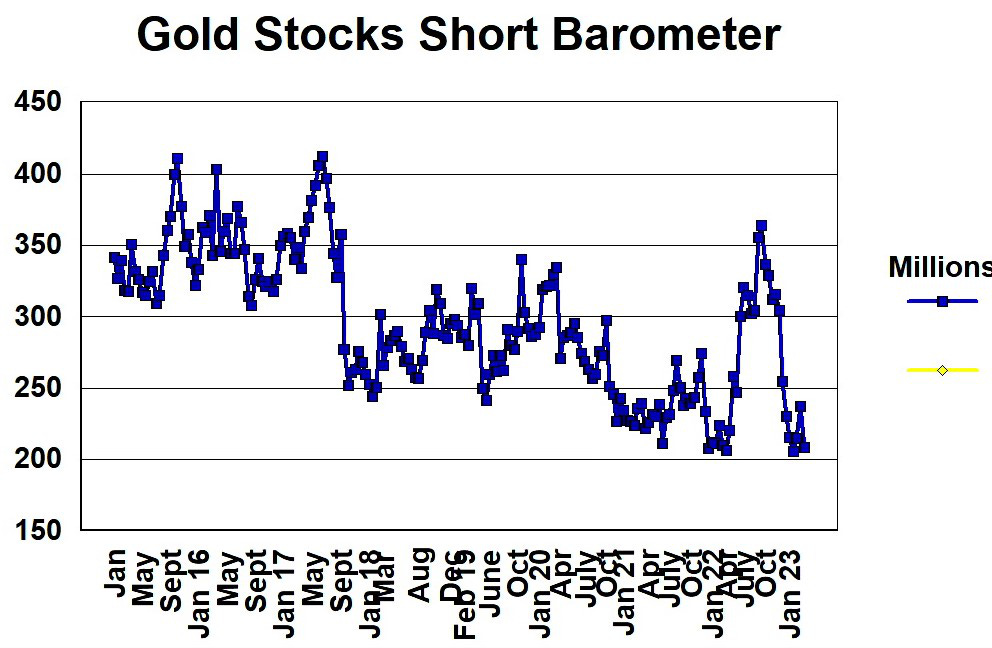

I was looking at gold stock call options last night and this morning and checking all the short positions on the gold stocks and updated the short barometer. Then gold broke higher this morning after weak US economic data that sent the US$ index down and bond rates lower. The market is pricing in Fed easing, but it could be a bit tricky and I will save that topic for another day.

The short positions on gold stocks has dropped to 8 year lows, it sure looks like sentiment is changing, but gold stocks are still lagging the gold price and many by a large margin. Despite June Comex Gold at $2039, the HUI index (next chart) is barely breaking the January highs, as I mentioned before, I want to see 275 close or better. It is coming and I don't think there is much sense waiting around. It is time to pick up some bargains.

With gold, I believe Central Banks have upped their bids for physical into the 1900s and this was supporting the market to consolidate in the $2000 area. We now have the break out and my $2070 target for this rally is close in sight. This is a very significant level because it will be the 3rd test of this high going back to January 2022 and August 2020. I am quite certain gold will breach this level but not certain how easily or quickly it will happen. You can be assured I will be watching closely and sending out any hints I uncover.

I believe now is the time to get further positions while the gold stocks are lagging gold. I am adding Kinross, back on the Selection List, mainly because of the break out on the chart today and it's low price historically. We got stopped out of the stock back in 2021 at $8.50 and we can now buy back much cheaper.

Kinross TSX:K, NY:KGC - - - - Recent Price C$6.80

Kinross was profitable in 2022 with lower gold prices and is paying C$12 cents per year in dividends. Reported net loss of $106.0-million in Q4 2022, or eight cents per share, and reported net earnings of $31.9-million, or two cents per share, in 2022. Kinross had adjusted net earnings of $108.2-million, or nine cents per share in Q4 2022, and $283.1-million, or 22 cents per share, in 2022.

