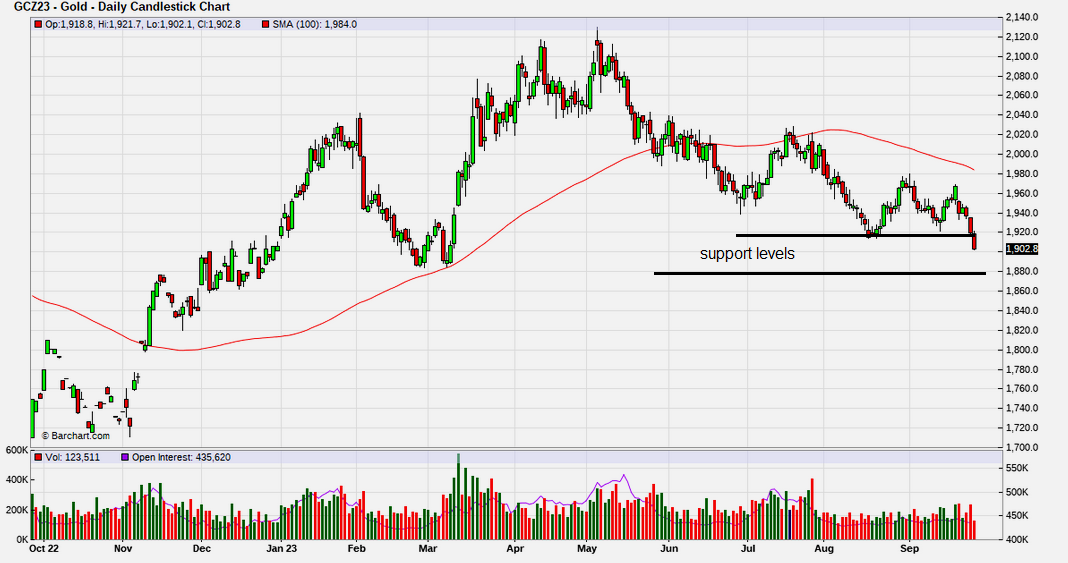

Gold has broke down on the chart Sept 27. I find this the most frustrating and crappy market I can remember. In 2008 it was bad but it was a quick 'V' shape recovery while this market has been going mostly sideways at boring levels for over a year.

The last rally did not make a new high and gold just broke down to a new low in this recent correction. Gold is down about -10% from the early May peak. I am expecting December Comex gold will now test the $1880 area that is a stronger support area.

To see consistent stronger gold prices, I believe gold has to be acknowledge by investors as a good alternative investment to poorly performing bonds and equities. You can see this strong demand occurring in China as their economy and markets are performing far worse than the U.S. I expect this will start to happen here within the next 6 months. The current narrative with U.S. markets is that the economy remains robust, inflation is coming down and a soft landing is expected. We can also see this with the US$ index that has gone up with an economy that is believed to be robust and expectation that interest rates will be higher for longer.

The US$ index has broken above 105 resistance and will probably peak in this rally somewhere between here and $110.

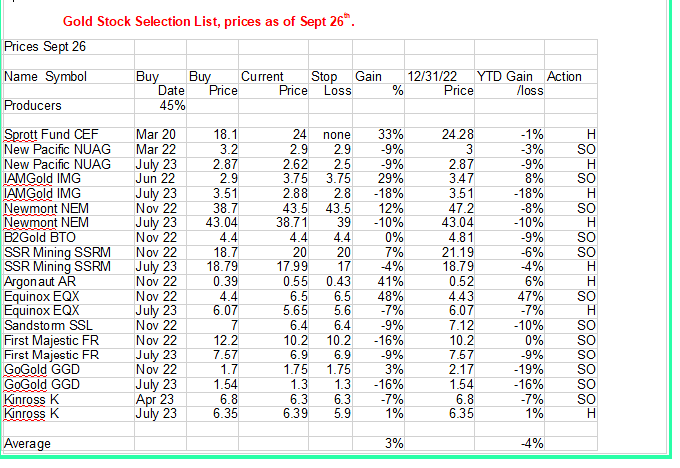

We got stopped out of a few positions BTO, FR, GGD and SSL and a few more are close to my stop levels. The rest I have as a hold. For the past couple years or more we have been getting stopped out of positions for small gains or losses and than buying back again. This range trading is getting very frustration but before too long we are going to get a big rally that will pay off.

Measuring gold stocks with the HUI gold bugs index it appeared we were off to a new bull market with the rise from 2022 lows to April/May 2023 highs and in hindsight we can call this a mini bull market for gold stocks. Today the index is a bit below 210 and we are in official bear status with a drop of -25% from recent highs. The 210 to 180 is a support area so I suspect we will see a bottom in this area, that could be a double bottom. A break below 170 would be quite negative.

