Welcome and thank you to the new smart, savvy and contrarian investors who have joined my substack. I am still very small here so please share and subscribe

Election BS

On the Canadian election, I wanted to mention the corrupt BS going on. In Poilevre's riding, 81 rogue candidates have been approved to run against him. And yes it was in main stream media, probably on the back pages of their web site. Can you imagine going to the voting booth with a ballot dragging on the floor and you have to go through over 81 names to find Poilievre on the list. Is this election interference?

And Canada has done nothing to combat other election interference. A warning came Monday from the Security and Intelligence Threats to Elections (SITE) Task Force, whose officials detailed how foreign state actors, are likely to use so-called “hack-and-leak” operations, generative AI, and social engineering to undermine confidence in Canada’s democratic process. And we all know who's side China is on.

How do you win the election in your riding? All you need is buses to load up with foreign students. Former Liberal MP Hang Dong plays dumb LOL. And how many trips did the buses make? And remember, you don't have to show ID that you are a Canadian citizen. Simply two pieces of ID that you reside in the riding you are voting in, like a Student ID and utility bill. Yes that is all, check it on Elections Canada website if you wish.

Go Gold and TSX Venture Close to Breakout

Goldman Sachs has just upgraded their 2025 year-end gold forecast from $3,300 to $3,700 per troy ounce, reflecting what it sees as a structural realignment of demand across three axes:

central bank accumulation;

ETF inflows linked to rising recession probability;

and investor positioning driven by macro volatility.

Remember, the news about all the physical gold moving from London to the US and mainstream was blaming tariffs. I said all along it was bullion banks and some hedge funds. They always make sure they do their buying before they come out with the bullish reports.

The gold producer stocks took at two day plunge and quickly recovered. However, the TSX Venture index really got clobbered in the mini crash, falling about -14% in about a week, I suspect many retail investors had margin calls and had to sell almost anything. The index was pushing on resistance again around 650, but because the crash did not bust through. As I have been commenting for some time, I want to see a close above 660 as a solid breakout and that would be a new high going back almost 3 years. I have no doubt it will happen, but the three year wait has been pure anguish.

Greenbriar - - - TSXV:GRB OTC:GEBRF - - - Recent Price - $0.52

Entry Price - $0.77 - - - - - - - Opinion – buy

Some very good news today. The Puerto Rico Energy Power Authority ("PREPA") has formally approved a settlement agreement with the Company's wholly owned subsidiary PBJL Energy Corporation ("PBJL"), and approved the pricing terms. PBJL will receive a rate of USD $0.0985 per kwh, with increases of $0.005 per year capped and/or never to exceed USD $0.115 per kwh. This is a very good rate, converting to Mwh it would be $98.50, at the top of the chart below. This is a reflection of the high electricity prices in Puerto Rico.

The agreement has now been submitted to the Puerto Rico Energy Bureau ("PREB") to continue with the approval process and, only if eventually necessary, to the Financial Oversight and Management Board ("FOMB").

One step closer to finally getting this project built. I would say that PREPA has been the slowest hurdle. Greenbriar has a project level lender who can provide debt financing for this project at the non-dilutionary project level. The project is 80 MWac and sized at 160 MWdc to annually produce 280 million kwh per year with a minimum contract life of 25 years. The US Federal Government provides a fully fungible 30% federal tax credit with an additional 10% to total 40% of the total capital costs if at least 40% of the materials are US made.

The chart looks very good. A triple bottom is in and a wedge pattern has formed. A close at $0.85 would be a break out of the wedge and a higher high. That would be a very bullish signal, but meanwhile we can accumulate at these lower prices.

Zonte Metals - - - - TSXV:ZON, OTC:EREPF - - - -Recent Price - $0.06

Entry Price - $0.09 - - - - - - - Opinion – buy

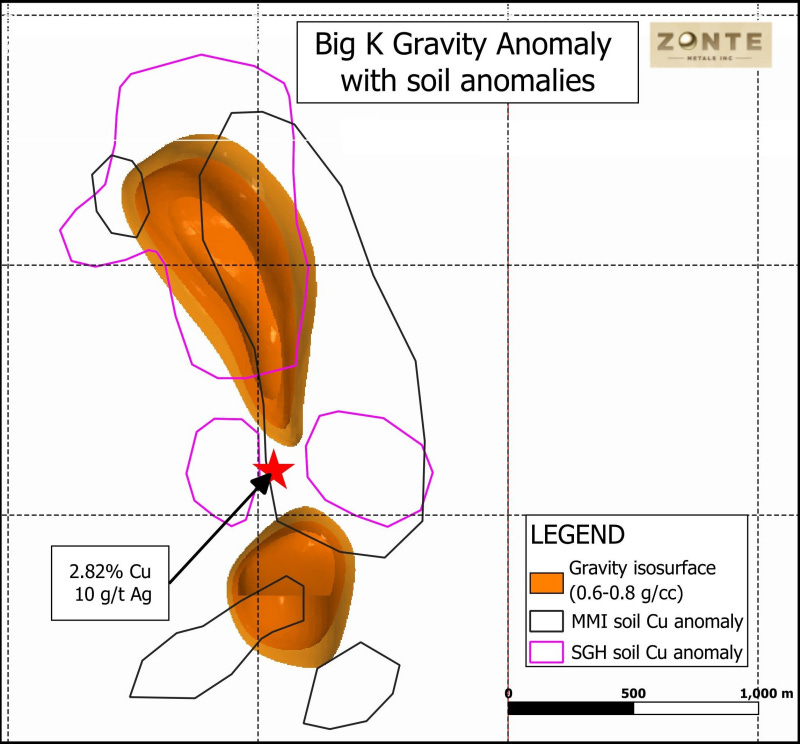

It has been a very frustrating 3 years for junior explorers, but Zonte keeps on advancing Cross Hills and it is a very strong project with yet another strong drill target identified. Big K (Nine Mile) is the 7th large anomaly outlined to date:

Discovery of two gravity anomalies within the target, extending the total length to 2.2km.

The largest gravity anomaly measures 1400 x 600m and 840m deep.

Above the anomaly, a bedrock copper showing returned 2.82% Cu and 10 g/t Ag.

Gravity anomalies are coincident with copper-in-soil anomalies.

Terry Christopher, President and CEO, commented: “The recent gravity survey, which covered the southern extension of the previously discovered Big K target, identified two closely spaced anomalies extending over a 2.2 km strike length. These gravity bodies, located approximately 40 to 60 meters below the surface, coincide with Cu-in-soil anomalies and known bedrock copper mineralization. A previously discovered copper vein, which returned 2.82% Cu and 10 g/t Ag, was found at the surface above the gravity targets. It is postulated that this surface copper mineralization was pushed up through the capping rock from a deeper source. The strong correlation across all exploration techniques highlights the high-priority nature of this target.”

The stock down at $0.06 is at the bottom of it's trading range and did get over 10 cents in late 2024. It needs to close at $0.11 to signal a breakout.

Giant Mining —— TSXV; BFG, OTC:BFGFF - - - - Recent Price - $0.32

Entry Price - $0.45 - - - - - - - Opinion – buy

BFG said today that drilling surpassed 1,000 feet (304.8 meters) at Hole MHB-34 which is the third of five holes of the 2025 diamond core drilling program, currently underway.

David Greenway, CEO of Giant Mining, commented: "We are excited about the continued success and efficiency of the geological and drilling team during our ongoing drill program. This is another step toward advancing Majuba Hill toward our ultimate goal of a new NI 43-101 mineral resource estimate. The scale and potential of this system continue to impress and the entire team at Giant Mining has never had more conviction in advancing Majuba Hill toward its true potential.”

The stock is posed for a move up, and some decent drill results could do it.

Paid Advertisers at playstocks

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.