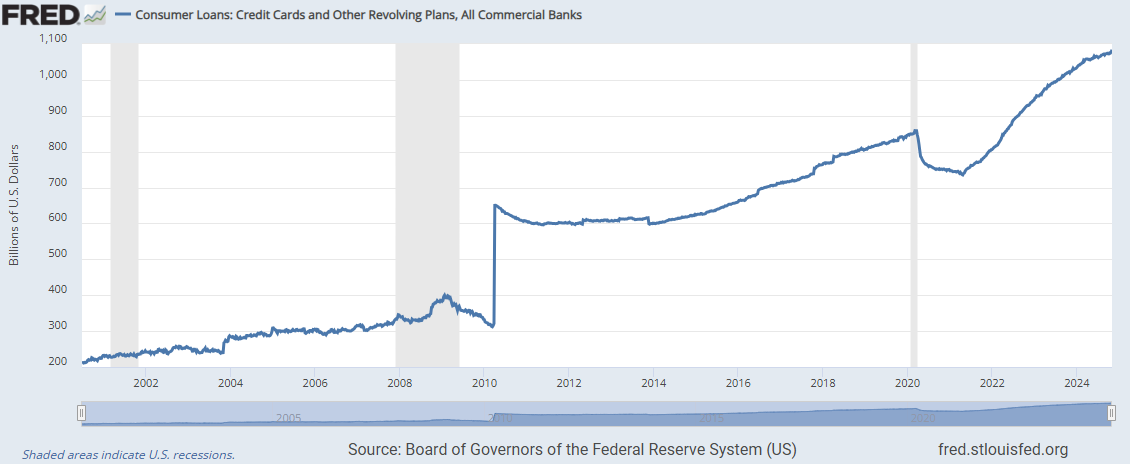

The Fed lowered rates 25 points as expected. U.S. consumer borrowing grew by $6.00B in September, the Federal Reserve said last Thursday, lower than the $12.20B consensus and decelerating from August's $7.64B, which was revised from $8.93B. Looks like the consumer is running out of gas and comes as no surprise. Credit has grown at the fastest pace since the QE programs after the 2008 financial crisis. More troublesome it has occurred during much higher interest rates.

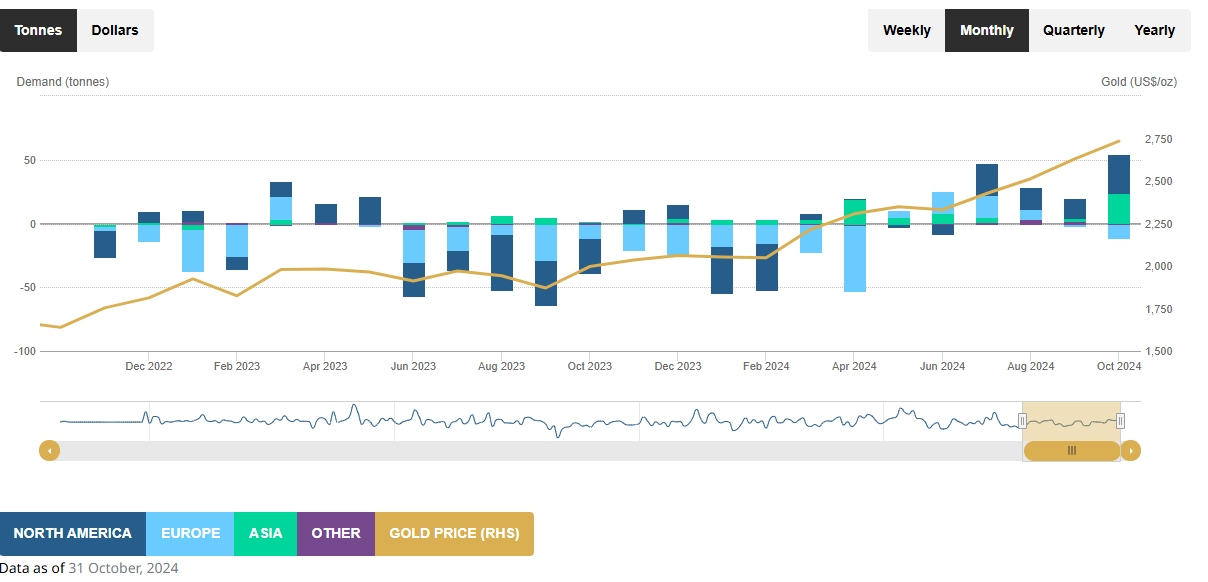

So far near term support has held for gold. Global physically backed gold ETFs extended their inflow streak to six months, adding US$4.3bn during October. North America once again led global inflows while Europe remained the only region with outflows. This has only just started.