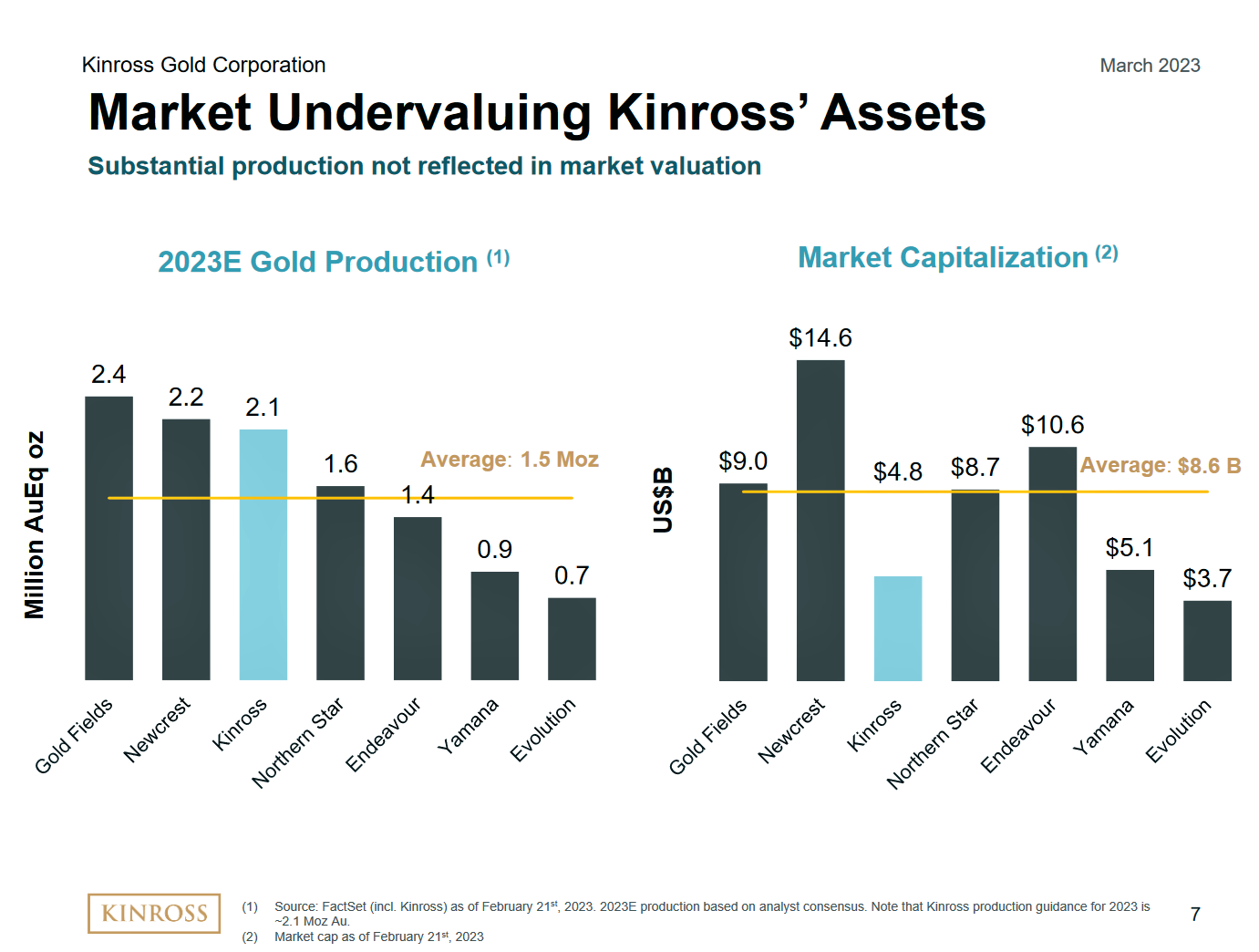

Kinross has strong operating cash flow of $474.3-million in Q4 2022, and $1,002.5-million in 2022. It is valued well below most peers on cash flow multiples. Cash and cash equivalents of $418.1-million, and total liquidity of $1.8-billion at Dec. 31, 2022. This next graphic from their presentation highlights that the stock is undervalued to peers with similar production, at 2.1 million in annual gold production.

