I hope everyone has a great long weekend. Next Tuesday all the traders will be back to their desk from summer holidays and lets see if September holds up to it's reputation as the worst month for stock markets.

Next week, I will also have a special report 'Canada Real Estate Bubble Pops, Pushing Canada into 3rd World Status Economically'. For paid subscribers only and critical for Canadian investors.

It never ceases to amaze me what the government (Democrats) will do to stop Trump. This is the first time I ever heard of such a ploy but some of the Battleground states are refusing to remove Robert Kennedy Jr, from their ballots.

Michigan - a key battleground state, said it was too late for Kennedy to withdraw as the nominee of the Natural Law Party.

Wisconsin - whose Elections Commission voted 5-1 on Tuesday against removing his name, citing a law which says "any person who files nomination papers and qualifies to appear on the ballot may not decline nomination."

Colorado - also refused to remove Kennedy's name.

I have never heard of this before, but as I have been commenting, that this is the weirdest, wildest and most unpredictable election ever. It really is the year of uncertainty. You can listen to what Kennedy’s running mate, Nicole Shanahan had to say in this interview.

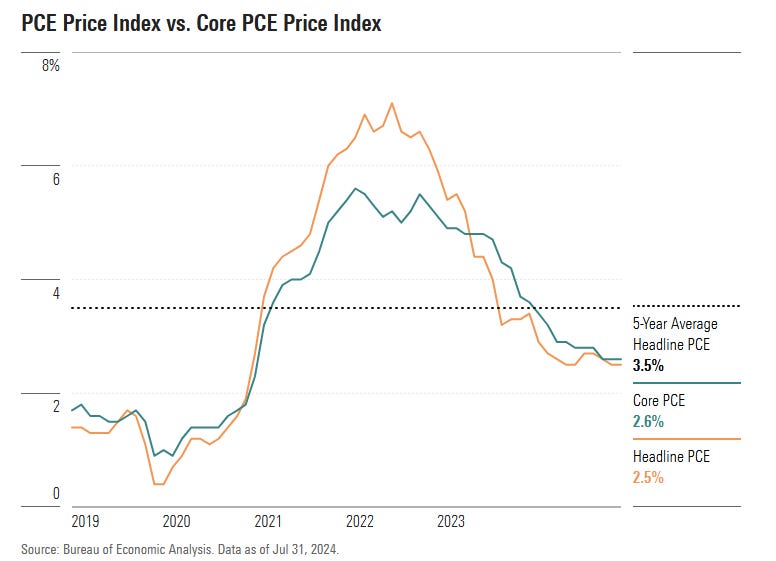

PCE, the Federal Reserve's preferred measure of inflation ticked up in July as the central bank considers its first interest rate cut in over four years. The Commerce Department reported that the personal consumption expenditures (PCE) price index rose 0.2% for the month, up 2.5% from a year ago, matching expectations.

Excluding food and energy, core PCE also climbed 0.2%, with a 2.6% annual increase, slightly below the 2.7% estimate. Personal income rose 0.3%, beating the 0.2% forecast, while consumer spending increased by 0.5%, as expected.

I don't believe inflation is coming back down to 2%, it has been hanging a little above 3% and core PCE a little below 3%. We are in a period of stagflation which is slow economies and rising inflation. Odds are that inflation is more likely to uptick again.

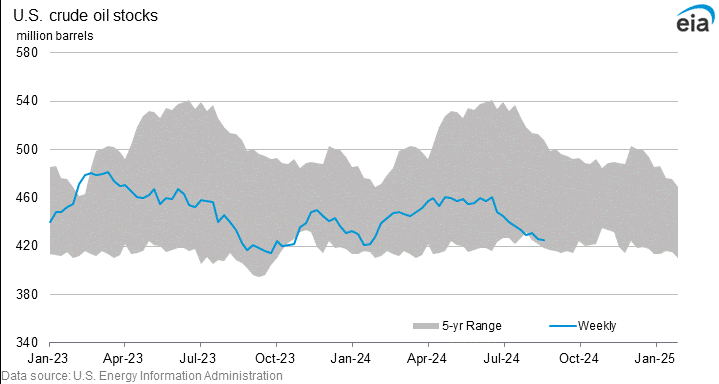

They say the stock market is going up because fears subsided of a weak economy, but oil prices are weak because of fears of weak demand from a weak economy. Which one is right? What I do know is oil inventories are dangerously low and still in hurricane season. Middle East conflicts continue to rise. Red Sea Insurance Surges on Sinking Tanker. After Houthis attacked the Greek-flagged Sounion tanker in the Red Sea last week, still leaking into the sea, the cost of additional war risk insurance for ships sailing through the Red Sea more than doubled to 1% of the vessel’s value from 0.4% before the attack.

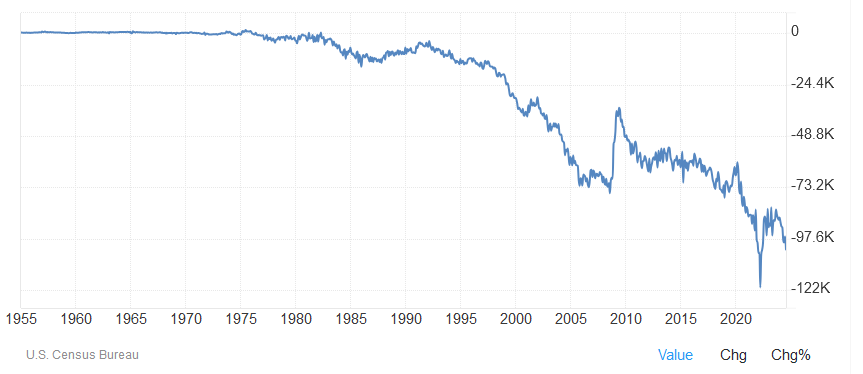

The U.S. trade deficit in goods widened sharply to highest level in more than two years. U.S. July trade imbalance up 6.3% to $102.7 billion. Imports expanded by 2.3% from the earlier month to $275.6 billion, which is a sign of healthy demand. However, long term, the U.S. is becoming more and more dependant on foreign supplies at a time of uncertain supply chains.