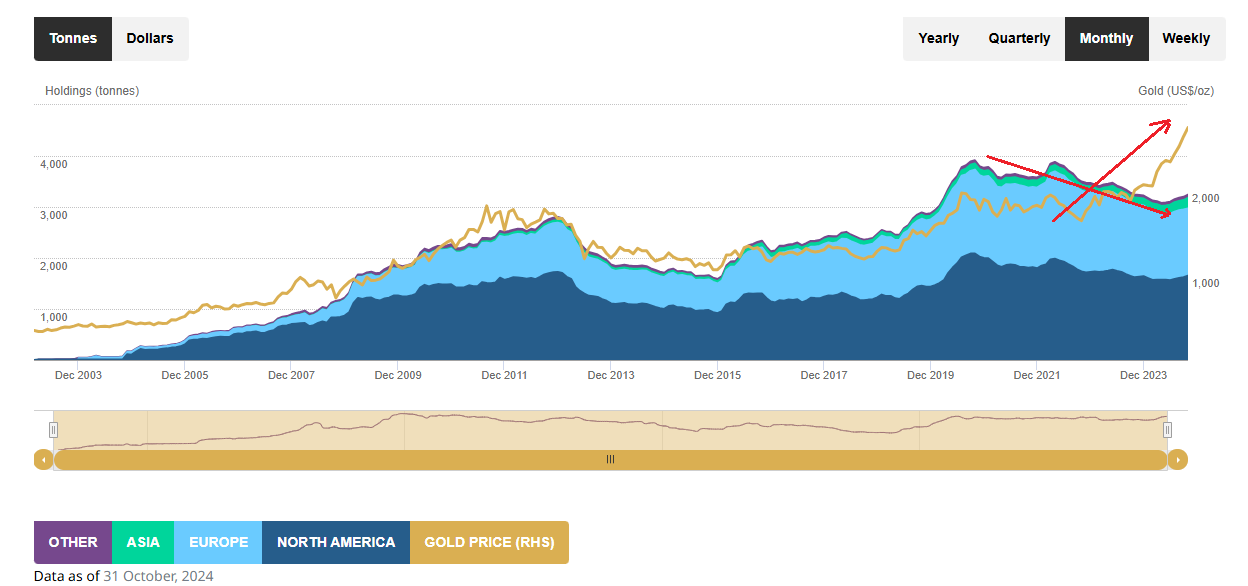

I have been pointed out that I believe Central Banks have been draining gold out of the GLD ETF. It becomes very evident on this chart that compares ETF holdings. Since the ETFs started their holding have always moved up and down with the gold price until around 2020/21 when CBs began heavy accumulation. You can see the big divergence via the red arrows.

Another likely hood is stocks of Gold ETFs have to be delivered in place of the COMEX or LBMA reserves, which were unable to supply the physical demand.

Coeur Mining - - - NYSE: CDE - - - - Recent Price - $6.59

Entry Price $7.00 - - - - - Opinion – buy

This week Coeur reported a very strong third quarter 2024 with strong production increases and lower costs across their portfolio. Higher production at all four operations drove a 21% increase in gold production and 15% increase in silver production, totaling 94,993 and 3.0 million ounces of gold and silver, respectively.

Costs applicable to sales per gold and silver ounce both declined 12% compared to the prior quarter, leading to margins more than double the prior period. Based on strong year-to-date production and cost performance, the Company reaffirmed its full-year guidance ranges

Robust quarterly financial performance driven by higher production and metals prices. Revenue of $313 million and adjusted EBITDA of $126 million increased 41% and 140% quarter-over-quarter, respectively. Operating cash flow totaled $111 million and free cash flow reached $69 million during the quarter, their highest levels in over a decade. Net income was $49 million and Adjusted EBITDA over the last twelve months (“LTM”) increased 2.5x to $287 million compared to a year ago.

Coeur was my most recent pick in late October and I picked the average of where the stock traded that week as our entry price. The recent correction in gold and silver provides a nice buy opportunity.

B2Gold - - - TSX:BTO, NY: BTG - - - - Recent Price – C$4.11

Entry Price – 4.45 - - - - Opinion – strong buy

B2Gold announces its operational and financial results for the third quarter of 2024 and not as good as Coeur but B2Gold is going to kick but in 2025 with strong production growth.

Total gold production in the third quarter of 2024 was 180,553 ounces. At the Fekola Mine, production was lower than expected due to the delayed timing of mining high-grade ore and by lower than anticipated equipment productivity and inclement weather throughout the quarter that reduced the mined volumes of high-grade ore. Damage to an excavator and the subsequent need for replacement equipment impacted equipment availability at Fekola, reducing tonnes mined in the first and second quarters of 2024, which affected the availability of higher-grade ore for the third quarter of 2024. Masbate and Otjikoto both continued to outperform expectations in the third quarter.

