Gold, Fed hits Bitcoin and RECO, GRB, GSPR

Welcome and thank you to all the new, smart, savvy and contrarian investors who have joined my substack. I am still small here so please share and subscribe while still this is still free.

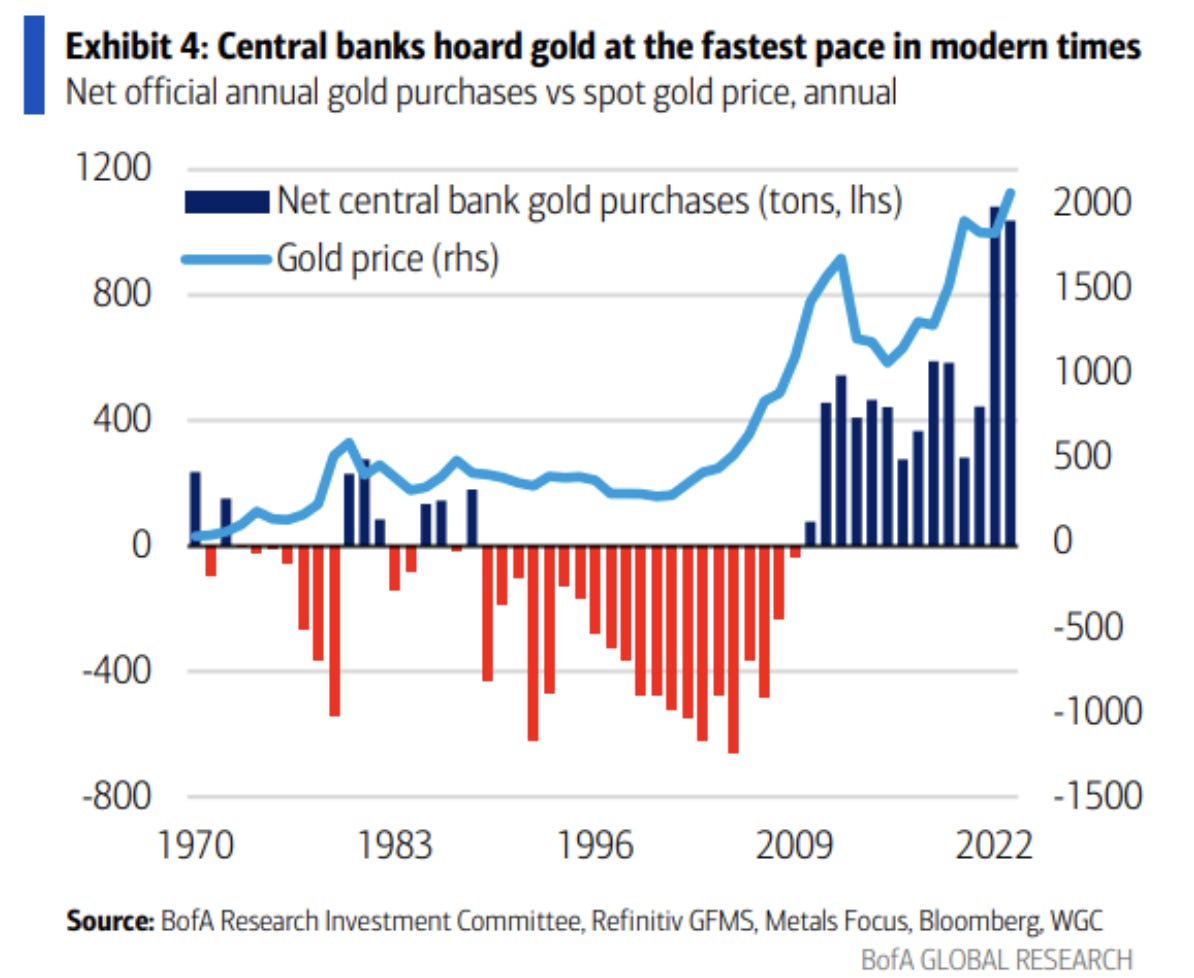

The commodity markets are complicated, especially when it comes to gold and silver, because they are also currencies. For a long time the Fed has made it obvious and stated publicly numerous times that it will intervene in the currency markets to protect the US$. The Fed has long intervened in the gold market to suppress it's price to make it less attractive to paper US$. However, that jig is up because the Fed is now about the only Central Bank selling gold vs all the other CBs buying. The amount of CB buying is unprecedented with huge record amounts in 2022 and 2023.

As I have commented numerous times, gold became a Tier 1 asset under the Basel accords in 2023 so CBS can hold it just like paper currencies and US Treasuries and Bonds. It is direct competition and a way for CBs to diversify out of Fiat assets and they are doing so big time.

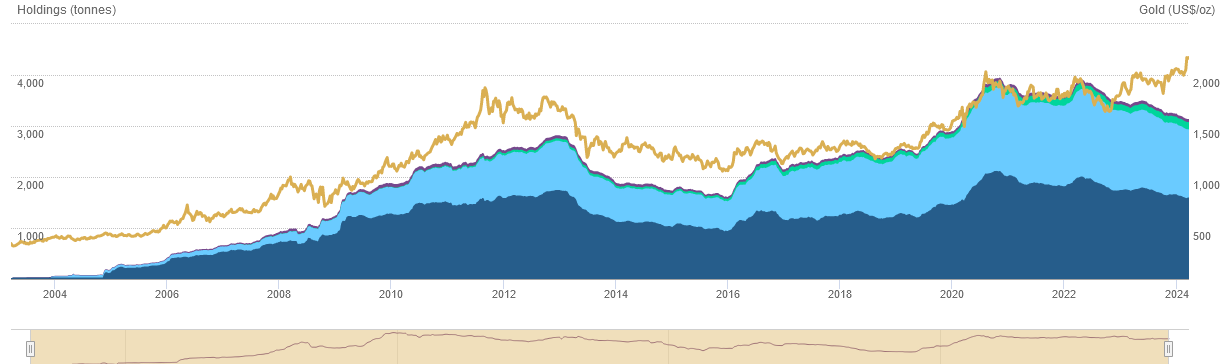

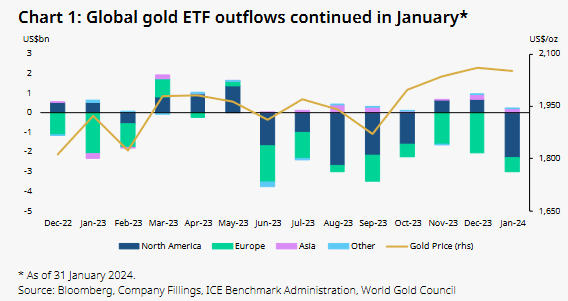

Further complicating the Feds intervention is the open interest on Comex gold is about half of what it was a few years ago. The Comex futures exchange is where they have carried out the interventions. The GLD ETF was also a tool but it is being drained by CBs to get physical as well as funds and retail switching into the Bitcoin ETFs. This drain from GLD is mostly looked at as negative when it is really positive. Many analysts are showing a chart like this and pointing out the anomaly of ETF outflows while gold is rising.

Like I said, a combination of physical moving into CBs and switching into Bitcoin ETFs. There has been a bit of inflow in gold ETFs in the past week and if this gains steam it will show that investment demand is rising. That said, I think the gold price will mainly be driven by the CB buying for now.

Global physically backed gold ETFs began 2024 with US$2.8bn outflows in January, stretching their losing streak to eight months . This was equivalent to a 51t reduction in global holdings, which lowered to 3,175t by the end of January.

My view on the Bitcoin ETFs is that they will end up being used to manage the Bitcoin price. I am sure many don't believe me and think I might be wearing a tin foil hat. I am anxiously waiting financial statements of these ETFs for more clues. The prospectus is always vague, just like the gold, GLD ETF that says it may hold physical gold and/or cash. However, we already got our first sign of probably official intervention in Bitcoin. A mysterious seller sold 400 Bitcoin all at once that drove the price down. This has all the foot prints of a Fed intervention. Bitcoin is seen as an alternative to US fiat dollars and it would make more sense for the Fed to now focus on Bitcoin when all they need is cash that they can print endlessly to short sell Bitcoin. They don't need to compete with other CBs like they do in the gold market. Expect more of this surprise selling at the weakest and thinnest points in the market. Just like gold, they typically picked Sunday evenings, they will pick their time and places in Bitcoin. The objective is to create downside volatility that will trigger stop losses and create more selling.

I am following several of the Bitcoin ETFs and will likely go with the ishares Bitcoin Trust as a trading vehicle, symbol 'IBIT' and it trades the most volume. Key to watch on these Bitcoin ETFs is Coinbase financial s. In January 2024, the Securities and Exchange Commission (the “SEC”) approved 11 spot Bitcoin ETF applications, eight of which are partnered with Coinbase. Coinbase borrows fiat and crypto assets from eligible institutional customers. These borrowings are generally open-term or have a term of less than one year. I wonder if they will just end up borrowing Bitcoin to meet their custodian holdings.

Coinbase's last financial show $206.9 billion in assets but just a fraction, $449 million are crypto assets, which is about half Bitcoin. These crypto assets should explode in Q1 2024 if they are really holding Bitcoin for these 8 ETFs.

Coinbase also shows $192 billion of safe quarding customer crypto assets. That is a pretty big base to borrow from. And remember this is at Dec 31, 2023 when Bitcoin prices were much lower. Here is a chart of the ishares IBIT and I compare it to Coinbase, COIN that has performed just as well.

Has the tech sector lost it's AI lustre? Tech stocks are up about 2% over the past 30 days and it's not the red-hot performance we've seen in recent months. Energy Select XLE is up 8.1%, Materials Select XLB up 5.9% and Industrial Select XLI up 3.6%. These better performers have been considered boring and I wonder has a market rotation begun? A few updates on our picks.

Greenbriar - - - - TSXV:GRB - - - - -Recent Price - $0.90

Entry Price $1.15 - - - - - - - Opinion – strong buy

Greenbriar put out news March 18th, that talked a lot about the water non issue. The schedule to break ground on Sage Ranch will be within the month of April, 2024. The continuing drama between the TCCWD (Tehachapi-Cummings County Water District) and the city does not affect Greenbriar Sustainable Living Inc.'s schedule. The company owns and has access to all of the deeded water rights, and any additional sources. The WSA was accurate and complete. The city council was correct in its approval of the WSA. The TCCWD wants to be a land planning agency, and the law does not permit this role. The city was correct in its full approval of the project. During all of the settlement negotiations with the TCCWD, and in front of eight lawyers and the company, the TCCWD emphatically stated they had no issue with Sage Ranch alone.

I don't know if this is why the stock is so cheap as it makes no sense. I think the market has not grasped the opportunity here as of yet. It will and probably come as a surprise when it does. Both in Canada and the USA it is not a shortage of housing but a shortage of affordable housing. That is exactly what Greenbriar's Sage Ranch addresses. You can see from this map below, that California is in the most need of affordable housing, so another huge bonus for Sage Ranch.

The stock is down at the bottom of it's recent trading range so a great buy price here.

Recon Africa - - - - TSXV:RECO - - - - - Recent Price - $0.86

Entry Price -$0.56 - - - - - - Opinion – strong buy

RECO entered into an agreement with Research Capital Corp. as the sole bookrunner and lead underwriter, on behalf of a syndicate of underwriters, pursuant to which the underwriters have agreed to purchase, on a bought deal basis, 11,112,000 units of the company at a price of 90 cents per unit for aggregate gross proceeds to the company of $10,000,800. This has been increased to $15 million. RECO has been working at bring in a senior partner, so the significance of this financing is they can drill their next 3 wells without a partner. Each well costs about $3.5 million to do. Should they hit on one or more of these 3 wells, it is a brand new ball game. They have a lot more data this go around to better target these wells for success.

GSP Resource - - - - - TSXV: GSPR - - - - - - - Recent Price - $0.10

Entry Price - $0.25 - - - - - - - - Opinion - buy

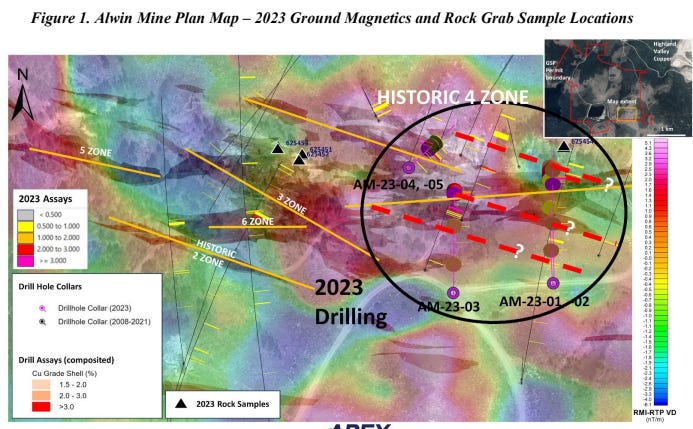

GSPR reports today the assay results of surface rock grab sampling and the results of ground geophysical surveys at the Alwin Mine Copper-Silver-Gold Project. The results of surface rock grab sampling, which includes a sample from the historic 3 Zone that returned 11% Cu (copper) and 0.65 g/t Au (gold) , and the identification of magnetic low structural lineaments hosting polymetallic mineralization, point the way to enhanced drill targeting for the 2024 exploration season.

The 3D modeling work completed by the Company, including digital capture of over 50,000 meters of surface and underground diamond drilling, has already resulted in exploration success the with recent the fall 2023 diamond drill program that yielded some of the highest grades of copper and precious metals drilled at the Alwin Property in the project’s history. Significantly, drillhole AM23-01 intersected 2.42% Cu, 47 g/t Ag, and 0.57 g/t Au over 12.8 m (3.14% copper-equivalent, CuEq) ; including 5.7 m averaging 5.21% Cu, 103 g/t Ag and 1.22 g/t Au (6.77 CuEq) ( see GSP Resource Corp. news release dated February 20, 2024 ).

GSP’s President & CEO, Simon Dyakowski, commented: “With the Copper price recently surpassing US$4/pound, now is great time own a historic high-grade copper mine in an area well suited for potential brownfield development. S&P Global Market Intelligence projects that annual global copper demand will nearly double to 50 million tonnes by 2035. Last year, global copper mine production sat at approximately 22 million tonnes, short of even the current demand.

The recent surface assay results verify and confirm the presence of exceptionally high-grade copper values at surface, reaffirming the potential of the historic mineralized zones targeted during past underground development.

Ground surveys have delivered a modern orientation survey over the known historic mineralized area. The magnetic response successfully delineated subsurface structures that host copper and polymetallic mineralization. Future geophysical and geochemical surveys over a larger area of the Alwin Property are planned to expand on the results to identify additional structures with the potential to host mineralization.”

In 2024 with a better understanding of the project we should see more good drill results and in the better market, I am expecting, we could see this stock get some legs this year.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.