Election Crash Warning, Gold, Gold Stocks, BTO, Taxes by Country

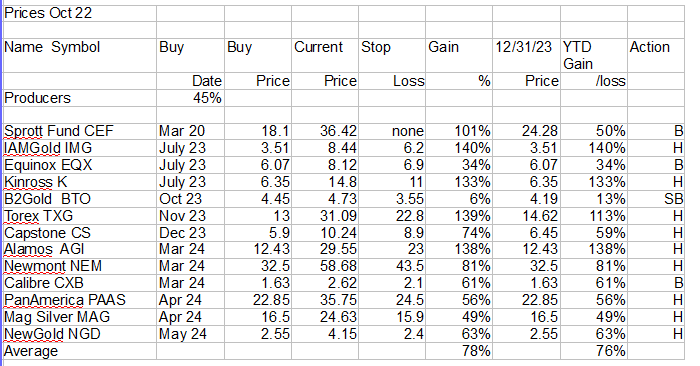

Welcome and thank you to all the new, smart, savvy and contrarian investors to my substack. I have 40 years experince investing in precious metal stocks. I also spent 30 years at IBM so have a good tech background. I can give investors great insights. Currently my 12 PM stocks are up 76% this year alone, about double the benchmarks like GDX and GDXJ. Please share and subscribe.

Election Crash Warning

I have been commenting that this U.S. election will be like no other and things I am discovering about shenanigans going on are very disturbing. No matter what side appears to have won, I expect there will be legal battles galore, recounts, demonstrations and even civil unrest. I am leery about talking about this and don't want to appear as for one side or the other. I am just very worried the turmoil could results in a severe market down turn, even a crash because values are so high.

Please hear me out for you own sake as an investor- Raise CASH

Here are a few disturbing things I have discovered.

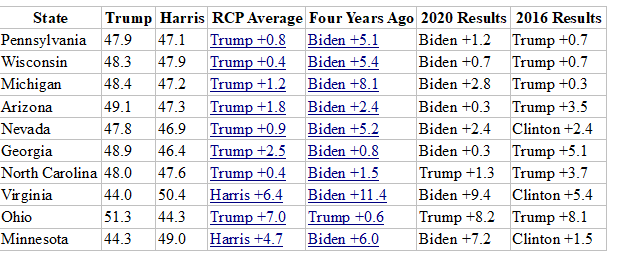

Trump keeps rising with polymart today has Trump odds of winning at 64% and Harris down to 36%. On Real Clear polling (which is an average of all polls), Trump is now leading in all the battleground states except Minnesota. Interesting chart that compares to last two elections. Note that in 2020 Polls had Biden way farther ahead than what the actual results turned out to be. This is the Democrat bias in the polls I talked about a number of times.

What does this mean? The Trump lead and the amount is unprecedented and if he loses, the far right and Republicans will go ballistic. All claiming election fraud and I can understand why, especially with the other things going on.

The Head of Operations of the leftist British Labour Party, Sofia Pattel now in government after 14 years of being the opposition, declared in a LinkedIn post that she is organising a party of 100 staff members to be sent to swing states in the US to campaign for Kamala Harris, prompting charges of election interference.

How can anyone be so dumb to post obvious election interference on social media? The post was later removed but perhaps they are so bold because they believe they are above the law.

There is an organization called Stop Bogus Ballots. They are a group of technology innovators, seasoned investigators, legal street fighters and concerned citizens, coming together to provide actionable, documented evidence, on a continuing basis, to stop election interference via broken mail-in ballot processes.

Their objective is to wake up America to the harm caused by unfettered mail-in ballots to anomalous addresses – enabling organizational, disciplined election interference.

They use Fractal Computing technology that enables them to take State voter rolls, property tax rolls, and other databases, and reconcile them in real-time to find data anomalies. They combine these results using Similarity Search technology which was first developed for the TSA No-Fly List.