Might as well get all the depressing news out. The junior market has broken strongly to the down side it looks like we are headed to new lows, levels last seen in the 2020 Covid panic. In the last 5 days the TSXV index has cratered. September is always are more active month for juniors and the volume picked up a little with many days trading over 20 million shares. Still these are very low volumes.

Where ever this bottoms, the next rally will probably be very substantial. The rally off the 2020 Covid lows was over 200%. Percentage wise the juniors usually move more in both directions.

To end on a positive note, well at least for us oil&gas investors. Oil broke higher yesterday!

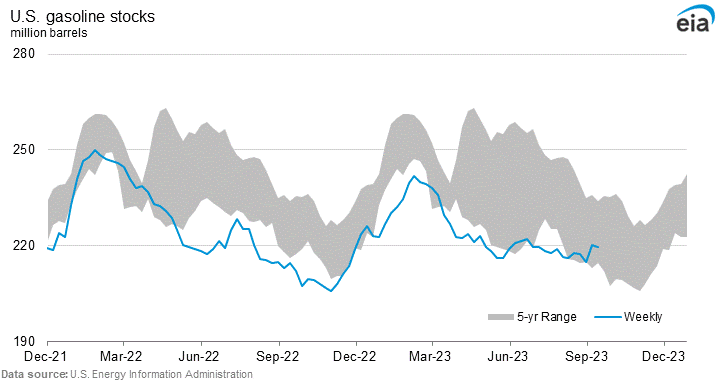

Oil hit my $94/95 target in the spot market a while back and now it has on the Comex futures. The catalyst yesterday was a larger drop in inventory levels than expected at the main hub in Cushing. Inventories have been cut in half since June, and now stand at just below 23M barrels, or a level that's close to the operational minimum below 20M barrels The bottom of tanks can become sludgy and difficult to remove oil.

I have been warning about this for a year at least, as the Biden administration's war on fossil fuels would results in shortages. That day is arriving. The gulf has managed to dodge hurricanes so far this season but the refinery maintenance season starts in October at a time there is low inventories with gasoline and distillates.