I believe the stock got punished more than many gold stocks because they had producing mines in Russia at the onslaught of the war. Kinross sold them off in June last year for US$340 million. At that time the CEO commented -

"After the completed divestment of our Russian business, Kinross' rebalanced portfolio maintains a substantial production outlook anchored by its two tier one assets -- Tasiast and Paracatu -- as well as a strong portfolio of mines in the Americas, a growing business in Chile, and the large, world-class Great Bear project in Canada," said J. Paul Rollinson, Kinross's president and chief executive officer. "We would like to thank our Russian work force for their dedication, professionalism and hard work. Their ongoing commitment to safety and the environment, especially during the transition of our business in the country, has been commendable."

You can see the break out on the chart today and I expect $8.00 is not a difficult target.

I am also suggesting the December C$6 Call option around $1.35 which is $0.80 in the money.

On the US side NY:KGC. I like the January 2024 $4 Call around $1.45 and it is $1.00 in the money.

I am also suggesting a couple other Call options on Gold stocks.

B2Gold TSX:BTO C$5.57. I like th C$5 December Call option around $1.25. It is well in the money and this stock is close to breaking out as well.

On the US side NY:BTG the January 2024 $5 call at $0.50.

First Majestic TSX:FR Recent Price C$10.25 is more a silver stock and is beaten up. We can go out to March 2024 and buy the $10 Call for around $2.10

On the US side NY:AG. I like the January 2024 US$8 Call for around $1.45

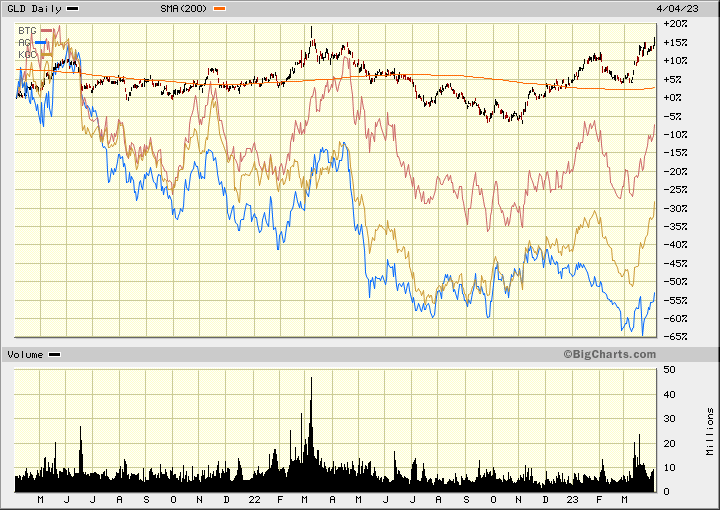

Below is a 2 year chart comparing these 3 stocks to the gold price GLD and you can see that they are all lagging gold by -22% to -70%.

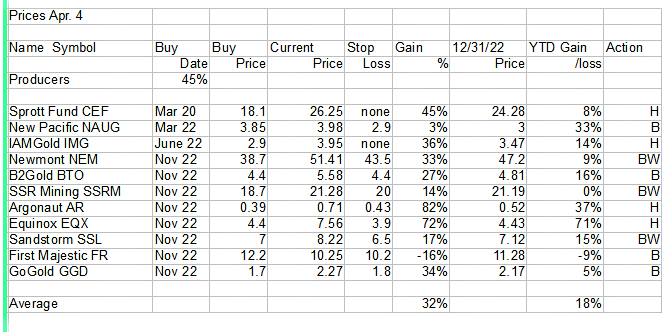

I updated our Gold stocks Selection List. I have put some of these at H (hold) and BW (buy on weakness) because I don't like buying on a strong up day. However some are so cheap, I have rated as B (buy)

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication