Gold is looking good but the market is not paying much attention. We had a doji reversal pattern at a higher level than the one in November. Also a higher high, so a test of record highs is not far off.

Silver ran up to $32 and has pulled back to around $30.40 today. We got lucky timing buying AYA Gold and Silver as it dropped and closed at $11.34 the day my newsletter went out, closed $11.43 the next day and is down a bit today so I will pick in between and Tuesdays close. $11.34 as our entry price. Their new mine startup is going well.

Aya Gold & Silver - - TSX: AYA, OTC: AYASF - - Recent Price - $11.19

Entry Price $11.40 - - - - - Opinion – buy

Today AYA announced that it has reached and surpassed the nameplate milling capacity at its 100% owned Zgounder Mine. The new plant began processing ore on November 4th, 2024. The first silver pour was achieved on November 27th, with commercial production reached on December 29th, less than two months after the new plant began processing the first ore.

Over a consecutive 30-day period ending on January 20th, 2025, the new plant processed a total of 65,990 tonnes of ore, an average of 2,200 tonnes/day, equivalent to 110% of nameplate capacity. Processing rates averaged 96 tonnes/hour, at 96% availability. Silver recovery was 85%.

Between January 11th and January 20th, mill throughput averaged 2,239 tpd, with mill availability and silver recovery at 98% and 89%, respectively. Recovery improved consistently as processing parameters were adjusted and grade fed to the plant increased.

Aztec Minerals - - TSXV:AZT, OTC: AZZTF - - Recent Price - $0.22

Entry Price $0.40 - - - - - - Opinion - buy

Yesterday Aztec announced initial results from first pass drilling at the Westside Target Area at the Tombstone Property in Southeastern Arizona.

TR24-13 intersected 33.5m of 22.05 gpt AgEq (0.11 gpt Au and 13.06 gpt Ag) and then 85.4m of 47.31 gpt AgEq (0.281 gpt Au and 24.79 gpt Ag) including 24.4m of 106.24 gpt AgEq (0.59 gpt Au and 59.16 gpt Ag)

TR24-8 intersected 6.1 m at 105.1 gpt AgEq (1.23 gpt Au and 7.0 gpt Ag) and then 21.3m at 38.75 gpt AgEq (0.35 gpt Au and 10.6 gpt Ag)

TR24-11 intersected 25.9m at 32.47 gpt AgEq (0.05 gpt Au and 28.56 gpt Ag)

These are low grades but over very good widths. TR24-13 combined intersect was 107.45 metres similar to 114.3 metres and 103.6 metres in drill results announced in November and December but it is going to add considerable to the resource numbers being in a completely new area.

The Westside target area’s first pass exploration drilling program has encountered oxide silver-gold mineralization in every drillhole to date, nearly doubling the area of drill demonstrated exploration potential from the Contention pit target area alone. The geologic modeling for the Westside target area was successful with blind targeting and confirmed the historic reporting of underground mine workings as well as Aztec’s modeling.

Additional assays pending release including results from additional Westside Area and Contention Southern Extension Target Areas. The stock has been edging higher in January with drill results, we could soon see a test of the October, 30 cent highs.

