Gold and Oil Break Higher, Zonte ZON- Video Interview

I am happy to share some very positive news in our areas of the market. Gold had the reversal I was looking for and oil is breaking out to higher highs. The gold chart is yesterday and gold is higher today so far.

Gold did not make a perfect morning doji star reversal pattern but close enough. The red candle, down day was a knee jerk reaction to higher inflation, erasing lower interest rate hopes. I think 'hopes' is the correct word, because that's all it is. Like I keep saying, inflation has become entrenched and won't be easy to bring back to the Feds 2% target. The next trading day was indecision and the reversal was confirmed the following day with the strong, green up candle stick.

It was positive to see a bounce off the support area but gold is not out of the woods yet. The down trend (blue lines) is still in play. First we need a break above the upper blue line and ultimately a close at $2,080 or better to break resistance.

Oil Breaking Out

Is the market finally coming to grips with the fact that the middle east war will intensify or has interventions failed in the energy markets?

The Iran-backed Houthi militant group on Sunday damaged a ship offshore Yemen, prompting its crew to abandon the vessel in the latest escalation of maritime tensions that have disrupted key trade routes in the Red Sea. CNBC reports “The ship suffered catastrophic damage and came to a complete halt,” Houthi Spokesperson Sare’e said. “As a result of the extensive damage the ship suffered, it is now at risk of potential sinking in the Gulf of Aden. During the operation, we made sure that the ship’s crew exited safely.”

An estimated 12% of global trade passes through the Red Sea every year, worth more than $1tn (£790bn).

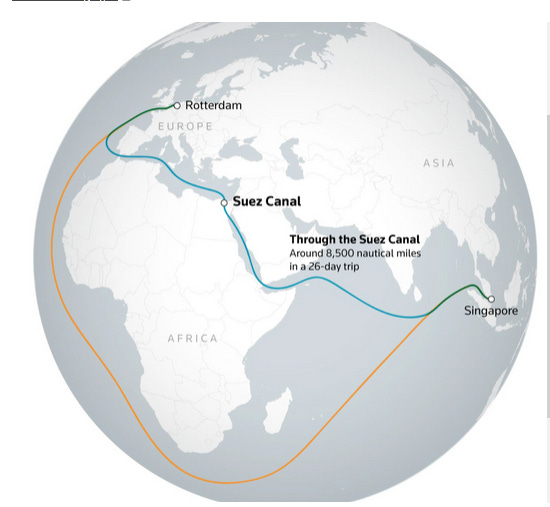

Steering clear of the Red Sea and taking the lengthy detour around the Cape of Good Hope, however, adds around 3,500 nautical miles (6,500km) and 10-12 days sailing time to each trip. This requires extra fuel (an additional $1m/£790,000's worth according to some estimates). Shipping giant Maersk is diverting all container vessels from Red Sea routes around Africa's Cape of Good Hope for the foreseeable future, warning customers to prepare for significant disruption, while Hapag Lloyd tallied a big increase in costs of diverting ships. This along with higher oil prices is going to increase shipping costs significantly and add more upward pressure on inflation.

Oil&gas stocks are cheap, cheap, cheap. And another sign of a bottom in the market is heavy merger and acquisition activity. These companies like to gobble up assets on the cheap. Last week,

further consolidation came to the energy sector as Diamondback Energy (FANG) and Endeavor Energy Resources finalized a merger to create an oil-and-gas behemoth worth more than $50B. The deal, announced early on Monday, will combine two rivals in the Permian Basin, where M&A activity has been on fire.

Oil is making a higher high and closing in on $80. I have commented I want to see a close above $80 to further confirm the new up trend. This chart is from yesterday and oil has pulled back a little this morning.

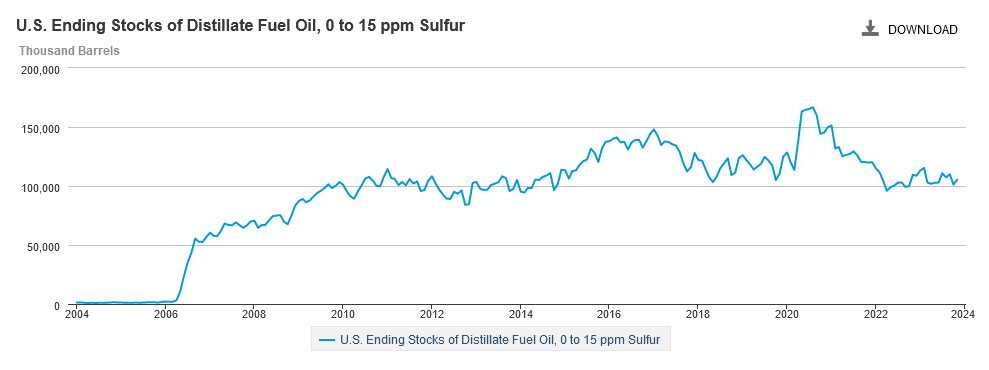

Distillate (diesel fuel) inventories are getting down to low levels, not seen in about 15 years. The low sulphur diesel inventories have been declining since mid 2020 with a recovery from Covid-19 and also new climate related regulations for shipping to use low sulphur diesel fuel. An inventory drop to 80,000 would be dangerously low given the higher usage rate today compared to 5 or 10 years ago.

Zonte Metals - - - TSXV:ZON - - OTC:EREPF - - - - Recent Price - $0.10

Entry Price - $0.09 —- - - - - - - - -Opinion – strong buy to $0.12

I did a 11 minute video interview with Terry at Zonte, that also includes an interesting segment in the core shack at the end of the video. Well worth viewing, click here. Some important key points:

With new soil data, Terry did not expect such a large and strong target at K7.

K6 that Zonte drilled is the weakest and smallest among targets at Cross Hills. However it was most advanced for Zonte to drill and try to prove their new exploration techniques.

If drill results are good at K6 it bodes very well for even stronger potential at the larger and stronger targets. There are over 10 at this time

Reading between the lines, Terry is pretty well laid back and conservative but seems to be certain that next drilling will be follow up at K6, so he must be very confident that the drilling intersected copper.

Drill results will be out soon and there is no positive speculation in the stock price, so mostly upside potential with little down side risk. What we want to see in these drill results is around 0.4% copper over some decent widths. Keep in mind, these will come from one of the weaker targets at Cross Hills and this will not just be a copper/gold discovery but the discovery of a whole new copper district in Canada. A drill hit is going to get huge attention in the industry, but who knows how the market will react short term. Either case it is good to buy ahead of the crowd and when the stock is so cheap, so why I upgraded to 'strong buy'.

Copper is the strongest metal among the base metals and battery metals but has been contained in a range between $3.60 and $4.00 the last 5 years.

It turned out to be a very good idea to average down in October 2023 at recent lows. The stock has rallied since then but under conditions of strong selling into the rally. This shows as the negative on balance volumes since that time. If this selling were to subside, the stock could really take off, and good drill results might do the trick.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.