Election – The Year of Uncertainty, Fed, Gold, Oil, TXG, BFG

Welcome and thank you to all the new, smart, savvy and contrarian investors to my substack. If you like outside the box thinking, a humble analyst that has spent his career studing market and economic cyles, someone not afraid of controversial topics and can be a bull and a bear, your at the right place.

Markets seem pretty complacent as September nears. I expect we might see a double top in the S&P 500. The big event this week is Wednesday with Nvidia the AI leader reporting quarterly results. With this AI craze the focus has been on revenue growth but it has been a black hole of expense and energy consumption. There is no clear view of how to profit with AI. Maybe the markets come to grip with this in September?

For 2024, I predicted there would be lots of uncertainty with wars and the US election. I predicted the first half of the year would be best for general equities. It certainly has and I have been commented last couple months to sell out and book profits for the year. I predicted weaker economies but inflation remaining. So far playing out on script. I expected stronger oil prices with war and this is one prediction has not panned out yet, but certainly is strange. I predicted new record gold prices and although this is very obvious, most investors are in disbelief. Let me touch on these topics/predictions for the current state of affairs.

Election Uncertainty Like No Other.

I expected Biden would be replaced but I am stunned they could not do any better than Kamala Harris. I really thought the Democrats would pull a rabbit out of the hat, but instead they just rigged a bad trick. I predicted Trump might be assassinated and it was just pure luck he was not, turning his head at the precise second.

I often comment, 'do as I do, not as I say'. Democrats criticize Trump for being against democracy and harp they are all for it when they prove in spades they are not. Harris is not a legitimate choice as no ballot was ever cast for her in a primary. And not only that, they would simply not allow Kennedy, a long time democrat to run in a primary. Harris is not popular and has no base of support, She was simply dropped in by the establishment with no democratic process, only because they could no longer hide the fact that Biden could not string together a coherent sentence.

The Joe Rogan Experience, compared Kamala Harris to a fifth-grader trying to fake a book report without having read the book. Not sure where I saw this comment, but I have to agree. “Kamala Harris remains the weakest Democratic presidential candidate since Walter Mondale.”

A bigger surprise and I did not see coming was Robert F. Kennedy Jr., himself and family long time Democrats switching to the Republicans and endorsing Trump. He sort of dropped out of the Presidential race, but again in a fashion never seen before. He will be withdrawing his name from 10 battleground states, but remaining on the ballot in other States. If he still gets 5% of the vote he would qualify to start a new party and he believes pulling from battle ground States will help Trump win.

I think it is important to listen and heed what Kennedy said:

“As you know, I left that party in October because it had departed so dramatically from the core values that I grew up with. It had become the party of war, censorship, corruption, big pharma, big tech, big ag, and big money. When it abandoned democracy by canceling the primary to conceal the cognitive decline of the sitting president, I left the party to run as an independent.”

He then gave the proof, how the Democrat Party subverted democracy under the lie of “saving” it.

“At the voting booth, the DNC waged continual legal warfare against both President Trump and myself.”

“It ran a sham primary that was rigged to prevent any serious challenge to President Biden.”

”Then, when a predictably bungled debate performance precipitated the palace coup against President Biden, the same shadowy DNC operatives appointed his successor, also without an election.”

I am not surprised Harris has a bump up in the polls, as it is quite common with a new candidate, a new breath of air, especially with Biden's pathetic showing. The legacy media has been harping about the polls, but what they don't tell you is the majority of polls stopped polling for 2 weeks to keep the high number for Harris locked in. After the fanfare wanes, I expect she will come down some and remember that Trump won in 2016 when he was way behind in the polls. And this time he is ahead. And remember that Harris previously polled as the most unpopular VP of all time.

Harris is benefiting from the short campaign, avoiding release of detailed policy ideas, which Trump could attack. She has the plausible argument that she wasn’t even a candidate until last month. She hasn’t been tested in spontaneous settings. All said and done, she is just more of Biden and the parties same policies of years past. More Bidenomics (just ditching that narrative), set prisoners free, abolish borders and continue with war.