These issues at Fekola are short term. Most important is upon issuance of the exploitation permit for Fekola Regional, mining operations will begin with initial gold production expected to commence in early 2025, with the potential to generate approximately 80,000 to 100,000 ounces of additional gold production per year from Fekola Regional sources

Attributable net loss was $0.48 per share; adjusted attributable net income of $0.02 per share: Net loss attributable to the shareholders in the third quarter of 2024 of $634 million ($0.48 per share), predominantly due to a non-cash impairment charge on the Goose Project as a result of the previously announced construction capital increases.

Goose Project construction and development remains on schedule for first gold pour in Q2 2025.

So far the stock is not pricing in a huge increase in production in 2025 with Fekola and their Goose Project, making it one of the best buys out there among mid tier gold stocks.

Alamos Gold - - - TSX/NY:AGI - - - - - Recent Price – C$27

Entry Price $12.43 - - - - - Opinion - hold

Alamos reported results for the quarter ended September 30, 2024. Alamos increased 2024 production guidance to between 550,000 and 590,000 ounces in September 2024. This represented a 13% increase from original guidance (based on the mid-point), reflecting the inclusion of the Magino mine from July 12, 2024 onward, as well as increased guidance for the Mulatos District

“We achieved a number of operational and financial records in the third quarter. Production increased to a record 152,000 ounces reflecting the addition of Magino and continued strong performances from Island Gold and Mulatos. With growing gold production and record gold prices, we generated record revenue and cash flow from operations before working capital, supporting strong ongoing free cash flow while funding our high-return growth initiatives,” said John A. McCluskey, President and Chief Executive Officer.

A record 152,000 ounces of gold production was a 9% increase from the second quarter. This reflected the inclusion of the recently acquired Magino mine as well as strong ongoing performances from Island Gold and the Mulatos District. The acquisition of Argonaut Gold Inc. was completed on July 12, 2024. This was the avenue by which we became shareholders at a great price.

AGI sold a record 145,204 ounces of gold at an average realized price of $2,458/ounce, generating record quarterly revenues of $360.9 million. This represented a 41% increase from the third quarter of 2023 and marks the third consecutive quarter of record revenue. Ounces sold were 4% lower than production in the quarter due to timing, with the sale of these ounces to benefit future quarters

Cash flow from operating activities was $165.5 million, including a record $192.8 million before changes in working capital ($0.46 per share). Cash flow from operating activities was impacted by working capital adjustments and transaction costs incurred on the acquisition of Argonaut.

Alamos was recognized as a TSX30, 2024 winner by the Toronto Stock Exchange. The annual ranking recognizes the 30 top performing stocks over a three-year period. Alamos’ share price increased 134% over the trailing three-year period. Amazing that most investors are missing this great performance by many gold stocks.

Equinox Gold - - - - TSX/NY: EQX - - - - Recent Price - $8.10

Entry Price $6.07 - - - - Opinion - hold

EQX announce that based on the operating progress achieved through October, its Greenstone Mine in Ontario, Canada has reached commercial production. This milestone marks the culmination of three years of construction and commissioning, accomplished during the challenges of a global pandemic, supply chain disruptions, and inflationary pressures. It is now going to pay off and I expect the stock will go much higher in 2025,

During Q3, the Greenstone Mine processed an average of 14,300 tonnes per day ("tpd"), representing 53% of design throughput, producing 42,400 ounces of gold at an average recovery rate of 79% and a cash cost of US$930 per ounce.

Highlights:

Produced 173,983 ounces of gold

Sold 173,973 ounces of gold at an average realized gold price of $2,461 per oz

Total cash costs of $1,720 per oz and AISC of $1,994 per oz

Two lost-time injuries; total recordable injury frequency rate of 1.79 per million hours worked for the 12-month rolling period (1.78 for the Quarter)

Income from mine operations of $101.4 million

Cash flow provided by operations before changes in non-cash working capital of $130.1 million (cash flow provided by operations of $139.5 million after changes in non-cash working capital

Greg Smith, President and CEO of Equinox Gold, commented: "This was a record quarter for Equinox Gold, with our best-ever third-quarter production and all-time highest quarterly revenue and adjusted EBITDA, reflecting the ongoing ramp-up at our Greenstone Mine and strong gold prices. During Q3, the Greenstone Mine demonstrated good progress, with both mining and processing rates increasing substantially. Subsequent to quarter-end, mining and milling rates have continued to increase and we were pleased to declare commercial production at Greenstone earlier today. The team remains focused on continuing this momentum through the fourth quarter as the mine progresses toward design capacity.

"In early October we updated our production expectations for Greenstone to reflect ramp-up progress to date, resulting in 2024 consolidated production guidance of 590,000 to 675,000 ounces of gold. With our highest quarterly production this year expected in Q4, we look forward to ending the year strongly and applying our increasing cash flow to pay down debt."

We are buying a couple more oil&gas stocks that went out to my paid group. I will feature here in a future issue.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.