Gold acted pretty much as expected to the correction/consolidation area that I previously marked out. Today it broke above that consolidation area and is now headed to new record highs.

The same fundamentals are applying themselves and that is Central Banks are adding physical gold to reserves instead of US$. The U.S. Banks have also joined in the buying of physical ahead of the July 1st final date for the Basal III accords. Physical gold has become a tier 1 asset like treasuries while Comex gold future contracts and gold ETFs will require a margin of collateral. A bank might as well have gold price exposure buying physical as an asset vs futures or ETFs that are not tier 1 assets.

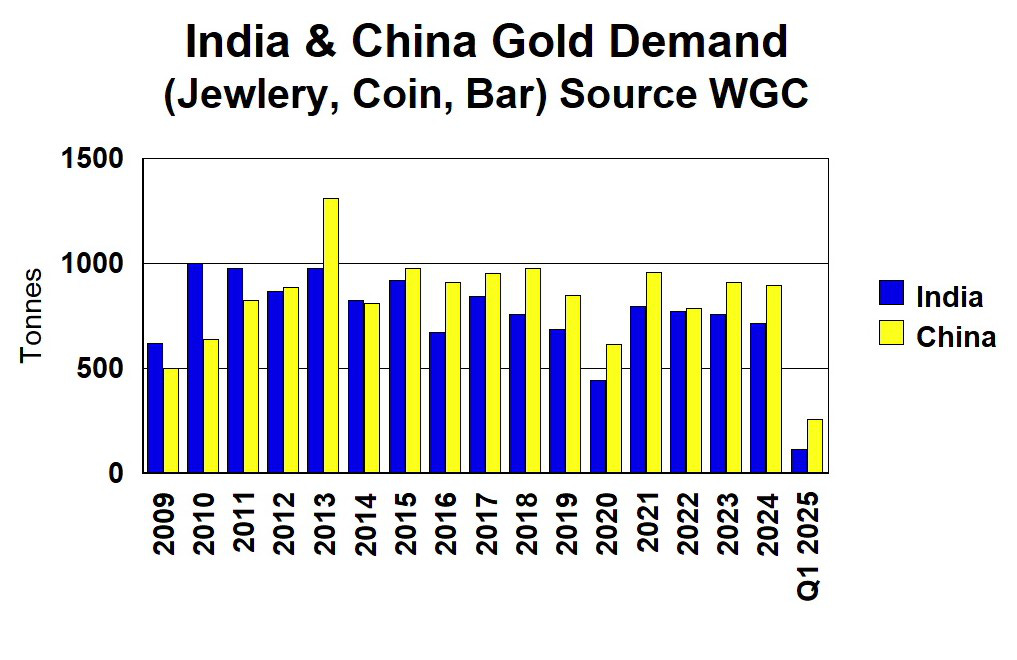

The trade war is also adding to physical demand and China's appetite for gold just gets stronger. According to World Gold Council, in Q1 2025 there was a big jump in China coin and bar demand to 126.7 tonnes from 86.2 tonnes in Q4 2024. China also had a significant jump in jewelery demand to 133 tonnes from 114.2 in Q4 2024. China is on pace to challenge the 2013 high demand.

Investment funds are very under invested in gold and gold stocks, so that demand will be coming into the market. Retail might just be dipping their toes in and I say that because I got my first cold call from a junior mining company in the past year or two, just yesterday. When retail comes in, we will see silver rise and volume on the TSX Venture pick up.

Finally after a painful and languishing bottom for about 3 years, the TSX Venture index has finally broke out to the upside. Today it is over my 660 break out target.

Volume has picked up a little and I expect we will soon be around 75 million shares per day and see a pretty quick move up to 880 area. We will see how May and June go and might see some slowness in the summer break, with a bigger move in the fall. That said, there are a lot of different wheels in motion compared to previous years.

Retail investors are still shorting the gold stocks, it just amazes me. Retail also bought heavily into equity stocks, ETFs and funds in April. They will get their head handed to them in both trades. Ever since gold stocks began up in April 2024, retail investors have been betting the short side with the DUST 2X short gold stocks ETF. Look at the big volume spike in this recent April correction.

Meanwhile, the NUGT ETF (2 times long gold stocks) sees volume fall right off. Investors have missed a 150% gain since April last year. When these rolls reverse, I might start thinking about a top.

Another sign that the junior market is slowing coming off life support, was how quickly Giant Mining bounced back from it's correction with some visual drill news

Giant Mining - - TSXV:BFG OTC: BFGFF - - - Recent Price $0.31

Entry Price $0.34 - - - - - Opinion – buy on weakness

BFG announced that drilling of Hole MHB-34 has surpassed 1,850 feet (563.88 meters). As shown below, native copper, cuprite, and chalcopyrite has been consistently observed in the deeper part of MHB-34, which has now surpassed 1,850 feet and exhibits visible copper mineralization. This drill hole currently in-progress at Majuba Hill contains promising copper mineralization. More photos

The stock quickly bounced up on high volume. Maybe it will see a bit of a pull back from this pop.

Paid Advertisers at playstocks

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.