However, the Harris campaign has said it has raised more than half a billion dollars, so have $$ behind them. They talk of more border patrol but it is really to facilitate more illegals. Democrats are trying to keep Ukraine alive so the inevitable collapse does not come before the election.

One has to wonder why the world's richest man, Musk backs Trump and now Kennedy. This is certainly a year of a very weird and unprecedented election process and it is not over yet. Logic would say that Trump will win, but I am not so certain, it really is the year of uncertainty. Keep in mind that only about 1/3 vote on election day, so the election will actually get started in mid September when absentee and mail in ballots start. I would expect the Democrats will be doing ballot harvesting like no tomorrow. We might not know results until weeks after the election. Seems technology is working in reverse when it comes to U.S. elections.

I follow elections because it is very important for the economy and investing markets. We know if Harris and the Democrats win it will be more of the same which has not turned out good. We know Trump would be good for oil&gas and might harm trade with tariffs. Harris support of contentious Biden policies on energy pipelines and bank mergers does not exactly bode well for the prospects for two key Canadian industries. Generally Republicans are good for the economy and markets with less tax and regulation. At the Bitcoin 2024 conference in Nashville, Trump made several promises to the Bitcoin community, that could benefit Bitcoin. However, I don't think it matters who gets in, the uncontrollable spending will continue and the inflation that goes with it. Go Gold!

Now for a twist. If the Democrats win the house and Trump wins the presidency, they could move to impeach him as an insurrectionist based on that past January 6th event. Weird times to say the least.

And more, as a federal judge on August 20 ruled that Robert F. Kennedy Jr. can continue to pursue his lawsuit against the Biden administration over censorship at the direction of the government. That’s a new one

I was talking with someone about Trump's assassination attempt and we believed he must be getting intelligence reports. However, he is refusing them. “I don’t want that, because as soon as I get that, they’ll say that I leaked it,” Trump continued. “So the best way to handle that situation is, I don’t need that briefing.”

“They come in, they give you a briefing, and then two days later they leak it, and then they say you leaked it.” Wow, he has come a long way in the political game since 2016.

Economics Weak with Continued Inflation

It has become obvious with the current government and Bidenomics, what I call 'the masters of economic data' the masters have gone to new extremes.