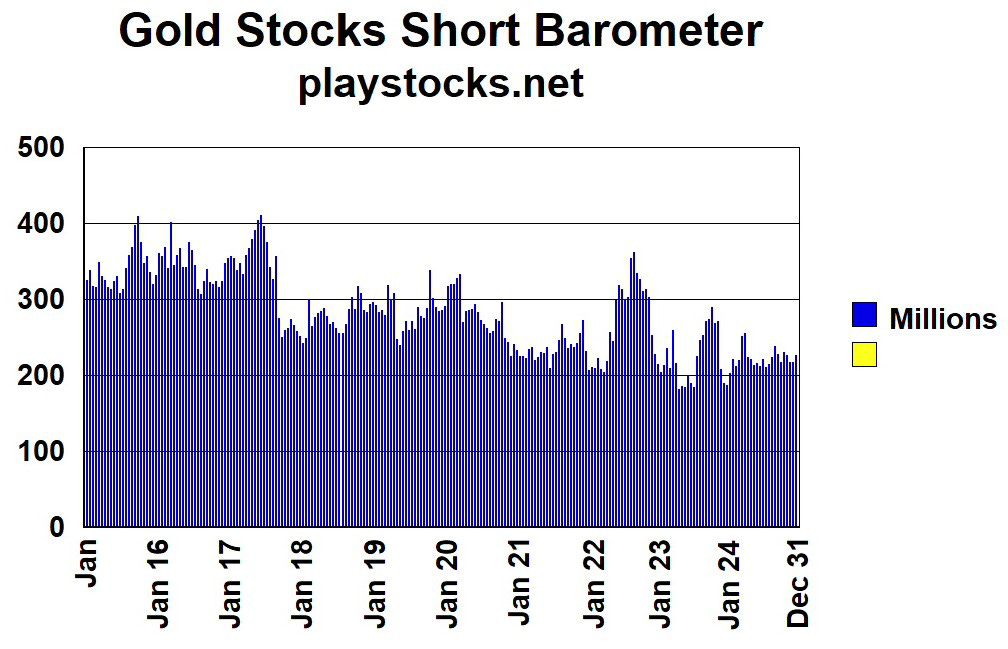

There has not been much change in the gold stock overall short positions so no bullish or bearish signal here.

Now jumping to a couple of our tech stocks

Hemostemix - - TSXV: HEM, OTC: HMTXF - - - - Recent Price - $0.30

Entry Price - $0.215 - - - - - - Opinion - buy

Hemostemix announced that its shares will commence trading on the OTCQB under symbol HMTXF today, January 23, 2025, while the Company presents "Welcome to Your Fountain of Youth!" at the Sequire Investor Summit at 11:00 a.m. A very good comment and summary from the CEO

"Listing on the OTCQB enables US investors to buy into their 'Fountain of Youth' and longevity, directly. As an investor in HMTXF, my wife and I invested $300,000 in the last round, which closed in November. We're up 600%. I fully expect in the fullness of time that I will be able to sell part of my position to fund my own ACP treatments. As management and directors, we have invested greater than $9.1 Million in Hemostemix's since 2020. We did so because ACP-01 works: it saves limbs from amputation; it regenerates heart function; it regenerates mental acuity. It is clinically relevant; it is statistically significant; it is safe in 498 treatments. That is all detailed in seven studies of 318 subjects, in nine peer review publications. But why wait for a disease process? Why not invest in Your Fountain of Youth today, to obtain longevity and enjoy the quality of life you have today well into your old age? That is why we trademarked Your Fountain of Youth. That is the message I am delivering to investors," Thomas Smeenk, CEO, said.

The stock has moved up some but still attractive here given the huge potential. To do the math, $3,000 would buy 10,000 shares and when the stock hits $5 it would pay for your ACP-01 therapy.

My last update on Gilat I commented I wanted to see it break to new highs or might consider selling. They had some more news Tuesday and it looks like the stock is breaking higher. It went above resistance but did not close above it, at least not yet.

Gilat Satellite Networks - - NASDAQ: GILT - - - Recent Price - $7.15

Entry Price - $8.16 - - - - - - Opinion - hold

GILT announced that its wholly owned US-based subsidiary, Gilat DataPath, has been awarded over $5 Million in contracts from the US Department of Defense (DoD) and additional international Defense Forces. These contracts, for DKET terminals and providing Field Service Representative (FSR) support, will be delivered across the globe over the next 12 months.

Gilat DataPath’s technical and field services are specifically designed to meet the demanding connectivity requirements of military and defense end-users in diverse and challenging environments. The orders include both contract extensions and new agreements with various agencies and partners, underscoring the trust placed in Gilat DataPath to deliver consistent, high-quality support.

Paid Advertisers at playstocks

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.

Hi Ron It Is Ron Here from Vancouver broke my phone lost your new number could you call me

thanks

Ron