Welcome and thank you to all the new, smart, savvy and contrarian investors to my substack. If you like outside the box thinking, a humble analyst that has spent his career studying market and economic cycles, picked numerous tops and bottoms, someone not afraid of controversial topics and can be a bull and a bear, your at the right place. Please share and subscribe.

Gold set a new record high yesterday and is setting another one today. It continues to amaze me how low the participation rate remains in North America. Dumb retail investors are shorting. It is a good opportunity for us. Most investors are chasing the previous returns in the tech sector while ignoring far superior returns in precious metals. As my last chart, $3.000 is the near term target.

B2Gold - TSX:BTO, NY:BTG - - Recent Price- C$4.42

Entry Price - $4.45 — - - - Opinion – strong buy

B2Gold is one of my favourite buys among gold stocks at this time. The stock is lagging, in part being punished by past events that are no longer a factor and not pricing in a big production improvement in 2025. Interesting report in the Globe and Mail this morning.

National Bank Financial analyst Don DeMarco has reaffirmed his "outperform" recommendation for B2Gold. The Globe's David Leeder writes that Mr. DeMarco tweaked his share target down by 25 cents to $6.25. Analysts on average target the shares at $5.62. Mr. DeMarco says a tour of B2Gold's Goose project in the 100-per-cent-owned Back River Gold District in Nunavut last week provided "modest derisking, adding more colour on the reasons behind the capex increases (many of which were out of B2Gold's control), a first-hand glimpse at development, showing significant progress since the tour last year, and construction to a world-class/BTO standard, by an experienced owner-build team." Mr. DeMarco says in a note: "At the tour, which included 10 sell-side analysts and two buy-side portfolio managers, the Vancouver-based company reaffirmed first pour at the mine is likely to be on time in the second quarter of 2025 and will be fully funded, tracking an updated budget released last week. Overall, we ascribe a neutral bias to the site tour given limited new and material information."

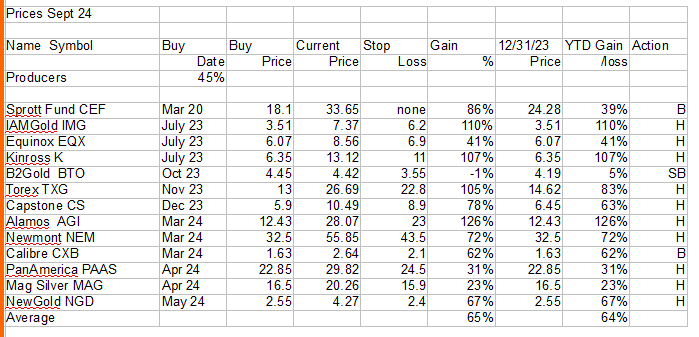

I updated our Selection List with new Stop/loss levels and Actions. Sprott CEF is always a buy because it is physical gold and silver. The best buys now are B2Gold and Calibre. A very good gain so far this year of 64%, If the sector gains investor interest this year we could get triple digits.

What is quite amazing and foolish to me is that retail investors are not only ignoring the gold stocks, they are shorting them. I looked at all the gold stock ETFs and the only one with increasing and a big increase in volume is the 'DUST' etf that is 2 times leverage short the Gold Miners Index.

Retail investors starting piling into this 'DUST' etf (shorting) in May, They keep getting their head handed to them in a basket and come back and get it chopped off again. Obvious they are not readers of this publication.

Giant Mining - - - CSE:BFG, OTC:BFGFF - - - Recent Price C$0.32

Entry Price $0.47 - - - - - Opinion – strong buy

Giant Mining reported an excellent drill hit on their first drill hole.

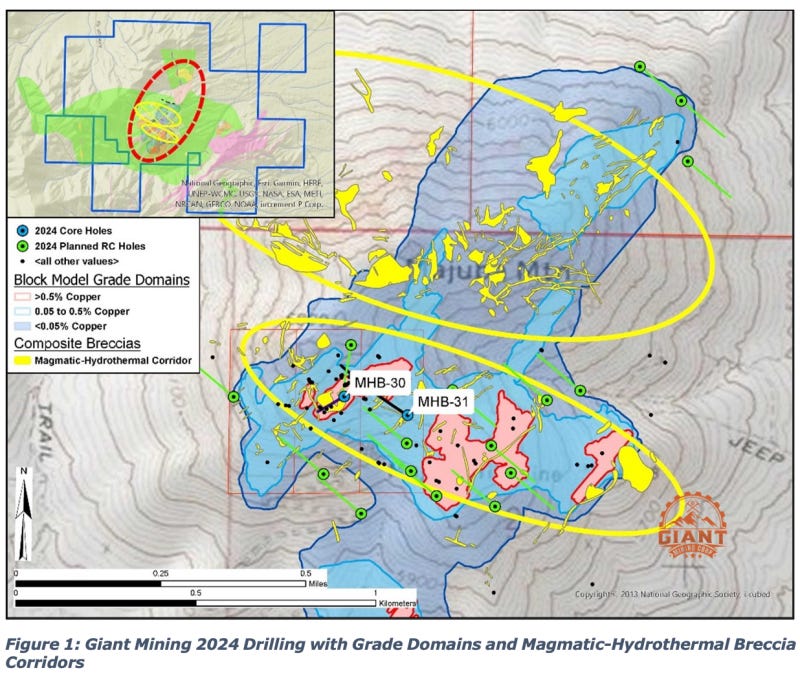

Hole MHB-30 from surface down to a depth of 218.0 feet (66.4 meters) consisting of 74.0 feet (22.6 meters) of 2.6% Cu and 30.1 g/t Ag within 218.0 feet of 1.35% Cu and 73.4 g/t Ag at its Majuba Hill Copper-Silver Deposit located in Pershing County, Nevada.

Combining the copper and the silver results returns a copper equivalent of: 0 to 218.0 feet of 2.1% Copper Equivalent (“CuEq”) including 140.0 to 214.0 feet at 2.9% CuEq .

This is an excellent drill hit for the first hole.

Below is the drill and property map. I am very anxious for drill hole MHB-31 because it is between two of the main zones and positive results would indicate they connect.

Paid Advertisers at playstocks

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.