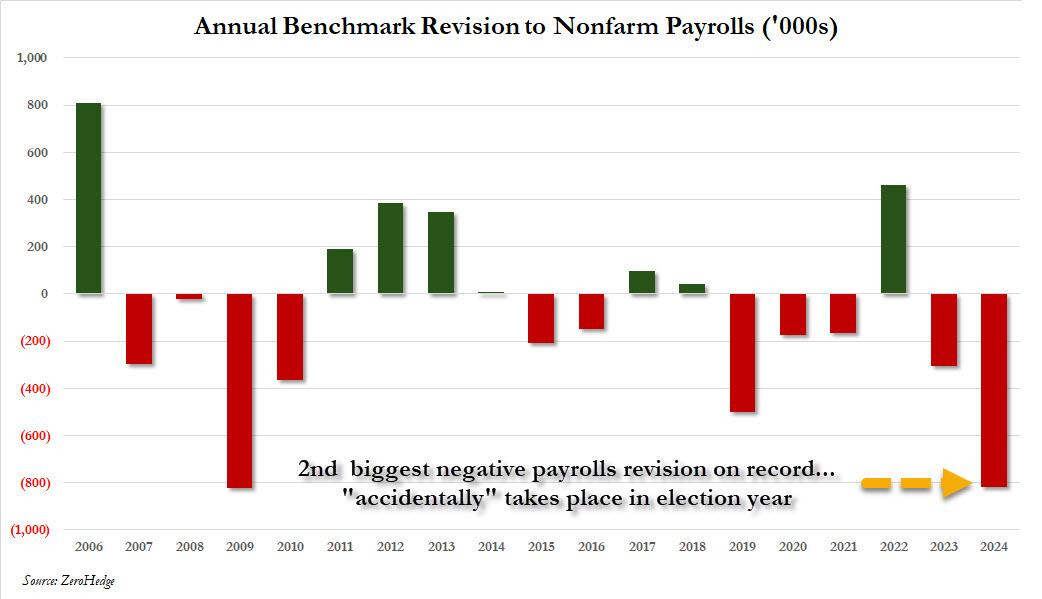

Every month good jobs numbers come out and previous months are revised lower. Last week we got the grand daddy of lower revisions. The number for the year March 2023 to March 2024 was revised down a whopping 818,000. This is the largest downward revision since 2009 after the financial crisis. At least back then they had the uncertain recovery after the 2008 crash. This time it is simply manipulation to print a better narrative than reality for election purposes.

You can't make this stuff up, simply stunning. Biden's Commerce Secretary Gina Raimondo – straight from the Democrat National Convention was asked about the record revision (important she is the Secretary of the Department of Commerce). You know responsible, for the Bureau of Economic Analysis - said she "doesn't believe" the revision because, somehow Trump was behind it. These people are so fixed on blaming Trump, they don't care if they sound like idiots. Then she was informed that the data comes from her own administration, the Labor Department's Bureau of Labor Statistics, Raimondo's response was simply stunning: "I am not familiar with that." Wow! The level of incompetence or lies is beyond believe.

I have been commenting for months on week economic data

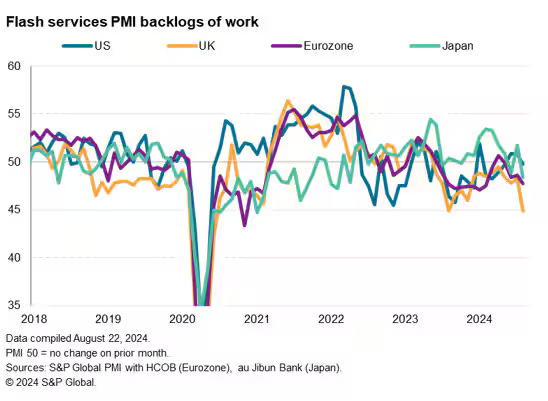

Last Thursday we got the Manufacturing Purchasing Managers' Index (PMI). It measures the activity level of purchasing managers in the manufacturing sector. A reading above 50 indicates expansion in the sector; below 50 indicates contraction. It came in at 48, below the 49.5 forecast.

And not just the U.S. Beneath the surface, the PMI data send some warning signals that growth is not as healthy as it seems. First, manufacturing is looking increasingly weak, as output fell sharply across the G4 as a whole amid slumping trade flows.

The big event last week was the Fed at Jackson Hole. Powell, probably worried about the economy, all but declared victory over price inflation, saying, “My confidence has grown that inflation is on a sustainable path back to 2 percent.”

He also insisted that a soft landing remains in play, saying, “There is good reason to think that the economy will get back to 2 percent inflation while maintaining a strong labor market."

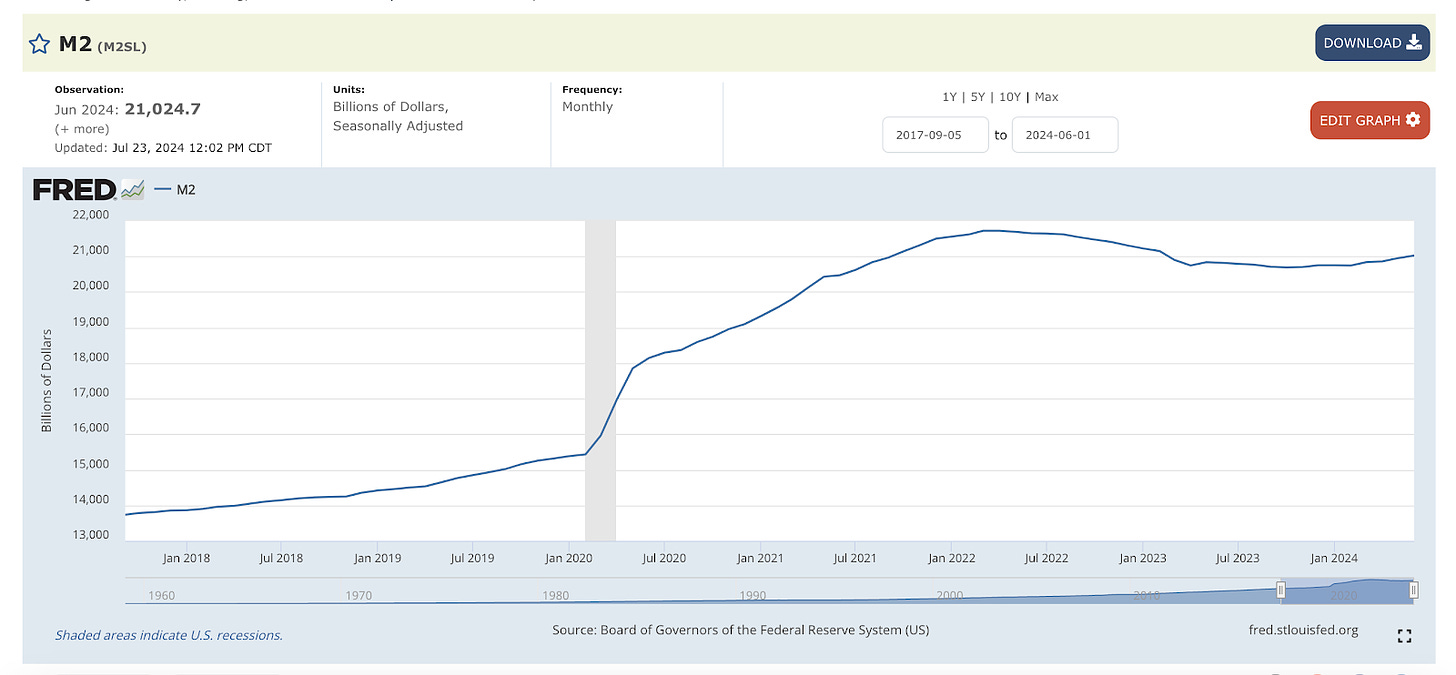

Meanwhile and quietly the Fed already started to ease monetary policy when it began slowing balance sheet reduction in June. Instead of allowing $60 billion in U.S. Treasuries to come off the balance sheet each month, it capped the runoff at $25 billion. Slowing and ultimately ending balance sheet reduction and lowering interest rates will increase the money supply, and the expansion of the money supply is, inflation.

The Fed never gets very far in the tightening cycle and the money supply is increasing again as we see above. QE will be next as the Fed will have to buy government debt. And remember, during the 2021 Jackson Hole speech, Powell doubled down on the “inflation is transitory” narrative. Now when he says heading back to 2% he really means we are accepting higher inflation.

LegalShield's Consumer Stress Index rose 5.8 points in July, the biggest single-month jump in over two decades. The index rose to 67.6, the highest level since November 2020 when governments shut down the economy during the pandemic.

LegalShield senior vice president of consumer analytics Matt Layton said, “The picture isn't as rosy as what the macro-level indicators would lead us to believe.”

According to LegalShield, the index “examines findings from approximately 150,000 calls received monthly from U.S. consumers seeking legal help,” and is comprised of three subindices: bankruptcies, foreclosures, and consumer finance. Once again, data out of reach from government adjustments paints a far different story than the official narrative,

Of course the biggest flashing signal of more inflation, too much debt, a weak economy that will invoke monetary easing is record gold prices. Most Central Banks are selling dollars and euros but buying gold. The US Central Bank is the only bank remaining trying to defend the dollar against gold. I thought they might try and push gold lower this weekend with thin August trading, but it is now a hopeless case for the Fed. They continue to push gold lower, but it has become a staircase of higher lows. Gold is up over $400 so far this year. So what if they lose on their gold shorts, they can just print the money.

Gold keeps stepping up higher and a price of $3,000 before year end would not surprise me, September into early next year are typically a strong period for gold prices.

There is still low North American investor interest and CBs have been the driving force but retail demand is getting stronger in Asia. India's gold imports from Peru in the first half of 2024 rose 81% from a year ago to $1.47 billion, Javier Manuel Paulinich Velarde, the Peruvian ambassador to India, told India Gold Conference.

BENGALURU, Aug 26 (Reuters) - Gold demand in India during the upcoming festive season is likely to remain robust, as the substantial reduction in import duty has made prices appealing, providing comfort to retail consumers and encouraging purchases, industry officials said.

India slashed import duties on gold in July to 6% from 15%, a step aimed at tackling smuggling.

Andrew Maguire in the U.K. is my favourite analyst on the gold and silver markets and I try to listen to all his episodes. The latest, 3 days ago here.

This year, TD Bank a big short player admitted they misjudged and were wrong footed. TD Bank commented who is the mystery buyer? I still don't think that many investors have caught on and understand this gold market. I speculated that $2150 to $2200 gold prices would wake up the market, but it was taken as a dream and disbelief. The market is awakening slowly because we have seen very strong moves in many of our gold stocks, but they are still way way undervalued compared to gold. Even so, I think we could see average triple digit gains with our gold stocks this year. Right now our 13 gold and silver producers have an average gain of +50%.

We have normal strong seasonal buying starting in September and than on October 22-24 at the BRICs summit we should see the announcement of the BRICs gold token.

I cannot stress enough and I think what many gold market players don't understand is that in January 2023 gold became a Tier 1 asset. Although many CBs believed gold was better than paper currencies, it became official when it was treated as equivilant with US$ and euros etc. That is when CBs started switching from paper currencies to gold in record amounts and it continues to this day.

Strange Oil Market

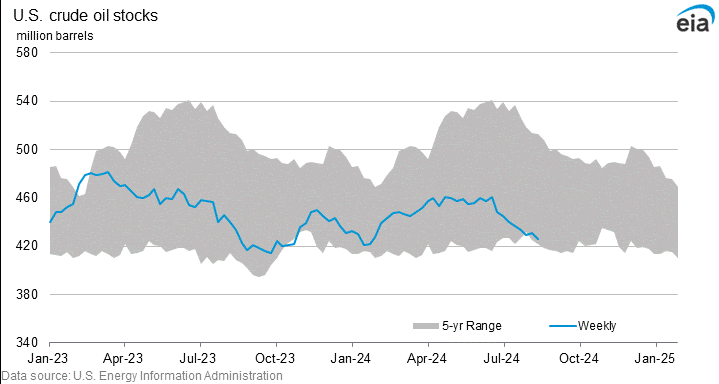

What has been strange is the oil market and I think it is intervention. Oil keeps getting knocked down in the face of escalating war in the middle east and U.S. oil inventories going lower and lower. Inventories now at 5 year lows.

The U.S. government is probably trying to paint inflation data. The only other explanation is that the oil market is predicting a bad recession that will lower demand. However, if this was true, why do we keep seeing these abrupt bounce backs whenever the price is steeply knocked down. Since end of May, oil has been abruptly hammered lower and then abruptly bounced back to where it was four times. This is an unusual trading pattern.

Perhaps oil prices will find their rightful level in a couple months when pre election inflation numbers are reported. I think we would need a significant world wide recession to effect demand much. It is still hurricane season and if one of them hits the Gulf with inventories this low, it could cause serious shortages.

September is the worst month for the stock market.

With so much uncertainty abound, I expect we could see a sell off. There are so many potential surprises that could hit the market.

Lets see how the market reads Nividia’s quarterly report Wednesday. A blow off peak or start of a sell off?

The United States is facing an unprecedented confluence of security threats, according to FBI Director Christopher Wray, who said the agency is deeply concerned about the simultaneous rise in terrorism, cybercrime, foreign election interference, and espionage activities by adversarial powers.

Speaking to reporters from The Associated Press at the FBI’s Minneapolis field office on Aug. 21, Wray said he’s “hard-pressed to think of a time” in his career “where so many different kinds of threats are all elevated at once.”

The BRICs October launch of a gold backed currency is probably deliberately been announced ahead of the U.S. election.

I don't think we could have anymore uncertainty or strange election related things because there has been so much thus far and it has not flinched markets.

There is a pretty good narrative that lower interest rates are coming, but that is already priced in. I am worried about September when all the traders are back at their desk. There may not be a obvious catalysts but maybe some selling will just bring more selling. Certainly gold is ringing an alarm bell about something. I am going to look for some ideas this week on the short side. For now a couple updates.

Torex Gold - - - - TSX:TXG - - - - - - - Recent Price C$26.60

Entry Price - $13.00- - - - - Opinion - hold

TXG reported very good Q2 results August 7th. Their Media Luna Project remains on track to deliver first copper concentrate production by year-end and to achieve commercial production in Q1 2025. Torex will have more than sufficient liquidity to fully fund the remaining project period expenditures. As at quarter end, they had total available liquidity of $346 million (including $109 million in cash), which is more than sufficient to cover the $224 million remaining on the project. It also maintains their strategic objective of $100 million of cash on the balance sheet.

On August 20, Scotia Capital analyst Eric Winmill hiked Torex Gold to "sector outperform" from "sector perform." He gave his share target a $1 (Canadian) boost to $27 (Canadian). Analysts on average target the shares at $29.17 (Canadian). Mr. Winmill says in a note, "With Torex Gold's Media Luna project build progressing well despite modest capex pressures and positive outlook for free cash flow in 2025E as Media Luna ramps up, we think the risk/reward profile for TXG shares looks increasingly favourable and supports our ratings change."

The stock just made 7 year highs and we are up just over 100%. I am in no hurry to taken any profits, this gold stock rally is just getting started. The stock is probably headed to test 2016 highs around $34.

With our copper juniors, Midnight Sun popped to highs in July and this month it is Giant Mining, perhaps September will be Zonte's turn.

Giant Mining - - - - - CSE:BFG, OTC:BFGFF - - - - - - - Recent Price - C$1.60

Entry Price - $0.80 - - - - - Opinion – hold

Speculation is building on drill results. Today they reported the first drill hole MHB-30 is at the lab and they showed a picture Copper Mineralized Fragments in Magmatic-Hydrothermal Breccia.

They also highlighted Drill hole MHB-31 with 9.5 meters (31 feet) Copper Mineralized Fragments in Magmatic-Hydrothermal Breccia. This hole was drilled in the gap zone between whittle pits 13 and 43. There has been no drill whole in between these pits so a hit here would be quite positive.

The stock is up 3 days in a row now so some consolidation would not be a surprise. However, there is a lot more drilling to come yet and assay results. We are also entering September, historically a favourable month for junior miners. We are at mild resistance and a nice 100% gain on the stock. I would not scorn anyone from taking a bit of profit, but I am in no hurry.

Although many of our oil&gas stocks are down. I wanted to mention

Birchcliff Energy TSX:BIR $6.15. Three executives collectively spent about $144,000 buying 23,600 shares. The main buyer was president and CEO Chris Carlsen, who bought 16,000 shares for just under $100,000. The other buyers were Robyn Bourgeois, Birchcliff's general counsel and corporate secretary, and Duane Thompson, its vice-president of operations.

I have said there are many reasons why insiders sell, but only one reason they buy. They believe the stock is going higher.

Paid Advertisers at playstocks

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.