.5 metres core length (6 metres estimated true width) in Borehole RR24-2011 including:

6.09 g/t gold and 9.60 g/t silver (6.17 AuEq) over 1.5 metres core length (1 metre estimated true width)

4.44 g/t gold and 38.05 g/t silver (4.78 AuEq) over 4.3 metres core length (4 metres estimated true width) in Borehole RR24-2005 including:

8.83 g/t gold and 46.90 g/t silver (9.24 AuEq) over 1.5 metres core length (1 metre estimated true width)

ODM East down-plunge drilling highlights:

2.59 g/t gold and 3.10 g/t silver (2.62 AuEq) over 13.50 metres core length (11 metres estimated true width) in Borehole RR24-2001 including:

5.47 g/t gold and 5.13 g/t silver (5.52 AuEq) over 4.50 metres core length (4 metres estimated true width)

17 East drilling highlights:

4.09 g/t gold and 31.42 g/t silver (4.37 AuEq) over 7.6 metres core length (6 metres estimated true width) in Borehole RR24-2003B including:

8.19 g/t gold and 74.76 g/t silver (8.85 AuEq) over 2.20 metres core length (2 metres estimated true width)

New gold mineralization intersection at Gap Area Target:

3.59 g/t gold over 4.50 metres core length (3 metres estimated true width) in Borehole RRUG24-0007 including:

7.65 g/t gold over 1.50 metres core length (1 metres estimated true width)

The stock is still way below it's 2016 high around $7.80, it should have no problem seeing $5 this year.

The market rotation is intensifying and money is coming back into the precious metal sector. It is has picked up from a trickle to a steady stream, but there is tons of upside room left. You won't want to miss my next gold and/or silver picks.

On the HUI gold bugs index, I have been commenting that we need to see a clear break above 330. That is coming soon and than above the 375 2020 highs. Take note that gold barely got over $2,000 back in 2020.

Bitcoin has been flirting with $58,000 plus a few times this week and seems to be struggling to go much higher. I am worried about poor September markets so am suggesting to sell our long ETF position on IBIT around $33.24. We bought at $31.45 so a decent 5.6% gain in less then a week.

The Bitcoin IBIT etf buy just went to paid subscribers Monday.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.