Copper Juniors - - Developments with 3 of our copper explorers

Giant Mining - - - CSE:BFG, OTC:BFGFF - - Recent Price - C$0.38

Entry Price - $0.80 - Opinion – strong buy at $0.30 and lower, average down to $0.45

I hope some of you took profits on that pop higher. Time to buy back? The stock is down because a financing at $0.20 becomes free trading next week. Maybe some shorting ahead of that. There was 15.4 million shares in that financing. I don't know how many will sell, but I think we can count on a few million at least. I would just try bids below market.

Midnight Sun - - - TSXV:MMA - - - - Recent Price - $0.28

Entry Price - $0.27 - - - - Opinion - buy

The Zambian Ministry of Mines and Minerals Development has published a decision on its website indicating Midnight Sun Mining Corp.'s renewal application for large-scale exploration licence 21509-HQ-LEL, which hosts the Kazhiba Dome target, has been rejected. This licence is one of three which make up Midnight Sun's Solwezi project and the current status does not affect the other two licences, the Kobold earn-in agreement or the co-operative exploration plan under way with First Quantum.

MMA applied for the renewal of the license and under law the government is required to notify them if rejected, there is any issue, or more info required etc. The company is then given a period to rectify any issues. They did not notify MMA. The company has received legal advice that until the formal rejection is received, the company retains its rights to the licence.

Interesting is that the Zambian website indicates a new license was give to a new entity. One thing I have learned in mining is that seldom a major discovery is made without some kind of legal shenanigans to try and get a piece of it. Most of these attempts fail but are tried because of the huge potential for gain. It is also possible this is a planned move by short traders.

Midnight Sun president and chief executive officer Al Fabbro states: "While we are disappointed in the current situation, we do believe it will be rectified and we are taking all possible steps to expedite a swift resolution so that we can resume our exploration at Kazhiba. In the meantime, we will launch our plans to work on Mitu, continuing with our co-operative exploration plan with First Quantum to define potential oxide copper feed sources for Kansanshi. At Dumbwa, KoBold has been working diligently compiling all available geological data and refining their work plan. We are excited for KoBold to begin systematic exploration of this large-scale target."

The stock has given up all it's gains and while frustrating, it is a buy opportunity. It ran up in price because of the Kobod and the First Quantumm deal and those licenses are not affected.

Element 29 Resources - - - TSXV:ECU - - - - Recent Price $0.27

Entry Price $0.63 - - - - Opinion - buy

Things have been quiet with ECU in the past 2 years during a period of severe weakness in the junior market. Now they have money, but I am going to wait to see what exploration plans are and will probably suggest a strong buy and averaging down then.

ECU closed a non-brokered private placement financing of 13,058,984 units at a price of 25 cents per unit for aggregate gross proceeds of $3,264,746. Each unit issued under the financing consists of one common share in the capital of the company and one non-transferable common share purchase warrant. Each warrant is exercisable for one common share at an exercise price of 50 cents per warrant share until Aug. 29, 2027.

They have an advanced copper discovery that will get attention in this better copper market.

Their Elida project is a newly discovered, large copper molybdenum porphyry cluster in west-central Peru, located 85 kilometres inland from the coast at a moderate elevation of 1,600 metres and is road accessible with excellent infrastructure for potential mine development and operation.

Phase 2 drill program on the Zone 1 copper deposit with hole ELID032 intersecting 404.5 metres ("m") of 0.45% copper ("Cu"), 0.032% molybdenum ("Mo"), and 3.6 g/t silver ("Ag"), for a 0.55% copper equivalent ("CuEq") grade, including 123.0 m of 0.52% Cu, 0.036% Mo and 4.0 g/t Ag (for 0.63% CuEq) starting from the bedrock surface at 45.5 m depth. The hole ended in strong copper mineralization grading 0.75% Cu, 0.032% Mo, 7.2 g/t Ag (0.87% CuEq) showcasing the robust mineralized system.

There is a significant initial mineral resource estimate at Elida of 322 million inferred tonnes grading 0.32% copper ("Cu") (for a total of 2.24 billion pounds of contained copper) plus 0.03% molybdenum and 2.6 g/t silver.

There is a new uptrend in place as the stock broke out in June on news of new directors to the board. This is some serious new blood into ECU and no doubt these professionals see the huge potential that I do.

Significant strong leadership added.

Brad Mercer is a professional geoscientist who retired in 2022 from his executive role as chief operating officer for Capstone Copper Corp. after 17 years of service and helping to build Capstone from a $20-million into a $5-billion company.

Chet Idziszek has over 40 years of experience as an exploration geologist and junior mining company executive during which time he has won several prestigious exploration awards, including the Prospector of the Year award from the Prospectors & Developers Association of Canada in 1994 for his roles in the discovery of the Eskay Creek gold-rich volcanogenic massive sulphide deposit in Northern British Columbia and the Cobre Panama porphyry copper deposit in the Republic of Panama.

Mary-Carmen Vera is a Peruvian geological engineer and member of the board of directors for the PDAC with extensive experience in the development and management of ESG (environmental, social, governance) and sustainability best practices for the mining and mineral exploration sectors.

Paid Advertisers at playstocks

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.