Recon Africa - - - TSXV:RECO - - - - OTC:RECAF - - - - Recent Price -Cdn $1.06

Entry Price - $0.56 - - - - - - - - - Opinion – buy

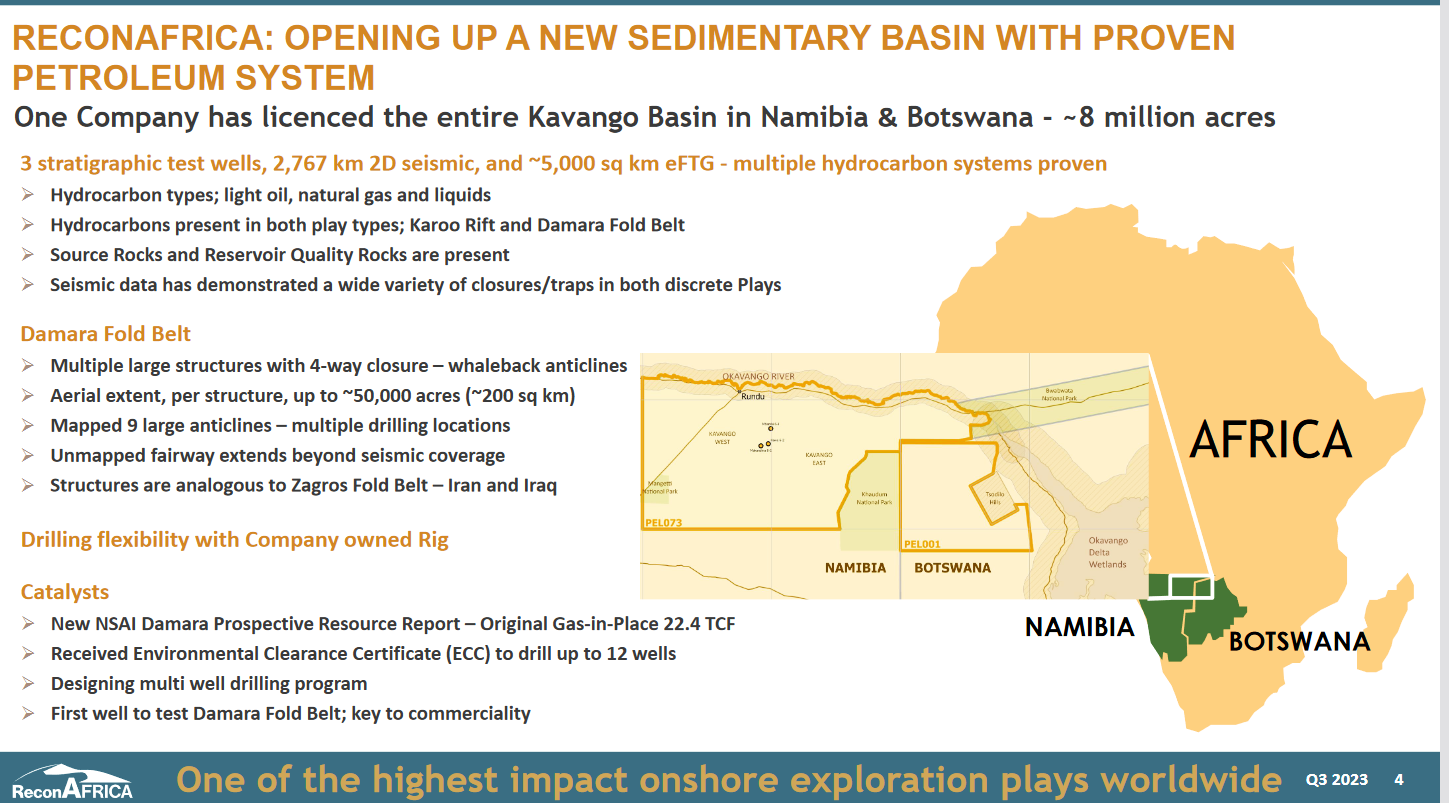

Tuesday I was on a call with Craig Steinke , the founder and chairman of RECO. To quickly recap, RECO has acquired a whole oil&gas basin in Nambia/Botswana that had zero exploration with the nearest exploration well something like over 100 miles away. RECO did 3 exploration wells that proved a working oil& gas system and gave them some good geological data, they then went on to do 2,767 km of 2D seismic and over 5,000 sq km of eFTG.

They have now compiled all this new data and there is a new presentation on the web site. I am not going to go into a lot of detail because they will soon be doing a webinar on their data and findings. They are planning to promote this to potential major JV partners and investors starting with the huge African Oil Week conference that starts October 9th.

Suffice to say, what they found is multiple huge structures with 4-way closure. They call these whaleback anticlines in the industry because of their huge size. Each structure is around 200 sq kms with multiple drill targets and this un-mapped fairway extends beyond their seismic coverage. The structures are analogous to the Zagros Fold Belt across Iran and Iraq. Next is like a summary slide form the presentation.

These appear to be large gas targets with each potentially over 1 trillion cubic feet. There are possible oil targets as well. It is still early days and they will have to drill to prove an economic well. Their plan is to bring in a senior partner or if necessary raise equity to drill at least 5 or 6 wells. This would be an ample test and that number of wells provides a good chance of success.

Craig commented he spent a lot of time seeking a new and the right CEO and had a lot of praise for new CEO Brian Reinsborough who put $1 million of his own money into a private placement. He has over 25 years in the deepwater Gulf of Mexico. Having worked globally for Mobil Oil, Nexen Inc. and Warburg Pincus as an executive-in-residence, and for Venari Resources, Mr. Reinsborough has discovered over two billion of barrels of oil equivalent over the course of his career in the deepwater Gulf of Mexico. During his career, he has been involved with some of the largest discoveries in the history of the Gulf of Mexico, including Appomattox, Anchor and Shenandoah.

Interesting was Ms. Iman Hill was also a CEO candidate and wanted to join the board even though Reinsborough got the job. Ms. Hill is a petroleum engineer and has held senior leadership roles at BP, Shell, BG, among others, during her career. She brings vast proficiency to the board from her experience gained in North and West Africa, the Middle East, South America, and the Far East. She previously served as chief executive officer of The International Oil & Gas Producers Association and is an independent director of United Oil & Gas (Alternative Investment Market listed). Previously, she has served as a director of DHT Holdings Inc., Outokumpu and EMGS.

CEO Reinsborough also brought along a lot of his technical team. Craig commented that what we really have now is RECO 2.0 and I think that is a good analogy. I believe we are headed for exciting times with RECO and it appears interest is picking back up again for oil&gas exploration.

On the chart it looks like a triple bottom is coming in. I believe between now and next week, ahead of African Oil Week and awareness of the new potential is an excellent time to accumulate stock.

However, the oil sector is still widely out of favour with investors. Oil stocks usually perform better, have leverage to rising oil prices but they are under performing oil. I put most of our oil stocks in this chart comparing to the oil etf 'USO' and only Earthstone, ESTE has done better than oil and that is because it had a take over offer. Investors are ignoring the sector and I guess need to be hit over the head some more before they figure it out.

At some point the oil stocks will play catch up.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.