Here is an example what they found in Wisconsin they took the 774,076 voter list and removed inactive that brought it down to 380,050 and of those:

2,,777 permanently moved out of state

2,325 address not deliverable and not found in the USPS database

7,571 incorrect or missing secondary (missing APT #5 for example) 513 door not accessible

976 single receptacle drop for mail for all residents at same physical address

97 No secure location at all to leave mail

13 Registered to a US Post Office street address

1,251 vacant for more than 90 days (person not rec. mail for more than 90 days, not necessarily an empty house)

31 Registered to a commercial address such as a UPS, Fedex store

3,408 Duplicates

275 Moved but left no forwarding address

168 At high rise building but not housing

442 Identified as a business location, but not commercial

10,877 Not all components of the address match up to what is in the USPS database

They found 30,724 discrepancies in total. Even if they are only half right, it could easily sway results for a Democrat win in these close battle ground states. I say Democrat because for strange reasons they get 80% to 90% of mail in ballots. It begs a question who is requesting ballots for people who have moved, requesting duplicate ballots be sent to an address, requesting a ballot to an undeliverable address and other discrepancies?

And then there is all the other States. And for strange reasons any attempt to rectify these problems is met with Democrat law suits claiming it restricts voter freedom. I won't even get into the issue of sending illegal immigrants and refugees to battleground States. This is another problem because of lack of voter ID.

Now just one more thing that very few have thought or know of. Even if Trump wins the election he might not be President in January 2025. Real Clear Politics has the House as a toss up. If Democrats win the house, they could enact a resolution that Trump is an insurrectionist and disqualify his electoral votes under Section 3 of the 14th Amendment.

From what I have learned about this scenario from Jim Rickards newsletter, has a U.S. legal background is Kamala would not have 270 Electoral votes needed to win. This would throw the election of the president to the House of Representatives voting as state delegations, not as individuals. Under the XII Amendment, only Kamala Harris could receive votes for president assuming Trump was disqualified, and no other candidate won any electors at all. You could end up with Harris as president and JD Vance as vice president. What would the market think of that? One thing for sure and that is uncertainty.

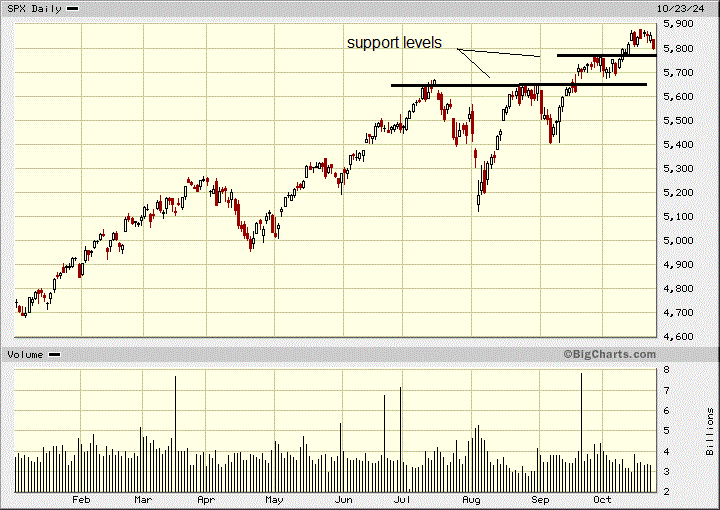

I hope everything goes well and above board with this election, but I think it is prudent to raise some cash. If markets sell off big, it would probably take gold down some too. We can buy back cheaper. The market has been edging lower the past week. Here are the support levels I see.

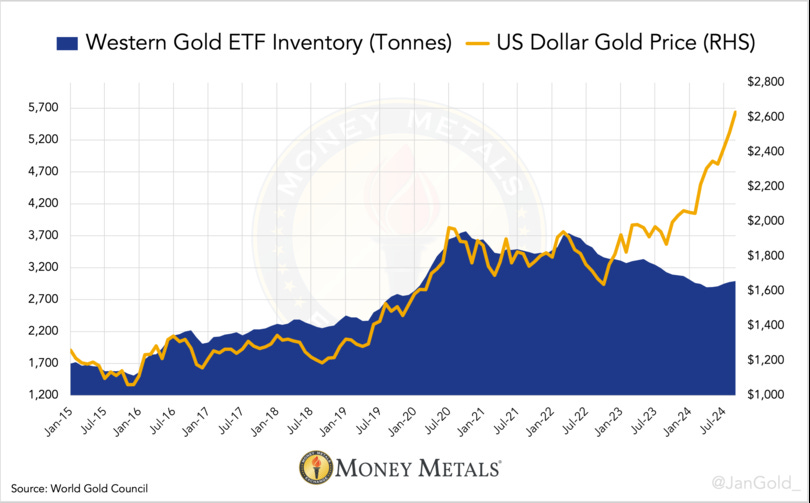

An interesting chart from Money Metals. I have recently highlighted the flow into the Gold ETFs and this puts it in perspective. As you can see the flow into the ETFs is very small so far, barely noticeable on the chart. The last time money came into the Gold ETFS in 2018 to 2020, gold ran from about $1,300 to $2,000.

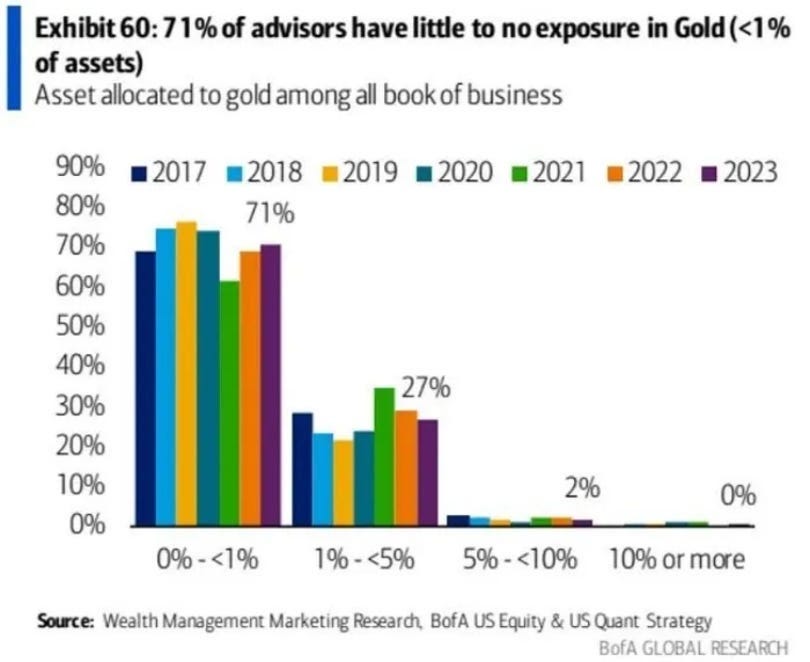

I have shown the BofA chart before but it is worth highlighting given the small inflow noted above. In 2023, a survey by Bank of America (BofA) indicated that 71% of U.S. investment advisors recommend a gold allocation between 0 and 1%, which is diddly. Their recommendation hasn’t changed and now we have consumer price inflation has since risen to multi-decade highs, two wars and U.S. fiscal policy has out of control.

In a June 2024 survey among North American investors by the World Gold Council (WGC), some institutions that didn’t own any gold said one of their barriers was that “other large institutions are not investing in gold.” However the survey showed more institutions have bought gold since 2019, although most are small allocations. 60% of respondents believe that gold tends to deliver less than sparkling long-term returns compared with other asset classes. This, despite it having outperformed US equities over the last 25 years with its 8% average annual return

Wall Street is very underweight gold, and could be a price driver when they get on board and allocate more of their portfolios to gold.

A few days ago, I commented on the strategist at BofA, on gold and they also said “With lingering concerns over U.S. funding needs and their impact on the U.S. Treasury market, the yellow metal may become the ultimate perceived safe haven asset,” BofA wrote.

Gold and silver are having a healthy correction today. They cannot go straight up but it provides better buying levels. Here is our precious metals stock list at yesterdays close with best buys.

I see Equinox and Calibre as good buys and of course yesterday's Coeur Mining. B2Gold is the strong buy and the bargain is highlighted on a long term chart.

B2Gold will have their Goose Mine come on stream in 2025 that will substantially add to production, cash flow and profits. It is a very high grade mine.

In other news the U.S. economy faces continued challenges, especially relating to future business conditions, according to a monthly series of indicators. The leading economic index published Monday by the Conference Board fell 0.5% in September, furthering a decline booked the previous month and dropping a little faster than economists had expected. The indicator has declined almost every month since early 2022.

Weakness in factory orders and consumers' outlook for the months ahead dragged the index lower, said Justyna Zabinska-La Monica, senior manager for business-cycle indicators at The Conference Board.

It is going to be interesting to see how the economic numbers come out after the election propaganda numbers are no longer required.

A subscriber sent me this video and it is so good I loaded up on my you tube channel to share. Send to friends if you like it. It is kind of funny, but not so much in your Canadian. And unfortunately true.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.