As my first missive here, I will tell you a bit about myself, how I got started and ended up here. I started investing soon after I started at IBM in 1974. I bought into some gold stocks and caught that huge wave up in gold to 1981. It got me very interested and I took numerous investment courses, invested in stocks, bonds, commodity futures and future options. I made lots and loss lots, but learned lots.

At IBM I worked in customer service and as systems, business and inventory analyst. I honed very good analytic skills and was building my own stock and market charts before the internet was providing them. I made my first million investing after I retired from IBM and focused full time on investing. I became a multi millionaire, lost it (not all market related) and did it again. In a nutshell, I found a formulae that works.

Why this, why now

My friends and colleagues convinced me to start an investment newsletter back in the late 1980s, so I have been doing it over 30 years. I developed a large following in the early days on the internet, but it has waned away with age and little marketing. The majority of my followers are ones of 15 years plus and I figure I will only do this for another 5 to 10 years. I would like to get better known, especially among new millennial investors. It is sort of a last hurrah and I believe I can pass on a lot of knowledge I gained.

The Playstocks Table

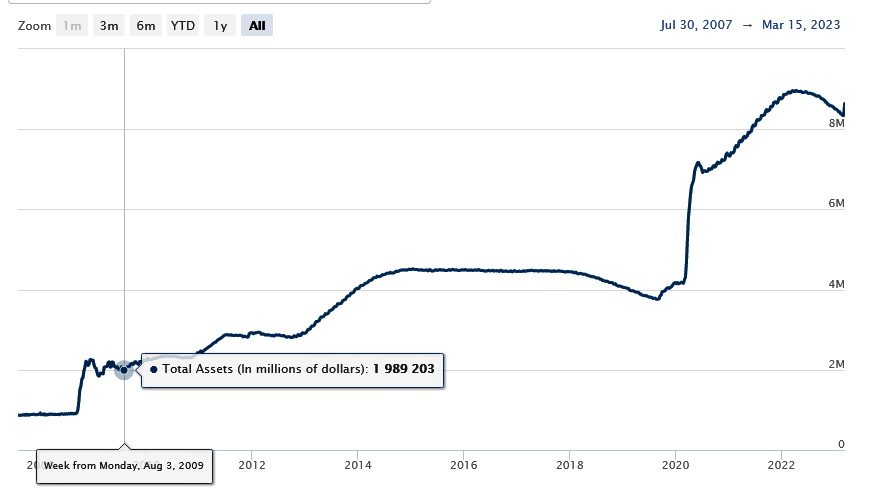

I believe it is very important to understand and time market and economic cycles. You don’t want to buy stock sectors at their tops nor sell them at their bottoms. You don’t have to be bang on, just being close will make you a lot more $$ in the long run. Successful investing is not a sprint, it is a marathon. I predicted and was warning about the 2000 and 2008 crashes, months to a year ahead of time. We made piles in Marijuana stocks and bailed out close to the top. I predicted the peak in Bitcoin within a few weeks. Recently I warned one month ahead of time about the 2020 Covid crash and in 2021 the Fed’s transitory inflation theory was bunk. I predicted this recent bear market in January 2022, telling everyone why they should get out. In that same warning, I predicted the Fed could not bring their $9 trillion balance sheet down to $8 trillion with out market havoc. They got to $8.3 trillion before they just started bailing out the recent bank failures.

In real estate it is all about location and investing is diversify, diversify, diversify. In 2000 I started what I call my Mighty Millennium Index of dividend paying stocks. I knew we were starting a cycle of lower interest rates so this index would be good for those seeking income and is also a nice way to diversify our investments. The index is about 12 to 15 dividend paying stocks that I adjust over time by selling some and buying others. The dividend yield has been around the 6% area. In 2022 when stocks and bonds were slaughtered my Millennium Index returned 14.7% plus an average 5.2% yield for a total return of 19.9%. I often suggest market weightings in cash, gold, bonds, my stock picks and the Millennium Index. Since late 2021/early 2022 I have been suggesting 40% to 50% cash, 10% gold, 20% Millennium Index and 20% or so in my energy, mining and tech picks. Don’t put too many eggs in one basket or sector.

With my newsletter you just don’t benefit from my insights. I have a team of colleagues I have come to know over the years that I trust and our very good analysts. They are always sending me market thesis and investment suggestions so I cherry pick through them too. I am often a contrarian and never afraid to stick my nose out into controversial market thesis or topics. I will call out market tops or bottoms when few will. I say the ‘sell’ word a lot, not just a buy side analyst like most. Very few investment newsletters would talk about Covid-19, they were too afraid of the controversy. To me it was Covid-19 policy response that was the number one thing effecting the economy and different market sectors bullish or bearish. I told it as I saw it even though some thought I had lost it and was a conspiracy nut. As an investment analyst I knew their Covid-19 data was not adding up and many policies had no scientific backing. I knew it took 7 to 10 years to develop safe and effective drugs or vaccines. I knew that less than 10% of drugs or vaccines that enter human trials ever come to market as safe and effective. When these shots were approved based on 28 days of trial data, alarm bells were sounding loudly in my office. I am not afraid to speak my mind and always back it up with links, lots of data and charts etc.

I think you will find my newsletter quite unique and beneficial in many ways.

What you get for Free vs Paid

I have no set time table when I put issues out, it is basically timed to what markets are doing, what I see coming and the timing to buy a stock and/or take part profits or sell all. In general about 4 to 8 issues per month and we are buying about 15 to 30 new stocks, ETFs or options per year and selling around the same. I just don’t make a pile of suggestions and talk about the winners. I follow up and close out all positions over time. It could mean 50 to 100 open positions at any one time. Sometimes I could go a few months without buying a new position. I don’t buy for the sake of buying when markets suck.

Free members will get around 20% to 25% or portions of my newsletter issues mostly the market commentary and sometimes some stocks we are selling or adding to positions. And sometimes just the first few pages of an issue.

Paid members will get all the issues and most importantly my specific stock and option picks. Along with periodic lists of open and closed positions. I focus on dividend stocks for my Millennium index. Senior and junior, including explorers in the mining and oil&gas sectors. Alternate energy and many of my tech stocks are new disruptive technology companies including the biotech sector. Stock options could be just about in any market sector.